|

市场调查报告书

商品编码

1851432

乳酸:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Lactic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

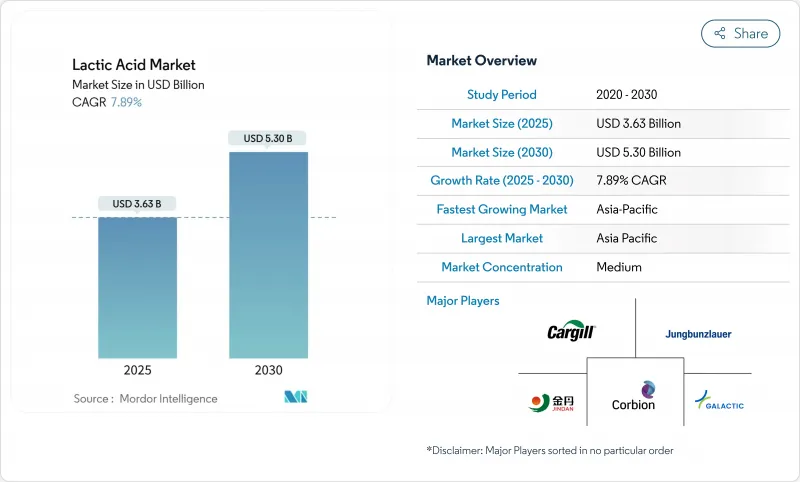

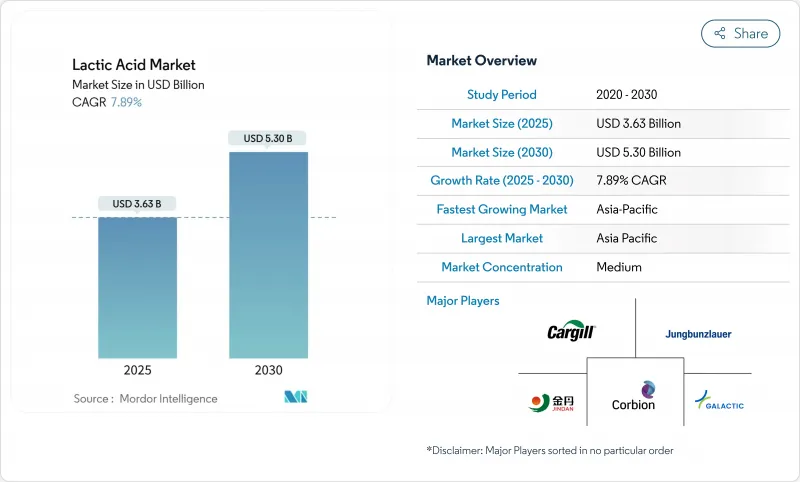

预计乳酸市场将从 2025 年的 36.3 亿美元成长到 2030 年的 53 亿美元,复合年增长率为 7.89%。

市场扩张主要受生物分解性塑胶、医药辅料和工业清洁剂等领域应用范围扩大的驱动。生物分解性塑胶产业的发展主要受环境问题和传统塑胶监管日益严格的推动。在医药领域,乳酸是药物製剂和控制释放系统的关键成分。在工业清洗领域,乳酸因其抗菌性能和环境友善性而被广泛应用。在3D列印领域,乳酸基材料具有优异的机械性能和生物相容性。该行业透过垂直整合、多元化的原材料来源和製程优化来保持竞争力,使製造商能够有效应对原材料价格波动。这包括采用先进的发酵技术、高效的纯化製程以及在整个价值链上建立策略伙伴关係关係。

全球乳酸市场趋势与洞察

PLA主导的生物分解性塑胶需求

乳酸从食品添加剂向聚合物前驱物的转变正在推动市场显着成长,其中聚乳酸 (PLA) 的应用对整体市场复合年增长率 (CAGR) 贡献良好。 NatureWorks 在泰国投资 6 亿美元兴建的工厂计划于 2025 年投入商业运营,该工厂将乳酸生产、丙交酯合成和 PLA 聚合整合于同一设施中,正是这一转变的典范。该工厂的一体化模式旨在优化生产效率并降低营运成本。欧盟的《一次性塑胶指令》要求在某些包装应用中使用可生物降解的替代品,为 PLA 的应用创造了有利的法规结构,进而促进了市场成长。阿联酋生物技术公司 (Emirates Biotech) 计划在阿联酋建造的工厂预计将成为全球最大的 PLA 工厂,这标誌着中东地区对该市场的投资不断增加,并凸显了该地区对永续材料生产的承诺。 PLA 技术在 3D 列印耗材和医疗设备领域的拓展正在扩大市场潜力,为製造业和医疗保健应用提供创新解决方案。聚左旋乳酸(PLA)获美国食品药物管理局(FDA)核准用于脸部脂肪减少治疗,证明了其在高价值医疗领域的广泛应用和安全性。完善的法律规范、持续的技术进步以及不断提升的生产能力,共同推动PLA成为2030年前乳酸市场成长的关键驱动力,再形成产业格局,并为永续材料解决方案创造新的机会。

食品和饮料防腐剂及调味剂的应用

食品饮料产业仍然是乳酸最大的终端市场,这得益于消费者对洁净标示产品和天然防腐方法的需求不断增长。美国食品药物管理局(FDA)已将乳酸认定为「公认安全」(GRAS),其使用限制仅限于良好生产规范(GMP),这为食品生产商提供了关于产品配方、安全合规和品管措施的全面监管指导。美国)的研究证实了乳酸对沙门氏菌的有效性,在对照试验中证明了其病原体减少率,从而拓展了乳酸的应用范围,使其不再局限于传统的乳製品发酵过程。乳酸的抗菌特性已在各种食品基质中得到广泛证实,尤其是在肉类和家禽加工环境中。欧洲食品安全局(EFSA)建议使用浓度为2-5%的乳酸对牛胴体进行消毒,这进一步强化了乳酸在食品安全通讯协定、微生物控制策略以及肉类加工卫生标准中的作用。在植物来源乳製品领域,生产者正利用特定的乳酸菌菌株来减少异味、增强营养吸收、改善质地,并透过提升产品的有机特性、功能优势和延长保质期来创造产品差异化的机会。乳酸在植物性乳製品中的应用已在蛋白质稳定性和风味形成方面展现出良好的效果,尤其是在优格和起司替代品等发酵产品中。

工业清洁剂

生产成本显着阻碍了市场成长,并影响了乳酸的竞争力,尤其是在价格敏感的工业应用领域。儘管发酵生产流程具有环境优势,但与合成化学路线相比,它需要对专用生物反应器、先进分离设备和复杂的纯化系统进行大量资本投资。 Corbion 在 2024 年资本市场报告中重点介绍了为应对持续存在的成本竞争力挑战而采取的全面营运效率提升和策略重组倡议。目前的成本结构对大宗商品应用产生了显着影响,在这些应用中,乳酸直接与合成防腐剂和酸味剂竞争,并且儘管其具有卓越的环境效益和永续,但仍限制了其在价格敏感领域的市场渗透。高昂的生产成本影响着从原材料采购到最终产品分销的整个价值链,这给那些力求在确保产品品质和永续性标准的同时保持价格竞争力的製造商带来了额外的挑战。

细分市场分析

预计到2024年,天然发酵将占据乳酸市场88.14%的份额,并在2030年之前以8.34%的复合年增长率成长。消费者对生物基产品的偏好源自于永续的生产方式和日益增强的环境意识。食品安全法规倾向于使用天然来源的酸,尤其是在食品和饮料应用领域,这进一步巩固了这种生产方式的主导地位。合成生产主要以石油中间体为原料,主要面向成本是首要考虑因素的特定产业领域,例如化学品製造和工业应用。

天然发酵技术的进步包括多基材处理(可同时发酵不同的原料)、基因编辑乳酸菌菌株(可提高转化效率)以及原位产物去除技术(可提高产量)。利用果蔬废弃物和木质纤维素残渣的成功示范计划表明,在不与粮食作物竞争的情况下,可以扩大生产规模。这些替代原料来源包括农业残余物、食品加工废弃物和林产品。原料多样化有助于保护乳酸市场免受粮食价格波动的影响,同时促进循环经济原则的实施。

由于液态乳酸与食品、製药和原位清洗 (CIP) 应用中的直接泵送系统相容,预计到 2024 年,液态乳酸将占据 64.82% 的市场份额。由于大多数工业生物反应器和下游填充设备都是专门针对液体处理操作进行设计和优化的,因此液态乳酸保持着市场主导地位。各产业对液体处理系统的广泛基础设施投资进一步巩固了这一优势。固态剂型乳酸市场正以 8.66% 的复合年增长率增长,这主要得益于动物饲料预混合料和干混个人保健产品(尤其是在储存和运输条件恶劣的地区)中对固体剂型乳酸的需求不断增长。此外,市场对保质期更长、易于在散装生产过程中操作的产品的需求不断增加,也推动了这一增长。

喷雾干燥和结晶製程的最新技术进步使製造商能够在保持产品高纯度的同时显着降低运输重量。这些改进包括优化粒径分布和增强水分控制系统。根据在多个生产设施进行的先驱性研究,将薄膜技术与蒸发製程结合的新型混合系统可降低10%以上的能耗。这些效率的提升正在逐步缩小液态和固体之间长期存在的价差,使固体在各种应用领域更具竞争力。专用包装解决方案的开发和货架稳定性的提高进一步增强了固态乳酸在新兴市场的吸引力。

区域分析

预计亚太地区将在2024年占据31.08%的市场份额,并在2030年之前以9.08%的复合年增长率增长。该地区凭藉在泰国、中国和印度的一体化生产设施拥有竞争优势,这些设施受益于丰富的甘蔗和玉米原料,每吨装机成本较低。 NatureWorks位于泰国的工厂正是这一区域策略的体现,它结合了本地原料供应、规模经济以及接近性出口港口的战略优势。此外,国内对一次性食品服务产品的需求不断增长以及对可堆肥购物袋的监管要求也进一步推动了市场成长。

北美凭藉其完善的玉米湿磨基础设施、先进的生物加工能力和健全的法规结构,保持着市场领先地位。该地区专注于医疗、个人护理和食品安全领域的高价值应用。儘管来自亚洲的PLA包装进口量不断增加,但由于企业偏好在地采购以减少范围3排放,北美市场仍保持稳定。

欧洲市场的成长主要受一次性塑胶指令的推动,该指令鼓励製造商采用可堆肥替代品。像 Galactic 和 Jungbunzlauer 这样的公司已经适应了监管要求,并在製药和化妆品应用领域站稳了脚跟。儘管农产品价格波动会影响采用率,但「绿色新政」倡议将继续支持对区域发酵设施的投资。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩大生物分解性塑胶的使用,特别是聚乳酸(PLA)的使用。

- 食品和饮料行业对乳酸作为防腐剂和增味剂的需求快速增长

- 扩大用途,用作药物製剂和辅料

- 在个人保健产品和化妆品製造领域日益普及

- 工业清洁应用需求不断成长

- 在饲料生产中增加使用

- 市场限制

- 乳酸的生产成本比传统替代品更高。

- 原物料价格波动,特别是玉米和甘蔗价格的波动;

- 来自合成替代品的竞争

- 产品化学性质带来的储存和运输挑战

- 供应链分析

- 监理展望

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按来源

- 自然的

- 合成

- 按形式

- 液体

- 固体的

- 按年级

- 食品级

- 工业级

- 医药级

- 化妆品级

- 透过使用

- 饮食

- 肉类、家禽、鱼贝类

- 乳製品

- 麵包店

- 糖果甜点

- 饮料

- 其他食品和饮料应用

- 聚乳酸(PLA)和生质塑胶

- 个人护理和化妆品

- 製药和医疗保健

- 工业和化学加工

- 饮食

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- Corbion NV

- Cargill Incorporated

- Galactic SA

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Jungbunzlauer Suisse AG

- Musashino Chemical Laboratory, Ltd.

- Futerro SA

- BBCA Biochemical

- Shandong Baisheng Biotech

- Cellulac Ltd.

- NatureWorks LLC

- Zhengzhou Tianrun

- Anhui COFCO Biochemical

- Qingdao Abel Technology

- TotalEnergies Corbion

- Zhejiang Huakang Pharmaceutical Co.

- Synbra Technology

- Henan Shenzhou Biochem

- Sulzer Chemtech

- Wei Mon Industry Co.(Unitika PLA JV)

第七章 市场机会与未来展望

The lactic acid market size is projected to increase from USD 3.63 billion in 2025 to USD 5.30 billion by 2030, at a CAGR of 7.89%.

The market expansion is primarily driven by increasing applications in biodegradable plastics, pharmaceutical excipients, and industrial cleaning products. The biodegradable plastics segment is growing due to environmental concerns and strict regulations on conventional plastics. In pharmaceuticals, lactic acid is essential for drug formulations and controlled-release systems. The industrial cleaning sector uses lactic acid for its antimicrobial properties and environmental compatibility. Growth enablers include integrated manufacturing facilities in Asia-Pacific, European regulations limiting single-use plastics, and the US FDA's GRAS (Generally Recognized as Safe) status.The 3D printing segment benefits from lactic acid-based materials that provide enhanced mechanical properties and biocompatibility. The industry maintains competitiveness through vertical integration, diverse feedstock sources, and process optimization, enabling manufacturers to manage raw material price fluctuations effectively. This includes implementing advanced fermentation technologies, efficient purification processes, and developing strategic partnerships throughout the value chain.

Global Lactic Acid Market Trends and Insights

PLA-driven Demand for Biodegradable Plastics

The evolution of lactic acid from a food additive to a polymer precursor is driving significant market growth, with Polylactic Acid (PLA) applications contributing to the overall market CAGR. NatureWorks' USD 600 million facility in Thailand, scheduled for commercial operation by 2025, demonstrates this transition by combining lactic acid production, lactide synthesis, and PLA polymerization in a single facility. The facility's integrated approach aims to optimize production efficiency and reduce operational costs. The European Union's Single-Use Plastics Directive supports market growth by requiring biodegradable alternatives for specific packaging applications, creating a regulatory framework that favors PLA adoption. The planned Emirates Biotech facility in the UAE, set to become the world's largest PLA plant, indicates increasing Middle Eastern investment in this market and highlights the region's commitment to sustainable materials production. The expansion of PLA technology into 3D printing filaments and medical devices has broadened its market potential, offering innovative solutions for manufacturing and healthcare applications. FDA approval of poly-L-lactic acid for facial fat loss treatment demonstrates its versatility and safety profile in high-value medical segments. The combination of supportive regulatory frameworks, continuous technological progress, and increased manufacturing capacity establishes PLA as the main driver of lactic acid market growth through 2030, reshaping the industry landscape and creating new opportunities for sustainable material solutions.

Food and Beverage Preservative and Flavor Uses

The food and beverage sector remains the largest end-market for lactic acid, with growth supported by increasing demand for clean-label products and natural preservation methods. The FDA's designation of lactic acid as Generally Recognized as Safe (GRAS), with restrictions limited to good manufacturing practices, provides food manufacturers with comprehensive regulatory guidance for product formulation, safety compliance, and quality control measures. USDA research confirms lactic acid's effectiveness in reducing Salmonella in poultry applications, demonstrating pathogen reduction rates in controlled studies and expanding its use beyond traditional dairy fermentation processes.The antimicrobial properties of lactic acid have been extensively documented across various food matrices, showing particular efficacy in meat and poultry processing environments. The European Food Safety Authority encourages lactic acid concentrations of 2-5% for beef carcass decontamination, strengthening its role in food safety protocols, microbial control strategies, and overall meat processing hygiene standards. In the plant-based dairy segment, manufacturers utilize specific lactic acid bacteria strains to reduce off-flavors, enhance nutrient absorption, and improve texture profiles, creating product differentiation opportunities through improved organoleptic properties, functional benefits, and extended shelf life. The application of lactic acid in plant-based dairy alternatives has also shown promising results in protein stabilization and flavor development, particularly in fermented products like yogurt alternatives and cheese substitutes.

Industrial Cleaning Formulations

Production costs significantly constrain market growth, particularly affecting lactic acid's competitiveness in price-sensitive industrial applications. The fermentation-based production process requires substantial capital investment in specialized bioreactors, advanced separation equipment, and complex purification systems compared to synthetic chemical routes, despite its environmental advantages. Corbion's 2024 capital market presentation emphasizes comprehensive operational efficiency improvements and strategic restructuring initiatives to address persistent cost competitiveness challenges. The current cost structure substantially impacts commodity applications where lactic acid directly competes with synthetic preservatives and acidulants, limiting market penetration in price-sensitive segments despite its superior environmental benefits and sustainable characteristics. The high production costs affect the entire value chain, from raw material procurement to final product distribution, creating additional challenges for manufacturers seeking to maintain competitive pricing while ensuring product quality and sustainability standards.

Other drivers and restraints analyzed in the detailed report include:

- Pharmaceutical Formulations and Excipients

- Personal Care and Cosmetics Expansion

- Raw-material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural fermentation accounts for 88.14% of the lactic acid market share in 2024 and is expected to grow at an 8.34% CAGR through 2030. Consumer preference for bio-based products stems from increasing awareness of sustainable production methods and environmental concerns. Food safety regulations supporting naturally derived acids, particularly in food and beverage applications, further reinforce the dominance of this production method. Synthetic production, primarily from petroleum intermediates, serves specific industrial segments where cost is the primary consideration, such as in chemical manufacturing and industrial applications.

Technological advancements in natural fermentation include multi-substrate processing, which allows for simultaneous fermentation of different raw materials, gene-edited Lactobacillus strains that improve conversion efficiency, and in situ product removal techniques that increase production yields. The successful implementation of demonstration projects using fruit waste and lignocellulosic residues indicates the potential for scaled production without competing with food crops. These alternative feedstock sources include agricultural residues, food processing waste, and forestry byproducts. This feedstock diversification helps protect the lactic acid market against fluctuations in grain prices while promoting circular economy principles.

Liquid lactic acid held a 64.82% revenue share in 2024, due to its compatibility with direct pumping systems in food, pharmaceutical, and clean-in-place (CIP) applications. This form maintains its market dominance because most industrial bioreactors and downstream filling equipment are specifically designed and optimized for liquid handling operations. The extensive infrastructure investment in liquid handling systems across industries further reinforces this dominance. The solid form segment is growing at an 8.66% CAGR, driven by increased adoption in animal feed premixes and dry-blend personal care products, particularly in regions with challenging storage and transportation conditions. The growth is also supported by the rising demand for extended shelf-life products and easier handling in bulk manufacturing processes.

Recent technological advancements in spray drying and crystallization processes enable manufacturers to maintain high product purity levels while significantly reducing shipping weights. These improvements include optimized particle size distribution and enhanced moisture control systems. New hybrid systems combining membrane technology and evaporation processes reduce energy consumption by more than 10%, according to pilot studies conducted across multiple production facilities. These efficiency improvements are gradually reducing the historical price difference between liquid and solid forms, making solid lactic acid increasingly competitive in various applications. The development of specialized packaging solutions and improved storage stability has further enhanced the appeal of solid lactic acid in emerging markets.

The Global Lactic Acid Market is Segmented by Source (Natural and Synthetic), Form (Liquid and Solid), Grade (Food Grade, Industrial Grade, and More), Application (Food and Beverages, Personal Care and Cosmetics, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Size and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held a 31.08% market share in 2024 and is expected to grow at a 9.08% CAGR through 2030. The region maintains a competitive advantage through integrated manufacturing facilities in Thailand, China, and India, which benefit from readily available sugarcane and corn feedstock, along with lower capital expenditure requirements per installed ton. NatureWorks' Thailand facility exemplifies this regional strategy by combining local feedstock availability, economies of scale, and strategic proximity to export ports. The market growth is further supported by increasing domestic demand for disposable food service items and regulatory requirements for compostable shopping bags.

North America maintains its market position through established corn-wet-milling infrastructure, sophisticated bioprocessing capabilities, and well-defined regulatory frameworks. The region focuses on high-value applications in medical, personal care, and food safety sectors. Despite increased PLA packaging imports from Asia, the North American market remains stable due to corporate preferences for local sourcing to reduce scope 3 emissions.

Europe's market growth is primarily driven by the Single-Use Plastics Directive, which encourages manufacturers to adopt compostable alternatives. Companies like Galactic and Jungbunzlauer have adapted to regulatory requirements, establishing strong positions in pharmaceutical and cosmetic applications. While agricultural price fluctuations affect adoption rates, Green Deal initiatives continue to support investments in regional fermentation facilities.

- Corbion N.V.

- Cargill Incorporated

- Galactic S.A.

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Jungbunzlauer Suisse AG

- Musashino Chemical Laboratory, Ltd.

- Futerro S.A.

- BBCA Biochemical

- Shandong Baisheng Biotech

- Cellulac Ltd.

- NatureWorks LLC

- Zhengzhou Tianrun

- Anhui COFCO Biochemical

- Qingdao Abel Technology

- TotalEnergies Corbion

- Zhejiang Huakang Pharmaceutical Co.

- Synbra Technology

- Henan Shenzhou Biochem

- Sulzer Chemtech

- Wei Mon Industry Co. (Unitika PLA JV)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding applications in biodegradable plastics production, particularly PLA (Polylactic Acid)

- 4.2.2 Surging Demand from the Food and Beverage Industry for Lactic Acid as a Preservative and Flavor Enhancer

- 4.2.3 Expanding use in pharmaceutical applications for drug formulation and as an excipient

- 4.2.4 Growing adoption in personal care products and cosmetics manufacturing

- 4.2.5 Escalating demand in industrial cleaning applications

- 4.2.6 Rising usage in animal feed production

- 4.3 Market Restraints

- 4.3.1 High production costs of lactic acid compared to conventional alternatives

- 4.3.2 Fluctuating raw material prices, particularly for corn and sugarcane

- 4.3.3 Competition from synthetic alternatives

- 4.3.4 Storage and transportation challenges due to the product's chemical properties

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Solid

- 5.3 By Grade

- 5.3.1 Food Grade

- 5.3.2 Industrial Grade

- 5.3.3 Pharmaceutical Grade

- 5.3.4 Cosmetic Grade

- 5.4 By Application

- 5.4.1 Food and Beverages

- 5.4.1.1 Meat, Poultry and Seafood

- 5.4.1.2 Dairy Products

- 5.4.1.3 Bakery

- 5.4.1.4 Confectionery

- 5.4.1.5 Beverages

- 5.4.1.6 Others Food and Beverage Applications

- 5.4.2 Polylactic Acid (PLA) and Bioplastics

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Pharmaceutical and Healthcare

- 5.4.5 Industrial and Chemical Processing

- 5.4.1 Food and Beverages

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Corbion N.V.

- 6.4.2 Cargill Incorporated

- 6.4.3 Galactic S.A.

- 6.4.4 Henan Jindan Lactic Acid Technology Co. Ltd.

- 6.4.5 Jungbunzlauer Suisse AG

- 6.4.6 Musashino Chemical Laboratory, Ltd.

- 6.4.7 Futerro S.A.

- 6.4.8 BBCA Biochemical

- 6.4.9 Shandong Baisheng Biotech

- 6.4.10 Cellulac Ltd.

- 6.4.11 NatureWorks LLC

- 6.4.12 Zhengzhou Tianrun

- 6.4.13 Anhui COFCO Biochemical

- 6.4.14 Qingdao Abel Technology

- 6.4.15 TotalEnergies Corbion

- 6.4.16 Zhejiang Huakang Pharmaceutical Co.

- 6.4.17 Synbra Technology

- 6.4.18 Henan Shenzhou Biochem

- 6.4.19 Sulzer Chemtech

- 6.4.20 Wei Mon Industry Co. (Unitika PLA JV)