|

市场调查报告书

商品编码

1851852

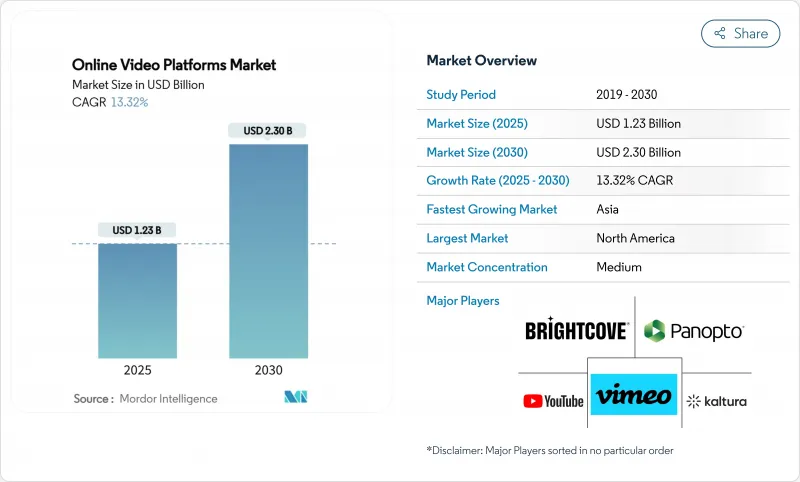

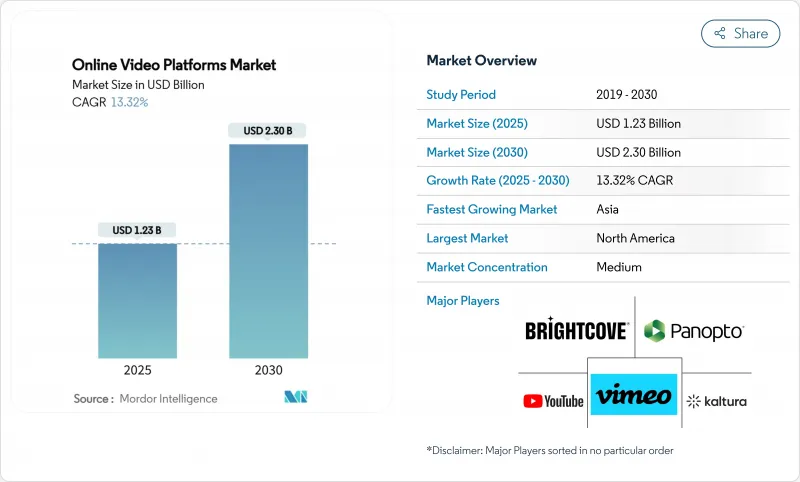

线上影片平台:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Online Video Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计到 2025 年,线上视讯平台市场价值将达到 12.3 亿美元,到 2030 年将达到 23 亿美元,年复合成长率为 13.32%。

成长反映了内容传送从传统模式向人工智慧赋能的生态系统的重大转变,该生态系统融合了程序化广告、数据分析和多种收益源。商业性5G的部署降低了延迟阈值,使直播和互动形式得以蓬勃发展。企业正在将影片融入培训、沟通和行销等各个职能部门,加速了对功能丰富、安全合规平台的需求。同时,对本地内容的监管压力正在推动对区域製作中心的大量投资,并在服务不足的语言领域创造差异化供应。虽然云端原生服务的日益普及确保了可扩展性,但向混合部署的转变表明,人们对合规性、成本和资料主权的担忧日益加剧。

全球线上视讯平台市场趋势与洞察

程序化广告彻底改变了影片货币化方式

程序化采购简化了广告主和发布商之间的交易,并将在2025年支撑近60%的电视和影片广告支出。自动化竞标整合了第一方数据,提高了联网电视和行动广告资源的定向精准度。自助服务工具扩大了用户访问范围,使中小企业能够与全球品牌并驾齐驱。因此,内容拥有者无需扩充销售团队即可实现收入成长。 《纽约时报》在2024年采用程式化影片后,营收成长了30%,这充分证明了该模式的扩充性。

行动优先的影片消费正在改变内容策略

超过70%的观众透过智慧型手机观看串流内容,在许多新兴市场,这一比例甚至超过80%。为了迎合用户的滚动观看习惯,出版商正在优化垂直格式和时长小于60秒的影片片段。行动端广告单元(例如激励广告和互动式广告)的引入,正在推动短影片广告的完成率和CPM溢价的提升。一些成功的获利案例,例如BuzzFeed在2024年推出垂直影片后营收成长40%,正在鼓励更广泛地采用这种模式。此外,这一趋势还有助于降低製作成本,并支援更高的内容更新频率和更精细的受众细分。

内容传送成本是拓展新兴市场面临的挑战。

亚洲和拉丁美洲骨干网路容量有限,导致CDN费用上涨,广告支援型服务的净利率受到挤压。虽然5G和边缘节点有望缓解这个问题,但目前的成本结构使得免费增值模式难以奏效,因为这些地区的ARPU值落后于已开发地区。供应商正在试验采用对等辅助分发和基于QUIC的媒体传输技术来降低频宽费用。

细分市场分析

到2024年,直播将占据线上视讯平台市场48%的份额,凸显其在娱乐、体育和企业活动中的普及程度。 5G的低延迟和高可靠性使平台能够将直播影片定位为一种高端互动方式,从而推动了其应用范围的扩大。这一领域持续吸引着寻求与受众即时互动的品牌。视讯分析虽然目前营收规模仍较小,但正以18%的复合年增长率成长,反映出企业在数据主导优化方面的投入不断增加。云端API的普及,使得自动化目标侦测、情绪分析和内容审核成为可能,并将影片转变为决策支援工具。随着企业透过互动指标和转换率的提升来量化投资报酬率,分析预算也随之增加,进一步丰富了线上视讯平台市场的收入来源。

其余类别——用户生成内容、自助平台和基于SaaS的专业套件——服务于不同的用户群体,但都受益于相同的底层架构。面向消费者的用户生成内容应用专注于社交传播和创作工具,而专业套件则整合了资产管理和多CDN路由等工作流程。这些细分领域正在推动平台选择的增加和竞争的加剧。

到2024年,解决方案将占总收入的70%,这主要得益于高品质串流媒体播放所需的影片分发和传输工具包。多重DRM库和数位浮水印等安全模组完善了分发套件,尤其对工作室和体育联盟而言更是如此。分析附加元件增加了订阅和授权收入,促使供应商将功能捆绑销售。然而,随着企业从资本支出模式转向营运支出模式,线上视讯平台服务市场规模正在迅速扩张。由于企业倾向于将编码、在地化和全天候监控外包给具有规模经济优势的专家,託管服务将以15%的复合年增长率成长。

在将影片堆迭整合到复杂的IT环境中时,专业服务至关重要。客製化播放器开发、API编配和合规性审核可确保平台部署符合技术和监管要求。这种咨询服务将全方位服务供应商与纯软体供应商区分开来。

区域分析

北美地区得益于成熟的宽频网路、高ARPU值以及联网电视设备的深度普及,预计将在2024年贡献全球35%的收入。该地区的媒体购买者预测,到2025年,他们将把近60%的电视和视频预算总合给数位视频,这一趋势将拓展平台的收入来源。由云端服务供应商、软体供应商和内容创作者组成的强大生态系统,正在推动人工智慧驱动的个人化和互动形式的快速试验。

亚太地区预计将以15%的复合年增长率实现最快成长,在2024年至2029年间新增收入达162亿美元。这一增长主要得益于智慧型手机的普及、数据价格的下降以及对本地语言内容日益增长的需求。仅印度一地,预计将贡献超过四分之一的优质影片收入,这主要得益于本地语言原创内容和体育赛事版权的推动。中国平台正利用其超级应用生态系统,透过交叉销售订阅和微交易来增强用户留存率。在东南亚,捆绑式行动数据套餐正在刺激注重价格的消费者首次尝试串流服务。

在企业积极采纳和监管推动下,欧洲市场依然强劲。欧盟的《视听媒体服务指令》要求全球平台投资欧洲内容创作,将资金注入当地工作室并创造就业机会。同时,随着光纤网路覆盖拉丁美洲二线城市,串流品质和广告资源不断提升,该地区的成长速度也正在加快。中东和非洲市场虽然仍处于起步阶段,但潜力巨大。 4G和5G网路覆盖范围的扩大以及年轻人口的成长,正在推动对具有文化相关性的内容的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美程式化广告成长带来的快速变现机会

- 亚洲短片行动消费激增

- 5G 的广泛应用实现了超低延迟的直播。

- 欧洲企业采用影片进行培训和内部沟通

- 基于云端原生和人工智慧的影片分析,提升观众参与度

- 收紧本地内容配额规定,以鼓励平台在中东的投资

- 市场限制

- 新兴市场高昂的CDN成本限制了盈利。

- 广告拦截会降低广告收入

- 数位版权管理标准碎片化,使全球分发复杂化。

- 平台企业面临的资料隐私合规(GDPR、CPRA)负担日益加重。

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济因素对产业的影响

- 投资分析

第五章 市场规模与成长预测

- 按类型

- 直播

- 视讯内容管理系统

- 影片分析

- 用户生成内容平台(UGC)

- 自助/DIY平台

- 基于SaaS的专业平台

- 按组件

- 解决方案

- 转码和处理

- 视讯串流媒体和发行

- 影片分析与互动

- 影片安全与数位版权管理

- 影片内容管理

- 服务

- 专业服务

- 託管服务

- 解决方案

- 按串流媒体类型

- 居住

- 视讯点播 (VoD)

- 透过部署模式

- 云

- 本地部署

- 杂交种

- 最终用户

- 媒体与娱乐

- 数位学习与教育

- BFSI

- 零售与电子商务

- 资讯科技/通讯

- 医疗保健和生命科学

- 政府/公共部门

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- Strategic Developments

- Vendor Positioning Analysis

- 公司简介

- Alphabet Inc.(YouTube LLC)

- Vimeo Inc.(IAC/InterActiveCorp)

- Brightcove Inc.

- IBM Corporation(IBM Video Streaming)

- Kaltura Inc.

- Panopto Inc.

- Wistia Inc.

- JW Player(Longtail Ad Solutions Inc.)

- Vidyard(BuildScale Inc.)

- Dacast Inc.

- Mux Inc.

- Qumu Corporation

- Dailymotion

- Wowza Media Systems LLC

- MediaPlatform Inc.

- Muvi LLC

- SproutVideo LLC

- Cloudflare Stream

- Bitmovin Inc.

- Vbrick Systems Inc.

第七章 市场机会与未来展望

The online video platforms market size is estimated at USD 1.23 billion in 2025 and is forecast to reach USD 2.30 billion by 2030, expanding at a 13.32% CAGR.

Growth reflects a decisive shift from legacy content delivery to AI-enabled ecosystems that weave together programmatic advertising, data analytics, and multi-revenue streams. Commercial 5G roll-outs are lowering latency thresholds, allowing live and interactive formats to flourish. Enterprises are embedding video across functions-training, communications, and marketing-accelerating demand for feature-rich, security-compliant platforms. Meanwhile, regulatory pressure for local content is prompting sizable investment in regional production hubs, thereby creating differentiated supply in underserved languages. Rising adoption of cloud-native services anchors scalability, but a pivot toward hybrid deployments signals mounting concern over compliance, cost, and data sovereignty.

Global Online Video Platforms Market Trends and Insights

Programmatic Advertising Revolutionizes Video Monetization

Programmatic buying now underpins nearly 60% of TV and video ad spend in 2025, streamlining transactions between advertisers and publishers. Automated auctions integrate first-party data, boosting targeting accuracy across connected-TV and mobile inventory. Self-serve tools widen access, enabling small businesses to compete alongside global brands. As a result, content owners unlock incremental revenue without expanding sales teams. The New York Times recorded a 30% uplift after adopting programmatic video in 2024, confirming the model's scalability

Mobile-First Video Consumption Reshapes Content Strategies

More than 70% of viewers watch streaming content on smartphones; in many emerging markets the ratio exceeds 80% . Publishers are optimizing vertical formats and sub-60-second clips to suit scroll-based behavior. Implementation of mobile-centric ad units-including rewarded and interactive overlays-improves completion rates, driving CPM premiums for short-form inventory. Monetization success stories, such as BuzzFeed's 40% revenue spike following a vertical-video push in 2024, encourage broader adoption. The trend also lowers production costs, supporting higher content cadence and granular audience segmentation.

Content Delivery Costs Challenge Emerging-Market Expansion

Limited backbone capacity inflates CDN fees, compressing margins for ad-supported services in Asia and Latin America. While 5G and edge nodes promise relief, current cost structures complicate freemium strategies where ARPU lags developed regions. Vendors experiment with peer-assisted delivery and Media over QUIC to tame bandwidth bills

Other drivers and restraints analyzed in the detailed report include:

- 5G Infrastructure Enables Next-Generation Experiences

- Corporate Adoption Accelerates Digital Transformation

- Ad-Blocking Technologies Threaten Revenue Models

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Live Streaming captured 48% share of the online video platforms market in 2024, underscoring its ubiquity across entertainment, sports, and corporate events. Adoption widened as 5G decreased latency and boosted reliability, allowing platforms to position live video as a premium engagement lever. The segment continues to attract brands seeking real-time interaction with audiences. Video Analytics, although smaller in revenue, is advancing at an 18% CAGR, reflecting higher enterprise spending on data-driven optimization. The availability of cloud APIs that automate object detection, sentiment analysis, and content moderation is transforming video into a decision-support asset. As enterprises quantify ROI through engagement metrics and conversion lift, analytics budgets rise accordingly, further diversifying revenue inside the online video platforms market.

The remaining categories-User-Generated Content, DIY platforms, and SaaS-based professional suites-serve varied user personas yet benefit from the same underlying infrastructure. Consumer-facing UGC apps emphasize social virality and creator tools, whereas professional suites integrate workflows like asset management and multi-CDN routing. Collectively, these niches reinforce platform choice and keep competitive intensity high.

Solutions commanded 70% revenue in 2024, led by video delivery and distribution toolkits essential for high-quality streaming. Security modules such as multi-DRM vaults and watermarking complement delivery pipelines, especially for studios and sports leagues. Analytics add-ons unlock incremental subscription or licensing revenue, incentivizing vendors to bundle features. The online video platforms market size for services, however, is scaling quickly as organizations shift from capital expenditure to operating expenditure models. Managed Services show 15% CAGR because enterprises prefer outsourcing encoding, localization, and 24/7 monitoring to specialists with economies of scale.

Professional Services remain indispensable when integrating video stacks into complex IT environments. Custom player development, API orchestration, and compliance audits ensure that platform rollouts meet both technical and regulatory requirements. This consultative layer differentiates full-service vendors from pure-play software providers.

The Online Video Platforms Market Report is Segmented by Type (Live Streaming, Video Content Management, Video Analytics, UGC Platforms, Self-service/DIY, Saas Professional), Component (Solutions, Services), Streaming Type (Live, Vod), Deployment Mode (Cloud, On-Premises, Hybrid), End User (Media and Entertainment, E-Learning, BFSI, and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35% of global revenue in 2024, fueled by mature broadband, high ARPU, and deep penetration of connected-TV devices. Media buyers in the region allocate nearly 60% of combined TV and video budgets to digital video in 2025, a trend that amplifies platform revenue streams. The robust ecosystem of cloud providers, software vendors, and content creators fosters rapid experimentation with AI-driven personalization and interactive formats.

Asia-Pacific is advancing fastest at a 15% CAGR and is projected to add USD 16.2 billion in revenue between 2024 and 2029. The surge stems from smartphone ubiquity, lower data tariffs, and escalating demand for local-language content. India alone is forecast to deliver over one quarter of incremental premium video revenue, helped by regional language originals and sports rights. Chinese platforms leverage super-app ecosystems to cross-sell subscriptions and micro-transactions, reinforcing user stickiness. In Southeast Asia, bundled mobile-data plans stimulate first-time streaming adoption among price-sensitive consumers.

Europe retains solid position owing to enterprise adoption and regulatory impetus. The EU's Audiovisual Media Service Directive obliges global platforms to invest in European storytelling, channeling funds into regional studios and jobs. Meanwhile, Latin America sees accelerating growth as fiber deployments reach secondary cities, lifting streaming quality and ad inventory. The Middle East and Africa remain nascent but promising; expanding 4G and 5G coverage, plus rising youth populations, underpin demand for culturally relevant content.

- Alphabet Inc. (YouTube LLC)

- Vimeo Inc. (IAC/InterActiveCorp)

- Brightcove Inc.

- IBM Corporation (IBM Video Streaming)

- Kaltura Inc.

- Panopto Inc.

- Wistia Inc.

- JW Player (Longtail Ad Solutions Inc.)

- Vidyard (BuildScale Inc.)

- Dacast Inc.

- Mux Inc.

- Qumu Corporation

- Dailymotion

- Wowza Media Systems LLC

- MediaPlatform Inc.

- Muvi LLC

- SproutVideo LLC

- Cloudflare Stream

- Bitmovin Inc.

- Vbrick Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Monetization Opportunities through Programmatic Advertising Growth in North America

- 4.2.2 Surge of Short-Form Mobile Video Consumption in Asia

- 4.2.3 Increasing 5G Penetration Enabling Ultra-Low-Latency Live Streaming

- 4.2.4 Corporate Adoption of Video for Training and Internal Communications in Europe

- 4.2.5 Cloud-native AI-powered Video Analytics Enhancing Viewer Engagement

- 4.2.6 Regulatory Push for Local Content Quotas Driving Platform Investments in Middle East

- 4.3 Market Restraints

- 4.3.1 High CDN Costs in Emerging Markets Limiting Profitability

- 4.3.2 Ad-blocking Adoption Reducing Advertising Revenues

- 4.3.3 Fragmented Digital Rights Management Standards Complicating Global Distribution

- 4.3.4 Rising Data-privacy Compliance Burden (GDPR, CPRA) on Platform Operations

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Macroeconomic factors Impact on the Industry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Live Streaming

- 5.1.2 Video Content Management Systems

- 5.1.3 Video Analytics

- 5.1.4 User-Generated Content Platforms (UGC)

- 5.1.5 Self-service/DIY Platforms

- 5.1.6 SaaS-based Professional Platforms

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.1.1 Transcoding and Processing

- 5.2.1.2 Video Delivery and Distribution

- 5.2.1.3 Video Analytics and Engagement

- 5.2.1.4 Video Security and DRM

- 5.2.1.5 Video Content Management

- 5.2.2 Services

- 5.2.2.1 Professional Services

- 5.2.2.2 Managed Services

- 5.2.1 Solutions

- 5.3 By Streaming Type

- 5.3.1 Live

- 5.3.2 Video on Demand (VoD)

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-premises

- 5.4.3 Hybrid

- 5.5 By End User

- 5.5.1 Media and Entertainment

- 5.5.2 E-learning and Education

- 5.5.3 BFSI

- 5.5.4 Retail and eCommerce

- 5.5.5 IT and Telecommunications

- 5.5.6 Healthcare and Life Sciences

- 5.5.7 Government and Public Sector

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Alphabet Inc. (YouTube LLC)

- 6.3.2 Vimeo Inc. (IAC/InterActiveCorp)

- 6.3.3 Brightcove Inc.

- 6.3.4 IBM Corporation (IBM Video Streaming)

- 6.3.5 Kaltura Inc.

- 6.3.6 Panopto Inc.

- 6.3.7 Wistia Inc.

- 6.3.8 JW Player (Longtail Ad Solutions Inc.)

- 6.3.9 Vidyard (BuildScale Inc.)

- 6.3.10 Dacast Inc.

- 6.3.11 Mux Inc.

- 6.3.12 Qumu Corporation

- 6.3.13 Dailymotion

- 6.3.14 Wowza Media Systems LLC

- 6.3.15 MediaPlatform Inc.

- 6.3.16 Muvi LLC

- 6.3.17 SproutVideo LLC

- 6.3.18 Cloudflare Stream

- 6.3.19 Bitmovin Inc.

- 6.3.20 Vbrick Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment