|

市场调查报告书

商品编码

1906898

中东和非洲(MEA)网路安全市场:市场份额分析、产业趋势、统计数据和成长预测(2026-2031 年)MEA Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

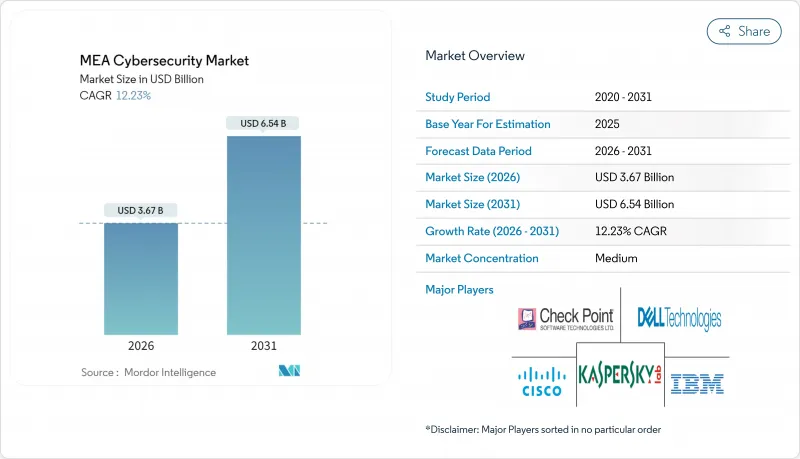

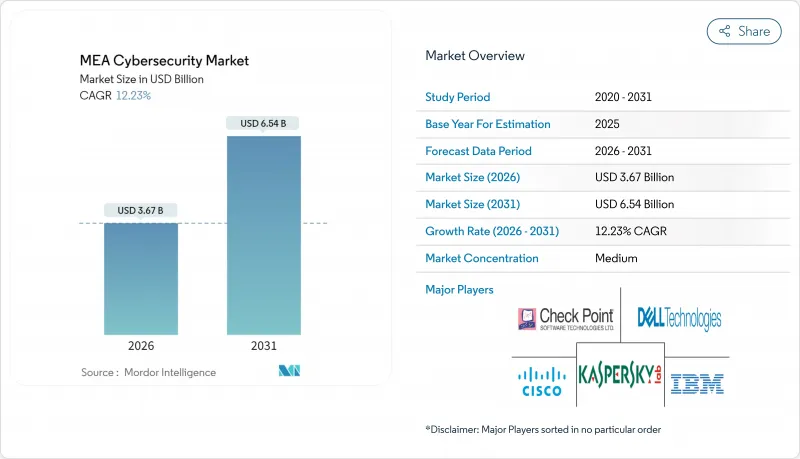

预计到 2026 年,中东和非洲网路安全市场规模将达到 36.7 亿美元,高于 2025 年的 32.7 亿美元,预计到 2031 年将达到 65.4 亿美元,2026 年至 2031 年的复合年增长率为 12.23%。

波湾合作理事会(GCC) 国家主权云端的快速部署、该地区油气资产面临的操作技术(OT) 威胁日益增长,以及撒哈拉以南非洲地区行动支付的爆炸式普及,共同推动了安全支出的成长。举办诸如 2030 年世博会和 NEOM 等大型活动,促进了关键国家基础设施的强化建设;同时,随着各组织向零信任架构转型,云端交付安全解决方案的采用率也在不断提高。此外,人才严重短缺和资料保护法律碎片化带来的成本压力,也为资安管理服务提供者在中东和非洲网路安全市场占据份额创造了机会。

中东和非洲 (MEA) 网路安全市场趋势与洞察

海湾合作委员会国家的主权云和资料居住政策加速了安全营运中心(SOC)的投资

沙乌地阿拉伯的《2024年网路安全基线》和阿联酋的《国家物联网安全政策》中均包含相关法规,强制要求在本国进行资料处理,这促使各组织机构建立本地安全营运中心(SOC)并培养本土人才。卡达的《2024-2030年国家网路安全战略》进一步强化了这项策略,该策略的目标是到2027年将市场规模扩大至110亿美元,并优先发展资安管理服务以填补人才缺口。因此,本地SOC的建造和託管服务的采用预计将支持中东和非洲网路安全市场的长期成长。

沙乌地阿拉伯和阿联酋加快发放数位银行牌照将推动合规主导安全支出。

沙乌地阿拉伯的监管沙盒计画和阿联酋的《个人资料保护法》要求数位银行在推出服务前必须展现出健全的风险管理框架。从中央银行到商业和工业部,多重监管查核点要求持续审核,这推动了对咨询、第三方评估和自动化平台的需求。在许可证申请激增的情况下,合规主导的采购进一步推动了中东和北非地区网路安全市场的发展。

网路安全人才严重短缺推高了服务成本。

儘管顾问的月薪超过 13,500 迪拉姆,但 87% 的阿联酋公司仍难以招募合格的网路安全人才。卡达每 10 万居民拥有 434.09 个网路安全工作岗位,但需求持续超过供给,迫使企业将监控和事件回应外包。不断上涨的人事费用推高了计划总成本,抑制了网路安全技术的普及,尤其是在中型企业中,并限制了中东和北非地区的网路安全市场发展。

细分市场分析

2025年,解决方案将占总收入的69.28%,企业将大量采购终端安全、网路和云端安全套件。这一主导地位体现了大型企业的强大购买力,他们仍然倾向于在关键环境中部署本地设备。人工智慧驱动的威胁侦测技术的持续创新正在推动解决方案支出,例如SentinelOne等供应商正在增加安全态势管理功能,以防御影子人工智慧资产。然而,受人才严重短缺和合规负担的推动,中东和北非地区的网路安全市场预计将以14.68%的复合年增长率成长,这也推动了对託管服务的需求。

随着整合商在自主云端环境中客製化复杂的混合架构,专业服务正在蓬勃发展。尤其是中小企业,正转向像 Liquid C2 这样的 SOC 即服务解决方案,这些方案以可预测的收费系统提供监控、事件回应和监管报告服务。这种转变正在重新分配中东和北非地区网路安全产业的市场份额,同时又能维持大型维修计划的解决方案销售。

截至2025年,受资料主权法规及与传统SCADA系统整合等因素驱动,本地部署架构将占中东和非洲网路安全市场规模的61.65%。然而,随着区域供应商建立本地接入点(PoP)以满足居住要求,云端交付安全预计将以15.43%的复合年增长率成长。思科面向阿联酋推出的安全服务边缘节点就是一个云端在地化、降低延迟并符合海湾合作委员会(GCC)法规的典型案例。

目前,混合模式在迁移蓝图中占据主导地位,企业将敏感工作负载保留在国内,同时将分析和沙箱任务路由到区域云端。 Gartner高峰会的讨论强调,随着企业将身分与边界防御分离,零信任架构的日益普及将进一步推动中东和北非地区网路安全市场的云端采用。

中东和非洲网路安全市场报告将该行业分为以下几个部分:按产品类型(解决方案、服务)、按部署模式(本地部署、云端部署)、按最终用户垂直行业(银行、金融、保险、医疗保健、IT、电信、工业、国防、製造、零售、电子商务、能源、公共产业、其他)、按最终用户公司规模(中小企业、大型企业)以及按地区。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 海湾合作委员会国家的主权云和居住要求加速了安全营运中心(SOC)投资。

- 沙乌地阿拉伯和阿联酋加快发放数位银行牌照将推动合规主导安全支出。

- 石油天然气资产遭受日益增多的OT网路攻击推动了ICS/SCADA安全技术的普及应用

- 撒哈拉以南非洲地区行动支付的爆炸性成长需要终端保护和诈欺防范措施。

- 透过大型活动计画(2030 年世博会、新未来城、杜拜航展)加速加强关键基础建设

- 新的国家网路安全法规(NCA ECC、阿联酋NESA、埃及DP法)强制要求共用威胁情报。

- 市场限制

- 网路安全人才严重短缺推高了服务成本。

- 非洲各国资料保护法律的零碎化加剧了合规难度。

- 非洲中小企业面临预算限制:优先考虑基础数位化而非安全

- 对进口安防设备的依赖易受地缘政治供应链中断的影响

- 重要法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 报价

- 解决方案

- 应用程式安全

- 云端安全

- 资料安全

- 身分和存取管理

- 基础设施保护

- 综合风险管理

- 网路安全设备

- 端点安全

- 其他服务

- 服务

- 专业服务

- 託管服务

- 解决方案

- 透过部署模式

- 本地部署

- 云

- 按最终用户行业划分

- BFSI

- 卫生保健

- 资讯科技/通讯

- 工业与国防

- 製造业

- 零售与电子商务

- 能源与公共产业

- 製造业

- 其他的

- 按最终用户公司规模划分

- 中小企业

- 大公司

- 按地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 巴林

- 科威特

- 阿曼

- 以色列

- 土耳其

- 非洲

- 南非

- 埃及

- 奈及利亚

- 肯亚

- 摩洛哥

- 其他非洲地区

- 中东

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- Broadcom(Symantec)

- Sophos Ltd.

- Kaspersky Lab

- Microsoft Corp.

- CrowdStrike Holdings Inc.

- Darktrace plc

- Rapid7 Inc.

- Mandiant

- McAfee Corp.

- Splunk Inc.

- LogRhythm Inc.

- Proofpoint Inc.

- BAE Systems Applied Intelligence

- Help AG

- StarLink DMCC

第七章 市场机会与未来展望

Middle East and Africa cybersecurity market size in 2026 is estimated at USD 3.67 billion, growing from 2025 value of USD 3.27 billion with 2031 projections showing USD 6.54 billion, growing at 12.23% CAGR over 2026-2031.

Rapid sovereign-cloud rollouts across the Gulf Cooperation Council, mounting operational-technology (OT) threats to regional oil and gas assets, and explosive mobile-money adoption in Sub-Saharan Africa are converging to lift security spending. Mega-event pipelines such as Expo 2030 and NEOM drive hardening of critical national infrastructure, while cloud-delivered security gains traction as organizations modernize toward zero-trust architectures. Parallel cost pressures from an acute talent shortage and fragmented data-protection laws create openings for managed security service providers to capture share in the Middle East and Africa cybersecurity market.

MEA Cybersecurity Market Trends and Insights

Sovereign-cloud and residency mandates across GCC accelerating SOC investments

Mandates embedded in Saudi Arabia's Essential Cybersecurity Controls 2024 and the UAE National IoT Security Policy require in-country data processing, pushing organizations to build local security operations centers and indigenous talent pipelines. The strategy is reinforced by Qatar's National Cybersecurity Strategy 2024-2030, which targets USD 11 billion market value by 2027 and prioritizes managed security services to offset talent shortages. As a result, local SOC build-outs and managed services adoption are expected to anchor long-term growth in the Middle East and Africa cybersecurity market.

Rapid digital-banking license issuance in KSA and UAE boosting compliance-led security spend

Saudi Arabia's regulatory sandbox programs and the UAE's Personal Data Protection Law compel digital banks to demonstrate robust risk-management frameworks before launch. Multiple regulatory checkpoints-from central banks to commerce ministries-require continuous audits, driving demand for consulting, third-party assessments, and automation platforms. Compliance-driven purchases add momentum to the Middle East and Africa cybersecurity market as license applications surge.

Acute shortage of cybersecurity talent inflating service costs

Eighty-seven percent of UAE enterprises struggle to recruit qualified professionals despite monthly salaries exceeding AED 13,500 for consultants. Qatar records 434.09 cybersecurity roles per 100,000 residents, yet demand continues to outstrip supply, forcing organizations to outsource monitoring and incident response. Higher wage bills lift overall project costs and temper adoption rates, particularly among mid-tier enterprises, constraining the Middle East and Africa cybersecurity market.

Other drivers and restraints analyzed in the detailed report include:

- Escalating OT cyber-attacks on oil and gas assets driving ICS/SCADA security uptake

- Explosive mobile-money adoption in Sub-Saharan Africa requiring endpoint and fraud protection

- Fragmented data-protection laws across African nations raising compliance complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions captured 69.28% of revenue in 2025 as organizations procured endpoint, network, and cloud-security suites in bulk. This dominance shows the purchasing power of large enterprises that still favor on-premise appliances for critical environments. Continued innovation in AI-driven threat detection reinforces solution spend, with vendors like SentinelOne adding security-posture management to defend shadow AI assets. The Middle East and Africa cybersecurity market nevertheless shows rising appetite for managed services, evident in a 14.68% CAGR outlook fueled by acute talent shortages and compliance burdens.

Professional services grow as integrators tailor complex hybrid architectures across sovereign-cloud environments. SMEs in particular gravitate toward SOC-as-a-Service offerings such as Liquid C2, which bundles monitoring, incident response, and regulatory reporting for a predictable fee structure. The shift reallocates share within the Middle East and Africa cybersecurity industry while preserving solution sales for large renovation projects.

On-premises architectures held 61.65% of the Middle East and Africa cybersecurity market size in 2025 due to data-sovereignty rules and legacy SCADA linkages. Yet cloud-delivered security is forecast to expand at 15.43% CAGR as regional providers establish local Points of Presence that meet residency mandates. Cisco's UAE Secure Service Edge node exemplifies cloud localization that lowers latency and aligns to GCC controls.

Hybrid models now dominate migration roadmaps. Organizations retain sensitive workloads in-country while routing analytics and sandboxing tasks to regional clouds. Gartner summit dialogues underscore zero-trust adoption as enterprises decouple identity from perimeter, further propelling cloud uptake within the Middle East and Africa cybersecurity market.

The Middle East and Africa Cybersecurity Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises), and Geography.

List of Companies Covered in this Report:

- IBM Corporation

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- Broadcom (Symantec)

- Sophos Ltd.

- Kaspersky Lab

- Microsoft Corp.

- CrowdStrike Holdings Inc.

- Darktrace plc

- Rapid7 Inc.

- Mandiant

- McAfee Corp.

- Splunk Inc.

- LogRhythm Inc.

- Proofpoint Inc.

- BAE Systems Applied Intelligence

- Help AG

- StarLink DMCC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sovereign-cloud and Residency Mandates across GCC Accelerating SOC Investments

- 4.2.2 Rapid Digital-Banking License Issuance in KSA and UAE Boosting Compliance-led Security Spend

- 4.2.3 Escalating OT Cyber-attacks on Oil and Gas Assets Driving ICS/SCADA Security Uptake

- 4.2.4 Explosive Mobile-Money Adoption in Sub-Saharan Africa Requiring Endpoint and Fraud Protection

- 4.2.5 Mega-Events Pipeline (Expo 2030, Neom, Dubai Airshow) Intensifying Critical-Infrastructure Hardening

- 4.2.6 New National Cyber Regulations (NCA ECC, UAE NESA, Egypt DP Law) Mandating Threat-Intel Sharing

- 4.3 Market Restraints

- 4.3.1 Acute Shortage of Cybersecurity Talent Inflating Service Costs

- 4.3.2 Fragmented Data-Protection Laws across African Nations Raising Compliance Complexity

- 4.3.3 Budget Constraints among African SMEs Prioritising Basic Digitisation over Security

- 4.3.4 Import Dependence on Security Appliances Exposed to Geopolitical Supply-Chain Disruptions

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Geography

- 5.5.1 Middle East

- 5.5.1.1 Saudi Arabia

- 5.5.1.2 United Arab Emirates

- 5.5.1.3 Qatar

- 5.5.1.4 Bahrain

- 5.5.1.5 Kuwait

- 5.5.1.6 Oman

- 5.5.1.7 Israel

- 5.5.1.8 Turkey

- 5.5.2 Africa

- 5.5.2.1 South Africa

- 5.5.2.2 Egypt

- 5.5.2.3 Nigeria

- 5.5.2.4 Kenya

- 5.5.2.5 Morocco

- 5.5.2.6 Rest of Africa

- 5.5.1 Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Palo Alto Networks Inc.

- 6.4.4 Fortinet Inc.

- 6.4.5 Check Point Software Technologies Ltd.

- 6.4.6 Trend Micro Inc.

- 6.4.7 Broadcom (Symantec)

- 6.4.8 Sophos Ltd.

- 6.4.9 Kaspersky Lab

- 6.4.10 Microsoft Corp.

- 6.4.11 CrowdStrike Holdings Inc.

- 6.4.12 Darktrace plc

- 6.4.13 Rapid7 Inc.

- 6.4.14 Mandiant

- 6.4.15 McAfee Corp.

- 6.4.16 Splunk Inc.

- 6.4.17 LogRhythm Inc.

- 6.4.18 Proofpoint Inc.

- 6.4.19 BAE Systems Applied Intelligence

- 6.4.20 Help AG

- 6.4.21 StarLink DMCC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment