|

市场调查报告书

商品编码

1906895

欧洲网路安全市场:市场占有率分析、产业趋势与统计资料、成长预测(2026-2031 年)Europe Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

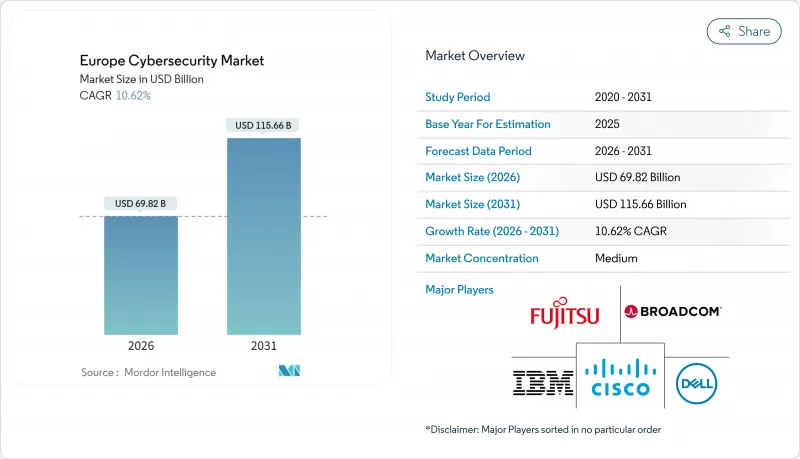

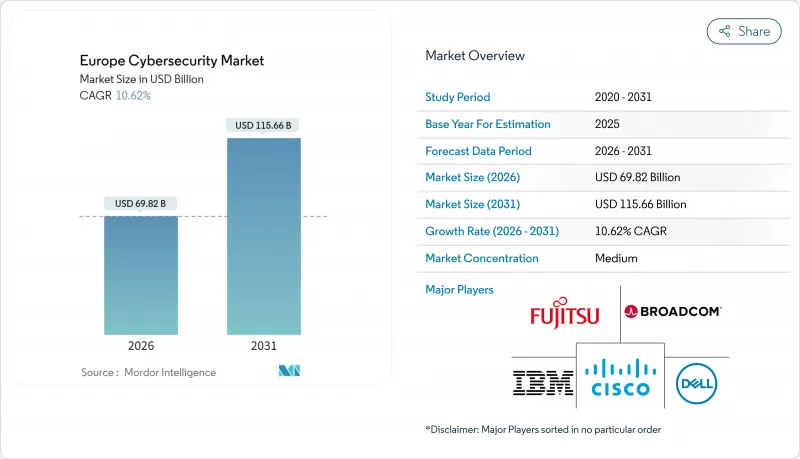

预计到 2026 年,欧洲网路安全市场规模将达到 698.2 亿美元。预计该市场规模将从 2025 年的 631.2 亿美元成长到 2031 年的 1,156.6 亿美元,2026 年至 2031 年的复合年增长率为 10.62%。

强制法规、日益加剧的地缘政治风险以及向自主云端平台加速转型,正推动网路安全从可自由支配的支出跃升为全部区域的核心营运成本。网路与资讯安全指令2 (NIS2) 和数位营运弹性法案 (DORA) 的实施巩固了支出计划,而俄乌衝突导致勒索软体造成的损失增加了30%,并提高了董事会层面的风险意识。云端优先策略仍在继续,而随着企业在自主性和规模之间寻求平衡,混合部署正在加速发展。为了满足合规要求,供应商纷纷收购事件回应和託管服务能力,供应商整合正在加剧。然而,日益激烈的竞争因29.9万名专业人员的短缺而有所缓和,这加剧了内部安全团队的压力,并推动了託管服务的普及。

欧洲网路安全市场趋势与洞察

随着欧盟范围内NIS2和DORA的实施,强制安全支出增加。

NIS2 将其适用范围扩大至超过 16 万家欧洲营业单位,并引入最高 1000 万欧元或全球营业额 2% 的罚款,使网路安全预算从可自由支配支出转变为强制性支出。 DORA 对金融机构施加了类似的 ICT 风险管理义务,迫使像 Belfius Bank 这样的银行重组其供应商组合以增强其韧性。法律要求已将平均安全支出推高至 IT 预算的 9%,89% 的公司表示需要招募新员工。整合平台和託管服务受益最大,因为它们简化了多司法管辖区报告流程,确保合规性并降低处罚风险。

与俄乌衝突相关的复杂勒索软体攻击激增

2024年,针对欧洲组织的勒索软体攻击增加了30%,威胁行为者利用了地缘政治紧张局势。 2025年第一季,製造业遭受的攻击增加了84%,资料外洩造成的损失超过556万美元,超过了以往危机造成的损失。 2023年,医疗保健产业的安全事件达到309起,其中一半与勒索软体相关,促使欧盟制定行动计划,分配更多事件回应资源。像LockBit这样的持续性勒索软体组织在被捣毁前发动了1700次攻击,凸显了行为模式的侦测和多层回应服务的必要性。

网路安全人才严重短缺限制了应对能力。

欧洲面临超过29.9万名合格网路安全专业人员的缺口,现有从业人员有76%缺乏正式资格。儘管德国的支出实现了两位数的成长,但仍难以填补职缺;法国预计仍有1.5万个职缺,儘管其年薪已接近9.81万美元。技能短缺正在拖慢计划开发进度,尤其是在云端安全和营运技术(OT)保护领域,迫使企业转向託管式侦测和回应服务,以取代内部自建能力。

细分市场分析

到2025年,解决方案将占据欧洲网路安全市场份额的67.25%,这主要得益于将云端、身分和网路控制整合到统一主机的整合平台。预计到2031年,包括託管侦测和回应在内的欧洲网路安全服务市场规模将以13.56%的复合年增长率成长,因为企业正寻求透过外包日常营运来填补人才缺口。推动这一高速成长要素是新纳入NIS2范围的中型企业,这些企业往往更倾向于单一订阅服务包,而非多供应商工具包。

託管服务供应商製合规仪表板,实现欧盟不同管理体制下的证据收集自动化。同时,随着大型银行和製造商建构零信任参考模型和后量子密码技术蓝图,对专业服务的需求仍然强劲。整合工作流程自动化和原生报告功能的整合解决方案供应商享有交叉销售优势,而专注于单一产品的供应商则面临整合压力。

到2025年,云端采用将占总收入的56.90%,因为企业将弹性和持续更新视为首要任务。混合模式目前正经历着15.03%的最快复合年增长率,因为主权规则要求企业在欧盟境内保留敏感资料的同时,持续利用全球超大规模资料中心业者的分析能力。随着金融机构试行部署抗量子攻击的都会区网路,欧洲混合架构的网路安全市场规模正在扩大。这些城域网路将遥测资料路由到主权云端中的分析引擎,同时将金钥保留在企业内部。

对于需要完全控制硬体的国防和公共部门工作负载而言,本地部署仍然是主流。然而,这些环境也在整合基于云端的威胁情报来源,从而建构复杂的拓扑结构。因此,供应商在 SaaS 和设备产品中提供相同的策略引擎,使管理员能够应用统一的控制措施,而无需考虑工作负载的位置。

欧洲网路安全市场报告公共产业、其他)、最终用户公司规模(中小企业、大型企业)和国家/地区对产业进行细分。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在欧盟范围内实施NIS2和DORA将增加强制安全支出。

- 与俄乌衝突相关的复杂勒索软体激增

- 快速向欧洲主权云端转型推动零信任架构

- 在德国和北欧製造基地扩展5G专用网络

- 数位身分(eIDAS 2.0)的引入催生了对身分验证的新需求。

- 保险公司主导的中型企业最低网路安全措施

- 市场限制

- 在欧盟范围内实施NIS2和DORA将增加强制安全支出。

- 与俄乌衝突相关的复杂勒索软体激增

- 快速向欧洲主权云端转型推动零信任架构

- 在德国和北欧製造基地扩展5G专用网络

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 报价

- 解决方案

- 应用程式安全

- 云端安全

- 资料安全

- 身分和存取管理

- 基础设施保护

- 综合风险管理

- 网路安全设备

- 端点安全

- 其他服务

- 服务

- 专业服务

- 託管服务

- 解决方案

- 透过部署模式

- 本地部署

- 云

- 按最终用户行业划分

- BFSI

- 卫生保健

- 资讯科技/通讯

- 工业与国防

- 製造业

- 零售与电子商务

- 能源与公共产业

- 製造业

- 其他的

- 按最终用户公司规模划分

- 中小企业

- 大公司

- 按国家/地区

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 其他欧洲国家(北欧国家、比荷卢经济联盟(不包括荷兰)、中欧和东欧以及巴尔干半岛)

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Fortinet Inc.

- Thales Group(Thales DIS)

- Siemens AG(Siemens Digital Industries)

- Atos SE(Eviden)

- Accenture PLC(Security Services)

- Kaspersky Lab JSC

- Trend Micro Inc.

- Sophos Ltd.

- F-Secure Corp.

- Darktrace PLC

- Orange Cyberdefense(Orange SA)

- Airbus Defence and Space GmbH(CyberSecurity)

- Capgemini SE

- Deutsche Telekom Security GmbH(T-Systems)

- BAE Systems Applied Intelligence

- Rapid7 Inc.

- CrowdStrike Holdings Inc.

- Nexus Group

- Secunet Security Networks AG

- Rohde & Schwarz Cybersecurity GmbH

第七章 市场机会与未来展望

Europe cybersecurity market size in 2026 is estimated at USD 69.82 billion, growing from 2025 value of USD 63.12 billion with 2031 projections showing USD 115.66 billion, growing at 10.62% CAGR over 2026-2031.

Mandatory regulation, rising geopolitical risk, and an accelerating shift to sovereign cloud platforms elevate cybersecurity from optional spend to core operational outlay across the region. Enforcement of the Network and Information Security Directive 2 (NIS2) and the Digital Operational Resilience Act (DORA) anchors spending plans, while the Russia-Ukraine conflict fuels a 30% rise in ransomware incidents that heightens board-level risk awareness. Cloud-first strategies persist, yet hybrid deployments gain traction as enterprises balance sovereignty with scale. Vendor consolidation intensifies as suppliers acquire incident-response and managed-services capabilities to meet compliance demand. Heightened competition, however, is tempered by a 299,000-professional skills deficit that stretches internal security teams and bolsters managed service uptake.

Europe Cybersecurity Market Trends and Insights

EU-wide Enforcement of NIS2 and DORA Elevating Mandatory Security Spend

NIS2 expands coverage to more than 160,000 European entities and introduces penalties of up to EUR 10 million or 2% of global turnover, which is shifting cybersecurity budgets from discretionary to compulsory . DORA imposes parallel ICT-risk mandates on financial entities, forcing banks such as Belfius to restructure vendor portfolios for resilience. The legal scope drives average security spending to 9% of IT budgets, while 89% of firms report new hiring needs. Integration-ready platforms and managed services benefit most because they streamline multi-jurisdiction reporting, sustain compliance, and reduce penalty exposure.

Surge in Sophisticated Ransomware Linked to Russia-Ukraine Conflict

Ransomware attacks on European organizations climbed 30% in 2024 as threat actors weaponized geopolitical tensions. Manufacturing bore 84% growth in strike volume during Q1 2025 with breach costs topping USD 5.56 million, eclipsing previous crisis-era losses. Healthcare incidents reached 309 in 2023, half involving ransomware, prompting an EU action plan that allocates additional incident-response resources. Persistent groups such as LockBit executed 1,700 attacks before takedown efforts, underlining the need for behavior-based detection and layered response services.

Acute Cybersecurity Skills Shortage Limiting Implementation Capacity

Europe lacks more than 299,000 qualified cybersecurity professionals, and 76% of existing staff possess no formal credentials. Germany posts double-digit growth in spending yet struggles to fill vacancies, while France expects 15,000 open roles despite salaries approaching USD 98,100. Skills scarcity slows project rollouts, particularly in cloud security and OT protection, compelling enterprises to shift toward managed detection and response as a substitute for in-house capability.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Shift to European Sovereign Clouds Driving Zero-Trust Architectures

- Expansion of 5G Private Networks in German and Nordic Manufacturing Hubs

- Rising Compliance Costs Straining Mid-Market Enterprise Budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 67.25% of the Europe cybersecurity market share in 2025, underpinned by integrated platforms that bundle cloud, identity, and network controls into unified consoles. The Europe cybersecurity market size for services, including managed detection and response, is projected to expand at a 13.56% CAGR to 2031 as enterprises offset workforce shortages by outsourcing daily operations. High-growth comes from mid-market firms newly covered under NIS2 that prefer single-subscription service bundles over multi-vendor toolkits.

Managed services providers tailor compliance dashboards that automate evidence collection across the EU's heterogeneous regulatory regimes. Concurrently, professional-services demand remains steady as large banks and manufacturers architect zero-trust reference models and post-quantum roadmaps. Integrated solution vendors that embed workflow automation and native reporting enjoy cross-sell advantage, while niche point-product suppliers face consolidation pressure.

Cloud deployments represented 56.90% of 2025 revenue as enterprises embraced elasticity and evergreen updates. Hybrid models now register the swiftest 15.03% CAGR because sovereignty rules compel companies to retain sensitive data inside EU borders while still tapping global hyperscaler analytics. The Europe cybersecurity market size for hybrid architectures grows as financial institutions pilot quantum-secure metro networks that keep keys on premises yet route telemetry to analytics engines in sovereign clouds.

On-premise installations persist in defense and public-sector workloads that require full control of hardware. Yet even these environments integrate cloud-based threat intelligence feeds, creating blended topologies. Vendors therefore package identical policy engines across SaaS and appliance form factors so administrators can enforce uniform controls regardless of workload location.

The Europe Cybersecurity Market Report Segments the Industry Into by Offering (Solutions, and Services), Deployment Mode (On-Premise, and Cloud), End-User Vertical (BFSI, Healthcare, IT and Telecom, Industrial and Defense, Manufacturing, Retail and E-Commerce, Energy and Utilities, Manufacturing, and Others), and End-User Enterprise Size (Small and Medium Enterprises (SMEs), and Large Enterprises). And Country.

List of Companies Covered in this Report:

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Fortinet Inc.

- Thales Group (Thales DIS)

- Siemens AG (Siemens Digital Industries)

- Atos SE (Eviden)

- Accenture PLC (Security Services)

- Kaspersky Lab JSC

- Trend Micro Inc.

- Sophos Ltd.

- F-Secure Corp.

- Darktrace PLC

- Orange Cyberdefense (Orange SA)

- Airbus Defence and Space GmbH (CyberSecurity)

- Capgemini SE

- Deutsche Telekom Security GmbH (T-Systems)

- BAE Systems Applied Intelligence

- Rapid7 Inc.

- CrowdStrike Holdings Inc.

- Nexus Group

- Secunet Security Networks AG

- Rohde & Schwarz Cybersecurity GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU-wide Enforcement of NIS2 and DORA Elevating Mandatory Security Spend

- 4.2.2 Surge in Sophisticated Ransomware Linked to Russia-Ukraine Conflict

- 4.2.3 Rapid Shift to European Sovereign Clouds Driving Zero-Trust Architectures

- 4.2.4 Expansion of 5G Private Networks in German and Nordic Manufacturing Hubs

- 4.2.5 Digital-ID Roll-out (eIDAS 2.0) Creating New Authentication Demand

- 4.2.6 Insurer-Driven Minimum Cyber-Controls for Mid-Market Firms

- 4.3 Market Restraints

- 4.3.1 EU-wide Enforcement of NIS2 and DORA Elevating Mandatory Security Spend

- 4.3.2 Surge in Sophisticated Ransomware Linked to Russia-Ukraine Conflict

- 4.3.3 Rapid Shift to European Sovereign Clouds Driving Zero-Trust Architectures

- 4.3.4 Expansion of 5G Private Networks in German and Nordic Manufacturing Hubs

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

- 4.10 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.1.1 Application Security

- 5.1.1.2 Cloud Security

- 5.1.1.3 Data Security

- 5.1.1.4 Identity and Access Management

- 5.1.1.5 Infrastructure Protection

- 5.1.1.6 Integrated Risk Management

- 5.1.1.7 Network Security Equipment

- 5.1.1.8 Endpoint Security

- 5.1.1.9 Other Services

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecom

- 5.3.4 Industrial and Defense

- 5.3.5 Manufacturing

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Manufacturing

- 5.3.9 Others

- 5.4 By End-User Enterprise Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 Netherlands

- 5.5.7 Rest of Europe (Nordics, Benelux excl. NL, CEE, Balkans)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Palo Alto Networks Inc.

- 6.4.3 IBM Corporation

- 6.4.4 Check Point Software Technologies Ltd.

- 6.4.5 Fortinet Inc.

- 6.4.6 Thales Group (Thales DIS)

- 6.4.7 Siemens AG (Siemens Digital Industries)

- 6.4.8 Atos SE (Eviden)

- 6.4.9 Accenture PLC (Security Services)

- 6.4.10 Kaspersky Lab JSC

- 6.4.11 Trend Micro Inc.

- 6.4.12 Sophos Ltd.

- 6.4.13 F-Secure Corp.

- 6.4.14 Darktrace PLC

- 6.4.15 Orange Cyberdefense (Orange SA)

- 6.4.16 Airbus Defence and Space GmbH (CyberSecurity)

- 6.4.17 Capgemini SE

- 6.4.18 Deutsche Telekom Security GmbH (T-Systems)

- 6.4.19 BAE Systems Applied Intelligence

- 6.4.20 Rapid7 Inc.

- 6.4.21 CrowdStrike Holdings Inc.

- 6.4.22 Nexus Group

- 6.4.23 Secunet Security Networks AG

- 6.4.24 Rohde & Schwarz Cybersecurity GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment