|

市场调查报告书

商品编码

1851862

贸易监控系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Trade Surveillance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

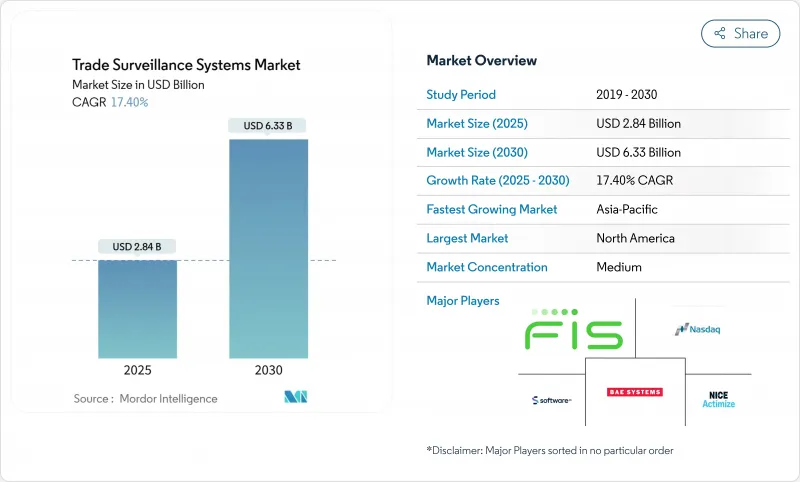

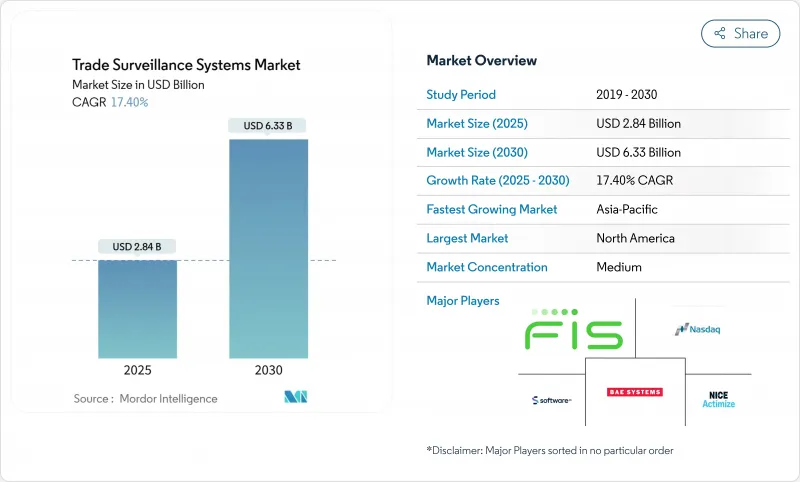

预计到 2025 年,贸易监控系统市场规模将达到 28.4 亿美元,到 2030 年将达到 63.3 亿美元,预测期(2025-2030 年)的复合年增长率为 17.40%。

更严格的报告要求,例如美国的综合审核追踪(CAT)和欧洲不断发展的MiFID II框架,是关键的推动因素。金融机构现在需要近乎即时的分析,筛检超过15万笔交易,并以97.5%的准确率识别可疑模式,这促使供应商转向高效能、人工智慧驱动的架构。云端技术的采用降低了前期投资需求,而混合模式则解决了资料主权问题。加密资产和代币化资产的快速成长增加了复杂性,迫使监控平台扩展到传统股票和衍生性商品之外。

全球贸易监控系统市场趋势与洞察

多资产电子交易市场的快速扩张

高频交易和演算法交易策略目前已占美国股票交易量的一半以上,这造成了传统规则无法覆盖的监控盲点。各公司必须关联股票、债券、选择权和大宗商品的订单簿,同时也要考虑毫秒级的延迟差异,因为这种差异使得交叉套利成为可能。从伦敦主导模式向全自动、订单驱动型交易所的转变表明,流动性的增加与市场操纵风险的上升并存。供应商正在透过统一资料来源并引入特定交易场所的校准机制来应对此挑战,这些校准机制可以标记分散市场中的欺骗交易和分层交易行为。

CAT 和其他交易后透明度要求

美国《商品交易法案》(CAT) 要求美国仲介使用单一格式报告所有股票和选择权事件。 2025年3月的修订案减少了个人资讯字段,但保留了唯一标识符,每年可为公司节省1200万美元,同时仍能向监管机构提供足够的资讯。类似的压力也正在欧洲酝酿,MiFIR 3引入了数位代币识别码和新的到期标籤,迫使系统升级以处理更丰富的数据。这促使金融机构将监控视为基本的合规基础设施,而非选择权风险管理工具。

与传统前台、中台和后勤部门系统的复杂集成

英国近92%的金融机构依赖大型主机,这些大型主机在夜间批量处理交易文件,无法实现秒级监控。实现讯息通讯协定、栏位分类和同步化需要多年的蓝图,并且通常涉及50多个内部团队。系统中断会导致资料馈送不完整和警报遗漏,迫使新旧平台并行运作一段时间,直到监管机构确认资料完整性为止。

细分市场分析

到2024年,解决方案将占据交易监控系统市场62.2%的份额,凸显了整合订单、执行和通讯资料的端到端平台的主导地位。该细分市场受益于高昂的转换成本和持续的规则更新,使供应商能够获得持续的授权收入。随着银行在关键监管期限前续签企业许可证,预计包含解决方案的交易监控系统市场规模将稳定成长。

随着小型企业将模型调优和监管映射外包,服务业将以 18.2% 的复合年增长率成长。託管服务合约可以弥补内部人才缺口,并提供全天候的区域覆盖。对于中型仲介而言,这种方式比聘请专职量化分析师更具成本效益,因为服务提供者可以一站式完成实施、行为模型校准和运作测试。

到2024年,本地部署系统仍将维持54.6%的市场份额,这反映了资料主权要求以及审核对防火墙后系统的偏好。然而,随着监管机构明确加密资料可储存在核准的司法管辖区,云端服务预计将成为交易监控系统市场中成长最快的领域,到2030年将以19.2%的复合年增长率成长。

云端服务供应商提供弹性运算能力,可在一夜之间回测数百万个场景。混合模式正日益普及,因为它们将个人识别资讯储存在本地资料中心,同时将去识别化的交易记录传输到云端丛集进行进阶分析。新加坡和加拿大的成功试验表明,只要加密金钥由客户管理,此类架构就能通过监管审查。

交易监控系统市场按组件(解决方案和服务)、部署类型(本地部署和云端部署)、交易类型(股票、固定收益、其他)、最终用户(卖方机构、买方机构、其他)、组织规模(一级全球银行、二级和中型企业、其他)以及地区进行细分。市场预测以美元计价。

区域分析

亚太地区监管科技发展速度最快,年复合成长率达18.1%,从追随者跃升为领跑者。新加坡金融管理局试行以人工智慧为基础的反洗钱和反恐融资模型,以加强交易监控。香港强制要求对持牌虚拟资产管理公司进行监管,从而推动了交易所和一级仲介的支出。

北美是最大的贡献者,占比34.16%,这主要得益于CAT(可能是指某种交易规则或法规)以及计划于2025年中期生效的卖空限制。美国受惠于供应商靠近主要股票和选择权交易所的地理优势,而随着交叉上市交易量的成长,加拿大也正在加速投资。

在欧洲,MiFID II 和 EMIR 已经引入了严格的交易报告製度,并且各国已拥有成熟的监管机构。即将推出的 MiFIR 3 将引入数位代币标识符,并扩大监管范围。欧洲大陆的银行正在升级其係统,以统一各业务部门的交易标识符,而英国公司则在实施并行流程,以应对英国脱欧后出现的差异。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球多资产电子交易所的快速扩张

- 综合审核追踪(CAT)和其他交易后透明度要求

- 人工智慧/机器学习驱动的异常检测可减少误报和合规成本。

- 云端原生SaaS交付降低了整体拥有成本

- 受监管机构对加密货币和数位资产交易的接受度日益提高

- 现实世界资产的代币化造成了新的监控盲点

- 市场限制

- 与传统前台、中台和后勤部门的高度整合复杂性

- 贸易监控数据科学人才短缺

- 分散的全域规则集会导致代价高昂的规则对应。

- 日益严格的隐私法规限制了全面监控资料的共享

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力:波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 服务

- 透过部署模式

- 本地部署

- 云

- 按交易类型

- 库存

- 固定收益

- 衍生性商品

- 外汇外汇

- 商品

- 数位资产

- 最终用户

- 卖方机构

- 买方机构

- 市场场所和交易所

- 监管机构和自律组织

- 按公司规模

- 全球一级银行

- 二线和中型企业

- 小型金融机构和仲介交易商

- 金融科技与加密货币交易所

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 新加坡

- 马来西亚

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NICE Ltd.(Actimize)

- Nasdaq Inc.(SMARTS)

- BAE Systems Digital Intelligence

- Fidelity National Information Services Inc.(FIS)

- Software AG

- Eventus Systems Inc.

- ACA Group

- TradingHub Group Ltd.

- eflow Ltd.

- B-next Group GmbH

- Solidus Labs Inc.

- Aquis Technologies Ltd.

- Trillium Management LLC

- SIA SpA

- IBM Watson Financial RegTech

- S&P Global Market Intelligence(KYC/Surveillance)

- VoxSmart Ltd.

- OneMarketData LLC

- SteelEye Ltd.

- CranSoft(Scila AB)

- KX Systems(First Derivatives plc)

- ShieldFC Ltd.

- IPC Systems Inc.(Connexus)

- Trapets AB

- Corvil Analytics by Pico

- Digital Reasoning Systems Inc.

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Trade Surveillance Systems Market size is estimated at USD 2.84 billion in 2025, and is expected to reach USD 6.33 billion by 2030, at a CAGR of 17.40% during the forecast period (2025-2030).

Heightened reporting mandates such as the United States' Consolidated Audit Trail (CAT) and Europe's evolving MiFID II framework are the core catalysts. Institutions now need near-real-time analytics that screen more than 150,000 transactions per second and spot suspicious patterns with 97.5% accuracy, pushing vendors toward high-performance, AI-driven architectures. Cloud deployment lowers upfront capital requirements, while hybrid models address data-sovereignty concerns. Rapid growth in crypto and tokenized assets adds complexity, forcing surveillance platforms to expand beyond traditional equities and derivatives.

Global Trade Surveillance Systems Market Trends and Insights

Rapid Expansion of Multi-Asset Electronic Trading Venues

High-frequency and algorithmic strategies now drive more than half of US equity volumes, creating surveillance blind spots that legacy rule sets struggle to cover. Firms must correlate order books across equities, fixed income, options, and commodities while accounting for millisecond latency gaps that enable cross-venue arbitrage. The shift from dealer models to fully automated order-driven venues in London illustrates how liquidity gains coexist with higher market-abuse risk. Vendors respond by unifying data feeds and embedding venue-specific calibrations that flag spoofing and layering across fragmented markets.

Mandatory CAT and Other Post-Trade Transparency Mandates

The CAT regime obliges US brokers to report every equity and option event under one schema. A March 2025 amendment trimmed personal data fields yet preserved unique identifiers, saving firms USD 12 million yearly while keeping regulators fully informed. Similar pressure builds in Europe, where MiFIR 3 introduces digital-token identifiers and new effective-date tags, compelling upgrades to handle richer payloads. Institutions, therefore, treat surveillance as foundational compliance infrastructure rather than optional risk tooling.

High Integration Complexity with Legacy Front-, Middle- and Back-Office Systems

Nearly 92% of UK institutions still rely on mainframes that batch-process trade files overnight, a cadence incompatible with second-by-second surveillance. Bridging message protocols, field taxonomies, and clock synchronisation requires multi-year roadmaps, often involving 50-plus internal teams. Disconnects cause incomplete data feeds and missed alerts, forcing parallel run periods where old and new platforms coexist until regulators certify data integrity.

Other drivers and restraints analyzed in the detailed report include:

- AI/ML-Powered Anomaly Detection Reducing False Positives and Cost

- Cloud-Native SaaS Delivery Lowering Total Cost of Ownership

- Shortage of Trade-Surveillance Data-Science Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions held 62.2% of the trade surveillance systems market share in 2024, underscoring the primacy of end-to-end platforms that integrate order, execution, and communications data. The segment benefits from high switching costs and continual rule updates, positioning vendors for recurring licensing revenue. The trade surveillance systems market size attached to solutions is projected to lift steadily as banks renew enterprise licences before key regulatory deadlines.

Services, though smaller, grow at 18.2% CAGR as institutions outsource model tuning and regulatory mapping. Managed-service contracts fill in-house talent gaps and provide 24-hour coverage across regions. Providers bundle implementation, behavioural-model calibration, and post-go-live testing, a package that mid-tier brokers consider more cost-effective than hiring specialised quants.

On-premise deployments retained a 54.6% share in 2024, reflecting data-sovereignty obligations and auditor preference for systems housed within firewalls. Yet the trade surveillance systems market size attributed to cloud offerings is set to rise fastest, expanding at 19.2% CAGR through 2030 as regulators issue clarifications that encrypted data may reside in approved jurisdictions.

Cloud providers offer elastic compute for back-testing millions of scenarios overnight, an ability that on-premise grids struggle to replicate without oversizing. Hybrid models gain traction because they keep personally identifiable information in local data centres while diverting de-identified trade records to cloud clusters for heavy analytics. Successful pilots in Singapore and Canada demonstrate that such architectures pass regulatory inspection when encryption keys remain client-controlled.

Trade Surveillance Systems Market is Segmented by Component (Solutions and Services), Deployment Mode (On-Premise and Cloud), Trading Type (Equities, Fixed Income, and More), End-User (Sell-Side Institutions, Buy-Side Institutions, and More), Organisation Size (Tier-1 Global Banks, Tier-2 and Mid-Sized Firms, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific records the fastest regional CAGR of 18.1%, moving from follower to front-runner in supervisory technology. Monetary Authority of Singapore pilots AI-based AML-CFT models that feed into trade-surveillance controls, creating reference implementations that other regulators monitor closely. Hong Kong mandates surveillance coverage for licensed virtual-asset operators, lifting spending among exchanges and prime brokers.

North America remains the largest contributor with a 34.16% share, driven by CAT and planned short-sale flags that take effect mid-2025. The United States benefits from vendor proximity to major equity and options venues, while Canada accelerates investment as cross-listing volumes climb.

Europe holds a mature adopter profile where MiFID II and EMIR already embed strict transaction reporting. Upcoming MiFIR 3 changes introduce digital-token identifiers that widen the regulatory perimeter. Continental banks upgrade systems to reconcile trade identifiers across business lines, and UK firms run parallel processes to manage post-Brexit divergence.

- NICE Ltd. (Actimize)

- Nasdaq Inc. (SMARTS)

- BAE Systems Digital Intelligence

- Fidelity National Information Services Inc. (FIS)

- Software AG

- Eventus Systems Inc.

- ACA Group

- TradingHub Group Ltd.

- eflow Ltd.

- B-next Group GmbH

- Solidus Labs Inc.

- Aquis Technologies Ltd.

- Trillium Management LLC

- SIA S.p.A.

- IBM Watson Financial RegTech

- S&P Global Market Intelligence (KYC/Surveillance)

- VoxSmart Ltd.

- OneMarketData LLC

- SteelEye Ltd.

- CranSoft (Scila AB)

- KX Systems (First Derivatives plc)

- ShieldFC Ltd.

- IPC Systems Inc. (Connexus)

- Trapets AB

- Corvil Analytics by Pico

- Digital Reasoning Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of global multi-asset electronic trading venues

- 4.2.2 Mandatory consolidated audit trail (CAT) and other post-trade transparency mandates

- 4.2.3 AI/ML-powered anomaly detection reduces false positives and compliance costs

- 4.2.4 Cloud-native SaaS delivery lowering total cost of ownership

- 4.2.5 Growing adoption of crypto and digital-asset trading by regulated institutions

- 4.2.6 Tokenisation of real-world assets creating new surveillance blind spots

- 4.3 Market Restraints

- 4.3.1 High integration complexity with legacy front-, middle- and back-office systems

- 4.3.2 Shortage of trade-surveillance data-science talent

- 4.3.3 Fragmented global rule sets leading to costly rule-mapping

- 4.3.4 Rising privacy regulations limiting holistic surveillance data pooling

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Trading Type

- 5.3.1 Equities

- 5.3.2 Fixed Income

- 5.3.3 Derivatives

- 5.3.4 Foreign Exchange

- 5.3.5 Commodities

- 5.3.6 Digital Assets

- 5.4 By End-user

- 5.4.1 Sell-Side Institutions

- 5.4.2 Buy-Side Institutions

- 5.4.3 Market Venues and Exchanges

- 5.4.4 Regulators and SROs

- 5.5 By Organisation Size

- 5.5.1 Tier-1 Global Banks

- 5.5.2 Tier-2 and Mid-Sized Firms

- 5.5.3 Small FIs and Broker-Dealers

- 5.5.4 FinTech and Crypto Exchanges

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Singapore

- 5.6.4.7 Malaysia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NICE Ltd. (Actimize)

- 6.4.2 Nasdaq Inc. (SMARTS)

- 6.4.3 BAE Systems Digital Intelligence

- 6.4.4 Fidelity National Information Services Inc. (FIS)

- 6.4.5 Software AG

- 6.4.6 Eventus Systems Inc.

- 6.4.7 ACA Group

- 6.4.8 TradingHub Group Ltd.

- 6.4.9 eflow Ltd.

- 6.4.10 B-next Group GmbH

- 6.4.11 Solidus Labs Inc.

- 6.4.12 Aquis Technologies Ltd.

- 6.4.13 Trillium Management LLC

- 6.4.14 SIA S.p.A.

- 6.4.15 IBM Watson Financial RegTech

- 6.4.16 S&P Global Market Intelligence (KYC/Surveillance)

- 6.4.17 VoxSmart Ltd.

- 6.4.18 OneMarketData LLC

- 6.4.19 SteelEye Ltd.

- 6.4.20 CranSoft (Scila AB)

- 6.4.21 KX Systems (First Derivatives plc)

- 6.4.22 ShieldFC Ltd.

- 6.4.23 IPC Systems Inc. (Connexus)

- 6.4.24 Trapets AB

- 6.4.25 Corvil Analytics by Pico

- 6.4.26 Digital Reasoning Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment