|

市场调查报告书

商品编码

1851891

永续包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Sustainable Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

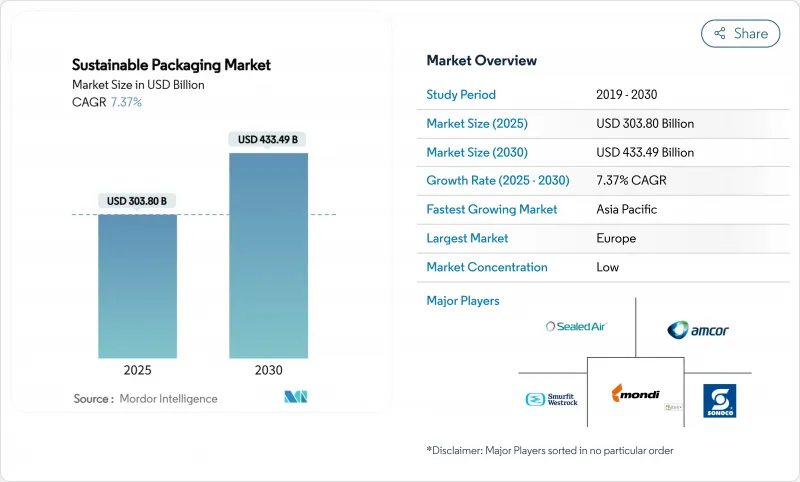

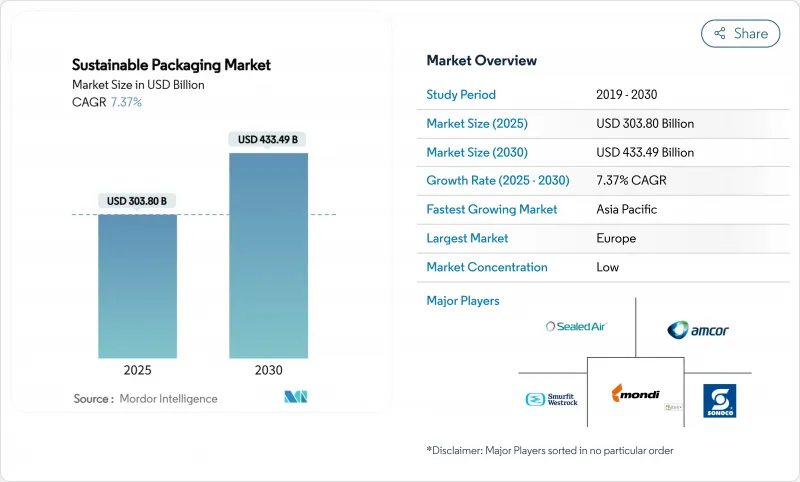

2025年永续包装市场规模估计为3,038亿美元,预计到2030年将达到4,334.9亿美元,复合年增长率为7.37%。

推动这一趋势的动力源于生产者延伸责任制(EPR)法规的融合,该法规目前已覆盖63个国家,消除了监管套利,并释放了跨境规模效益。品牌对最低再生材料基准值的承诺、化学回收技术的快速发展以及电子商务对包装尺寸合理化需求的增长,都在加速向循环解决方案领域的资本投入。对菌丝体和海藻基材的创业融资,以及人工智慧辅助分类以提高材料产量比率,正在缩小再生材料和原生材料之间的成本差距。同时,像安靠与贝里全球的合作这样的策略併购,正在整合研发资源,加速下一代包装形式的商业化。

全球永续包装市场趋势与洞察

生产者延伸责任法促进合规趋同

随着63个国家和地区的生产者责任延伸(EPR)强制规定趋于一致,监管碎片化的局面正在解决。欧盟的《包装和包装废弃物条例》于2025年2月生效,该条例设定了PET食品包装30%的回收率目标,并禁止使用全氟烷基和多氟烷基物质(PFAS)。肯亚的新法规与欧盟的收费系统类似,而奥勒冈州和科罗拉多将从2025年7月起要求品牌方出资设立生产者责任组织。统一的时间表使全球品牌能够大规模部署单一的设计方案,从而降低合规成本,并加速永续包装市场的应用。

品牌承诺推动PCR内容标准化超越监理门槛

领先的消费品公司承诺到2030年,其产品组合中消费后回收材料(PCR)的比例将达到25%至50%,从而超越了法律要求。例如,联合利华的目标是到2025年实现所有包装可回收、可重复使用或可堆肥,安姆科承诺为吉百利的包装供应1000吨再生塑料,这些自愿性目标有效地设定了行业基准。美国塑胶公约的标准化PCR测量套件正在简化检验,提高采购透明度,并促进永续包装市场的成长。

PCR树脂供应限製成策略瓶颈

目前,品牌承诺的用量超过了食品级透明消费后回收塑胶(PCR)的供应量。原乳产量的下降导致天然高密度聚乙烯(HDPE)的供应量减少,推高了溢价,迫使企业依赖进口,并削弱了国内回收企业的竞争力。这种供需失衡威胁到监管配额的及时完成,并减缓了永续包装市场向大众市场的扩张。

细分市场分析

儘管可回收包装在2024年仍将保持45.32%的市场份额,但可堆肥和可生物降解产品的复合年增长率高达12.54%,这反映出投资者对B'Zeos等生医材料(例如其海藻薄膜)的信心。永续包装市场规模的成长主要得益于餐饮服务和个人护理品牌对无微塑胶碎片解决方案的需求。然而,美国祇有30%的城市拥有工业堆肥设施,阻碍了可堆肥可持续包装在短期内的普及。为此,《堆肥法案》(COMPOST Act)提案津贴20亿美国扩大堆肥处理能力。

消费者对消费后产品处理的困惑持续加剧有机废弃物的污染,因此亟需更清楚的标籤和公众教育宣传活动。厌氧消化已成为一种改善计划经济效益并产生沼气收入的替代方案,可部分弥补基础设施的不足。随着政策和加工流程的差距逐步缩小,可堆肥包装在永续包装市场中正蓬勃发展。

到2024年,纸和纸板将占总收入的40.43%,这主要得益于成熟的回收系统和消费者的信任。然而,植物来源基材正以11.43%的复合年增长率快速增长,这主要得益于斯道拉恩索的干成型纤维生产线,该生产线可减少75%的用水量和30%的能源消耗,从而增强了循环经济的竞争力。由于PFAS(全氟烷基和多氟烷基物质)的禁用以及更严格的再生材料含量法规,聚烯在永续包装市场的份额预计将逐步萎缩。

先进的回收技术发泡体,例如柏克莱大学的260°C汽化工艺,可将聚乙烯转化为原料,回收率高达98%,从而实现食品级循环利用并减少降级回收。菌丝泡棉和木质PET替代品拓展了其应用范围,不再局限于小众领域,这预示着市场区隔领域正在经历更广泛的材料转型。

区域分析

欧洲在2024年占据34.57%的收入份额,这反映了其成熟的回收基础设施和领先的监管立场,并由此制定了生态设计规范。根据循环利用绩效调整生产者责任延伸(EPR)费用,奖励了高再生材料含量的包装,并强化了供应商的创新週期。统一的押金返还制度简化了回收流程,使欧洲成为先进回收试点计画和生物基材料商业化的标竿市场。该地区是许多跨国品牌总部所在地,进一步提高了需求密度,而永续包装市场正持续在当地测试和推广突破性技术。

得益于日本、韩国和澳洲不断完善的监管政策,以及中国和印度试点推行的生产者责任延伸制度(EPR),亚太地区预计将实现11.21%的年复合成长率,成为成长最快的地区。日本将于2024年生效的再生塑胶强制令,以及2025年6月生效的食品接触用再生树脂正面表列,将开拓高利润应用领域,并刺激国内树脂再加工投资。中国不断完善的再生塑胶监管政策,加上强劲的电子商务成长,正在推动再生塑胶产量的扩张。越南的纸包装产业预计到2026年将达到35亿美元,是出口导向製造业推动区域扩张的典范。

北美正受惠于各州推行的生产者责任延伸制度(EPR)以及消费品产业领导者积极的自愿性措施。奥勒冈州、科罗拉多和加州的计画正在资助路边回收设施的升级改造,增加消费后回收材料(PCR)的供应,并缩小成本差距。诸如近期澳洲的克罗克斯案等「绿色清洗」诉讼,正在推动资讯揭露更加严格,增强消费者信任,并促进供应链透明化。中东/非洲和南美洲虽然仍在发展中,但其政策正在迅速趋同,随着基础设施的扩展,为早期技术进入者创造了閒置频段机会。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 生产者延伸责任制(EPR)法律在经合组织和金砖国家市场中日益普及

- 品牌拥有者的承诺推动产品组合中PCR含量超过25%。

- 扩大电子商务物流中零售商回收和再利用试点项目

- 人工智慧驱动的分类技术提高了消费后产量比率

- 食品级聚烯化学回收技术突破

- 新创公司 Mycelium and Seaweed Packaging 获得创业投资

- 市场限制

- 高品质PCR树脂的供需缺口

- 通货膨胀主导的成本溢价(相对于原生基板)

- 北美和亚太地区的堆肥基础设施分散

- 「绿色清洗」诉讼风险修改后的行销声明

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 评估微观经济因素的影响

第五章 市场规模与成长预测

- 透过流程

- 可重复使用的包装

- 可回收包装

- 可堆肥/可生物降解包装

- 可食用包装

- 依材料类型

- 纸和纸板

- 塑胶

- 玻璃

- 金属(铝、钢)

- 植物来源的原料(甘蔗渣、洋菇等)

- 按包装类型

- 难的

- 灵活的

- 按功能

- 初级包装

- 二级包装

- 三级/运输包装

- 最终用户

- 食品/饮料

- 製药和医疗保健

- 化妆品和个人护理

- 电子商务与零售

- 消费性电子产品

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- Smurfit WestRock Company

- Tetra Pak International SA

- Sonoco Products Company

- Sealed Air Corporation

- Mondi plc

- Huhtamaki Oyj

- BASF SE

- Ardagh Group SA

- Ball Corporation

- Crown Holdings Inc.

- Genpak LLC

- International Paper Company

- Stora Enso Oyj

- Graphic Packaging Holding Co.

- Uflex Ltd.

- Novolex Holdings Inc.

- Ecovative LLC

第七章 市场机会与未来展望

The sustainable packaging market size stood at a value of USD 303.80 billion in 2025 and is projected to reach USD 433.49 billion by 2030, reflecting a CAGR of 7.37%.

Momentum is anchored in converging Extended Producer Responsibility (EPR) regulations that now span 63 countries, eliminating regulatory arbitrage and unlocking cross-border scale efficiencies. Brand commitments to minimum recycled-content thresholds, rapid progress in chemical recycling technologies, and rising e-commerce volumes that demand packaging right-sizing are accelerating capital deployment toward circular solutions. Venture funding into mycelium and seaweed-based substrates, coupled with AI-enabled sortation that improves material yields, is narrowing the cost gap between recycled and virgin feedstocks. Simultaneously, strategic mergers-such as the Amcor-Berry Global tie-up-are consolidating research and development resources to speed commercialization of next-generation formats.

Global Sustainable Packaging Market Trends and Insights

Extended Producer-Responsibility Laws Create Compliance Convergence

Converging EPR mandates in 63 jurisdictions are dismantling regulatory fragmentation. The European Union's Packaging and Packaging Waste Regulation, effective February 2025, sets 30% recycled-content targets for PET food packaging and bans PFAS, prompting similar frameworks across OECD and BRICS economies. New Kenyan statutes mirror EU fee structures, while Oregon and Colorado require brand-funded Producer Responsibility Organizations from July 2025. Harmonized timelines let global brands deploy single-design solutions at scale, lowering compliance costs and accelerating adoption across the sustainable packaging market.

Brand Commitments Drive PCR Content Standardization Beyond Regulatory Minimums

Major consumer-goods firms now exceed legislation by pledging 25-50% post-consumer recycled (PCR) content portfolio-wide by 2030. Unilever's 2025 goal for all packaging to be recyclable, reusable, or compostable and Amcor's supply of 1,000 tons of recycled plastic for Cadbury wrappers exemplify voluntary targets setting de facto industry baselines. Standardized PCR measurement toolkits from the U.S. Plastics Pact streamline verification, catalyzing procurement clarity and fueling growth in the sustainable packaging market.

PCR Resin Supply Constraints Create Strategic Bottlenecks

Brand pledges now outstrip supply of clear, food-grade PCR. Declining milk volumes shrink the natural HDPE stream, inflating premiums and forcing import reliance that undercuts domestic reclaimers. This imbalance threatens timely fulfillment of regulatory quotas, slowing mass-market expansion of the sustainable packaging market.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Logistics Pilots Scale Reusable Packaging Systems

- AI-Enhanced Sortation Technologies Improve Recycling Economics

- Cost Premium Persistence Challenges Mass-Market Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recyclable formats retained a 45.32% share in 2024, yet compostable and biodegradable offerings are growing at a 12.54% CAGR, reflecting investor faith in biomaterials such as B'Zeos' seaweed films. The sustainable packaging market size for compostables is riding demand from food-service and personal-care brands seeking solutions free from microplastic fragmentation. However, only 30% of U.S. municipalities have access to industrial composting sites, curbing near-term penetration. In response, the U.S. COMPOST Act proposes USD 2 billion in grants to expand capacity, which would directly lift diversion rates and long-run growth prospects.

Consumer confusion over end-of-life handling still triggers contamination in organic-waste streams, calling for clearer labeling and public-education campaigns. Anaerobic digestion has emerged as an alternate pathway, generating biogas revenue that improves project economics and partially offsets infrastructure shortfalls. With policy and processing gaps gradually closing, compostable formats are set to capture an expanding slice of the sustainable packaging market.

Paper and paperboard represented 40.43% of 2024 revenue owing to mature recycling systems and consumer trust. Plant-based substrates, however, are advancing at 11.43% CAGR, propelled by Stora Enso's dry-forming fiber lines that cut water use by 75% and energy by 30%, boosting circularity credentials. The sustainable packaging market share of polyolefins is expected to contract gradually as PFAS bans and recycled-content rules intensify.

Advanced recycling breakthroughs, including Berkeley's 260 °C vaporization process that converts polyethylene into feedstock with 98% recovery, enable food-grade loops and mitigate downcycling. Mycelium foams and wood-based PET replacements are expanding addressable use cases beyond niche segments, signaling a broader materials transition within the sustainable packaging market.

The Sustainable Packaging Market Report is Segmented by Process (Reusable, Recyclable, and More), Material Type (Paper and Paperboard, Plastics, and More), Packaging Format (Rigid, Flexible), Function (Primary, Secondary, Tertiary/Transport), End User (Food and Beverage, Pharmaceutical and Healthcare, Cosmetics and Personal Care, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe's 34.57% revenue share in 2024 reflects its first-mover regulatory stance that has birthed mature recycling infrastructure and eco-design norms. EPR fee modulation by circularity performance incentivizes high-recycled-content packaging, reinforcing supplier innovation cycles. Harmonized deposit-return schemes streamline collection, making Europe the reference market for both advanced recycling pilots and bio-based material commercialization. Multinational brand headquarters located in the region further amplify demand density, ensuring the sustainable packaging market continues to test and scale breakthroughs locally.

Asia-Pacific is on track for the fastest 11.21% CAGR thanks to tightening rules in Japan, South Korea, Australia, and pilot EPR frameworks in China and India. Japan's recycled-plastic mandate effective 2024 and its positive list for food-contact recycled resins entering force in June 2025 unlock high-margin applications and spur domestic resin reprocessing investments. China's evolving supervision policy for recycled plastics coupled with strong e-commerce growth accelerates volume uptake. Vietnam's paper-packaging sector, projected at USD 3.5 billion by 2026, exemplifies regional expansion anchored in export-oriented manufacturing.

North America benefits from state-level EPR adoption and aggressive voluntary commitments by consumer-goods leaders. Oregon, Colorado, and California programs fund curbside upgrades, boosting PCR feedstock availability and narrowing cost spreads. Greenwashing litigation-exemplified by Australia's recent Clorox action-raises disclosure rigor, bolstering consumer trust and driving transparent supply chains. Middle East & Africa and South America remain nascent but show rapid policy convergence, opening white-space opportunities for early technology entrants as infrastructure scales.

- Amcor plc

- Smurfit WestRock Company

- Tetra Pak International SA

- Sonoco Products Company

- Sealed Air Corporation

- Mondi plc

- Huhtamaki Oyj

- BASF SE

- Ardagh Group SA

- Ball Corporation

- Crown Holdings Inc.

- Genpak LLC

- International Paper Company

- Stora Enso Oyj

- Graphic Packaging Holding Co.

- Uflex Ltd.

- Novolex Holdings Inc.

- Ecovative LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Extended producer-responsibility (EPR) laws surge in OECD and BRICS markets

- 4.2.2 Brand-owner pledges driving >25 % PCR content across portfolios

- 4.2.3 Retailer take-back and reuse pilots scaling in e-commerce logistics

- 4.2.4 AI-enabled sortation raising post-consumer recycling yields

- 4.2.5 Food-grade chemical recycling breakthroughs for polyolefins

- 4.2.6 Emerging mycelium and seaweed packaging securing venture capital

- 4.3 Market Restraints

- 4.3.1 Supply-demand gap in high-quality PCR resins

- 4.3.2 Inflation-driven cost premium vs. virgin substrates

- 4.3.3 Fragmented composting infrastructure in North America and APAC

- 4.3.4 "Greenwashing" litigation risk altering marketing claims

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assessment of Impact of Microeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Process

- 5.1.1 Reusable Packaging

- 5.1.2 Recyclable Packaging

- 5.1.3 Compostable / Biodegradable Packaging

- 5.1.4 Edible Packaging

- 5.2 By Material Type

- 5.2.1 Paper and Paperboard

- 5.2.2 Plastics

- 5.2.3 Glass

- 5.2.4 Metal (Aluminum, Steel)

- 5.2.5 Plant-based Materials (Bagasse, Mushroom, etc.)

- 5.3 By Packaging Format

- 5.3.1 Rigid

- 5.3.2 Flexible

- 5.4 By Function

- 5.4.1 Primary Packaging

- 5.4.2 Secondary Packaging

- 5.4.3 Tertiary / Transport Packaging

- 5.5 By End User

- 5.5.1 Food and Beverage

- 5.5.2 Pharmaceutical and Healthcare

- 5.5.3 Cosmetics and Personal Care

- 5.5.4 E-commerce and Retail

- 5.5.5 Consumer Electronics

- 5.5.6 Other End User

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Smurfit WestRock Company

- 6.4.3 Tetra Pak International SA

- 6.4.4 Sonoco Products Company

- 6.4.5 Sealed Air Corporation

- 6.4.6 Mondi plc

- 6.4.7 Huhtamaki Oyj

- 6.4.8 BASF SE

- 6.4.9 Ardagh Group SA

- 6.4.10 Ball Corporation

- 6.4.11 Crown Holdings Inc.

- 6.4.12 Genpak LLC

- 6.4.13 International Paper Company

- 6.4.14 Stora Enso Oyj

- 6.4.15 Graphic Packaging Holding Co.

- 6.4.16 Uflex Ltd.

- 6.4.17 Novolex Holdings Inc.

- 6.4.18 Ecovative LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment