|

市场调查报告书

商品编码

1906133

聚对苯二甲酸丙二醇酯:市场份额分析、产业趋势与统计、成长预测(2026-2031)Polytrimethylene Terephthalate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

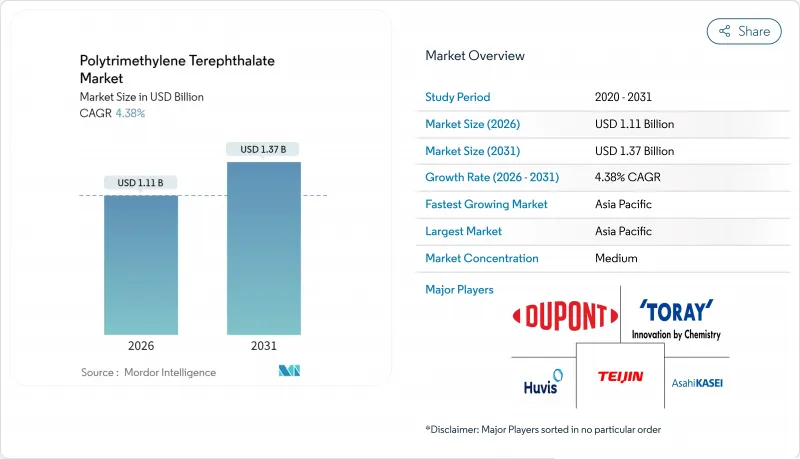

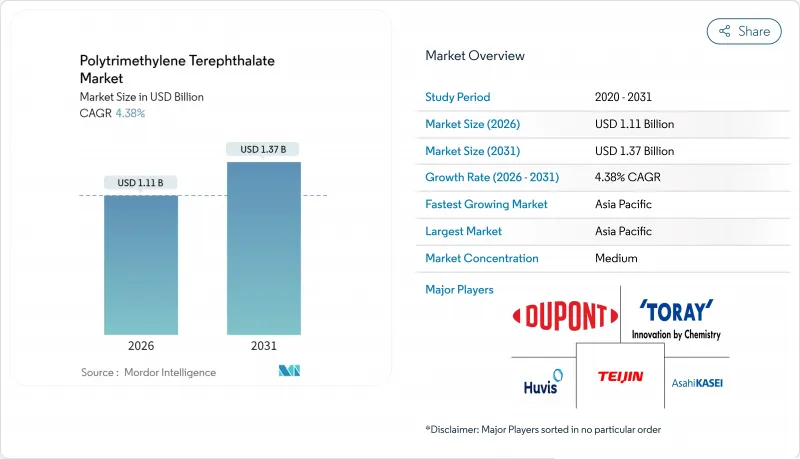

预计到 2025 年,聚对苯二甲酸丙二醇酯市值将达到 10.6 亿美元,到 2026 年将增长至 11.1 亿美元,到 2031 年将增长至 13.7 亿美元,在预测期(2026-2031 年)内将增长到 4.38%。

这种适度的成长速度得益于该聚合物能够弥合普通PET和高端工程塑胶之间的差距,其弹性回復率超过95%,染色鲜艳,且具有固有的抗污性。对舒适拉伸服饰的需求不断增长、地毯产量扩大以及永续性需求,持续支撑着亚太、北美和欧洲市场的稳定销售成长。持续存在的不利因素包括:与PET相比,其生产成本高出20-30%;1,3-丙二醇原料价格波动;以及PET和PBT生产商不断拓展化学回收途径带来的持续竞争。然而,自2025年1月起禁止在纺织品上使用PFAS涂层,使得PTT固有的抗污性更具商业性吸引力,提升了其价值提案。

全球聚对苯二甲酸丙二醇酯市场趋势及洞察

对弹性舒适布料的需求不断增长

全球运动服和休閒品牌纷纷选用聚噻唑啉酮(PTT)面料,因为PTT纤维在拉伸后能比普通涤纶更可靠地恢復原长,从而延长服装的使用寿命并保持其合身性。亚洲纺织品製造商正在拓展PTT与氨纶混纺的专用生产线,中国主要製造商报告称,高弹针织布料的订单实现了两位数的增长。帝人前沿(Teijin Frontier)的多功能聚酯纤维布料系列展示瞭如何在不牺牲舒适性的前提下,将PTT与防紫外线和透气性相结合。随着零售商将销售策略转向利润更高的功能性服饰,PTT在价格敏感型细分市场中的应用正在加速成长。

永续性发展推动生物基和可再生聚酯纤维的发展

PTT可透过利用玉米衍生的葡萄糖来生产1,3-丙二醇组分,从而达到31%的生物基含量。杜邦公司自2015年起已将此方法商业化。儘管生物基等级产品价格溢价高达15-20%,但欧盟和美国针对范围3排放的政策压力正加速服装企业签订多年采购合约的步伐。 Nova Research预测,生物聚合物产能将于2023年达到440万吨,年均成长率达17%。 PTT是该领域为数不多的几种可商购的芳香族聚酯之一。目前,化学回收公司正在测试酵素解聚技术,以同时处理PET和PTT,在避免复杂分类流程的同时,拓展循环经济的选择范围。

高昂的生产成本

生物来源1,3-丙二醇的价格仍比石油化学衍生的乙二醇高出25-30%,这限制了其与PET纤维的成本竞争力,尤其是在大众市场T恤和包装领域。有限的工厂规模(年产量均不超过20万吨)限制了固定成本的多元化。预计到2024年,亚洲烯烃的利润率将进一步下降,这将进一步挤压特种聚合物的经济效益。因此,PTT供应商正将目光投向高性能运动服、地毯和工程化合物等高端细分市场,以保护其利润空间。

细分市场分析

到2025年,石油基聚对苯二甲酸丙二醇酯(PDT)仍将占据66.05%的市场份额,这反映了其成熟的供应链和相对的成本优势。然而,随着品牌商力争2030年实现聚酯中25-50%的可再生含量,生物基PDT的生产正以5.29%的复合年增长率快速成长。这一转变推动生物基PDT市场的成长速度超过了整体产业需求。自2023年以来,发酵技术的进步已使生物基PDT的单位成本降低了12%。甘油在产品中的特定应用也降低了原料成本。该细分市场的收入成长在欧盟和美国最为显着,这两个国家的碳排放揭露法规正在提升绿色高级产品的经济效益。

同时投资建造的酵素回收工厂使得利用回收的PTT和生物基PTT生产混合颗粒成为可能,从而可以在不影响纱线强度的前提下混合两种材料。种植者认为这种方法可以有效对冲玉米价格波动,因为它使他们能够根据市场相关人员灵活调整生物基PTT的含量。利害关係人预计,到2028年,随着年产能达到40万吨,生产规模的扩大将缩小与石油基PTT的价格差距,进一步增强聚对苯二甲酸丙二醇酯市场的长期永续性。

区域分析

预计到2025年,亚太地区将占聚对苯二甲酸丙二醇酯(PTA)市场收入的60.20%,并在2031年之前以5.21%的复合年增长率增长,这主要得益于中国庞大的纱线生产基地以及Triexta地毯生产线在该地区的快速普及。中石化位于江苏省的300万吨级PTA工厂将于2024年运作,这标誌着上游产业的持续强劲发展,并确保了PTT一体化生产商对苯二甲酸的稳定供应。日本纺织製造商正致力于超细长丝的精密纺丝技术,而韩国树脂供应商则在积极推进生物基材料的整合,巩固了其在该地区市场领先地位。

北美仍然是杜邦公司第二大生产基地,这要归功于杜邦TriExta地毯的成功经验以及住宅对不含PFAS、易于打理的地板材料的青睐。美国地板材料製造商正在建造专门用于生产PTT连续长丝的新挤出工厂,分销管道也透过性能保证计划销售这种纤维,以吸引养宠物的家庭。

政策主导的需求成长在欧洲尤其显着,生态设计指令和生产者延伸责任制正在推动对低碳材料的需求。德国和斯堪地那维亚品牌指定使用生物基PTT纤维以达到科学碳目标,而义大利加工商则将回收的PTT与原生生物基材料混合,用于奢华时尚品牌。

南美洲和中东及非洲地区尚处于采用的早期阶段,但巴西和埃及不断增长的纤维出口表明,一旦当地纺纱厂建立供应协议,该地区将具有潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对拉伸舒适布料的需求不断增长

- 致力于永续性:向生物基和可再生聚酯过渡

- 利用 TRIEXTA 拓展地毯和地板材料的应用

- 聚对苯二甲酸丙二醇酯(PTT)在3D列印原型製作耗材的应用

- 轻质复合材料在电动车的应用

- 市场限制

- 高昂的生产成本

- 与现有聚对苯二甲酸乙二醇酯 (PET) 和聚丁烯对苯二甲酸酯(PBT) 生产商的竞争

- 原料供应波动

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按来源

- 石油衍生的聚对苯二甲酸丙二醇酯(PTT)

- 生物基聚对苯二甲酸丙二醇酯(PTT)

- 透过使用

- 服饰

- 家用纺织品

- 工业纤维

- 其他用途(汽车内装零件等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Asahi Kasei Corporation

- DuPont

- Huvis

- RTP Company

- Shell plc

- Shenghong Holding Group Co., Ltd.

- Technip Energies NV

- Teijin Limited

- TORAY INDUSTRIES, INC.

- Xianglu Tenglong Group

第七章 市场机会与未来展望

The Polytrimethylene Terephthalate Market was valued at USD 1.06 billion in 2025 and estimated to grow from USD 1.11 billion in 2026 to reach USD 1.37 billion by 2031, at a CAGR of 4.38% during the forecast period (2026-2031).

This moderate pace comes from the polymer's ability to bridge commodity PET and higher-end engineering plastics, offering elastic recovery above 95%, vivid dye uptake, and inherent stain resistance. Rising demand for comfort-stretch apparel, expanding carpet output, and mounting sustainability mandates continue to underpin steady volume gains in Asia-Pacific, North America, and Europe. Persistent headwinds include 20-30% higher production costs versus PET, feedstock price volatility for 1,3-propanediol, and entrenched competition from PET and PBT producers who are scaling up chemical-recycling routes. Nonetheless, the shift away from PFAS coatings in textiles effective January 2025 lifts the value proposition of PTT by making its built-in stain repellence more commercially attractive.

Global Polytrimethylene Terephthalate Market Trends and Insights

Rising Textile Demand for Stretch-Comfort Fibres

Global activewear and athleisure brands are specifying PTT because the fibre recovers its original length after stretching more reliably than standard polyester, extending garment life and fit. Asian fabric mills are scaling dedicated lines to blend PTT with spandex, and leading mills in China are quoting double-digit order growth for high-elastic knit fabrics. Teijin Frontier's multifunctional polyester fabric range illustrates how PTT can be paired with UV protection and breathability finishes without compromising comfort. As retailers shift merchandising toward higher-margin performance clothing, adoption accelerates even in price-sensitive segments.

Sustainability Push Toward Bio-Based and Recyclable Polyester

PTT can reach 31% bio-content when its 1,3-propanediol component is derived from corn glucose, an approach already commercialised by DuPont since 2015. Policy pressure in the EU and US on Scope 3 emissions is prompting apparel groups to sign multiyear offtake agreements for bio-based grades despite premiums of 15-20%. The nova-Institut estimated bio-polymer capacity at 4.4 million t in 2023, growing 17% annually, with PTT one of the few commercial aromatic polyesters in the mix. Chemical recyclers are now trialling enzymatic depolymerisation that processes PET and PTT together, opening circularity options while avoiding complex sorting.

High Production Costs

Biological 1,3-propanediol remains 25-30% dearer than petrochemically derived ethylene glycol, hampering cost parity with PET fabrics, particularly in mass-market T-shirts and packaging. Limited plant scales-none exceeding 200 ktpa-restrict fixed-cost dilution. Asian olefin margins tightened through 2024, further squeezing specialty polymer economics. PTT suppliers therefore target premium niches such as performance sportswear, carpets, and engineering compounding to defend margins.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Carpet/Flooring Applications Using Triexta

- Polytrimethylene Terephthalate Adoption in 3D Printing Filaments for Prototyping

- Competition from PET and PBT Incumbents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petro-based grades retained a 66.05% position within the Polytrimethylene Terephthalate market in 2025, reflecting entrenched supply chains and relative cost advantages. Yet bio-based output is expanding at a 5.29% CAGR as brand owners commit to 25-50% renewable content in polyester by 2030. This shift keeps the Polytrimethylene Terephthalate market size for bio grades on a steeper curve than overall industry demand. Fermentation improvements have trimmed unit costs for bio-PDO by 12% since 2023, while side-stream valorisation of glycerol lowers net feedstock expenses. The segment's revenue gains are strongest in the EU and US, where carbon-intensity disclosure rules raise the economic return on green-premium products.

Parallel investments in enzymatic recycling plants enable hybrid pellets that blend recycled and bio-based PTT without compromising yarn tenacity. Producers see the route as a hedge against corn-price swings because bio-feedstock share can flex depending on market signals. Once capacity reaches 400 kt annually by 2028, stakeholders expect operating scale to narrow the price gap with petro-PTT, reinforcing the long-term sustainability narrative of the Polytrimethylene Terephthalate market.

The Polytrimethylene Terephthalate Market Report is Segmented by Source (Petro-Based PTT and Bio-Based PTT), Application (Apparel, Household Textiles, Industrial Fabrics, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 60.20% of Polytrimethylene Terephthalate market revenue in 2025 and is projected to register a 5.21% CAGR to 2031, propelled by China's vast yarn spinning base and the rapid adoption of Triexta carpet lines in the region. Sinopec's 3 million t PTA plant commissioned in Jiangsu during 2024 signals ongoing upstream strength, ensuring reliable terephthalic acid flows to integrated PTT producers. Japanese fibre makers emphasise precision spinning for ultra-microfilaments, while South Korean resin suppliers push bio-feedstock integration, supporting regional leadership.

North America remains the second-largest cluster, underpinned by DuPont's legacy in Triexta carpets and the migration of residential homeowners toward PFAS-free, easy-clean flooring. US floor-covering mills have installed new extrusion capacity dedicated to PTT bulk-continuous-filament yarns, and distribution chains now market the fibre under performance warranty programmes that resonate with pet-owning households.

Europe reflects a policy-driven pull, with eco-design directives and extended-producer-responsibility schemes elevating demand for low-carbon materials. Brands in Germany and Scandinavia specify bio-PTT fabrics to meet Science-Based Targets, and converters in Italy blend recycled PTT with virgin bio content for luxury fashion houses.

South America and the Middle East and Africa remain early-stage adopters, yet rising textile exports from Brazil and Egypt suggest latent potential once local yarn spinners establish supply agreements.

- Asahi Kasei Corporation

- DuPont

- Huvis

- RTP Company

- Shell plc

- Shenghong Holding Group Co., Ltd.

- Technip Energies N.V.

- Teijin Limited

- TORAY INDUSTRIES, INC.

- Xianglu Tenglong Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Textile Demand for Stretch-Comfort Fibres

- 4.2.2 Sustainability Push Toward Bio-Based and Recyclable Polyester

- 4.2.3 Expansion of Carpet/Flooring Applications using Triexta

- 4.2.4 Polytrimethylene Terephthalate (PTT) Adoption in 3-D-Printing Filaments for Prototyping

- 4.2.5 Use in EV Lightweight Composite Components

- 4.3 Market Restraints

- 4.3.1 High Production Costs

- 4.3.2 Competition from Polyethylene Terephthalate (PET) And Polybutylene Terephthalate (PBT) Incumbents

- 4.3.3 Feed-Stock Supply Volatility

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Source

- 5.1.1 Petro-based Polytrimethylene Terephthalate (PTT)

- 5.1.2 Bio-based Polytrimethylene Terephthalate (PTT)

- 5.2 By Application

- 5.2.1 Apparel

- 5.2.2 Household Textiles

- 5.2.3 Industrial Fabrics

- 5.2.4 Other Applications (Automotive Interior Parts, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 DuPont

- 6.4.3 Huvis

- 6.4.4 RTP Company

- 6.4.5 Shell plc

- 6.4.6 Shenghong Holding Group Co., Ltd.

- 6.4.7 Technip Energies N.V.

- 6.4.8 Teijin Limited

- 6.4.9 TORAY INDUSTRIES, INC.

- 6.4.10 Xianglu Tenglong Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment