|

市场调查报告书

商品编码

1906160

中东和非洲风力发电:市场份额分析、行业趋势和统计数据、成长预测(2026-2031 年)Middle-East And Africa Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

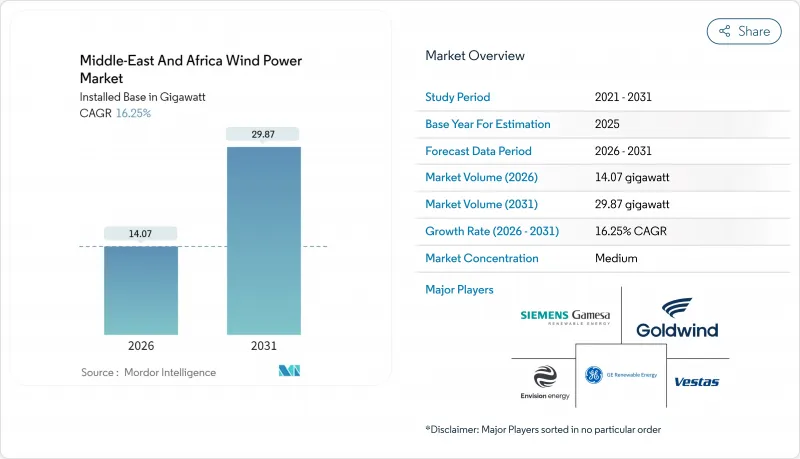

预计中东和非洲风电市场将从 2025 年的 12.10 吉瓦成长到 2026 年的 14.07 吉瓦,到 2031 年将达到 29.87 吉瓦,2026 年至 2031 年的复合年增长率为 16.25%。

强劲的主权财富基金投资,特别是沙乌地公共投资基金500亿美元的可再生能源投资,支撑了这一成长。政策目标的强化、陆域风电平准化度电成本(LCOE)的下降以及购电协议(PPA)的扩大是推动成长的关键因素。国际风力涡轮机製造商正在加强其在当地的布局,而中国新参与企业则凭藉成本驱动的竞标获得了优势。开发商透过试点储能係统来平滑电力输出波动,并采用混合设计方案,从而对冲电网风险。区域港口的供应链拥塞以及离岸风力发电早期阶段的审批流程仍然是营运中的摩擦点,但明确的国家目标确保了计划多年可预见性。

中东和非洲风力发电厂的发展趋势与分析

政府可再生能源目标和竞标制度

国家竞标计划是计划储备的基础。沙乌地阿拉伯的目标是到2030年达到50%的清洁电力,风电装置容量达到16吉瓦,并计画在2024年于杜马特·贾达尔(Dumaat Al Jandal)风电场创下每千瓦时0.0199美元的历史最低风价。埃及的目标是到2035年实现7.2吉瓦的风电装置容量,并获得32亿美元的多边融资支持。摩洛哥的目标是到2030年实现10吉瓦的风电装置容量,并充分利用其大西洋沿岸的资源。阿联酋已将2050年电力结构的12%规划为风电。这些协调一致的政策降低了需求风险,吸引了一流的金融机构,并促进了在地化供应链的建立。

陆域风电平准化能源成本低于区域石化燃料基准水平

在摩洛哥、埃及和沙乌地阿拉伯,风力发电成本已降至每千瓦时0.03美元以下,超过了天然气价格(每度电0.035-0.045美元)。杜马特·贾达尔(Doumat Al-Jandal)电厂2024年的电价比石化燃料替代能源低40%。摩洛哥的塔法亚(Tarfaya)风电场售价为每千瓦时0.025美元,使得跨国出口具有商业性可行性。苏伊士湾风电计划的运转运转率超过40%,进一步增强了风电投资的经济合理性。

撒哈拉以南地区多个市场的政策不确定性

在奈及利亚,波动不定的上网电价和多层级审批流程导致资金筹措成本上升150-200个基点。肯亚新的电网法规造成了过渡期延误,加纳因货币波动面临容量支付通膨,而衣索比亚的地区衝突则阻碍了风电走廊的开发。这些挑战导致开发週期延长长达18个月,并限制了缺乏健全竞标机制地区近期新增装置容量。

细分市场分析

受成熟的供应链和低资本成本的推动,陆上计划预计将在 2025 年引领中东和北非地区风电场的整体成长,并在 2031 年前保持 16.25% 的复合年增长率。南非东开普省和沙乌地阿拉伯杜马特贾达尔的风电场容量係数约为 40%,而摩洛哥大西洋沿岸稳定的信风使容量係数超过 45%。

离岸风力发电也拥有巨大的潜力。红海沿岸水深20-50米,风速可达9米/秒。 NEOM的4吉瓦计画旨在2028年前启动首批计划的建设。埃及正在筹备10吉瓦的离岸风电开发项目,并正与欧洲方面洽谈优惠获利能力。如果先导计画证明可行,中东和非洲的风电场预计从2027年起迅速向离岸风电转型。

这份中东和非洲风电场报告按地点(陆上和海上)、风机容量(3兆瓦以下、3-6兆瓦和6兆瓦以上)、应用领域(大型公用事业、商业和工业以及区域计划)和地区(沙乌地阿拉伯、阿联酋、约旦、伊朗、南非、埃及、摩洛哥以及其他中东和非洲国家)进行分析。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府可再生能源目标和竞标

- 陆域风电平准化能源成本低于区域石化燃料基准

- 资料中心和采矿业企业间购电协议 (PPA) 的扩展

- 海湾合作委员会和东非地区的输电网扩建投资

- 利用红海沿岸离岸风力发电製氢的试点项目

- 沙乌地阿拉伯涡轮机製造在地化奖励

- 市场限制

- 撒哈拉以南多个市场的政策不确定性

- 电网稳定性和限电风险

- 海上计划的初始资本投资成本高

- 中东和非洲港口供应链拥堵

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按位置

- 陆上

- 离岸

- 按涡轮机容量

- 3兆瓦或以下

- 3~6MW

- 超过6兆瓦

- 透过使用

- 实用规模

- 商业和工业

- 社区计划

- 按成分(定性分析)

- 机舱/涡轮机

- 刀刃

- 塔

- 发电机和减速器

- 系统周边设备

- 按地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 约旦

- 伊朗

- 南非

- 埃及

- 摩洛哥

- 其他中东和非洲地区

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- GE Renewable Energy

- Xinjiang Goldwind Science & Technology

- Envision Energy

- Acciona Energia

- Mainstream Renewable Power

- EDF Renouvelables

- Enel Green Power

- ENGIE

- ACWA Power

- Masdar Clean Energy

- Lekela Power

- Orascom Construction

- Nordex SE

- Enercon GmbH

- Ming Yang Smart Energy

- Siemens Energy

- Doosan Enerbility

- Suzlon Energy Ltd.

第七章 市场机会与未来展望

The Middle-East And Africa Wind Power Market is expected to grow from 12.10 gigawatt in 2025 to 14.07 gigawatt in 2026 and is forecast to reach 29.87 gigawatt by 2031 at 16.25% CAGR over 2026-2031.

Robust sovereign wealth-fund investments, especially the Saudi Public Investment Fund's USD 50 billion renewable allocation, anchor this momentum. Intensifying policy targets, declining onshore levelized costs, and expanding corporate power purchase agreements (PPAs) form the core growth architecture. International turbine makers strengthen local footprints while Chinese entrants win cost-sensitive bids. Developers hedge grid risks through storage pilots and hybrid designs that smooth output variability. Supply-chain congestion at regional ports and early-stage offshore permitting remain operational friction points, yet the depth of national targets secures multi-year project visibility.

Middle-East And Africa Wind Power Market Trends and Insights

Government Renewable-Energy Targets & Auctions

National auction programs underpin project pipelines. Saudi Arabia targets 50% clean electricity by 2030 with 16 GW of wind capacity, achieving a record USD 0.0199 per kWh tariff at Dumat Al Jandal in 2024. Egypt aims to achieve 7.2 GW of wind energy by 2035, backed by USD 3.2 billion in multilateral financing. Morocco's 10 GW target for 2030 exploits Atlantic resources, while the UAE channels 12% of its 2050 generation mix toward wind. These synchronized mandates reduce demand risk, attract tier-one financiers, and encourage supply-chain localization.

Falling On-Shore LCOE Below Regional Fossil Benchmarks

Wind costs have dropped below USD 0.03 per kWh in Morocco, Egypt, and Saudi Arabia, which is lower than natural-gas tariffs of USD 0.035-0.045 per kWh. Dumat Al Jandal's 2024 tariff came in 40% under fossil alternatives. Morocco's Tarfaya complex sells at USD 0.025 per kWh, making cross-border exports commercially viable. Gulf of Suez projects operate at capacity factors above 40%, reinforcing the economic argument for wind investment.

Policy Uncertainty in Several Sub-Saharan Markets

Nigeria's shifting feed-in tariffs and multi-layer permitting elevate financing spreads by 150-200 basis points. Kenya's new grid codes create transition delays, Ghana faces currency fluctuations that inflate capacity payments, and Ethiopia's regional conflicts hinder wind corridor development. These issues stretch development timelines by up to 18 months and temper near-term capacity additions outside stable auction jurisdictions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Corporate PPAs from Data-Center & Mining Sectors

- Grid-Expansion Investments Across GCC & East Africa

- Grid Stability & Curtailment Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Onshore projects are expected to control the entire Middle East and Africa wind power market in 2025 and sustain a 16.25% CAGR to 2031, driven by mature supply chains and low capital costs. South Africa's Eastern Cape farms and Saudi Arabia's Dumat Al Jandal demonstrate performance with capacity factors of nearly 40%. Morocco's Atlantic villas exceed 45% factors thanks to consistent trade winds.

Offshore potential is substantial. The Red Sea coasts offer water depths of 20-50 m with wind speeds of 9 m/s. NEOM's 4 GW plan aims to anchor the first projects by 2028. Egypt is lining up 10 GW of offshore prospects and is negotiating concessional European financing. As pilot arrays prove bankable, the Middle East and Africa wind power market may diversify rapidly toward offshore capacity after 2027.

The Middle East and Africa Wind Power Market Report is Segmented by Location (Onshore and Offshore), Turbine Capacity (Up To 3 MW, 3 To 6 MW, and Above 6 MW), Application (Utility-Scale, Commercial and Industrial, and Community Projects), and Geography (Saudi Arabia, UAE, Jordan, Iran, South Africa, Egypt, Morocco, and Rest of Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

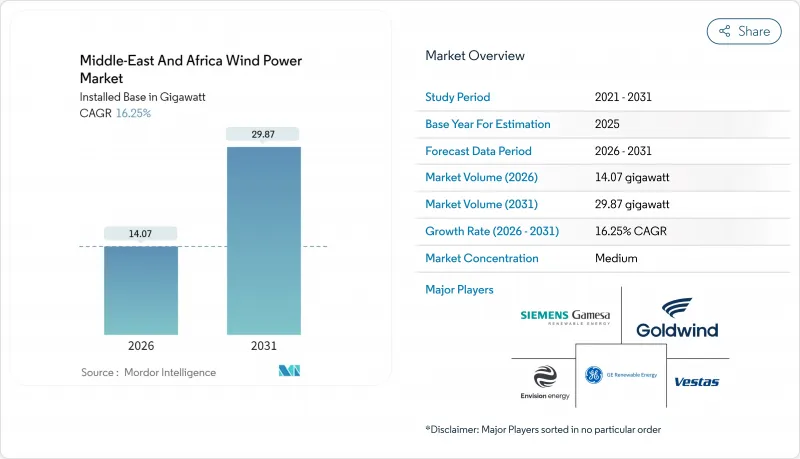

List of Companies Covered in this Report:

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- GE Renewable Energy

- Xinjiang Goldwind Science & Technology

- Envision Energy

- Acciona Energia

- Mainstream Renewable Power

- EDF Renouvelables

- Enel Green Power

- ENGIE

- ACWA Power

- Masdar Clean Energy

- Lekela Power

- Orascom Construction

- Nordex SE

- Enercon GmbH

- Ming Yang Smart Energy

- Siemens Energy

- Doosan Enerbility

- Suzlon Energy Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government renewable-energy targets & auctions

- 4.2.2 Falling on-shore LCOE below regional fossil benchmarks

- 4.2.3 Expansion of corporate PPAs from data-centre & mining sectors

- 4.2.4 Grid-expansion investments across GCC & East Africa

- 4.2.5 Offshore wind-to-hydrogen pilots along the Red Sea

- 4.2.6 Saudi localisation incentives for turbine manufacturing

- 4.3 Market Restraints

- 4.3.1 Policy uncertainty in several Sub-Saharan markets

- 4.3.2 Grid stability & curtailment risk

- 4.3.3 High upfront CAPEX for offshore projects

- 4.3.4 Supply-chain congestion at MEA ports

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 By Turbine Capacity

- 5.2.1 Up to 3 MW

- 5.2.2 3 to 6 MW

- 5.2.3 Above 6 MW

- 5.3 By Application

- 5.3.1 Utility-scale

- 5.3.2 Commercial and Industrial

- 5.3.3 Community Projects

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Nacelle/Turbine

- 5.4.2 Blade

- 5.4.3 Tower

- 5.4.4 Generator and Gearbox

- 5.4.5 Balance-of-System

- 5.5 By Geography

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Jordan

- 5.5.4 Iran

- 5.5.5 South Africa

- 5.5.6 Egypt

- 5.5.7 Morocco

- 5.5.8 Rest of Middle East & Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Siemens Gamesa Renewable Energy

- 6.4.2 Vestas Wind Systems A/S

- 6.4.3 GE Renewable Energy

- 6.4.4 Xinjiang Goldwind Science & Technology

- 6.4.5 Envision Energy

- 6.4.6 Acciona Energia

- 6.4.7 Mainstream Renewable Power

- 6.4.8 EDF Renouvelables

- 6.4.9 Enel Green Power

- 6.4.10 ENGIE

- 6.4.11 ACWA Power

- 6.4.12 Masdar Clean Energy

- 6.4.13 Lekela Power

- 6.4.14 Orascom Construction

- 6.4.15 Nordex SE

- 6.4.16 Enercon GmbH

- 6.4.17 Ming Yang Smart Energy

- 6.4.18 Siemens Energy

- 6.4.19 Doosan Enerbility

- 6.4.20 Suzlon Energy Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment