|

市场调查报告书

商品编码

1852152

超材料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Metamaterials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

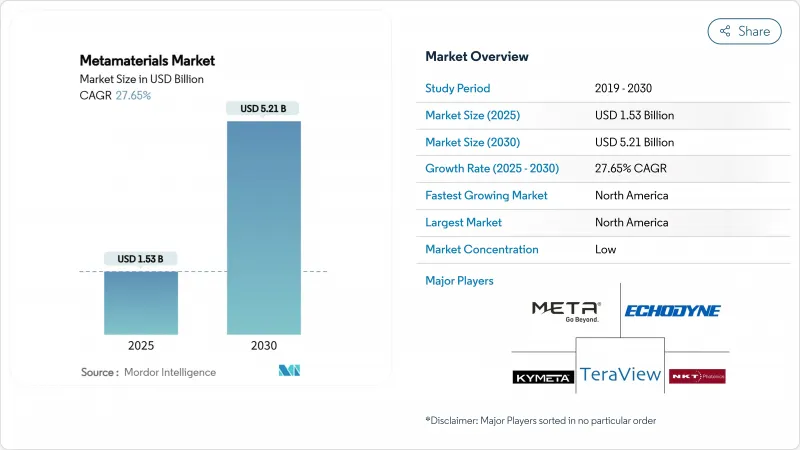

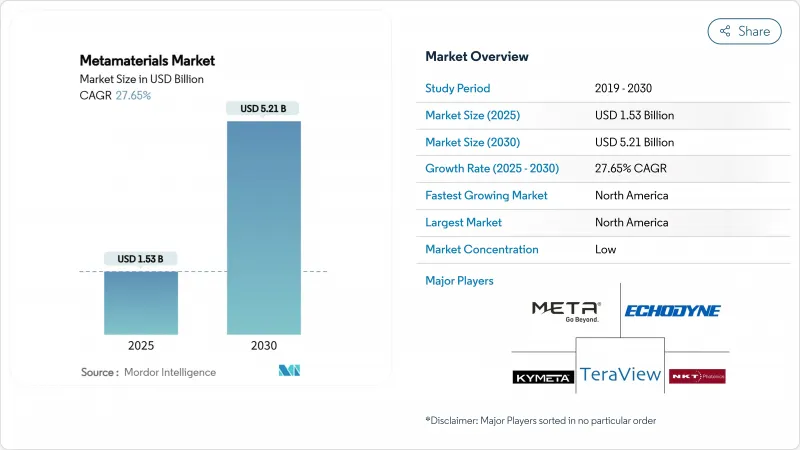

预计到 2025 年,超材料市场规模将达到 15.3 亿美元,到 2030 年将达到 52.1 亿美元,预测期(2025-2030 年)复合年增长率为 27.65%。

北美地区占据35.88%的区域市场份额,是成长最快的地区,预计到2030年复合年增长率将达到28.92%。 5G/6G部署、国防隐身需求以及节能设备的需求是推动市场成长的主要因素。电磁超材料因其在天线和表面择频元件中的多功能应用,将占总收入的44.19%。天线和雷达系统目前已占总支出的62.94%,其中航太和国防领域的买家占终端用户需求的54.19%。该领域的竞争格局依然分散,许多专业厂商都在将各自的设计商业化。高昂的製造成本和有限的标准化程度阻碍了产品的广泛应用,但积层製造和奈米製造技术的快速发展正在逐步缩小这些限制。

全球超材料市场趋势与洞察

扩展 5G 和 6G 网路规划:超材料辅助下一代连接

基于超材料的天线正在重新定义毫米波传输,它们将波束控制硬体压缩到超薄层中,同时保持Gigabit的吞吐量。已在 60 GHz 频段演示的数位编码超表面能够产生多个同步波束,从而缓解都市区的讯号阻塞并支援 6G 的可靠性。二维超表面可以改善非地面电波5G/6G 覆盖的链路预算。商业供应商正从实验室原型转向整合可重构智慧表面的混合卫星终端,以确保行动平台不间断的连接。这种超薄硬体与软体定义控制的结合,使超材料市场在通讯业者在全球密集部署高频段网路的过程中,能够持续吸引通讯领域的投资。

奈米技术与材料科学进展:原子尺度精密工程

根据国家奈米技术计划,联邦政府已申请2025年拨款22亿美元,累积支出超过450亿美元,用于建造原子级製造的共用基础设施。逐层增材製造技术如今能够在整个表面上建立连续变化的梯度折射率分布,使工程师能够局部调节相位、振幅和偏振。这种高精度加速了超材料在结构健康监测器、生物医学植入和汽车雷达外壳中的应用。早期使用3D列印互锁模组製造频率选择性吸收器的生产测试实现了99.5%的吸收率,同时减少了模具工序。此类突破降低了准入门槛,使主流设备製造商在中期内实现大规模生产成为可能。

超材料:对知识差距认识不足阻碍市场渗透

复杂的波动物理概念令那些缺乏专案研发预算的领域的决策者望而却步。美国国家科学基金会累计3.8667亿美元用于其先进製造业人才培养计划,旨在透过实践培训弥补这一缺口。展示天线小型化和噪音衰减优势的示范计划正在推动相关技术的应用,但拉丁美洲和东南亚部分地区的中小型企业仍面临陡峭的学习曲线。

细分市场分析

预计到2024年,电磁感应技术将占超材料市场收入的44.19%,年复合成长率达29.27%,巩固其作为超材料市场核心地位的地位。该技术在频率选择面板、相位阵列天线和负折射率透镜等领域的整合应用,正在推动电讯和国防领域的需求成长。以以金额为准,该领域目前占超材料市场规模的7.2259亿美元,预计到2030年将超过30亿美元。利用具有增强生物化学灵敏度的石墨烯共振器进行兆赫探测的兴起,将为未来带来更多机会。

声学、双曲面和负指数等新兴领域拓展了功能范围。声学结构透过欧盟资助的METAVISION试验,用于抑制工业工厂中的机械振动。双曲面板可引导亚衍射光子,实现超高解析度成像,这在医学诊断领域具有重要意义。结合多种类型的混合堆迭结构,可在单一层压板中实现对声音、热和光的多模态控制。因此,研究兴趣正在多元化发展,同时电磁波在大规模应用的优势也日益凸显。

区域分析

北美地区占35.88%,复合年增长率最高,达28.92%。联邦政府对先进製造业和劳动力项目的3.8667亿美元投资正在加强一个强大的创新生态系统。航太、国防和电讯的集中,确保了早期需求,并使本地供应商能够改进大规模生产方法。

亚太地区正经历工业化和电子技术能力融合的浪潮,而大规模的公共资金投入正是推动这项进程的关键。中国的战略技术规划正将资源集中在6G和卫星网路建设,加速超表面材料在基地台和行动终端天线领域的本地化应用。在印度的生产关联激励计划(PLI)下,其电子产品产量预计将从2020-21财年的55.4万液盎司(约合760亿美元)增至2023-24财年的95.2万液盎司(约合1150亿美元),这将为半导体级超材料元件的发展创造有利条件。日本和韩国正在改进用于自动驾驶汽车和智慧工厂的高频雷达吸波材料。

欧洲占了重要份额,这得益于英国创新战略和德国工业4.0蓝图下针对先进材料的公私合作项目。低场磁振造影和工业噪音控制的现场试验表明,欧洲已建立起蓬勃发展的合作研究网络。政策框架强调开放测试平台和标准化,引导超材料市场走向跨国规模发展。

南美洲和中东及非洲是利用超材料增强型电讯骨干网路实现跨越式发展的新兴领域,可望超越传统基础设施。能源采集为远端感测器节点供电,符合该地区非电气化的发展优先事项,一旦成本障碍消除,其潜力将充分发挥。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩展 5G 和 6G 网路计划

- 奈米技术和材料科学的进展

- 量子计算和光电的进展

- 来自航太和国防工业的需求不断增长

- 日益重视能源效率和永续性

- 市场限制

- 对超材料优势缺乏认识

- 合成超材料的成本

- 材料耐久性和标准化问题

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

第五章 市场规模与成长预测

- 按类型

- 电磁

- 兆赫

- 光子

- 可调

- 表面择频元件(FSS)

- 其他类型(声学、负指数/双曲、非线性、掌性)

- 透过使用

- 天线和雷达

- 感应器

- 屏蔽装置

- 超级镜头

- 光线和声音过滤

- 其他用途(太阳能、吸收器等)

- 按最终用户行业划分

- 航太/国防

- 电讯

- 电子学

- 卫生保健

- 其他终端使用者产业(汽车和交通运输、能源和电力等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Acoustic Metamaterials Group Limited(AMG)

- Echodyne Corp.

- Evolv Technologies, Inc.

- Fractal Antenna Systems, Inc

- JEM Engineering

- Kymeta Corporation

- Meta Materials Inc.

- Metalenz, Inc.

- Metamagnetics

- Multiwave Technologies

- Nanohmics Inc.

- Nanoscribe GmbH and Co. KG

- NanoSonic, Inc.

- NKT Photonics A/S

- Pivotal Commware

- Teraview Limited

第七章 市场机会与未来展望

The Metamaterials Market size is estimated at USD 1.53 billion in 2025, and is expected to reach USD 5.21 billion by 2030, at a CAGR of 27.65% during the forecast period (2025-2030).

North America holds the leading 35.88% regional slice and is also the fastest-growing territory, propelled by a 28.92% CAGR through 2030. Demand pivots on 5G/6G roll-outs, defense stealth requirements, and energy-efficient devices. Electromagnetic metamaterials account for 44.19% of revenue thanks to their versatile role in antennas and frequency-selective surfaces. Antenna and radar systems already command 62.94% of spending, and aerospace and defense buyers contribute 54.19% of end-user demand. The competitive field remains fragmented as niche specialists commercialize proprietary designs. High fabrication costs and limited standardization still curb wider uptake, but rapid advances in additive manufacturing and nanofabrication are narrowing these constraints.

Global Metamaterials Market Trends and Insights

Expansion of 5G and 6G Network Plan: Metamaterials Enabling Next-Generation Connectivity

Metamaterial-based antennas are redefining millimeter-wave transmission by compressing beam-steering hardware into ultra-thin layers while sustaining multi-gigabit throughput. A digitally coded metasurface demonstrated at 60 GHz produced multiple simultaneous beams, a capability that mitigates urban signal blockage and underpins 6G reliability. Satellite links profit as well; 2D metasurfaces boost link budgets for non-terrestrial 5G/6G coverage. Commercial vendors have moved beyond lab prototypes, with hybrid satellite terminals integrating reconfigurable intelligent surfaces to secure uninterrupted connectivity for mobile platforms. This marriage of low-profile hardware and software-defined control positions the metamaterials market for sustained telecom spending as carriers densify high-band networks worldwide.

Advancements in Nanotechnology and Material Science: Precision Engineering at Atomic Scale

Federal programs request USD 2.2 billion for 2025 under the National Nanotechnology Initiative, lifting cumulative outlays above USD 45 billion and furnishing shared infrastructure for atomic-scale fabrication . Layer-by-layer additive methods now build graded index profiles that vary continuously across a surface, giving engineers a toolbox for tailoring phase, amplitude, and polarization locally. Such precision accelerates the insertion of metamaterials into structural health monitors, biomedical implants, and automotive radar housings. Early production trials using 3D-printed interlocking blocks to create frequency-selective absorbers reached 99.5% absorptivity while reducing tooling steps. These breakthroughs lower entry barriers and make volume output feasible for mainstream device makers over the medium term.

Lack of Awareness of Benefits of Metamaterials: Knowledge Gap Limiting Market Penetration

Complex wave-physics concepts deter decision-makers in sectors without dedicated R&D budgets. The U.S. National Science Foundation earmarked USD 386.67 million for advanced manufacturing workforce programs to bridge this gap with hands-on training . Demonstration projects that visualize gains in antenna miniaturization or noise attenuation are widening adoption, yet smaller firms in Latin America and parts of Southeast Asia still face steep learning curves.

Other drivers and restraints analyzed in the detailed report include:

- Growing Advancements in Quantum Computing and Photonics: Convergence Creating New Possibilities

- Increasing Demand from the Aerospace and Defense Industry: Strategic Applications Driving Adoption

- Cost of Synthesization of Metamaterials: Economic Barriers to Commercialization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electromagnetic variants accounted for 44.19% of 2024 revenue and are forecast to expand at 29.27% CAGR, reinforcing their role as the cornerstone of the metamaterials market. Their integration into frequency-selective panels, phased-array antennas, and negative-index lenses drives pervasive demand across telecom and defense. In value terms, this cohort represented USD 722.59 million of the metamaterials market size and is on track to cross USD 3.0 billion by 2030. The rise of terahertz detection, powered by graphene resonators with heightened biochemical sensitivity, amplifies future opportunities.

Emerging niches such as acoustic, hyperbolic, and negative-index formats broaden the functional palette. Acoustic structures dampen machinery vibration in industrial plants, supported by EU-funded METAVISION trials. Hyperbolic slabs channel sub-diffraction photons for super-resolution imaging, an asset in medical diagnostics. Hybrid stacks that fuse multiple classes unlock multi-modal control over sound, heat, and light within a single laminate. Research interest therefore accelerates diversification while reinforcing electromagnetic dominance at scale.

The Metamaterials Market Report Segments the Industry by Type (Electromagnetic, Terahertz, Tunable, Photonic, and More), Application (Antenna and Radar, Sensors, Cloaking Devices, Superlens, and More), End-User Industry (Healthcare, Telecommunication, and More), and Geography (Asia-Pacific, North America, Europe, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America translated a 35.88% stake and the highest regional CAGR of 28.92%. Federal investments of USD 386.67 million for advanced manufacturing and workforce programs reinforce a robust innovation ecosystem. Concentrated aerospace, defense, and telecom primes guarantee early-stage demand, enabling local suppliers to refine mass-production methods.

Asia-Pacific follows as industrialization and electronics capacity converge with sizable public funding. China's strategic technology plans channel resources into 6G and satellite networks, accelerating local adoption of metasurfaces for base-station and handset antennas. India's electronics output grew from INR 5.54 lakh crore (USD 76 billion) in FY 2020-21 to INR 9.52 lakh crore (USD 115 billion) in FY 2023-24 under the PLI scheme, providing fertile ground for semiconductor-grade metamaterial components. Japan and South Korea refine high-frequency radar absorbers for autonomous vehicles and smart factories.

Europe commands a sizeable share thanks to public-private programs targeting advanced materials under the UK Innovation Strategy and Germany's Industry 4.0 roadmap. Field trials in low-field MRI and industrial noise abatement testify to a thriving collaboration network. Policy frameworks emphasize open test beds and standardization, steering the metamaterials market toward cross-border scalability.

South America and the Middle East & Africa represent emerging frontiers, leveraging metamaterial-enhanced telecom backbones to leapfrog legacy infrastructure. Energy-harvesting metasurfaces that power remote sensor nodes align with regional off-grid electrification priorities, signaling untapped potential once cost barriers abate.

- Acoustic Metamaterials Group Limited (AMG)

- Echodyne Corp.

- Evolv Technologies, Inc.

- Fractal Antenna Systems, Inc

- JEM Engineering

- Kymeta Corporation

- Meta Materials Inc.

- Metalenz, Inc.

- Metamagnetics

- Multiwave Technologies

- Nanohmics Inc.

- Nanoscribe GmbH and Co. KG

- NanoSonic, Inc.

- NKT Photonics A/S

- Pivotal Commware

- Teraview Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of 5G and 6G Network Plan

- 4.2.2 Advancements in Nanotechnology and Material Science

- 4.2.3 Growing Advancements in Quantum Computing and Photonics

- 4.2.4 Increasing Demand from the Aerospace and Defense Industry

- 4.2.5 Growing Emphasis on Energy Efficiency and Sustainability

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness of Benefits of Metamaterials

- 4.3.2 Cost of Synthesization of Metamaterials

- 4.3.3 Concerns of Material Durability and Standardization

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Patent Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Electromagnetic

- 5.1.2 Terahertz

- 5.1.3 Photonic

- 5.1.4 Tunable

- 5.1.5 Frequency Selective Surface (FSS)

- 5.1.6 Other Types(Acoustic, Negative-Index and Hyperbolic, Non-linear and Chiral)

- 5.2 By Application

- 5.2.1 Antenna and Radar

- 5.2.2 Sensors

- 5.2.3 Cloaking Devices

- 5.2.4 Superlens

- 5.2.5 Light and Sound Filtering

- 5.2.6 Other Applications (Solar, Absorbers, etc.)

- 5.3 By End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Telecommunications

- 5.3.3 Electronics

- 5.3.4 Healthcare

- 5.3.5 Other End user Industries (Automotive and Transportation, Energy and Power, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Acoustic Metamaterials Group Limited (AMG)

- 6.4.2 Echodyne Corp.

- 6.4.3 Evolv Technologies, Inc.

- 6.4.4 Fractal Antenna Systems, Inc

- 6.4.5 JEM Engineering

- 6.4.6 Kymeta Corporation

- 6.4.7 Meta Materials Inc.

- 6.4.8 Metalenz, Inc.

- 6.4.9 Metamagnetics

- 6.4.10 Multiwave Technologies

- 6.4.11 Nanohmics Inc.

- 6.4.12 Nanoscribe GmbH and Co. KG

- 6.4.13 NanoSonic, Inc.

- 6.4.14 NKT Photonics A/S

- 6.4.15 Pivotal Commware

- 6.4.16 Teraview Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Use of Metamaterials in Solar Systems

- 7.3 Metamaterial-based Radars for Drones