|

市场调查报告书

商品编码

1851491

资料中心安全:市场占有率分析、产业趋势、统计资料和成长预测(2025-2030 年)Data Center Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

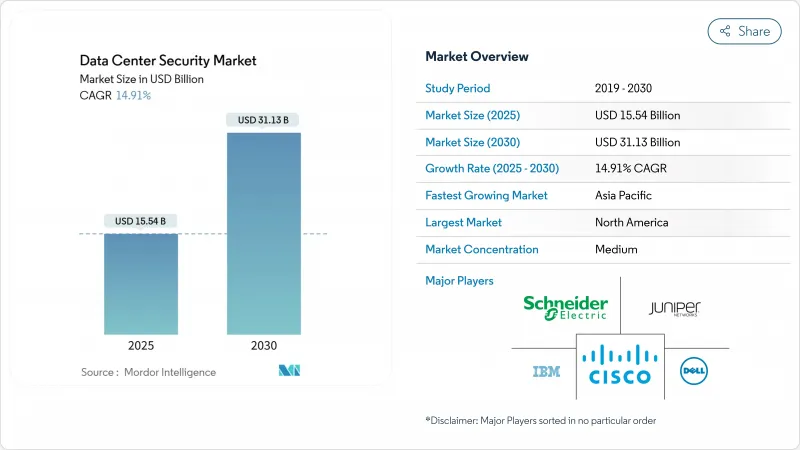

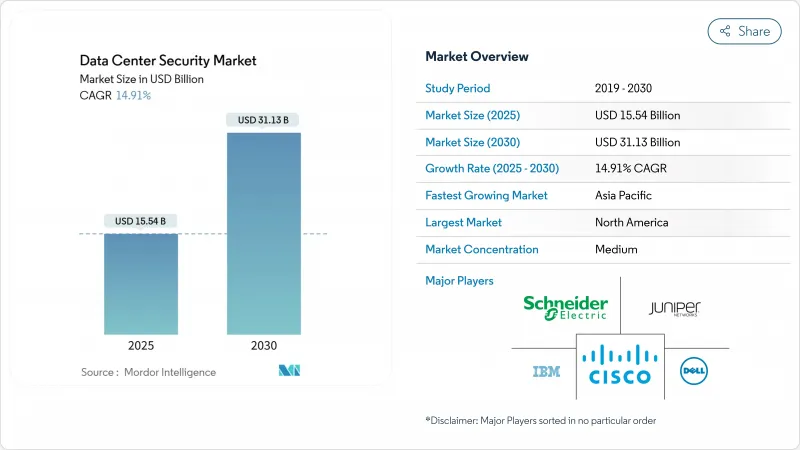

预计到 2025 年,资料中心安全市场规模将达到 155.4 亿美元,到 2030 年将达到 311.3 亿美元,年复合成长率为 14.91%。

这反映出营运商面临越来越大的压力,需要保护支撑人工智慧训练、边缘分析和混合云端工作负载的高密度环境。网路攻击频率的上升、超大规模部署的快速发展以及日益严格的全球法令遵循,正促使供应商重新设计实体和逻辑控制措施。企业正从边界防御转向以身分为中心的零信任架构,以检验每个请求并持续监控设备健康状况。对人工智慧驱动的威胁搜寻、整合实体和逻辑平台以及安全即服务模式的同步投资,正在重塑采购模式,尤其对于资源受限的企业而言更是如此。

全球资料中心安全市场趋势与洞察

爆炸性的数据流量和超大规模建设

到2024年,超大规模业者将处理全球76%的AI伺服器出货量,集中了大量需要严密防御的宝贵资产。到2030年,AI园区电力预算可能超过5GW,这将推动安全区域、无徽章生物识别和AI辅助网路分段的同步升级。供应商目前正在交付模组化安全设备,这些设备能够处理Terabit加密流量而不会出现延迟峰值;运营商也在整合机器学习感测器,以检测传统防火墙无法侦测到的异常东西向流量。这些变化共同推动了资料中心安全市场的持续支出,尤其是在託管、企业和边缘设施纷纷效仿超大规模最佳实践的情况下。

日益复杂的网路攻击

2024年下半年,随着攻击者自动化侦察和漏洞利用,企业平均每週将遭受1900次攻击。零时差攻击的武器化週期正从数週缩短至数小时,迫使营运商部署无需分析师干预即可自动搜寻和消除威胁的自学习防御系统。将持续行为分析与自适应策略引擎整合已成为至关重要的环节。对统一端点、工作负载和网路遥测资料的平台进行投资,正在扩大中型企业资料中心安全市场的潜在规模,这些企业先前依赖各自独立的工具集。

多层安全措施需要较高的资本支出/营运支出

从周界防护到异常侦测,全端式安全防护通常会占用设施预算的两位数百分比。到2025年,云端安全可能占企业网路安全支出的20%。营运商透过安全即服务协议来抵消成本,将资本支出转化为可预测的费用,但为旧设备量身定制这些服务会延长整合週期。託管服务提供者正面临可用性紧张和价格压力,这导致升级延迟,并阻碍了市场区隔领域的成长。

细分市场分析

以身分感知防火墙、微隔离和人工智慧增强型监控为基准的逻辑安全措施,在2024年占据了资料中心安全市场55.65%的份额。到2030年,该细分市场将以17.2%的复合年增长率成长,这反映出企业越来越迫切地需要检验每个会话。企业现在更倾向于使用能够根据设备状态、地理位置和行为偏差动态调整权限的策略引擎。

实体安全措施仍然至关重要,尤其是在边缘机架等盗窃和篡改风险较高的区域。人工智慧摄影机、生物识别旋转门和机器人技术正与软体警报系统融合,建构一个统一的指挥中心,透过单一主机即可管理锁具、警报和资料包流。这种融合以统一平台取代了各自独立的门禁系统,消除了安全盲区,从而提升了资料中心安全市场的交叉销售潜力。

2024年,从新一代防火墙到资料中心基础设施管理(DCIM)嵌入式监控等解决方案将占据资料中心安全市场67.8%的份额。然而,由于复杂性、监管变化和技能缺口等因素,託管服务将以17.74%的复合年增长率成长,超过硬体更新周期。目前,服务提供者正将威胁调查、取证分析和合规性报告整合到基于结果的服务等级协定(SLA)中。

随着企业根据零信任基准和量子安全蓝图调整架构,咨询需求也随之成长。 IBM 的全天候託管服务套件标誌着企业正从保护云端工作负载转向在保护云端工作负载之上迭加事件回应,以应对企业留住员工的挑战。这一趋势将带来新的经常性收入,并扩大全球资料中心安全市场。

资料中心安全市场报告按安全类型(实体安全解决方案及其他)、产品/服务(解决方案、服务)、资料中心类型(超大规模资料中心、企业级资料中心、边缘资料中心及其他)、垂直产业(IT与通讯、银行、金融服务及保险及其他)和地区(北美、欧洲及其他)对产业进行分类。市场预测以美元计价。

区域分析

北美将在2024年以37.25%的市占率引领资料中心安全市场,主要得益于高密度超大规模集群和日益严格的监管审查。光是美国就占该地区支出的77%,云巨头纷纷宣布斥资数十亿美元部署人工智慧园区,从一开始就采用零信任架构。随着传统资料中心面临日益严格的电力限制,迫使营运商在其分散式环境中复製安全控制措施,亚特兰大和凤凰城等二线城市也因此吸引了更多成长。

亚太地区年复合成长率高达19.21%,是该地区成长最快的,这主要得益于两位数的产能成长和对数位银行的需求。在新加坡,随着绿色开发禁令的解除,绿色开发许可的发放刺激了对安全待开发区的收购;而东京则利用其严格的个人资讯保护法来吸引银行、金融服务和保险(BFSI)企业入驻。在中国和印度,对加密金钥本地化的重视推动了对客製化合规模块的需求,进而促进了国内服务提供者的资料中心安全市场发展。三井物产在神奈川县投资1.18亿美元兴建超大规模资料中心,凸显了这个投资趋势。

在欧洲,义大利、西班牙和法国正在增加对新型人工智慧丛集的安全投资,同时努力平衡GDPR法规的要求和可再生能源目标。拉丁美洲预计到2024年将实现42%的成长,其中巴西和墨西哥将引领这一成长。巴西能源供应的改善与关键云端区域重迭。在中东和非洲,主权云端服务和经济特区奖励措施正在被采用,将资料中心安全市场扩展到杜拜和约翰尼斯堡等待开发区园区。在所有地区,资料主权和出口管制计划(例如美国资料中心VEU认证)的主题都在增强对防篡改审核追踪的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 爆炸性的数据流量和超大规模建设

- 日益复杂的网路攻击

- 严格的全球合规性

- 云和混合IT扩大了攻击面

- 资料中心内基于人工智慧的零信任架构(鲜为人知)

- 边缘/模组化资料中心的自主实体安全(隐蔽式)

- 市场限制

- 多层安全措施需要较高的资本支出/营运支出

- 网路技能短缺

- 电力和冷却预算给安保工作带来压力(鲜为人知)

- 资料在地化架构的复杂性(鲜为人知)

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场宏观经济趋势

第五章 市场规模及成长预测(价值,2024-2030 年)

- 按安全类型

- 实体安全

- 逻辑/网路安全

- 报价

- 解决方案

- 服务(咨询、整合、管理)

- 依资料中心类型

- 超大规模云端服务商/云端服务供应商

- 搭配

- 企业和边缘运算

- 按行业

- 银行与金融服务 (BFSI)

- 资讯科技和电信

- 医疗保健与生命科学

- 消费品和零售

- 政府和国防部

- 媒体与娱乐

- 其他(能源、教育等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 新加坡

- 澳洲

- 马来西亚

- 亚太其他地区

- 南美洲

- 巴西

- 智利

- 阿根廷

- 其他南美洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议和 MandA

- 市占率分析

- 公司简介

- Cisco Systems Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Symantec(Gen Digital)

- Juniper Networks Inc.

- VMware by Broadcom

- Fortinet Inc.

- Palo Alto Networks Inc.

- Trend Micro Inc.

- Dell Technologies

- Hewlett Packard Enterprise

- Citrix Systems

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- Genetec Inc.

- Bosch Security Systems

- Arista Networks

- Cyxtera Technologies

- Hikvision Digital Technology

- Johnson Controls

- NEC Corporation

- Market Opportunities and Future Outlook

- White-space and Unmet-Need Assessment

The data center security market is valued at USD 15.54 billion in 2025 and is projected to reach USD 31.13 billion by 2030, advancing at a 14.91% CAGR.

The expansion reflects mounting pressure on operators to safeguard high-density environments that now power AI training, edge analytics, and hybrid-cloud workloads. Rising cyber-attack frequency, rapid hyperscale build-outs, and tighter global compliance rules are reshaping how vendors design physical and logical controls. Companies are moving from perimeter defenses to identity-centric, zero-trust blueprints that verify every request and continuously monitor device health. Parallel investments in AI-driven threat hunting, converged physical-logical platforms, and security-as-a-service models are reshaping buying patterns, especially among resource-constrained enterprises.

Global Data Center Security Market Trends and Insights

Explosive Data-Traffic and Hyperscale Build-Outs

Hyperscale operators are on track to handle 76% of global AI server shipments in 2024, concentrating valuable assets that demand hard-to-breach defenses. Power budgets for AI campuses could top 5 GW by 2030, prompting parallel upgrades in security zones, badge-less biometrics, and AI-assisted network segmentation.Vendors now ship modular security appliances that process terabits of encrypted traffic without latency spikes. Operators also embed machine-learning sensors that surface anomalous east-west flows invisible to legacy firewalls. Together these shifts stimulate sustained spending, especially across the data center security market as colocation, enterprise, and edge facilities mirror hyperscale best practices.

Escalating Cyber-Attack Sophistication

Organizations endured an average of 1,900 weekly attacks in late 2024, driven by attackers automating reconnaissance and exploit delivery. Zero-day weaponization cycles collapsed from weeks to hours, pressuring operators to deploy self-learning defenses that hunt and neutralize threats without analyst intervention. Integration of continuous behavior analytics and adaptive policy engines is now baseline. Investment gravitates toward unified platforms that converge endpoint, workload, and network telemetry, expanding the addressable data center security market among midsize enterprises that previously relied on siloed toolsets.

High CAPEX/OPEX for Multi-Layer Security

Full-stack protection-from perimeter fencing to anomaly detection-regularly consumes double-digit percentages of facility budgets. Cloud security could absorb 20% of enterprise cyber spend by 2025. Operators offset costs through security-as-a-service contracts that shift capital outlays into predictable fees, yet customizing these services to legacy gear inflates integration timelines. Colocation providers navigate tight vacancy and pricing pressure, delaying upgrades and tempering growth within segments of the data center security market.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Global Compliance Mandates

- Cloud and Hybrid IT Attack-Surface Expansion

- Cyber-Skills Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Logical safeguards held 55.65% share of the data center security market in 2024 as identity-aware firewalls, micro-segmentation, and AI-enhanced monitoring became baseline. The segment is poised for a 17.2% CAGR through 2030, reflecting heightened urgency to inspect east-west traffic and verify every session. Enterprises now favor policy engines that adjust privileges dynamically, referencing device posture, geolocation, and behavioral deviations.

Physical safeguards remain foundational, particularly across edge racks where theft and tampering risks climb. AI-powered cameras, biometric turnstiles, and robotics converge with software alerts, creating integrated command centers where a single console governs locks, alarms, and packet flows. This convergence lifts cross-sell potential inside the data center security market as buyers replace siloed badge systems with unified platforms that slash blind spots.

Solutions contributed 67.8% to the data center security market size in 2024, ranging from next-gen firewalls to DCIM-embedded surveillance. Yet complexity, regulatory churn, and skills gaps propel managed services to a 17.74% CAGR, outstripping hardware refresh cycles. Providers now bundle threat hunting, forensic analysis, and compliance reporting under outcome-based service-level agreements.

Consulting demand likewise rises as firms recalibrate architectures against zero-trust baselines and quantum-safe roadmaps. IBM's 24/7 managed service suite illustrates the shift, layering incident response on cloud-workload protection for enterprises lacking continuous staff coverage. This trajectory creates fresh recurring revenue and expands the global data center security market.

Data Center Security Market Report Segments the Industry Into Security Type(Physical Security Solutions, and More). Offering (Solutions, Services), Data Center Type(Hyperscalers, Enterprise and Edge, and More), Industry Vertical(IT and Telecom, BFSI and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the data center security market at 37.25% in 2024, underpinned by dense hyperscale clusters and elevated regulatory scrutiny. The United States alone captured 77% of regional spend, with cloud giants announcing multi-billion-dollar AI-campus rollouts that integrate zero-trust blueprints from day one. Secondary metros such as Atlanta and Phoenix attract growth as power caps tighten in legacy hubs, compelling operators to replicate security controls across dispersed footprints.

Asia-Pacific is set for a 19.21% CAGR, the fastest among regions, thanks to double-digit capacity additions and digital-banking demand. Singapore's moratorium-ending green permits spur secure greenfield sites, while Tokyo leverages stringent privacy laws to lure BFSI tenants. China and India emphasize localized encryption keys, prompting bespoke compliance modules and fueling the data center security market across indigenous service providers. Mitsui & Co.'s USD 118 million (JPY 18 billion) stake in a Kanagawa hyperscale facility highlights the investment tide.

Europe intensifies security investments in new AI clusters across Italy, Spain, and France, balancing GDPR mandates with renewable-energy targets. Latin America posted 42% growth in 2024, led by Brazil and Mexico where energy access improvements coincide with marquee cloud regions. The Middle East and Africa adopt sovereign-cloud clauses and SEZ incentives, extending the data center security market to greenfield campuses in Dubai and Johannesburg. Across all regions, data-sovereignty themes and export-control programs such as the U.S. Data Center VEU Authorization reinforce demand for tamper-proof audit trails

- Cisco Systems Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Symantec (Gen Digital)

- Juniper Networks Inc.

- VMware by Broadcom

- Fortinet Inc.

- Palo Alto Networks Inc.

- Trend Micro Inc.

- Dell Technologies

- Hewlett Packard Enterprise

- Citrix Systems

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- Genetec Inc.

- Bosch Security Systems

- Arista Networks

- Cyxtera Technologies

- Hikvision Digital Technology

- Johnson Controls

- NEC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive data-traffic and hyperscale build-outs

- 4.2.2 Escalating cyber-attack sophistication

- 4.2.3 Stringent global compliance mandates

- 4.2.4 Cloud and hybrid IT attack-surface expansion

- 4.2.5 AI-powered zero-trust fabric inside DC (under-radar)

- 4.2.6 Autonomous physical security for edge/modular DC (under-radar)

- 4.3 Market Restraints

- 4.3.1 High CAPEX/OPEX for multi-layer security

- 4.3.2 Cyber-skills shortage

- 4.3.3 Power and cooling budgets crowd out security (under-radar)

- 4.3.4 Data-localization architecture complexity (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Anlaysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (Value, 2024-2030)

- 5.1 By Security Type

- 5.1.1 Physical Security

- 5.1.2 Logical / Cyber Security

- 5.2 By Offering

- 5.2.1 Solutions

- 5.2.2 Services (Consulting, Integration, Managed)

- 5.3 By Data Center Type

- 5.3.1 Hyperscalers/Cloud Service Providers

- 5.3.2 Colocation

- 5.3.3 Enterprise and Edge

- 5.4 By Industry Vertical

- 5.4.1 Banking and Financial Services (BFSI)

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Consumer Goods and Retail

- 5.4.5 Government and Defense

- 5.4.6 Media and Entertainment

- 5.4.7 Others (Energy, Education, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Singapore

- 5.5.3.5 Australia

- 5.5.3.6 Malaysia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirate

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves and MandA

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Check Point Software Technologies Ltd.

- 6.4.4 Symantec (Gen Digital)

- 6.4.5 Juniper Networks Inc.

- 6.4.6 VMware by Broadcom

- 6.4.7 Fortinet Inc.

- 6.4.8 Palo Alto Networks Inc.

- 6.4.9 Trend Micro Inc.

- 6.4.10 Dell Technologies

- 6.4.11 Hewlett Packard Enterprise

- 6.4.12 Citrix Systems

- 6.4.13 Schneider Electric SE

- 6.4.14 Siemens AG

- 6.4.15 Honeywell International Inc.

- 6.4.16 Genetec Inc.

- 6.4.17 Bosch Security Systems

- 6.4.18 Arista Networks

- 6.4.19 Cyxtera Technologies

- 6.4.20 Hikvision Digital Technology

- 6.4.21 Johnson Controls

- 6.4.22 NEC Corporation

- 6.5 Market Opportunities and Future Outlook

- 6.5.1 White-space and Unmet-Need Assessment