|

市场调查报告书

商品编码

1851434

数位物流:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Digital Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

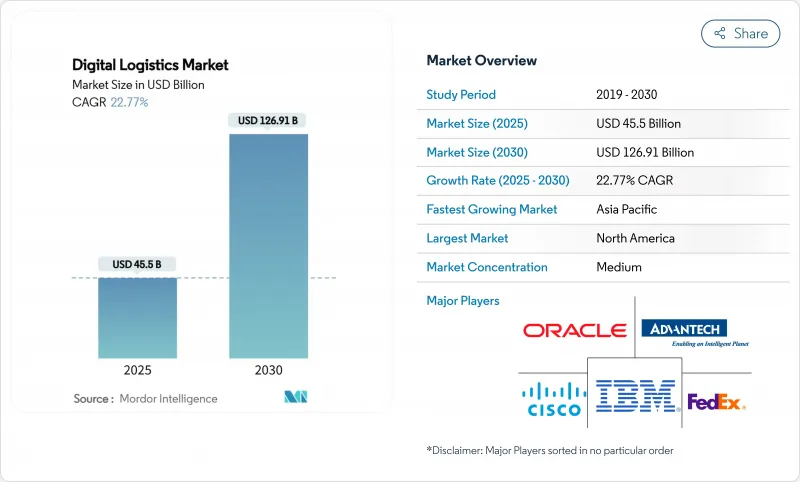

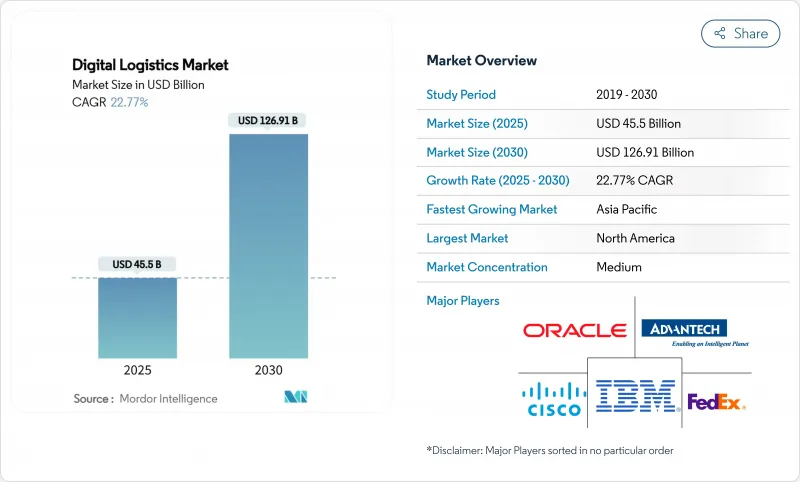

预计到 2025 年,数位物流市场规模将达到 455 亿美元,到 2030 年将达到 1,269.1 亿美元,预测期(2025-2030 年)复合年增长率为 22.77%。

电子商务的快速扩张、人工智慧、物联网和区块链的融合,以及向云端原生架构的转型,正在加速企业采用新技术。预测分析能够提高库存准确性并减少浪费,而即时物联网远端资讯处理技术则能降低车辆油耗并支援永续性目标。 71%的汽车原始设备製造商(OEM)目前倾向于直接面向消费者的销售模式,这迫使物流供应商重新思考「最后一公里」配送模式。儘管日益严峻的网路威胁和区域基础设施差异正在减缓转型步伐,但零售商、製药公司和政府的持续投资支撑着市场的长期发展势头。

全球数位物流市场趋势与洞察

北美即时物联网车辆远端资讯处理的扩展

互联的远端资讯处理设备现在可以即时传输引擎健康状况、驾驶员行为和货物数据,从而实现预测性维护,将停机时间减少 30%,燃油消耗降低 15-20%。物流供应商将这些优势转化为优质的、有保障的交付窗口,在提升服务水准的同时减少排放。预计到 2032 年,物联网物流的支出将超过 1,147 亿美元,车队远端资讯处理已成为企业管理层的优先事项,尤其对于那些寻求在永续性方面脱颖而出的运输企业而言更是如此。

欧洲第三方物流公司采用人工智慧驱动的预测性仓库分析

一家欧洲第三方物流公司正结合机器学习演算法和电脑视觉技术,为其仓库创建数位双胞胎,在不影响订单满足率的前提下,实现了20-30%的库存削减。情境建模使操作人员能够主动发现劳动力瓶颈,并在几分钟内(而非几小时)调整拣货路线。这些功能为新型增值合约奠定了基础,这些合约将需求预测和履约捆绑在一起,帮助第三方物流公司提升利润率。

非洲5G走廊投资不足

目前只有7%的主要运输走廊实现了5G网路覆盖,这限制了跨境货物的即时可视性。清关平均耗时48-72小时,而网路连线较好的地区仅需4-6小时,导致货物滞留时间过长,库存成本居高不下。据估计,要弥补这一差距,需要投入约47亿美元,这将超出目前公共和私人部门的投入承诺,儘管试点走廊已开始展现出生产力提升的迹象。

细分市场分析

到2024年,数位化物流服务将贡献32%的收入,但其高达24.1%的复合年增长率表明,企业越来越倾向于外包专业知识。缺乏内部人才的企业正越来越多地选择外包管理服务,以监督系统整合、资料清洗和持续优化。儘管解决方案在2024年仍将占剩余68%的收入,并支撑着许多转型蓝图,但买家现在更重视模组化和开放API,而非单一的整体式套件。供应商的成功将取决于能否将强大的核心平台与合作伙伴生态系统结合,以应对低温运输检验和清关等专业需求。

72%的中型企业更倾向于签订服务合约而非直接购买软体,以避免资本支出并加快投资回报。像Tech Mahindra这样的供应商正在将低程式码加速器和人工智慧套件捆绑销售,使客户能够在几天内而不是几个季度内重新配置工作流程。随着法规、需求模式和永续性目标的不断变化,这种灵活性至关重要。解决方案供应商正在透过分拆模组并提供计量收费的商业模式来应对这一变化,从而确保数位物流市场持续多元化发展。

到2024年,云端平台将占据数位物流市场58%的份额,并在2030年之前以23.5%的复合年增长率成长。可扩展性、快速部署和全球可存取性使云端架构成为全通路物流网路的首选。与本地部署相比,企业报告指出引进週期缩短了35%,整体拥有成本降低了42%。虽然安全性曾经是采用云端技术的一大障碍,但企业级加密、零信任框架和主权云端选项已经消除了大部分担忧。

儘管混合模式在资料驻留法规严格的行业中仍然存在,但边缘到云端架构如今已能在不放弃管治的前提下满足即时处理的需求。北美以 67% 的云端采用率领先,欧洲紧随其后,为 63%。随着频宽的提升和超大规模资料中心推出新的区域,新兴市场正在迎头赶上。本地部署仍将继续服务于一些特定用例,例如超低延迟机器人和专有传统硬件,但其在数位物流市场规模中的份额预计将稳步下降。

数位物流市场按类型(解决方案、服务)、部署模式(云端基础、本地部署)、系统/类型(库存管理、仓库管理系统 (WMS)、车队管理等)、最终用户(零售/电子商务、製造业、汽车业、製药业、生命科学业等)和地区进行细分。

区域分析

预计到2024年,北美将占全球数位物流市场收入的38%。电子商务的蓬勃发展、5G的广泛应用以及充裕的创业投资资金,正在催生一个充满活力的生态系统,其中包括SaaS供应商、机器人公司和货运技术新兴企业。十分之八的物流业者计划在2025年将人工智慧融入至少一个工作流程,监管机构也正在逐步放宽自动驾驶卡车试验的限制。

亚太地区是全球成长引擎,预计到2030年将以24.3%的复合年增长率成长。中国、印度和东南亚地区凭藉着蓬勃发展的线上消费和雄心勃勃的国家物流走廊,正推动着这一成长动能。跨境卖家受益于关税支付模式和智慧储物柜,但数据标准的碎片化推高了成本,并阻碍了小型企业的进入。城市拥挤促使微型仓配和两轮配送模式的兴起,而离岛则利用无人机来弥补基础设施的不足。

在欧洲,先进的基础设施与政策主导的永续性相融合。与碳排放挂钩的道路通行费和低排放区正在推动对路线规划软体和电动「最后一公里」配送车队的需求。该地区的第三方物流公司正在率先应用预测性仓库分析技术,以应对劳动力短缺和薪资上涨的问题。中东正投入大量政府资金建设智慧港口和铁路网络,以实现经济多元化,摆脱对石油的依赖。非洲的潜力仍与5G和海关现代化息息相关,而南美洲正面临人才短缺的困境,这导致仓库管理系统(WMS)的实施成本上升了高达40%。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美即时物联网车队远端资讯处理技术的扩展

- 欧洲第三方物流公司部署人工智慧驱动的预测性仓库分析

- 亚洲当日电履约激增

- 国家绿色货运数位化奖励(中东)

- 汽车OEM直接面向消费者的数位化物流计划

- 欧洲新冠疫情后药品低温运输数位化指令

- 市场限制

- 非洲5G走廊投资不足

- 亚太地区数据标准碎片化阻碍了跨境贸易。

- 云端物流平台网路保险保费飙升

- 拉丁美洲WMS人才短缺

- 价值/供应链分析

- 监管和技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 服务

- 透过部署模式

- 云端基础的

- 本地部署

- 按系统/类型

- 库存管理

- 仓库管理系统(WMS)

- 车队管理

- 数据管理与分析

- 追踪和监控

- 其他类型

- 按最终用户行业划分

- 零售与电子商务

- 製造业

- 车

- 製药和生命科学

- 饮食

- 石油、天然气和能源

- 消费品

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 中东

- GCC

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SAP SE

- IBM Corporation

- Oracle Corporation

- Honeywell International Inc.

- Advantech Co. Ltd.

- Blue Yonder(Formerly JDA Software)

- Manhattan Associates Inc.

- Korber Supply Chain(HighJump)

- Tech Mahindra Ltd.

- Infosys Ltd.

- HCL Technologies Ltd.

- Amazon Web Services(AWS)

- DHL Group

- FedEx Corp.

- Cisco Systems Inc.

- Trimble Inc.

- Verizon Communications Inc.

- Bosch Software Innovations GmbH

- Maersk Digital

- Vinculum Group

- Hexaware Technologies Ltd.

第七章 市场机会与未来展望

The Digital Logistics Market size is estimated at USD 45.5 billion in 2025, and is expected to reach USD 126.91 billion by 2030, at a CAGR of 22.77% during the forecast period (2025-2030).

Rapid e-commerce expansion, the convergence of AI, IoT and blockchain, and the pivot toward cloud-native architectures are accelerating enterprise adoption. Predictive analytics is improving inventory accuracy and cutting waste, while real-time IoT telematics is lowering fleet fuel use and supporting sustainability targets. Enterprises increasingly treat digital logistics as a source of competitive advantage; 71% of automotive OEMs now favor direct-to-consumer distribution, forcing logistics providers to rethink last-mile models. Heightened cyber-threat levels and regional infrastructure gaps temper the pace of transformation, yet sustained investment by retailers, pharmaceutical firms and governments underlines the market's long-term momentum.

Global Digital Logistics Market Trends and Insights

Expansion of real-time IoT fleet telematics in North America

Connected telematics devices now stream engine health, driver behavior, and cargo data in real time, enabling predictive maintenance that cuts downtime by 30% and fuel use by 15-20%. Logistics providers translate these gains into premium, guaranteed delivery windows that raise service levels while shrinking emissions. With IoT logistics spending expected to top USD 114.7 billion by 2032, fleet telematics has become a boardroom priority, particularly for carriers seeking to differentiate on sustainability.

AI-powered predictive warehouse analytics adoption by European 3PLs

European 3PLs combine machine-learning algorithms and computer vision to create digital twins of warehouses, unlocking 20-30% inventory reductions without harming fill-rates. Scenario modelling helps operators pre-empt labor bottlenecks and reroute pick paths in minutes rather than hours. These capabilities underpin new value-added contracts that bundle demand forecasting with fulfillment, helping 3PLs move up the margin curve.

Under-investment in 5G corridors across Africa

Only 7% of key transport corridors have 5G coverage, limiting real-time visibility for cross-border hauls. Customs clearance averages 48-72 hours versus 4-6 hours in well-connected regions, prolonging dwell times and inventory carry costs. Closing the gap requires an estimated USD 4.7 billion, a figure that exceeds current public-private commitments, though pilot corridors are starting to demonstrate productivity uplifts.

Other drivers and restraints analyzed in the detailed report include:

- Surge in same-day e-commerce fulfillment across Asia

- National green-freight digitalization incentives (Middle East)

- Fragmented data standards blocking cross-border APAC trade

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital logistics services contributed 32% to 2024 revenue, but their stronger 24.1% CAGR points to a growing preference for outsourced expertise. Companies short on in-house talent increasingly contract managed services to orchestrate system integration, data cleansing and continuous optimization. Solutions still generate the remaining 68% of 2024 revenue and anchor many transformation roadmaps, yet buyers now expect modularity and open APIs rather than monolithic suites. Vendor success hinges on coupling a robust core platform with curated partner ecosystems that address specialized functions such as cold-chain validation or customs brokerage.

Mid-market adopters illustrate the shift: 72% now favor service contracts over direct software ownership to avoid capex and accelerate ROI. Providers such as Tech Mahindra bundle low-code accelerators and AI toolkits so clients can reconfigure workflows in days rather than quarters. This flexibility is crucial as regulations, demand patterns, and sustainability targets evolve. Solution vendors respond by unbundling modules and offering pay-as-you-scale commercial models, ensuring the digital logistics market continues to diversify.

Cloud platforms accounted for a 58% digital logistics market share in 2024 and will grow at a 23.5% CAGR through 2030. Scalability, rapid deployment and global accessibility make cloud architectures the default choice for omnichannel logistics networks. Companies report deployment cycles 35% faster and total cost of ownership 42% lower than on-premise alternatives, underscoring the economic rationale for migration. Security once hampered adoption, but enterprise-grade encryption, zero-trust frameworks and sovereign-cloud options have alleviated most concerns.

Hybrid models persist in highly regulated verticals where data-residency rules apply, yet edge-to-cloud architectures now satisfy real-time processing demands without relinquishing governance. North America leads with 67% cloud adoption, closely followed by Europe at 63%. Emerging markets are catching up as bandwidth improves and hyperscalers launch new regional zones. On-premise deployments will continue to serve niche use cases involving ultra-low-latency robotics or proprietary legacy hardware, but their share of the digital logistics market size is projected to contract steadily.

The Digital Logistics Market is Segmented by Type (Solutions, Services), Deployment Mode (Cloud-Based, On-Premise), System / Type(Inventory Management, Warehouse Management System (WMS), Fleet Management, and More), End-User Vertical (Retail and E-Commerce, Manufacturing, Automotive, Pharmaceuticals, and Life Sciences and More), and Geography

Geography Analysis

North America commanded 38% of the digital logistics market revenue in 2024. Deep e-commerce penetration, widespread 5G rollouts and abundant venture funding nurture a vibrant ecosystem of SaaS providers, robotics firms and freight-tech start-ups. Eight in ten logistics operators plan to embed AI in at least one workflow by 2025, while regulators steadily open corridors for autonomous trucking trials.

Asia-Pacific is the growth engine, expanding at a 24.3% CAGR through 2030. China, India, and Southeast Asia underpin this trajectory with surging online consumption and ambitious national logistics corridors. Cross-border sellers benefit from duty-paid models and smart lockers, yet fragmented data standards inflate costs and curb small-business participation. Urban congestion prompts micro-fulfillment build-outs and two-wheel deliveries, whereas remote islands adopt drones to bridge infrastructure gaps.

Europe blends advanced infrastructure with policy-driven sustainability. Carbon-linked road tolls and low-emission zones amplify demand for routing software and electric last-mile fleets. The region's 3PLs pioneer predictive warehouse analytics to counter labor shortages and rising wage bills. The Middle East channels sovereign funds into smart ports and rail links to diversify beyond oil. Africa's potential remains tied to 5G and customs modernization, while South America contends with talent deficits that inflate WMS implementation costs by 40%.

- SAP SE

- IBM Corporation

- Oracle Corporation

- Honeywell International Inc.

- Advantech Co. Ltd.

- Blue Yonder (Formerly JDA Software)

- Manhattan Associates Inc.

- Korber Supply Chain (HighJump)

- Tech Mahindra Ltd.

- Infosys Ltd.

- HCL Technologies Ltd.

- Amazon Web Services (AWS)

- DHL Group

- FedEx Corp.

- Cisco Systems Inc.

- Trimble Inc.

- Verizon Communications Inc.

- Bosch Software Innovations GmbH

- Maersk Digital

- Vinculum Group

- Hexaware Technologies Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Real-time IoT Fleet Telematics in North America

- 4.2.2 AI-powered Predictive Warehouse Analytics Adoption by European 3PLs

- 4.2.3 Surge in Same-day E-commerce Fulfilment Across Asia

- 4.2.4 National Green-Freight Digitalization Incentives (Middle East)

- 4.2.5 Automotive-OEM Direct-to-Consumer Digital Logistics Programs

- 4.2.6 Post-COVID Pharma Cold-Chain Digitization Mandates in Europe

- 4.3 Market Restraints

- 4.3.1 Under-investment in 5G Corridors across Africa

- 4.3.2 Fragmented Data-standards Blocking Cross-Border APAC Trade

- 4.3.3 Cyber-insurance Premium Spikes for Cloud-Logistics Platforms

- 4.3.4 Skilled-WMS-Talent Shortage in Latin America

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud-based

- 5.2.2 On-premise

- 5.3 By System / Type

- 5.3.1 Inventory Management

- 5.3.2 Warehouse Management System (WMS)

- 5.3.3 Fleet Management

- 5.3.4 Data Management and Analytics

- 5.3.5 Tracking and Monitoring

- 5.3.6 Other Types

- 5.4 By End-user Vertical

- 5.4.1 Retail and E-commerce

- 5.4.2 Manufacturing

- 5.4.3 Automotive

- 5.4.4 Pharmaceuticals and Life Sciences

- 5.4.5 Food and Beverage

- 5.4.6 Oil and Gas and Energy

- 5.4.7 Consumer Packaged Goods

- 5.4.8 Other End-user Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 Turkey

- 5.5.4.3 Israel

- 5.5.4.4 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Nigeria

- 5.5.5.3 Rest of Africa

- 5.5.6 Asia Pacific

- 5.5.6.1 China

- 5.5.6.2 India

- 5.5.6.3 Japan

- 5.5.6.4 South Korea

- 5.5.6.5 ASEAN

- 5.5.6.6 Rest of Asia Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 SAP SE

- 6.4.2 IBM Corporation

- 6.4.3 Oracle Corporation

- 6.4.4 Honeywell International Inc.

- 6.4.5 Advantech Co. Ltd.

- 6.4.6 Blue Yonder (Formerly JDA Software)

- 6.4.7 Manhattan Associates Inc.

- 6.4.8 Korber Supply Chain (HighJump)

- 6.4.9 Tech Mahindra Ltd.

- 6.4.10 Infosys Ltd.

- 6.4.11 HCL Technologies Ltd.

- 6.4.12 Amazon Web Services (AWS)

- 6.4.13 DHL Group

- 6.4.14 FedEx Corp.

- 6.4.15 Cisco Systems Inc.

- 6.4.16 Trimble Inc.

- 6.4.17 Verizon Communications Inc.

- 6.4.18 Bosch Software Innovations GmbH

- 6.4.19 Maersk Digital

- 6.4.20 Vinculum Group

- 6.4.21 Hexaware Technologies Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment