|

市场调查报告书

商品编码

1852183

物联网半导体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)IoT Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

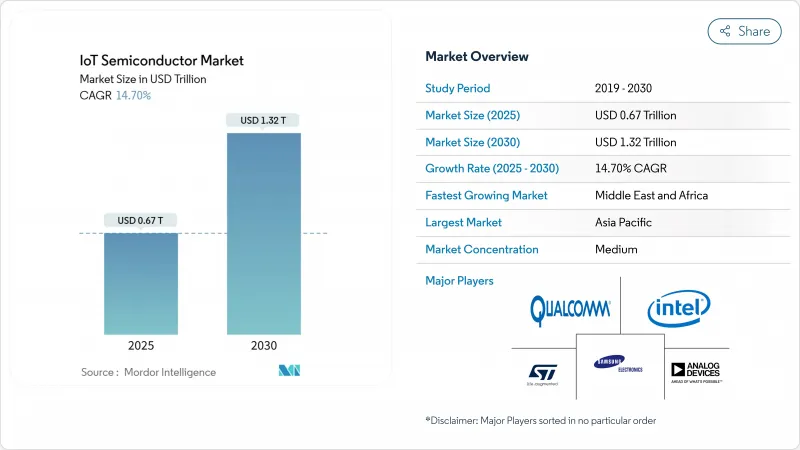

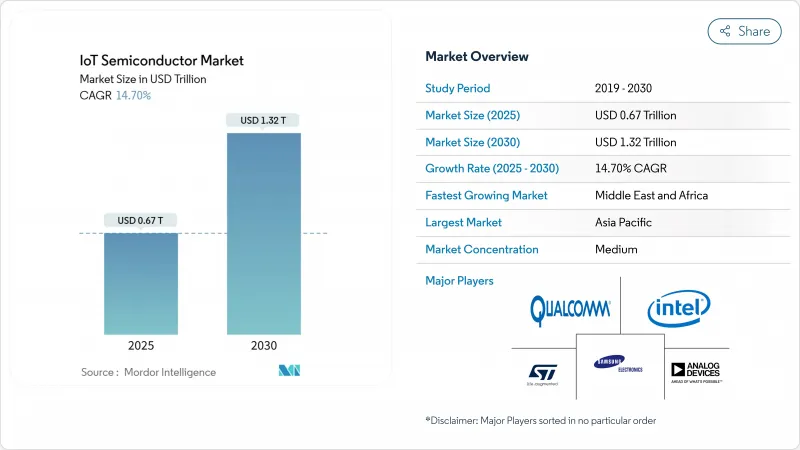

预计到 2025 年,物联网半导体市场规模将达到 6,700 亿美元,到 2030 年将达到 1.32 兆美元,预测期(2025-2030 年)的复合年增长率为 14.70%。

全球物联网半导体市场的扩张主要得益于分散式边缘人工智慧处理、工业自动化专案以及互联消费设备的稳定成长。随着製造商将工作负载从云端迁移到边缘,物联网晶片面临着在保持低于个位数毫瓦功耗预算的同时,增加神经网路加速功能的压力。政府鼓励半导体製造区域化的奖励正在推动北美和欧洲新建晶圆厂,而製造业回流政策也正在改变全球物联网半导体市场的筹资策略。供应链多元化与技术节点分化一致:先进节点(<14奈米)支援资源彙整人工智慧推理,而成熟节点(40-28奈米)则维持了面向大众市场感测器的成本竞争力。

全球物联网半导体市场趋势与洞察

互联消费品和穿戴式装置的兴起

对环境运算体验的需求推动了对配备持续启动感测器和无线电模组的超低功耗晶片的需求。注重健康的穿戴式装置越来越多地配备医用级光电体温计、体温计和心电图感测器,这需要安全的资料路径来符合日益严格的隐私法规。高通公司报告称,2025年第一季物联网营收将达到15亿美元,年增36%,印证了消费者需求的成长动能。随着5G调变解调器与装置端人工智慧的融合,设计人员正转向异构SoC,将应用处理器、NPU和连接功能整合到单一晶粒上,提升了全球物联网半导体市场的晶片面积效率。

工业4.0主导了对低功耗MCU的需求。

实施数位孪生和预测性维护的工厂需要能够本地采集振动、温度和声学数据并降低网路延迟的微控制器。英特尔的智慧工厂生产线透过即时微影术校准实现了接近理论值的产量比率,证明了边缘分析在严苛环境下的价值。坚固耐用的微控制器将机器学习指令集与安全启动和空中升级相结合,为全球物联网半导体市场在未来十年持续获得工业订单奠定了基础。

端对端安全和隐私漏洞

白宫网路信任标誌要求符合 NIST IR 8425 标准,这提高了资源受限设备中安全元件整合的门槛。对成本敏感的原始设备製造商 (OEM) 将面临额外的晶片面积和韧体检验成本。量子运算日益增长的威胁将迫使晶片製造商支援基于格的密码学,从而延迟产品发布并限制近期全球物联网半导体市场的成长。

细分市场分析

2024年,处理器将实现25.65%的最大营收成长,主要得益于整合CPU、NPU和多重通讯协定无线电的晶粒晶片组合。更高的整合度可减少印刷电路面积并缩短认证週期,从而巩固处理器在全球物联网半导体市场的主导地位。安全IC预计将以17.90%的复合年增长率实现最快成长,因为零信任架构在物联网半导体市场的每个节点都嵌入了硬体信任根。感测器、连接、记忆体、逻辑和电源管理等细分市场的出货量将呈现更广泛的成长曲线,其中专用低功耗DRAM将以价格分布出售。

封装内电压调节升级使AI加速器能够在低于0.5V的电压下工作,从而延长穿戴式装置的电池续航时间。 MEMS製造商将可出货的压力感测器高度降低至低于0.8毫米,拓展了戒指和耳塞的设计空间。 SEALSQ赢得一份合同,为英国智慧电錶提供2400万颗抗量子晶片,这标誌着关键基础设施安全防护的转变。

数位双胞胎技术在亚太地区的工厂中应用日益广泛,预计到2024年,工业和製造业的市场份额将保持在22.71%。对状态监测MCU的需求将维持两位数成长直至2030年,其中汽车产业将以16.74%的复合年增长率引领成长,这主要得益于软体定义车辆对计算区域的集中化管理。由于采用区域架构的普及,汽车晶片的物联网半导体市场规模预计将快速扩张,该架构能够减轻线束重量,并支援透过OTA进行功能提升销售。

医疗保健领域将从远端监控扩展到受监管的设备连接框架,从而增强对认证安全元件的需求。利用人工智慧驱动的库存机器人进行零售测试,将使视觉优化的系统单晶片 (SoC) 能够即时核对货架库存,从而使物联网半导体市场的收入来源多元化。随着被动光纤网路透过单一光纤骨干网路连接暖通空调、照明和安防系统,建筑自动化订单将会增加。

区域分析

到2024年,亚太地区将占物联网半导体市场收入的34.92%,这主要得益于台湾地区63.8%的半导体总产量份额以及中国不断增长的产能。从晶圆到封装的垂直整合缩短了前置作业时间,使原始设备製造商(OEM)能够快速迭代。然而,出口限制正促使跨国OEM厂商在日本、印度和美国部署产能以对冲风险,再形成物联网半导体市场的供应格局。

中东和非洲地区以18.71%的复合年增长率呈现最快成长态势。海湾国家的智慧城市预算正投入数十亿美元用于交通分析、能源仪表板和公共感测器网络,这需要坚固耐用、宽温域的硅晶片。北非的5G网路部署将为从港口延伸至内陆自由贸易区的物流走廊提供低延迟遥测功能,进而扩大物联网半导体市场的终端用户群。

北美和欧洲仍然是技术创新中心。美国《晶片法案》将向16个州的晶圆厂注资500亿美元,到2027年将国内先进节点晶片产能翻倍至22%。欧洲《晶片法案》的目标是到2030年占据20%的全球市场份额,英特尔和义法半导体正在德国和法国投资建造晶片丛集。这些地区优先发展高价值的汽车和医疗晶片,儘管物联网半导体市场成长放缓,但这些晶片仍占据了物联网半导体市场中利润丰厚的份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 联网消费者与穿戴装置的兴起

- 工业4.0主导了对低功耗MCU的需求。

- 汽车ADAS和V2X晶片要求

- 物联网SoC内部的边缘AI推理

- Matter 通讯协定加速智慧家庭更新换代週期

- 透过卫星和Sub-GHz频段连线进行远端资产追踪

- 市场限制

- 端对端安全和隐私漏洞

- 碎片化的通讯标准

- 传统製程节点(28/40nm)的代工厂产能紧张。

- 先进射频知识产权的出口管制限制

- 产业价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 副产品

- 处理器

- 感应器

- 连线IC

- 储存装置

- 逻辑装置

- 电源管理积体电路

- 安全积体电路

- 最终用户

- 卫生保健

- 消费性电子产品

- 工业和製造业

- 车

- BFSI

- 零售

- 楼宇自动化

- 其他最终用户

- 依技术节点

- 90奈米或以上

- 65-45 nm

- 40-28 nm

- 22-16 nm

- 14奈米或更小

- 透过连接技术

- Bluetooth /BLE

- Wi-Fi(802.11x)

- NB-IoT/LTE-M

- 5G RedCap

- 超宽频(UWB)

- Thread/Zigbee

- 卫星物联网

- 依处理器架构

- 基于 Arm 的

- RISC-V

- x86

- 其他/混合型

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 新加坡

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Qualcomm Technologies Inc.

- Intel Corporation

- Texas Instruments Incorporated

- NXP Semiconductors NV

- Cypress Semiconductor Corporation(Infineon)

- MediaTek Inc.

- Microchip Technology Inc.

- Samsung Electronics Co., Ltd.

- Silicon Laboratories Inc.

- TDK InvenSense Inc.

- STMicroelectronics NV

- Nordic Semiconductor ASA

- Analog Devices, Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- Arm Holdings plc

- NVIDIA Corporation

- Marvell Technology Group Ltd.

第七章 市场机会与未来展望

The IoT Semiconductor Market size is estimated at USD 0.67 trillion in 2025, and is expected to reach USD 1.32 trillion by 2030, at a CAGR of 14.70% during the forecast period (2025-2030).

The Global IoT Semiconductor market size expansion is powered by distributed edge-AI processing, industrial automation programs, and a steady rise in connected consumer devices. Manufacturers are moving workloads from cloud to edge, forcing IoT silicon to add neural acceleration while holding power budgets below single-digit milliwatts. Government incentives aimed at regionalizing semiconductor fabrication are encouraging new fabs in North America and Europe, while reshoring policies are altering sourcing strategies across the Global IoT Semiconductor market. Supply-chain diversification aligns with technology-node bifurcation: advanced nodes (<14 nm) enable resource-intensive AI inference, whereas mature nodes (40-28 nm) keep costs competitive for mass-market sensors.

Global IoT Semiconductor Market Trends and Insights

Proliferation of Connected Consumer and Wearable Devices

Demand for ambient computing experiences is lifting volumes for ultra-low-power chips that keep sensors and radios active at all times. Health-focused wearables now integrate medical-grade photoplethysmography, temperature, and ECG sensors that need secure data paths to comply with tightening privacy rules. Qualcomm reported USD 1.5 billion in IoT revenue for Q1 2025, up 36% year over year, underscoring consumer momentum. As 5G modems converge with on-device AI, designers shift to heterogeneous SoCs that fuse application processors, NPUs, and connectivity on one die, driving silicon-area efficiency across the Global IoT Semiconductor market.

Industry 4.0-Led Demand for Low-Power MCUs

Factories deploying digital twins and predictive maintenance lean on microcontrollers that ingest vibration, thermal, and acoustic data locally, cutting network latency. Intel's smart-factory line achieved near-theoretical yield through real-time lithography calibration, proving the value of edge analytics inside harsh environments. Rugged MCUs now combine machine-learning instruction sets with secure boot and OTA updates, positioning the Global IoT Semiconductor market for sustained industrial orders through the decade.

End-to-End Security and Privacy Vulnerabilities

The White House Cyber Trust Mark requires compliance with NIST IR 8425, raising the bar for secure-element integration in resource-limited devices. Cost-sensitive OEMs face additional silicon area and firmware validation expenses. Rising quantum-computing threats press chipmakers to support lattice-based cryptography, delaying product launches and tempering short-term Global IoT Semiconductor market growth.

Other drivers and restraints analyzed in the detailed report include:

- Automotive ADAS and V2X Silicon Requirements

- Edge-AI Inference Inside IoT SoCs

- Legacy-Node (28/40 nm) Foundry Capacity Crunch

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processors generated the largest revenue slice in 2024 at 25.65%, anchored by single-die combos that merge CPU, NPU, and multi-protocol radios. Enhanced integration trims printed-circuit area and shortens certification cycles, fortifying processor dominance in the Global IoT Semiconductor market. Security ICs are poised for the fastest expansion with a 17.90% CAGR as zero-trust architectures embed hardware roots-of-trust into every node of the IoT Semiconductor market. Sensor, connectivity, memory, logic, and power-management lines track broader unit shipment curves, with specialized low-power DRAM commanding premium price points.

Upgrades in in-package voltage regulation now supply sub-0.5 V rails for AI accelerators, extending battery life in wearables. MEMS makers push shippable pressure sensors below 0.8 mm height, opening design space in rings and earbuds. SEALSQ secured contracts for 24 million quantum-resistant chips that protect UK smart meters, showcasing a security shift across critical infrastructure.

Industrial and manufacturing retained a 22.71% share in 2024 as digital-twin rollouts scaled across APAC plants. Demand for condition-monitoring MCUs sustains double-digit unit growth through 2030. Automotive leads in CAGR at 16.74% as software-defined vehicles centralize compute domains. The IoT Semiconductor market size for automotive silicon is projected to climb sharply on the back of zonal architectures that cut harness weight and enable OTA feature upsells.

Healthcare extends beyond remote monitoring to regulated device connectivity frameworks, strengthening demand for certified secure elements. Retail pilots using AI-powered inventory robots enlist vision-optimized SoCs to reconcile shelf stock in real time, diversifying the IoT Semiconductor market revenue base. Building-automation orders rise as passive optical networks connect HVAC, lighting, and security over a single fibre backbone.

The IoT Semiconductor Market is Segmented by Product (Processor, Sensor, and More), End-User (Healthcare, Consumer Electronics, and More), Technology Node, Connectivity Technology (Bluetooth/BLE, Wi-Fi, and More), Processor Architecture (Arm-Based, RISC-V, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 34.92% of the IoT Semiconductor market revenue in 2024, propelled by Taiwan's 63.8% share of total semiconductor output and China's capacity build-out. Vertical integration from wafer to packaging lowers lead times, letting OEMs iterate faster. Yet export controls nudge multinational OEMs toward capacity hedging in Japan, India, and the United States, reshaping the IoT Semiconductor market supply map.

The Middle East and Africa exhibit the fastest trajectory at 18.71% CAGR. Gulf smart-city budgets allocate billions for traffic analytics, energy dashboards, and public-safety sensor grids, demanding robust, wide-temperature-range silicon. 5G rollouts across North Africa unlock low-latency telemetry for logistics corridors stretching from ports to inland free-trade zones, enlarging the endpoint base for the IoT Semiconductor market.

North America and Europe remain innovation centers. The U.S. CHIPS Act channels USD 50 billion into fabs across 16 states, doubling domestic advanced-node capacity to 22% by 2027. Europe's Chips Act targets a 20% global share by 2030, with Intel and STMicroelectronics investing in Germany and France clusters. These regions prioritize high-value automotive and medical silicon, forming lucrative slices of the IoT Semiconductor market size despite moderate unit growth.

- Qualcomm Technologies Inc.

- Intel Corporation

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Cypress Semiconductor Corporation (Infineon)

- MediaTek Inc.

- Microchip Technology Inc.

- Samsung Electronics Co., Ltd.

- Silicon Laboratories Inc.

- TDK InvenSense Inc.

- STMicroelectronics N.V.

- Nordic Semiconductor ASA

- Analog Devices, Inc.

- Broadcom Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- Arm Holdings plc

- NVIDIA Corporation

- Marvell Technology Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of connected consumer and wearable devices

- 4.2.2 Industry 4.0-led demand for low-power MCUs

- 4.2.3 Automotive ADAS and V2X silicon requirements

- 4.2.4 Edge-AI inference inside IoT SoCs

- 4.2.5 Matter protocol accelerating smart-home refresh cycles

- 4.2.6 Satellite and sub-GHz connectivity for remote asset tracking

- 4.3 Market Restraints

- 4.3.1 End-to-end security and privacy vulnerabilities

- 4.3.2 Fragmented communications standards

- 4.3.3 Legacy-node (28/40 nm) foundry capacity crunch

- 4.3.4 Export-control limits on advanced RF IP

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product

- 5.1.1 Processor

- 5.1.2 Sensor

- 5.1.3 Connectivity IC

- 5.1.4 Memory Device

- 5.1.5 Logic Device

- 5.1.6 Power-Management IC

- 5.1.7 Security IC

- 5.2 By End-user

- 5.2.1 Healthcare

- 5.2.2 Consumer Electronics

- 5.2.3 Industrial and Manufacturing

- 5.2.4 Automotive

- 5.2.5 BFSI

- 5.2.6 Retail

- 5.2.7 Building Automation

- 5.2.8 Other End-users

- 5.3 By Technology Node

- 5.3.1 >=90 nm

- 5.3.2 65-45 nm

- 5.3.3 40-28 nm

- 5.3.4 22-16 nm

- 5.3.5 <=14 nm

- 5.4 By Connectivity Technology

- 5.4.1 Bluetooth / BLE

- 5.4.2 Wi-Fi (802.11x)

- 5.4.3 NB-IoT / LTE-M

- 5.4.4 5G RedCap

- 5.4.5 Ultra-Wideband (UWB)

- 5.4.6 Thread / Zigbee

- 5.4.7 Satellite IoT

- 5.5 By Processor Architecture

- 5.5.1 Arm-based

- 5.5.2 RISC-V

- 5.5.3 x86

- 5.5.4 Other / Hybrid

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Singapore

- 5.6.4.6 Australia

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Qualcomm Technologies Inc.

- 6.4.2 Intel Corporation

- 6.4.3 Texas Instruments Incorporated

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 Cypress Semiconductor Corporation (Infineon)

- 6.4.6 MediaTek Inc.

- 6.4.7 Microchip Technology Inc.

- 6.4.8 Samsung Electronics Co., Ltd.

- 6.4.9 Silicon Laboratories Inc.

- 6.4.10 TDK InvenSense Inc.

- 6.4.11 STMicroelectronics N.V.

- 6.4.12 Nordic Semiconductor ASA

- 6.4.13 Analog Devices, Inc.

- 6.4.14 Broadcom Inc.

- 6.4.15 Infineon Technologies AG

- 6.4.16 Renesas Electronics Corporation

- 6.4.17 ON Semiconductor Corporation

- 6.4.18 Arm Holdings plc

- 6.4.19 NVIDIA Corporation

- 6.4.20 Marvell Technology Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment