|

市场调查报告书

商品编码

1906253

行销科技市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Marketing Technology Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

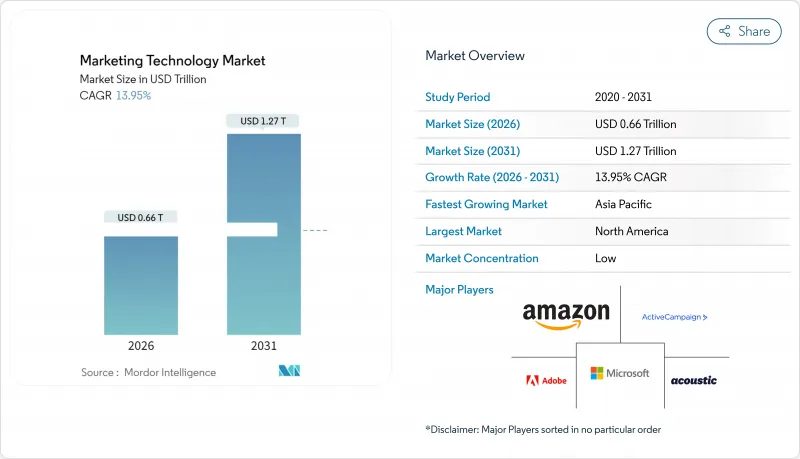

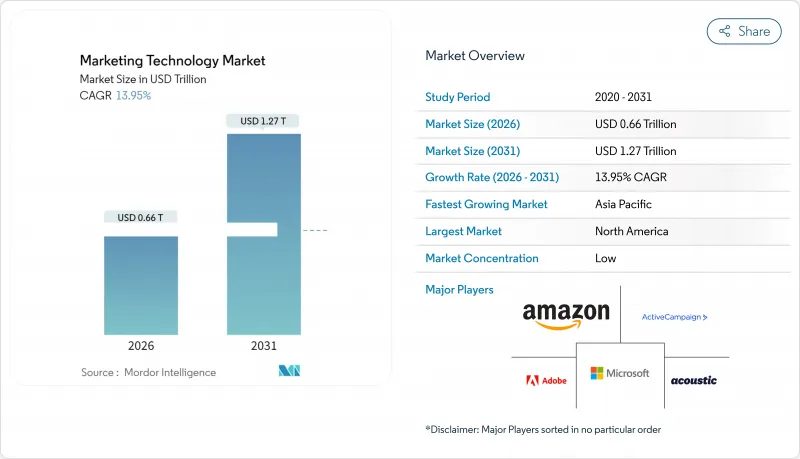

预计到 2025 年,行销技术市场价值将达到 5,800 亿美元,到 2026 年将成长至 6,609.1 亿美元,到 2031 年将成长至 12708.2 亿美元,预测期(2026-2031 年)的复合年增长率为 13.95%。

企业对云端优先、嵌入式人工智慧技术堆迭的需求是关键的成长要素,它能够实现宣传活动调整、动态内容产生以及大规模跨通路归因。市场领导企业正在将生成式人工智慧融入其核心产品。同时,监管机构日益施压,要求企业转向以隐私为先的资料策略,这推高了第一方和零方资料资产的价值。竞争格局有利于那些能够在可配置架构中整合创新、数据和激活工作流程的供应商,从而使企业能够精细控製成本、延迟和合规性。自动化内容管道带来的营运效率提升已经提高了宣传活动的投资报酬率,并抵消了不断增长的人工智慧运算支出。

全球行销科技市场趋势与洞察

云端优先行销技术堆迭的采用率激增

企业持续积极向云端原生架构转型,以消除资料孤岛,并在所有客户触点实现即时决策。微软在墨西哥投资13亿美元、在巴西投资27亿美元建造资料中心,凸显了建置区域基础设施以支援低延迟客户资料处理的必要性。 IT团队报告称,週期时间显着缩短,使行销人员能够将宣传活动部署时间从数週缩短至数小时,从而提高个人化精准度和产生收入速度。

生成式人工智慧贯穿整个宣传活动编配

生成式人工智慧正在将传统的、手动的、被动的流程转变为主动的体验编配引擎。 Adobe 的客户经验编配平台展示了人工智慧如何整合创新和行销功能,从而实现持续的内容优化,而无需依赖耗费大量人力的 A/B 测试。企业强调利润率的提升,其独特的模式与传统的 SaaS 工具相比,毛利率提高了 50-60%。

总拥有成本 (TCO) 增加和合併负债

企业在现有系统中加装人工智慧工具会产生计画外的资料迁移和维护成本,这些成本可能超出初始预算 40% 至 60%。仅云端储存一项,到 2025 年,IT 支出就将超过 2000 亿美元,这将迫使财务长重新考虑他们的平台选择。

细分市场分析

到2025年,行销自动化将占据行销科技市场25.60%的份额,凸显其作为全通路客户体验管理核心的地位。随着企业转向整合数据、内容和激活工作流程的编配引擎,与行销自动化相关的行销技术市场规模预计将持续成长。目前,人工智慧驱动的生成式内容工具的收入基数较小,但预计到2031年将以25.92%的复合年增长率成长,因为品牌会将支出重新分配到可扩展的人工智慧驱动的内容生成领域。社群媒体和内容行销套件透过实现直接的受众互动而稳定成长,而富媒体创作工具则受益于影片需求的不断增长。

企业将快速内容部署视为可持续的竞争优势,并正将预算集中投入能够将创意与即时效果分析结合的平台。 Adobe 的 GenStudio Foundation 就是一个很好的例子,它展示了供应商如何将自动化整合到内容供应链中,使行销人员能够在不损害品牌价值的前提下发布内容。销售赋能套件现在包含基于人工智慧训练的过往成交资料的预测案源计分,以加速销售转换。

区域分析

到2025年,北美将占据行销技术市场37.60%的份额,这主要得益于成熟的云端运算应用、创业融资以及先进的人工智慧研究能力。随着各州隐私法的出台,合规难度加大,区域领导企业正利用深度生态系统整合来维持竞争优势。加拿大企业正在完善其用户许可策略,以应对C-27法案的实施;而美国企业则正在采用隐私安全的分析技术,以规避诉讼风险。

亚太地区是成长最快的地区,预计2026年至2031年复合年增长率将达到15.95%。政府对数位基础设施的支持正在加速行动优先消费群体对行销技术的采用。在印度,受本地语言内容和人工智慧驱动的广告导向创新推动,预计到2025年,数位行销市场规模将达到11.2兆印度卢比(134亿美元)。东南亚的广告主正在将更大比例的媒体支出分配给社群电商,而澳洲公司则在增加人工智慧行销预算,以逐步提高转换率。

欧洲市场受到严格监管的影响。 《一般资料保护规范》(GDPR) 2025、《数位市场法案》和《数位服务法案》共同重新定义了资料管理义务。服务于该地区的供应商必须建立符合所有27个成员国标准的预设隐私架构,并且通常需要将这些标准推广至全球。在拉丁美洲,墨西哥同时迎来了Netflix的10亿美元製作投资计画和阿里巴巴的首个本地云端区域,预示着国际公司在该地区数位化业务的强劲成长。同时,在中东和非洲,随着支付基础设施的成熟和跨境物流的改善,开发者正在加速采用电子商务平台。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 主流趋势:云端优先行销技术堆迭的快速普及

- 主流趋势-将生成式人工智慧融入整体宣传活动编配

- 主流趋势:以隐私为中心的第一方资料策略

- 鲜为人知的趋势:零方资料微交换项目

- 不太受欢迎-可组合的CDP架构打破了套件锁定。

- 市场限制

- 主流趋势-总拥有成本 (TCO) 和合併负债不断增加

- 主流趋势-复杂行销技术堆迭中的技能差距

- 鲜为人知的趋势:苹果私有中继和浏览器级广告拦截

- 一个鲜为人知的趋势:ESG主导的云碳排放上限限制数据密集型行销技术

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业资金筹措和併购趋势

第五章 市场规模与成长预测

- 副产品

- 社群媒体工具

- 内容行销工具

- 富媒体创作工具

- 行销自动化平台

- 数据和分析工具

- 销售赋能工具

- 透过使用

- 资讯科技/通讯

- 零售与电子商务

- 卫生保健

- 媒体与娱乐

- 体育赛事

- BFSI

- 按地区

- 北美洲

- 南美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Adobe Inc.

- Alphabet Inc.(Google Marketing Platform)

- Amazon Web Services(AWS for Martech)

- Salesforce Inc.

- Microsoft Corp.

- Oracle Corp.

- HubSpot Inc.

- SAP SE

- Shopify Inc.

- Mailchimp(Intuit)

- Hootsuite Inc.

- Sprinklr Inc.

- Zoho Corp.(Zoho Marketing Plus)

- Optimizely

- Klaviyo

- Acoustic LP

- ActiveCampaign

- FullCircl Ltd.

- Buzzoole Holdings Ltd.

- Konnect Insights

- Iterable

第七章 市场机会与未来展望

The Marketing Technology Market was valued at USD 580 billion in 2025 and estimated to grow from USD 660.91 billion in 2026 to reach USD 1,270.82 billion by 2031, at a CAGR of 13.95% during the forecast period (2026-2031).

Enterprise demand for cloud-first, AI-embedded stacks is the primary accelerator, enabling real-time orchestration of campaigns, dynamic content generation, and cross-channel attribution at scale. Market leaders are embedding generative AI in core products, while regulatory pressure to transition toward privacy-first data strategies raises the value of first-party and zero-party data assets. Competitive dynamics favor vendors that can unify creative, data, and activation workflows inside a composable architecture, giving enterprises granular control over costs, latency, and compliance. Operational efficiency gains from automated content pipelines are already improving campaign ROI enough to offset rising AI compute expenditures.

Global Marketing Technology Market Trends and Insights

Cloud-First Marketing Stacks Adoption Surge

Enterprises continue an aggressive pivot toward cloud-native architectures to collapse data silos and enable real-time decisioning across every customer touchpoint. Microsoft's USD 1.3 billion Mexico and USD 2.7 billion Brazil data-center commitments underscore the need for regional infrastructure that supports low-latency customer data processing. IT teams report cycle-time reductions that let marketers shrink campaign rollouts from weeks to hours, boosting personalization accuracy and revenue velocity.

GenAI Embedded Across Campaign Orchestration

Generative AI is transforming what used to be manual, reactive workflows into proactive experience orchestration engines. Adobe's Customer Experience Orchestration platform illustrates how AI unites creative and marketing functions under one roof, enabling continuous content optimization without relying on labor-intensive A/B testing. Enterprises highlight margin expansion as proprietary models deliver 50-60% gross margins versus legacy SaaS tools.

Rising Total Cost of Ownership and Integration Debt

Organizations layering AI tools onto legacy stacks face unplanned data-migration and maintenance bills that exceed initial budgets by 40-60%. Cloud storage alone surpassed USD 200 billion of IT spend in 2025, pressuring CFOs to reassess platform choices.

Other drivers and restraints analyzed in the detailed report include:

- Privacy-Driven First-Party Data Strategies

- Zero-Party Data Micro-Exchange Programs

- Skills Gap for Complex Martech Stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Marketing Automation captured 25.60% of the marketing technology market share in 2025, validating its role as the control center for omnichannel journey management. The marketing technology market size tied to Marketing Automation is projected to grow alongside enterprises' pivot to unified orchestration engines that connect data, content, and activation workflows. GenAI-Powered Content Tools, while representing a smaller revenue base today, are forecast to post a 25.92% CAGR through 2031 as brands redistribute spend toward scalable, AI-driven content generation. Social media and content marketing suites post steady gains by enabling direct audience engagement, whereas rich-media creation tools benefit from rising video demand.

Enterprises view content velocity as a durable moat, directing budgets toward platforms that marry creative excellence with real-time performance insights. Adobe's GenStudio Foundation exemplifies how vendors integrate automation into the content supply chain, allowing marketers to publish without sacrificing brand integrity. Sales-enablement suites now embed predictive lead scoring that draws on AI-trained historical win data to accelerate pipeline conversion.

The Marketing Technology Market Report is Segmented by Product (Social Media Tools, Content Marketing Tools, Rich-Media Creation Tools, and More), Application (IT and Telecommunications, Retail and E-Commerce, Healthcare, Media and Entertainment, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 37.60% of the marketing technology market in 2025 due to mature cloud adoption, venture funding, and advanced AI research capabilities. Regional leaders leverage deep ecosystem integrations to maintain competitive edge, even as state-level privacy statutes multiply compliance tasks. Canadian enterprises refine consent strategies in anticipation of Bill C-27, while US-based firms deploy privacy-preserving analytics to stay ahead of litigation exposure.

APAC is the fastest-growing region, projected to log a 15.95% CAGR over 2026-2031. Governments support digital infrastructure build-outs, enabling widespread uptake of marketing tech among mobile-first consumers. India expects its digital marketing sector to reach INR 1.12 lakh crore (USD 13.4 billion) by 2025, powered by local-language content and AI-enabled ad-targeting innovations. Southeast Asian advertisers are directing larger shares of media spend toward social commerce, and Australian enterprises are expanding AI marketing budgets to capture incremental conversion gains.

Europe's outlook is colored by stringent regulations: GDPR 2025, the Digital Markets Act, and the Digital Services Act collectively redefine data stewardship obligations. Vendors serving the region must design default-privacy architectures that comply across all 27 member states, often rolling those standards global. In Latin America, Mexico welcomed both Netflix's USD 1 billion production pledge and Alibaba's first local cloud region, signals that international players foresee robust digital growth. Meanwhile, Middle East and Africa developers accelerate e-commerce stack adoption as payment rails mature and cross-border logistics improve.

- Adobe Inc.

- Alphabet Inc. (Google Marketing Platform)

- Amazon Web Services (AWS for Martech)

- Salesforce Inc.

- Microsoft Corp.

- Oracle Corp.

- HubSpot Inc.

- SAP SE

- Shopify Inc.

- Mailchimp (Intuit)

- Hootsuite Inc.

- Sprinklr Inc.

- Zoho Corp. (Zoho Marketing Plus)

- Optimizely

- Klaviyo

- Acoustic L.P.

- ActiveCampaign

- FullCircl Ltd.

- Buzzoole Holdings Ltd.

- Konnect Insights

- Iterable

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream - Cloud-first marketing stacks adoption surge

- 4.2.2 Mainstream - GenAI embedded across campaign orchestration

- 4.2.3 Mainstream - Privacy-driven first-party data strategies

- 4.2.4 Under-the-radar - Zero-party data micro-exchange programs

- 4.2.5 Under-the-radar - Composable CDP architectures beating suite lock-in

- 4.3 Market Restraints

- 4.3.1 Mainstream - Rising total cost of ownership and integration debt

- 4.3.2 Mainstream - Skills gap for complex martech stacks

- 4.3.3 Under-the-radar - Apple Private Relay and browser-level ad-blocking

- 4.3.4 Under-the-radar - ESG-driven cloud carbon limits on data-heavy martech

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Funding and M&A Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Social Media Tools

- 5.1.2 Content Marketing Tools

- 5.1.3 Rich-Media Creation Tools

- 5.1.4 Marketing Automation Platforms

- 5.1.5 Data and Analytics Tools

- 5.1.6 Sales Enablement Tools

- 5.2 By Application

- 5.2.1 IT and Telecommunications

- 5.2.2 Retail and E-commerce

- 5.2.3 Healthcare

- 5.2.4 Media and Entertainment

- 5.2.5 Sports and Events

- 5.2.6 BFSI

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 South America

- 5.3.3 Europe

- 5.3.4 Asia-Pacific

- 5.3.5 Middle East

- 5.3.6 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 Alphabet Inc. (Google Marketing Platform)

- 6.4.3 Amazon Web Services (AWS for Martech)

- 6.4.4 Salesforce Inc.

- 6.4.5 Microsoft Corp.

- 6.4.6 Oracle Corp.

- 6.4.7 HubSpot Inc.

- 6.4.8 SAP SE

- 6.4.9 Shopify Inc.

- 6.4.10 Mailchimp (Intuit)

- 6.4.11 Hootsuite Inc.

- 6.4.12 Sprinklr Inc.

- 6.4.13 Zoho Corp. (Zoho Marketing Plus)

- 6.4.14 Optimizely

- 6.4.15 Klaviyo

- 6.4.16 Acoustic L.P.

- 6.4.17 ActiveCampaign

- 6.4.18 FullCircl Ltd.

- 6.4.19 Buzzoole Holdings Ltd.

- 6.4.20 Konnect Insights

- 6.4.21 Iterable

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment