|

市场调查报告书

商品编码

1852155

工厂自动化和工业控制:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Factory Automation And Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

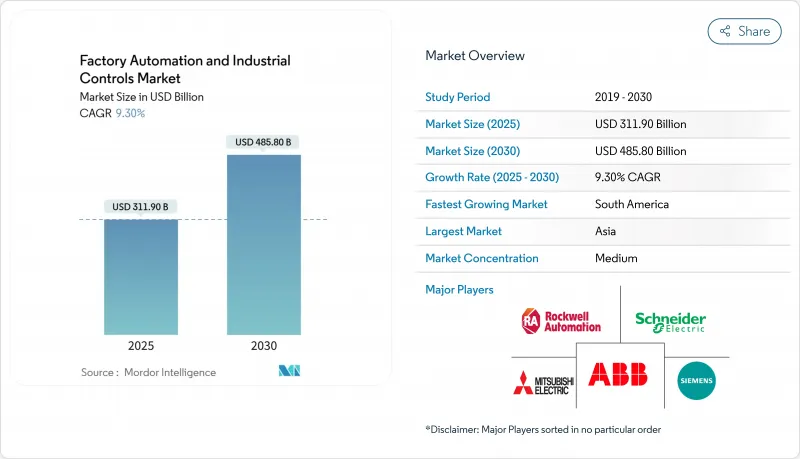

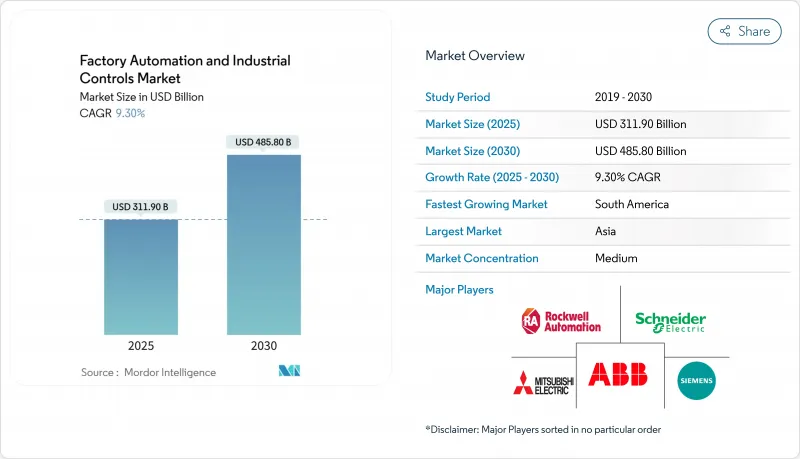

预计到 2025 年,工厂自动化和工业控制市场规模将达到 3,119 亿美元,到 2030 年将扩大到 4,858 亿美元。

随着製造商面临人才短缺、严格的能源效率法规以及缩短供应链的需求,其发展动能日益强劲。不断上涨的人事费用促使企业部署智慧机器人和视觉检测单元,而北美和欧盟的能源导向指令则鼓励对高效驱动器和智慧电錶进行投资。数位孪生、边缘分析和云端连接控制器构成了下一代工厂的核心,为服务提供者创造了新的收入来源,这些服务提供者可以将基于状态的维护迭加到现有硬体之上。同时,关税主导的半导体采购改革正在加速区域製造基地的建设,进一步提升了工厂自动化和工业控制市场的发展轨迹。将操作技术专长与安全软体生态系统结合的平台供应商持续获得定价权,这得益于政府资金的支持,例如530亿美元的《晶片和工业安全法案》(CHIPS Act),该法案为国内工厂的资本支出提供资金支持。

全球工厂自动化与工业控制市场趋势及洞察

加速采用工业4.0

全球约80%的生产商计划在2025年前实施工业4.0解决方案,但仅有10%实现了端到端的数位化。英国的「智慧製造」(Made Smarter)资助计画和中国33个製造创新中心网路等国家级计画提供资金和技术指导,推动工厂自动化和工业控制市场向高阶分析和自主优化方向发展。新加坡的「智慧产业准备指数」(Smart Industry Readiness Index)同样帮助中型企业衡量自身进展,确保自动化移动机器人和云端调度工具能带来可衡量的成本节约。人工智慧、物联网感测器和巨量资料引擎的融合能够提供即时洞察,从而减少废料、平衡能源负荷并缩短维护週期。供应商透过在这些资料流周围建立网路安全和远端支援层来脱颖而出,将常规的控制器销售转化为多年的服务年金。

能源效率要求和成本压力

各国政府已在能源效率专案上投资超过1兆美元,如今期望工业界为全球减碳目标做出重大贡献。工厂正积极响应,部署变速驱动装置、智慧压缩机和人工智慧驱动的调度平台,将生产转移到非尖峰时段的可再生能源。联合国欧洲经济委员会正在推广工业能效的最佳实践,并强调数位化控制与脱碳之间的连结。在工厂自动化和工业控制市场,供应商正将碳排放仪錶板预先整合到可程式逻辑控制器(PLC)中,使合规成为附加价值服务。随着公用事业公司提高分时电价,智慧照明和热回收系统等投资回收期短的计划在企业的资本支出清单中占据了重要地位。

自动化计划初始投资较高

全面的自动化专案通常会超出传统的预算週期,尤其对于中小企业而言更是如此。到2024年,该产业的併购倍数可能达到EBITDA的18倍,这将推高供应商的定价预期,并拉高损益平衡点。 10%的基本进口关税,加上对中国製造的半导体征收的50%关税,推高了零件成本,并使资本项目的投资回报率计算变得更加复杂。儘管《晶片法案》(CHIPS Act)下的公共补贴可以帮助支付部分费用,但管理者仍需要应对培训成本和整合风险,这些风险可能会在系统切换期间中断生产。

细分市场分析

到2024年,工业控制系统将占据工厂自动化和工业控制市场58%的份额,凸显其作为连续製造和离散製造营运支柱的重要地位。分散式控制系统、SCADA系统和现代PLC正在整合人工智慧驱动的诊断功能,以预防停机事件的发生,并与企业资源计画(ERP)系统同步,实现准时制生产。半导体製造和电池组装行业对工业控制系统的需求日益增长,这些行业依赖微秒的循环执行来实现零缺陷的生产效率。同时,受智慧相机和协作机器人技术的进步推动,预计到2030年,现场设备所占的工厂自动化和工业控制市场规模将以9.8%的复合年增长率增长,这些技术将自学习演算法整合到更靠近生产线的位置。

机器视觉平台正从简单的存在检测发展到复杂轮廓的三维测量,从而实现在线校正而非后续返工。曾经被隔离的工业机器人如今已与人类共用工作空间,并由安全操作韧体和接近感测器引导。这些功能降低了整合门槛,并为产品週期短的产业开闢了新的机会。感测器製造商正致力于开发更高解析度、更低功耗的设计,将振动、声学和热讯号即时反馈给控制层,从而增强预测性维护模型,延长设备寿命并减少计划外停机。

到2024年,硬体将占工厂自动化和工业控制市场规模的62.5%,因为企业需要对老旧的控制器和伺服驱动器进行现代化改造,以适应更快的生产週期和更严格的精度要求。同时,服务收入正以每年11.2%的速度成长,这反映出经营团队倾向于采用基于结果的合同,以降低技术部署的风险。多年期合约通常将安装、整合和分析支援打包到一个基于奖励的定价框架中,使供应商的激励机制与工厂的绩效挂钩。

预测性维护订阅服务汇总振动和温度趋势,并将车队与匿名化的同类数据集进行基准测试,以便在灾难性故障发生之前识别异常情况。系统整合商正在透过协定转换器和边缘网关实现获利,这些转换器和网关将传统的 Modbus 设备连接到运行在安全 OPC UA 链路上的云端仪表板。随着智慧感测器安装数量的增长,培训和变更管理活动也同步增加,这标誌着工厂自动化和工业控制市场从一次性通讯协定交易转向年金式服务模式的转变。

工厂和工业自动化市场按产品(工业控制系统、现场设备)、组件(硬体、其他)、控制系统结构(专有/厂商特定、其他)、最终用户产业(汽车、化学和石化、公共产业、其他)以及地区进行细分。市场预测以美元计价。

区域分析

到2024年,亚洲将占据全球39.4%的收入份额,这主要得益于其密集的製造业生态系统、技术纯熟劳工储备以及积极的数位化政策框架。中国的「2025愿景」正在资助一条结合人工智慧调度和5G运动控制的示范生产线;与此同时,日本的大型企业集团正在部署自主物料搬运和精密焊接机器人,以缓解长期存在的劳动力短缺问题。韩国的晶片製造基地和印度智慧电錶的推广应用将进一步推动硬体需求,巩固亚洲在工厂自动化和工业控制市场的核心地位。

随着供应链主权问题日益受到联邦政府重视,北美製造商正加快投资步伐。 《晶片与整合产品法案》(CHIPS Act)拨款530亿美元,将刺激本地感测器和控制器生产,进而带动对安全边缘运算设备的需求。将于2025年4月实施的普遍关税将加强近岸外包,并促进先前依赖海外零件采购的中小型工厂自动化。

欧洲高度重视永续性和网路韧性。根据“復苏与韧性基金”,欧洲政府拨款1500亿欧元(约1630亿美元)用于数位转型,旨在实现工业基础现代化。然而,由于实施过程中存在差距,许多公司不得不求助于私人整合商以满足报告期限的要求。能源法规和供应链可追溯性的合规压力对食品、化学和消费品工厂的影响尤其显着。

儘管南美洲的物联网装置容量较小,但预计到2030年将以10.1%的复合年增长率成长。巴西的「巴西新产业」计画已拨款3,000亿雷亚尔(约610亿美元)用于研发奖励、设备补贴和税收减免,使自动化升级在经济上更具吸引力。阿根廷的「数位化工厂蓝图」鼓励在农业机械和食品加工领域开展物联网试点项目,儘管该地区面临技能短缺的问题。随着跨境技术转移的扩展,区域系统整合商正与全球原始设备製造商合作,提供适合该地区小批量生产和电源品质不稳定的承包生产线。

随着政策制定者寻求摆脱资源密集型产业,中东和非洲也加入了工厂自动化和工业控制市场。待开发区工业园区将从一开始就采用预测性维护平台,从而能够跨越传统架构,专注于数据主导运营,并专注于满足出口市场合规要求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速采用工业4.0

- 能源效率要求和成本压力

- 製造业劳动力短缺问题日益严重

- 政府对数位化工厂的奖励策略

- 低程式码/无程式码自动化平台

- 利用人工智慧升级预测性品管

- 市场限制

- 对自动化计划的前期投资

- OT网路中的网路安全漏洞

- 互通性标准碎片化

- 控制器半导体供应的波动

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特的五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 副产品

- 工业控制系统

- 分散式控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 监控与数据采集(SCADA)

- 产品生命週期管理(PLM)

- 人机介面(HMI)

- 製造执行系统(MES)

- 企业资源规划(ERP)

- 其他工业控制系统

- 现场设备

- 机器视觉系统

- 工业机器人

- 感测器和发射器

- 马达和驱动器

- 其他现场设备

- 工业控制系统

- 按组件

- 硬体

- 软体

- 服务

- 按最终用户行业划分

- 车

- 化工/石油化工

- 公用事业

- 製药

- 食品和饮料

- 石油和天然气

- 电子和半导体

- 航太与国防

- 其他行业

- 按控制系统结构

- 专有/厂商特定

- 开放/互通

- 混合架构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric SE

- Mitsubishi Electric Corp.

- Honeywell International Inc.

- Emerson Electric Co.

- Omron Corp.

- Yokogawa Electric Corp.

- GE Vernova

- Texas Instruments Inc.

- Bosch Rexroth AG

- Fanuc Corp.

- Keyence Corp.

- Advantech Co. Ltd.

- Beckhoff Automation GmbH

- Delta Electronics Inc.

- Lenze SE

- WAGO Kontakttechnik GmbH

- Hollysys Automation Technologies

第七章 市场机会与未来展望

The factory automation and industrial controls market size reached USD 311.90 billion in 2025 and is forecast to advance to USD 485.80 billion by 2030, translating into a 9.30% CAGR.

Momentum builds as manufacturers confront talent shortages, stringent energy-efficiency rules, and the imperative to shorten supply chains. Rising labor costs encourage companies to install intelligent robotics and vision-enabled inspection cells, while energy-oriented directives in North America and the EU reward investments in high-efficiency drives and smart metering. Digital twins, edge analytics, and cloud-connected controllers form the core of next-generation factories, creating new revenue pools for service providers that overlay condition-based maintenance atop existing hardware stacks. Meanwhile, tariff-driven redesigns of semiconductor sourcing are accelerating regional production footprints, further lifting the factory automation and industrial controls market trajectory. Platform vendors that blend operational-technology expertise with secure software ecosystems continue to gain pricing power, supported by government funding such as the USD 53 billion CHIPS Act that underwrites capital outlays for domestic fabs.

Global Factory Automation And Industrial Controls Market Trends and Insights

Industry 4.0 Adoption Acceleration

Roughly 80% of global producers intend to embed Industry 4.0 solutions by 2025, yet only 10% have achieved end-to-end digitization. National programs-such as the UK's Made Smarter grants and China's network of 33 Manufacturing Innovation Centers-offer capital and technical guidance, pushing the factory automation and industrial controls market toward advanced analytics and autonomous optimisation. Singapore's Smart Industry Readiness Index likewise helps mid-sized firms benchmark progress, ensuring that automated mobile robots and cloud scheduling tools deliver measurable cost relief. Convergence of AI, IoT sensors, and big-data engines yields real-time insights that cut scrap, tune energy loads, and shorten maintenance interventions. Vendors differentiate by wrapping cybersecurity and remote-support layers around these data flows, turning routine controller sales into multi-year service annuities.

Energy-Efficiency Mandates & Cost Pressure

Governments invested more than USD 1 trillion in efficiency programs and now expect industry to shoulder a sizeable share of the global CO2-reduction target. Factories respond by installing variable-speed drives, smart compressors, and AI-enabled scheduling platforms that shift production to off-peak renewable availability. The United Nations Economic Commission for Europe promotes industrial energy-efficiency best practices, underscoring the link between digital controls and decarbonisation. In the factory automation and industrial controls market, vendors now pre-package carbon dashboards with programmable logic controllers, turning compliance into a value-added service. As utilities raise time-of-use tariffs, fast-payback projects such as intelligent lighting and heat-recovery systems climb the corporate capital list.

High Upfront CAPEX of Automation Projects

Comprehensive automation programs often exceed traditional budgeting cycles, especially for small and mid-sized enterprises. Sector M&A multiples reached 18 times EBITDA in 2024, raising vendor pricing expectations and extending break-even horizons. Universal baseline import tariffs of 10%, plus a 50% duty on Chinese semiconductors, elevate component costs and complicate ROI math for capital programmes. While public grants under the CHIPS Act defray some expenses, managers still contend with training outlays and integration risks that may disrupt production during cut-overs.

Other drivers and restraints analyzed in the detailed report include:

- Rising Labor Shortages in Manufacturing

- Low-Code / No-Code Automation Platforms

- Cyber-Security Vulnerabilities in OT Networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial control systems secured 58% of the factory automation and industrial controls market in 2024, underscoring their role as the operational backbone for continuous and discrete manufacturing. Distributed control systems, SCADA, and modern PLCs integrate AI-powered diagnostics that pre-empt downtime events and synchronise with enterprise resource planning for just-in-time sequencing. Demand intensifies in semiconductor fabrication and battery cell assembly, areas that rely on microsecond-level loop execution to achieve defect-free throughput. At the same time, the factory automation and industrial controls market size attributed to field devices is on track to expand at 9.8% CAGR to 2030, propelled by advances in smart cameras and collaborative robotics that embed self-learning algorithms close to the production line.

Machine-vision platforms move beyond simple presence checks toward 3D measurement of complex contours, enabling in-line correction rather than post-process rework. Industrial robots, once fenced, now share workspace with humans, guided by safe-motion firmware and proximity sensors. These capabilities lower integration barriers and open fresh opportunities in industries with shorter product cycles. Sensor manufacturers push higher-resolution, lower-power designs that feed real-time vibration, acoustic, and thermal signatures back to the control layer, reinforcing predictive-maintenance models that stretch asset life and limit unplanned outages.

Hardware generated 62.5% of the factory automation and industrial controls market size in 2024 as companies refreshed aging controllers and servo drives to handle faster cycle times and tighter tolerances. Nevertheless, service revenues are climbing 11.2% per year, reflecting management's preference for outcome-based contracts that de-risk technology adoption. Multi-year agreements often bundle installation, integration, and analytics support into usage-based pricing frameworks that align vendor incentives with plant performance.

Predictive-maintenance subscriptions aggregate vibration and temperature trends, benchmarking equipment fleets against anonymised peer datasets to spotlight outliers well before catastrophic failure. System-integration houses monetise protocol converters and edge gateways that join legacy Modbus devices to cloud dashboards running on secure OPC UA links. As the installed base of intelligent sensors swells, training and change-management engagements rise in parallel, completing the shift from one-time capital transactions to annuity-style service flows within the factory automation and industrial controls market.

The Factory and Industrial Automation Market Segmented Into Product (By Industrial Control Systems, Field Devices), Component (hardware and More), Control System Architecture (Proprietary / Vendor-Specific and More), End-User Industry (Automotive, Chemical and Petrochemical, Utility and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia captured 39.4% of 2024 revenue thanks to dense manufacturing ecosystems, skilled labour pools, and assertive digital-policy frameworks. China's 2025-era initiatives finance demonstration lines that combine AI scheduling with 5G-enabled motion control, while Japanese conglomerates deploy autonomous haulage and precision welding robots to offset chronic labour gaps. South Korea's chip fabrication complexes and India's smart-meter roll-outs further extend hardware demand, reinforcing Asia's central role in the factory automation and industrial controls market.

North American manufacturers accelerate investments as supply-chain sovereignty climbs the federal agenda. The CHIPS Act's USD 53 billion allotment stimulates local sensor and controller production, creating knock-on demand for secure edge-computing appliances. Universal tariffs introduced in April 2025 reinforce near-shoring, encouraging automation in small and mid-tier plants that previously relied on offshore component sourcing.

Europe focuses on sustainability and cyber-resilience. While the EUR 150 billion allocation for digital transition under the Recovery and Resilience Facility (USD 163 billion) aims to modernise industrial bases, execution gaps prompt many firms to leverage private-sector integrators to meet reporting deadlines eca. Compliance pressures with energy codes and supply-chain traceability hold particular sway in food, chemicals, and consumer goods plants.

South America, though starting from a smaller installed base, is projected to expand at a 10.1% CAGR through 2030. Brazil's "New Industry Brazil" program earmarks R$ 300 billion (USD 61 billion) for R&D incentives, equipment credits, and tax benefits, making automation upgrades financially attractive. Argentina's digital-factory roadmap encourages IoT pilots in agricultural machinery and food processing despite skills shortages. As cross-border technology transfer grows, regional system integrators partner with global OEMs to deliver turnkey lines suited to smaller batch volumes and variable-quality power supplies common in the region.

The Middle East and Africa join the factory automation and industrial controls market as policy makers diversify away from resource-heavy sectors. Green-field industrial zones embed predictive-maintenance platforms from inception, allowing them to leapfrog legacy architectures and focus on data-driven operations keyed to export-market compliance.

- ABB Ltd

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric SE

- Mitsubishi Electric Corp.

- Honeywell International Inc.

- Emerson Electric Co.

- Omron Corp.

- Yokogawa Electric Corp.

- GE Vernova

- Texas Instruments Inc.

- Bosch Rexroth AG

- Fanuc Corp.

- Keyence Corp.

- Advantech Co. Ltd.

- Beckhoff Automation GmbH

- Delta Electronics Inc.

- Lenze SE

- WAGO Kontakttechnik GmbH

- Hollysys Automation Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry 4.0 adoption acceleration

- 4.2.2 Energy-efficiency mandates & cost pressure

- 4.2.3 Rising labor shortages in manufacturing

- 4.2.4 Government stimulus for digital factories

- 4.2.5 Low-code / no-code automation platforms

- 4.2.6 AI-driven predictive quality control upgrades

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX of automation projects

- 4.3.2 Cyber-security vulnerabilities in OT networks

- 4.3.3 Fragmented interoperability standards

- 4.3.4 Semiconductor supply volatility for controllers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Industrial Control Systems

- 5.1.1.1 Distributed Control System (DCS)

- 5.1.1.2 Programmable Logic Controller (PLC)

- 5.1.1.3 Supervisory Control & Data Acquisition (SCADA)

- 5.1.1.4 Product Lifecycle Management (PLM)

- 5.1.1.5 Human-Machine Interface (HMI)

- 5.1.1.6 Manufacturing Execution System (MES)

- 5.1.1.7 Enterprise Resource Planning (ERP)

- 5.1.1.8 Other Industrial Control Systems

- 5.1.2 Field Devices

- 5.1.2.1 Machine Vision Systems

- 5.1.2.2 Industrial Robotics

- 5.1.2.3 Sensors and Transmitters

- 5.1.2.4 Motors and Drives

- 5.1.2.5 Other Field Devices

- 5.1.1 Industrial Control Systems

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Chemical and Petrochemical

- 5.3.3 Utility

- 5.3.4 Pharmaceutical

- 5.3.5 Food and Beverage

- 5.3.6 Oil and Gas

- 5.3.7 Electronics and Semiconductor

- 5.3.8 Aerospace and Defense

- 5.3.9 Other Industries

- 5.4 By Control System Architecture

- 5.4.1 Proprietary / Vendor-Specific

- 5.4.2 Open / Interoperable

- 5.4.3 Hybrid Architecture

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of APAC

- 5.5.5 Middle East

- 5.5.5.1 UAE

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Rockwell Automation Inc.

- 6.4.4 Schneider Electric SE

- 6.4.5 Mitsubishi Electric Corp.

- 6.4.6 Honeywell International Inc.

- 6.4.7 Emerson Electric Co.

- 6.4.8 Omron Corp.

- 6.4.9 Yokogawa Electric Corp.

- 6.4.10 GE Vernova

- 6.4.11 Texas Instruments Inc.

- 6.4.12 Bosch Rexroth AG

- 6.4.13 Fanuc Corp.

- 6.4.14 Keyence Corp.

- 6.4.15 Advantech Co. Ltd.

- 6.4.16 Beckhoff Automation GmbH

- 6.4.17 Delta Electronics Inc.

- 6.4.18 Lenze SE

- 6.4.19 WAGO Kontakttechnik GmbH

- 6.4.20 Hollysys Automation Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment