|

市场调查报告书

商品编码

1906217

马来西亚网路安全市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Malaysia Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

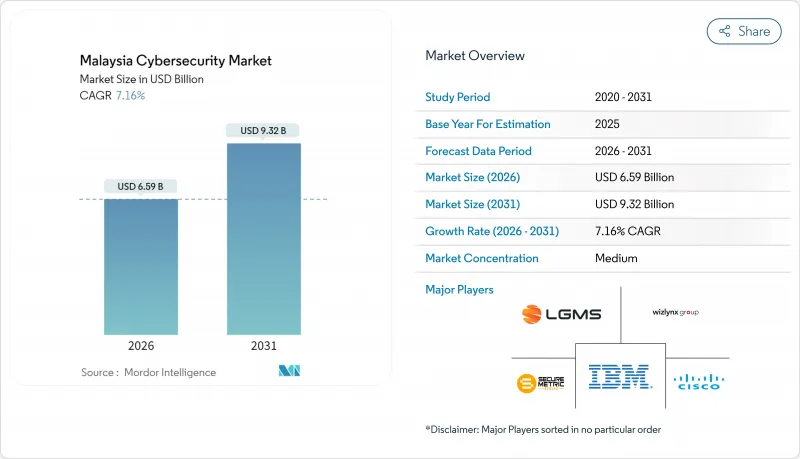

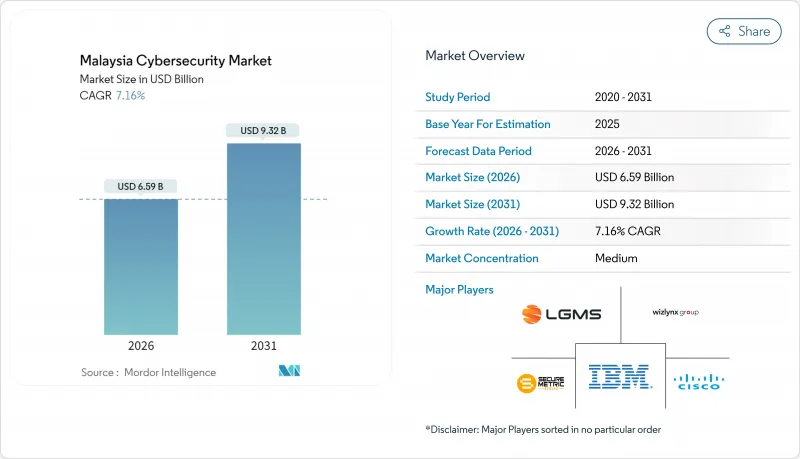

预计马来西亚网路安全市场将从 2025 年的 61.5 亿美元成长到 2026 年的 65.9 亿美元,并预计到 2031 年将达到 93.2 亿美元,2026 年至 2031 年的复合年增长率为 7.16%。

马来西亚网路安全市场保持两位数的低成长势头,使其成为该国更广泛的ICT生态系统中成长最快的数位基础设施领域之一。云端优先战略、2024年《网路安全法》下严格的许可製度以及资料外洩造成的经济损失,都在推动市场的持续成长。大型企业正在将其现有的控制措施扩展到零信任计划,而中小企业则开始透过订阅服务进行初步部署,这些服务提供较低的前期成本。对5G边缘网路、超大规模资料中心和操作技术(OT)现代化改造的同步投资,进一步巩固了马来西亚网路安全市场长期成长的基础。

马来西亚网路安全市场趋势与洞察

马来西亚快速部署「云端优先」策略,推动公共部门云端安全支出成长

马来西亚加速推进的「云端优先」策略正促使政府支出转向云端原生防御,例如云端云端存取安全仲介)和工作负载保护平台(WPP)。各部会和机构目前正将分类、加密和持续监控纳入所有应用程式迁移计划,从而推动了对咨询和託管服务的基本需求。公共部门早期成功的案例正鼓励金融机构和电信业者采用类似的架构,并在马来西亚网路安全市场产生连锁反应。系统整合商正围绕责任共担模式重新设计其产品组合,在单一合约下提供咨询、实施和託管检测服务。这些变化正带来支出结构性的针对性的改进,而非短暂的成长。

2024 年网路安全法案:许可强制令和 NCII 合规要求推动供应商需求

2024 年网路安全法案强制要求对穿透测试和保全行动等核心服务进行许可,并要求关键基础设施营运商遵守行业特定的行为准则。各组织机构正积极回应,将合规性提升至经营团队层面的优先事项,并聘请外部审核以满足新的法律标准。由于企业优先选择经过预先审核的合作伙伴以避免违规,早期获得许可的供应商已获得明显的销售优势。该法案还明确了事件报告时限,从而推动了对即时侦测工具和威胁情报整合的需求。这些变化共同推动了马来西亚网路安全市场规模的持续成长,因为持续的合规义务已纳入 IT 预算。

高阶安全架构师严重短缺,导致计划工期延长,成本上升。

经验丰富的架构师持续短缺,导致复杂的云端迁移专案停滞不前,计划工期延长37%,人事费用上升超过25%。这种人才短缺推高了大型转型合约的竞标价格,加剧了企业预算压力,并延误了关键里程碑的完成。企业正透过将架构工作外包给託管安全服务提供者 (MSSP) 或从区域中心引入专家来应对这项挑战,但签证审批时间限制了短期内的改进。儘管供应商的蓝图包含低程式码策略引擎和参考架构以缩短设计时间,但对于受监管的工作负载,实际操作的监督仍然至关重要。因此,人才短缺持续拖累马来西亚网路安全市场的复合年增长率 (CAGR)。

细分市场分析

预计到2025年,解决方案将占据马来西亚网路安全市场52.20%的份额,其中以保护混合环境的网路和云端安全套件为主导。然而,随着企业寻求运作的专业技术支持,预计到2031年,服务将以7.42%的复合年增长率超越解决方案。高侦测准确率、全天候监控和内建合规性仪表板使託管安全服务提供者 (MSSP) 成为策略合作伙伴,而非战术性供应商。基于每月活跃资产的定价模式降低了中型企业的进入门槛。本地供应商利用其对监管法规的熟悉程度来赢得与网路安全法律相关的合约。同时,全球供应商提供能够整合来自不同工具的警报的编配平台。咨询、实施和託管侦测与回应 (MDR) 服务的整合,提供了超越技术转售的价值提案,巩固了马来西亚网路安全市场以服务主导的成长模式。

然而,对于拥有严格资料居住规则的组织而言,解决方案组合仍然至关重要。银行、金融和保险 (BFSI) 以及公共产业行业的设备更新週期为防火墙、入侵防御系统和安全邮件闸道提供了持续的收入来源。下一代安全资讯和事件管理 (SIEM) 平台整合了行为分析和自动化功能,以弥补人才短缺,并将产品创新与国家技能发展目标相契合。供应商将永久许可证与云端交付的分析功能捆绑销售,以弥合本地控制和 SaaS 可视性之间的差距。与本地整合商的联合产品能够加快价值实现速度,并体现马来西亚网路安全市场的协作特性。

到2025年,本地部署系统将占马来西亚网路安全市场规模的52.85%,这主要受传统工作负载和资料权限要求的驱动,而这些需求在银行业和公共服务业仍然占据主导地位。这些产业的硬体更新换代为设备供应商提供了稳定的基础。然而,云端采用率预计将超过本地部署更新,到2031年将以8.05%的复合年增长率成长。付费使用制、持续的功能发布以及人工智慧驱动的分析,使得云端控制对奉行数位化优先策略的机构极具吸引力。责任共担框架鼓励企业将维护工作外包给专业供应商,从而支持云端技术在马来西亚网路安全市场的长期应用。

供应商蓝图包括在马来西亚境内设立资料本地化节点,以增强受监管客户的信心。虽然未来对自主云端平台的改进可能会降低剩余的阻力,但与工业控製网路相关的硬体更新换代可能会继续支撑本地部署设备的市场。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 市场定义与研究假设

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 马来西亚快速部署「云端优先」策略,推动公共部门云端安全支出成长

- 根据2024年《网路安全法案》颁发的许可证以及强制遵守国家网路资讯基础设施(NCII)的要求将推动供应商需求。

- 新山资料中心激增推动了周边安全和营运技术安全的投资

- 超过97%的5G覆盖率将推动行动核心网路和边缘安全升级。

- 资料外洩造成的122亿美元经济损失促使各董事会增加预算

- 国家製定培养25000名网路防御人员的目标推动了咨询和培训支出。

- 市场限制

- 高阶安全架构师严重短缺,导致计划工期延长,成本上升。

- 由于传统IT基础设施主要依赖资本支出(CAPEX),中小企业面临预算限制。

- 跨境资料主权规则的碎片化正在减缓云端迁移进程。

- 金融服务业以外领域多因子认证普及率低会增加剩余风险

- 价值链分析

- 重要法规结构评估

- 关键相关人员影响评估

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 报价

- 解决方案

- 应用程式安全

- 云端安全

- 资料安全

- 身分和存取管理

- 基础设施保护

- 综合风险管理

- 网路安全

- 端点安全

- 服务

- 专业服务

- 託管服务

- 解决方案

- 透过部署模式

- 云

- 本地部署

- 按最终用户行业划分

- BFSI

- 卫生保健

- 资讯科技和电信

- 工业与国防

- 零售与电子商务

- 能源与公共产业

- 製造业

- 其他的

- 按最终用户公司规模划分

- 大公司

- 中小企业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- LGMS Berhad

- IBM Corporation

- Cisco Systems Inc.

- Securemetric Bhd

- Wizlynx Group

- Akati Sekurity

- Palo Alto Networks

- Fortinet Inc.

- Check Point Software Tech.

- Trend Micro Inc.

- Kaspersky Lab

- Nexagate Sdn Bhd

- Ishan Tech Sdn Bhd

- Capgemini SE

- Microsoft Corp.

- AVG Technologies(Gen Digital)

- ATandT Cybersecurity

- NTT Data Security

- BAE Systems AI Malaysia

- Darktrace plc

- CrowdStrike Holdings Inc.

第七章 市场机会与未来趋势

- 评估差距和未满足的需求

The Malaysia cybersecurity market is expected to grow from USD 6.15 billion in 2025 to USD 6.59 billion in 2026 and is forecast to reach USD 9.32 billion by 2031 at 7.16% CAGR over 2026-2031.

This low-double-digit trajectory positions the Malaysia cybersecurity market among the faster-growing digital-infrastructure segments within the country's wider ICT ecosystem. Cloud-first mandates, strict licensing under the Cyber Security Act 2024, and the monetized cost of data breaches are each propelling sustained demand. Large enterprises are broadening existing controls into zero-trust programs, while small and medium enterprises are starting first-time deployments through subscription services that lower upfront costs. Parallel investments in 5G edge networks, hyperscale data centers, and operational-technology modernization further anchor a long runway for the Malaysia cybersecurity market.

Malaysia Cybersecurity Market Trends and Insights

Rapid Roll-out of Malaysia's Cloud-First Strategy Propelling Public-Sector Cloud Security Spending

Malaysia's accelerated cloud-first strategy is redirecting government spending toward cloud-native defenses such as cloud access security brokers and workload-protection platforms. Ministries now integrate classification, encryption, and continuous monitoring into every application-migration plan, lifting baseline demand for advisory and managed services. Public-sector visibility into early success stories is encouraging financial institutions and telecom carriers to adopt similar architectures, creating a multiplier effect across the Malaysia cybersecurity market. System integrators have redesigned portfolios around shared-responsibility models, bundling consulting, deployment, and managed detection under single contracts. Collectively, these changes translate to a structural uplift in addressable spending rather than a one-time spike.

Cyber Security Act 2024 Licensing and Mandatory NCII Compliance Fuelling Vendor Demand

The Cyber Security Act 2024 enforces mandatory licensing for penetration testing, security-operations, and other core services, while critical-infrastructure operators must observe sector-specific codes of practice. Organizations have responded by elevating compliance to board-level priority and retaining external auditors to align controls with the new legal baseline. Providers that secured early licences gained a measurable sales advantage because enterprises prefer pre-qualified partners to avoid regulatory missteps. The act also formalized incident-reporting timelines, spurring demand for real-time detection tools and threat-intelligence integrations. Together, these shifts embed recurring compliance obligations into IT budgets, sustaining momentum in the Malaysia cybersecurity market size.

Acute Shortage of Senior Security Architects Inflating Project Timelines and Costs

Complex cloud migrations stall because experienced architects remain scarce, extending project timelines by 37% and boosting labor costs by more than one-quarter . The scarcity inflates bids for large transformation contracts, squeezing corporate budgets and delaying key milestones. Organizations counter by outsourcing architecture to MSSPs or importing expertise from regional hubs, but long visa lead times cap near-term relief. Vendor roadmaps now include low-code policy engines and reference architectures that cut design hours, yet hands-on oversight remains indispensable for regulated workloads. Talent constraints therefore act as a persistent drag on the Malaysia cybersecurity market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Data-Centre Boom in Johor Bahru Elevating Perimeter and OT Security Investments

- 5G Coverage >= 97 % Driving Mobile Core and Edge Security Upgrades

- SME Budget Constraints Owing to Legacy CAPEX-heavy IT Footprints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions maintained 52.20% share of the Malaysia cybersecurity market in 2025, led by network and cloud-security suites that protect hybrid environments. However, services are forecast to outpace solutions at a 7.42% CAGR through 2031 as enterprises look for always-on expertise. Higher detection accuracy, round-the-clock monitoring, and built-in compliance dashboards position MSSPs as strategic partners rather than tactical suppliers. Pricing models based on monthly active assets lower entry barriers for mid-tier firms. Local providers leverage regulatory familiarity to capture contracts tied to the Cyber Security Act, while global vendors package orchestration platforms that unify alerts across point tools. Convergence of advisory, deployment, and MDR services brings value propositions beyond technology resale, solidifying service-led growth in the Malaysia cybersecurity market.

The solutions portfolio nevertheless remains critical for organizations with strict data-residency rules. Appliance refresh cycles in BFSI and utilities sustain revenue for firewall, intrusion-prevention, and secure-email gateways. New-generation SIEM platforms incorporate behavioral analytics and automation to offset talent scarcity, aligning product innovation with national skills-development goals. Vendors bundle perpetual licenses with cloud-delivered analytics to bridge on-premise controls and SaaS visibility. Co-delivery with local integrators accelerates time to value, reflecting the collaborative nature of the Malaysia cybersecurity market.

On-premise systems accounted for 52.85% of the Malaysia cybersecurity market size in 2025 because legacy workloads and data-sovereignty mandates still dominate in banking and public service. Hardware refreshes in these sectors provide a stable base for appliance vendors. Yet cloud deployments are expanding at an 8.05% CAGR through 2031, outstripping on-premise upgrades. Consumption-based pricing, continuous feature releases, and AI-driven analytics make cloud controls appealing for institutions pursuing digital-first strategies. Shared-responsibility frameworks encourage enterprises to off-load maintenance to specialized providers, supporting long-term adoption in the Malaysia cybersecurity market.

Vendor roadmaps include data-localization nodes within Malaysia to reassure regulated customers. Over time, improvements in sovereign-cloud platforms may erode the remaining resistance, but hardware refreshes tied to industrial-control networks ensure a continuing market for on-premise gear.

The Malaysia Cybersecurity Market Report is Segmented by Offering (Solutions [Application Security, Cloud Security, and More], Services [Professional Services, and More]), Deployment Mode (Cloud, On-Premise), End-User Industry (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Retail and E-Commerce, and More), End-User Enterprise Size (Large Enterprises, Smes). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- LGMS Berhad

- IBM Corporation

- Cisco Systems Inc.

- Securemetric Bhd

- Wizlynx Group

- Akati Sekurity

- Palo Alto Networks

- Fortinet Inc.

- Check Point Software Tech.

- Trend Micro Inc.

- Kaspersky Lab

- Nexagate Sdn Bhd

- Ishan Tech Sdn Bhd

- Capgemini SE

- Microsoft Corp.

- AVG Technologies (Gen Digital)

- ATandT Cybersecurity

- NTT Data Security

- BAE Systems AI Malaysia

- Darktrace plc

- CrowdStrike Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Roll-out of Malaysia's Cloud-First Strategy Propelling Public-Sector Cloud Security Spending

- 4.2.2 Cyber Security Act 2024 Licensing and Mandatory NCII Compliance Fuelling Vendor Demand

- 4.2.3 Data-Centre Boom in Johor Bahru Elevating Perimeter and OT Security Investments

- 4.2.4 5G Coverage >= 97 % Driving Mobile Core and Edge Security Upgrades

- 4.2.5 USD 12.2 bn Economic Losses From Breaches Raising Boardroom Budgets

- 4.2.6 National Goal of 25 000 Cyber Defenders Boosting Consulting and Training Spend

- 4.3 Market Restraints

- 4.3.1 Acute Shortage of Senior Security Architects Inflating Project Timelines and Costs

- 4.3.2 SME Budget Constraints Owing to Legacy CAPEX-heavy IT Footprints

- 4.3.3 Fragmented Cross-border Data-Sovereignty Rules Slowing Cloud Migrations

- 4.3.4 Low Multi-factor-Auth Adoption Outside BFSI Heightening Residual Risk

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security

- 5.1.1.8 End-point Security

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Retail and E-commerce

- 5.3.6 Energy and Utilities

- 5.3.7 Manufacturing

- 5.3.8 Others

- 5.4 By End-user Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 LGMS Berhad

- 6.4.2 IBM Corporation

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Securemetric Bhd

- 6.4.5 Wizlynx Group

- 6.4.6 Akati Sekurity

- 6.4.7 Palo Alto Networks

- 6.4.8 Fortinet Inc.

- 6.4.9 Check Point Software Tech.

- 6.4.10 Trend Micro Inc.

- 6.4.11 Kaspersky Lab

- 6.4.12 Nexagate Sdn Bhd

- 6.4.13 Ishan Tech Sdn Bhd

- 6.4.14 Capgemini SE

- 6.4.15 Microsoft Corp.

- 6.4.16 AVG Technologies (Gen Digital)

- 6.4.17 ATandT Cybersecurity

- 6.4.18 NTT Data Security

- 6.4.19 BAE Systems AI Malaysia

- 6.4.20 Darktrace plc

- 6.4.21 CrowdStrike Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment