|

市场调查报告书

商品编码

1906263

马来西亚资料中心冷却:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Malaysia Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

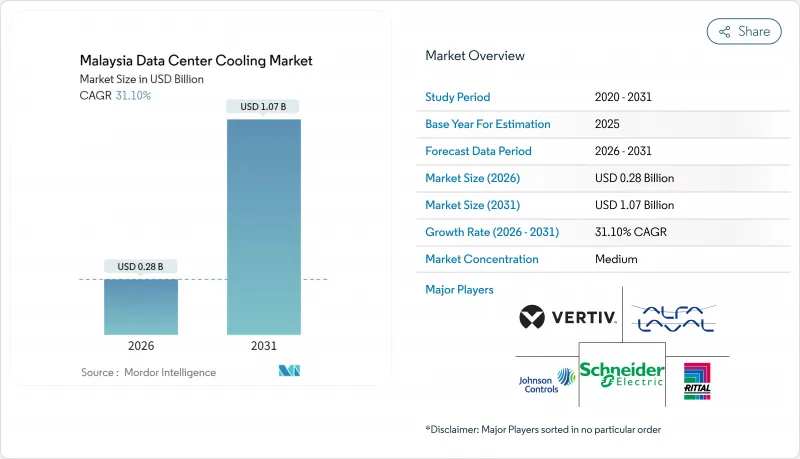

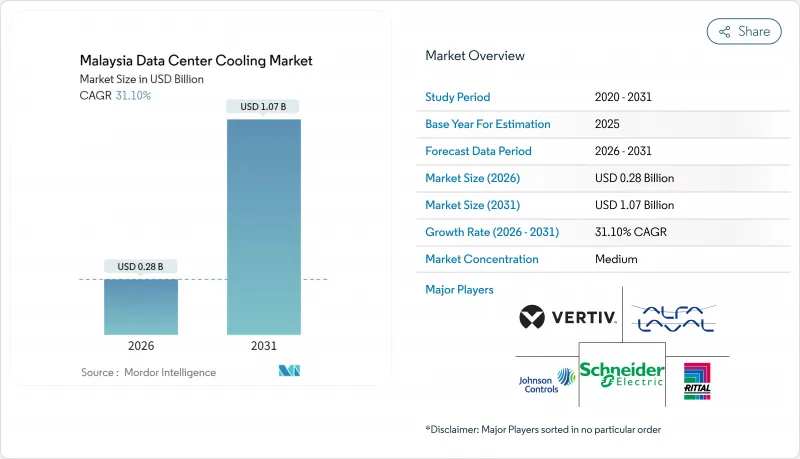

预计到 2026 年,马来西亚资料中心冷却市场价值将达到 2.8 亿美元。

这代表着从 2025 年的 2.1 亿美元成长到 2031 年的 10.7 亿美元,2026 年至 2031 年的复合年增长率为 31.10%。

马来西亚作为东南亚领先的资料中心位置,其发展势头强劲,这得益于政府降低营运成本的激励措施,以及人工智慧(AI)工作负载对先进温度控管的需求。柔佛州、赛城和吉隆坡大都会大都会圈持续吸引外商直接投资,可再生能源采购计画也鼓励营运商升级冷却基础设施,以提高能源效率。随着机架功率密度超过40kW,液冷解决方案正日益普及,但就装置容量而言,风冷系统仍占主导地位。供应链本地化和组件整合,以及不断壮大的国内工程师队伍,使供应商能够满足日益增长的需求,即便资源限制给设计选择带来了压力。

马来西亚数据中心冷却市场趋势与洞察

马来西亚作为亚太地区枢纽的战略地位

马来西亚位于新加坡和其他东协市场之间,为超过6.5亿用户提供低于20毫秒的低延迟服务。这促使营运商越来越多地将计算丛集和相应的冷却设施部署在本地。高达15条海底光缆的密集部署,使得依赖冗余冷水循环和独立机房的高可用性架构成为可能。与新加坡相比,马来西亚的土地成本低30-40%,这使得专用园区能够配备冷水-液体转换室和专用蓄热仓储设施,从而降低整体拥有成本。微软马来西亚西部云端区域每个机房采用三条独立的冷却管线,以确保高人工智慧密集区域的运作。预计到2030年,该地区的数位经济收入将成长两倍,达到1兆美元,因此,新建园区将继续投资高效能冷却器和热通道封闭技术,以确保即使在热带环境下也能保持高性能。

超大规模和託管资料中心投资激增,推动降温需求

柔佛州到2024年IT装置容量将达到1.6GW,已签约专案可望推动区域需求到2035年超过5GW。机架密度超过40kW时,需采用接近温度低于2°C的液冷迴路,以确保晶片可靠性。普林斯顿数位集团(Princeton Digital Group)150MW的园区将已建成面积的35%用于冷却设备和公用设施走廊,这反映了散热设备所需面积的不断增长。超大规模采购正在推动泵浦和热交换器的在地化生产,马来西亚国家能源公司(Tenaga Nasional)报告称,该领域的电力需求实现了两位数的成长,这为创新型散热平台的长期发展前景提供了支撑。

资料中心冷却所需的能源消费量和水资源需求不断增加

冷却约占设施总消费量的40%。到2026年,马来西亚的电力需求可能成长130%,这将考验发电储备。水压问题更为迫切:柔佛州监管机构预测,资料中心日用水量将达到6.73亿公升,但现有供水网路日供水量仅1.42亿公升。一项为期三年的饮用水淘汰计画迫使企业安装空冷式和再生水冷却系统,将使资本支出增加高达35%。能够部署闭式液冷系统的业者可以实现80%至90%的节能,但在快速成长的资本支出週期中,初始成本仍是一大障碍。

细分市场分析

截至2025年,受现有部署和营运商熟悉度的推动,风冷架构在马来西亚资料中心冷却市场仍占71.20%的份额。然而,液冷平台继续以25.85%的复合年增长率成长,预计到2031年将成为马来西亚资料中心冷却市场规模成长的最大部分。虽然对于20kW以下的机架,冷却器机组加CRAH(机房空调机组)设计仍然是首选,但在中等密度机房中,风冷解决方案仍然占据主导地位,因为间接蒸发冷却和节热器盘管可以提高PUE(电源使用效率)。液浸式冷却槽可将风扇能耗降低到接近零,从而在电费上涨的压力下降低营运成本。混合式后门热交换器作为一种过渡技术,无需进行重大设备升级即可实现工作负载迁移。供应商正在推动热交换器撬装设备的在地化生产,以缩短前置作业时间并抓住人工智慧应用带来的机会。

能源和永续性目标也推动了对液冷技术的投资。浸没式冷却和晶片级直冷迴路即使在 500kW 的机架负载下也能稳定组件的出口温度,从而提高单位面积的运算密度,并降低土地资源紧张地区的土地成本。普林斯顿数位集团 (Princeton Digital Group) 位于柔佛州的园区在将其 GPU丛集切换为两相浸没式冷却后,面积减少了 20%,从而实现了长期的成本优势。随着人工智慧云端的扩展,液冷系统很可能在新超大规模资料中心取代风冷系统,但对大规模维修的需求仍将持续存在,风冷系统在二级资料中心和企业级资料中心仍然至关重要。

机房空调(CRAH)和机房冷冻空调(CRAC)机组在马来西亚资料中心冷却市场中占据最大的收入份额,达到32.40%,这主要得益于它们在新建和现有设施中的广泛应用。间接冷却式冷却器与板式热交换器结合,可延长水侧节能运转运作,并将年度电力消耗量降低两位数。配备智慧风机驱动装置的冷却塔可根据湿球温度的波动调节气流,从而延长压缩机寿命并降低尖峰负荷费用。水泵、阀门和变频驱动装置可实现精确的流量控制,延长维护週期。控制和监控平台正成为成长重点,它们利用预测分析来预防组件故障并调整阀门位置以实现最佳热效率。

随着营运商寻求透过降低PUE值来抵消不断上涨的电费,软体的重要性日益凸显。马里兰大学对控制系统维修,在实施人工智慧驱动的流量分析后,容量提升了100%,PUE值降低了5.5%。马来西亚赛城的一个类似计画则利用嵌入冷通道地砖的光纤感测器来调节风扇转速,实现了每年8%的节能效果。能够整合硬体、软体和现场服务的供应商在竞标中越来越受到青睐,这标誌着市场正在从零散的设备采购转向整合式全生命週期解决方案。

马来西亚资料中心冷却市场按冷却技术(气冷、液冷)、冷却组件(机房空调机组 (CRAH/CRAC)、冷却器和热交换器等)、资料中心类型(超大规模(自有和租赁)、其他)以及最终用户行业(IT 和电信、零售和消费品等)进行细分。市场预测以美元以金额为准(USD) 为以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 冷气成本的关键考虑因素

- 资料中心营运主要成本开销分析(重点关注冷却)

- 冷冻技术比较研究(设计复杂性、PUE、优缺点、气候条件利用率)

- 资料中心冷却的关键创新和发展趋势

- 资料中心采取的主要节能措施

第五章 市场动态

- 市场驱动因素

- 马来西亚作为亚太地区区域枢纽的战略定位

- 超大规模和託管资料中心投资激增,推动降温需求

- 政府税收优惠和「我的数位蓝图」计画旨在支持资料中心建设。

- 新加坡资料中心容量的提升推动了柔佛州资料中心的扩张

- AI/GPU工作负载密度不断增加,推动了先进液冷技术的应用

- 国家电网现代化(CRESS,可再生能源购电)协助高功率资料中心

- 市场限制

- 资料中心冷却所需的能源消费量和水资源需求不断增加

- 不断上涨的电费和新的碳定价机制的不确定性

- 缺乏用于永续冷却的再生水基础设施

- 液冷系统设计与维修人员技能缺口

- 市场机会

- 推动永续性和绿色/可再生能源资料中心的兴起

- 价值/供应链分析

- 监管环境

- 技术展望

第六章:马来西亚现有资料中心建设状况分析

- 资料中心 IT 负载容量(兆瓦)和面积(平方英尺)分析(2019-2031 年)

- 马来西亚主要资料中心集群分析

- 马来西亚即将建成的主要超大规模资料中心分析

第七章 市场规模与成长预测

- 透过冷却技术

- 空气冷却法

- 冷却器和节热器

- 电脑房空调机组 (CRAH)

- 冷却塔(直接冷却式、间接冷却式、两级冷却式)

- 其他空气冷却技术

- 液冷法

- 浸没式冷却

- 晶片直接冷却

- 后门式热交换器

- 空气冷却法

- 透过冷却组件

- 电脑房空调机组(CRAH/CRAC)

- 冷却器和热交换装置

- 冷却塔和干式冷却器

- 泵浦和阀门

- 控制和监控软体

- 依资料中心类型

- 超大规模(自有和租赁)

- 企业版(本地部署)

- 搭配

- 按最终用户行业划分

- 资讯科技和电信

- 零售和消费品

- 卫生保健

- 媒体与娱乐

- BFSI

- 其他最终用户

第八章 竞争情势

- 市占率分析

- 公司简介

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Vertiv Group Corp.

- Johnson Controls Inc.

- Geoclima Srl

- Carrier Global Corporation

- GIGA-BYTE Technology Co. Ltd

- Eaton Corporation PLC

- Right Power Technology Sdn Bhd

- Huawei Digital Power Technologies Co. Ltd

- Alfa Laval AB

- Iceotope Technologies Limited

- Daikin Industries Ltd.

- Stulz GmbH

- Munters Group AB

- Delta Electronics Inc.

- Fujitsu Ltd.

- Nortek Data Center Cooling

- NTT Facilities Inc.

- Trane Technologies plc

- Green Revolution Cooling(GRC)

- CoolIT Systems Inc.

- Asperitas BV

第九章 投资分析

第十章 市场机会与未来趋势

第十一章 关于我们

Malaysia data center cooling market size in 2026 is estimated at USD 0.28 billion, growing from 2025 value of USD 0.21 billion with 2031 projections showing USD 1.07 billion, growing at 31.10% CAGR over 2026-2031.

Momentum is anchored in the nation's emergence as Southeast Asia's preferred data center location, government incentives that reduce operating costs, and artificial-intelligence (AI) workloads that demand advanced thermal management. Foreign direct investment continues to pour into Johor, Cyberjaya and Greater Kuala Lumpur, while renewable-energy procurement schemes encourage operators to upgrade cooling infrastructure for energy efficiency. Liquid-based solutions are gaining attention as rack power densities move past 40 kW, yet air-based systems still dominate installed capacity. Supply-chain localization and component integration, coupled with a growing domestic skills base, position vendors to capture expanding demand even as resource constraints pressure design choices.

Malaysia Data Center Cooling Market Trends and Insights

Strategic Location of Malaysia as Regional Hub in Asia-Pacific

Malaysia's position between Singapore and other ASEAN markets delivers sub-20 ms latency to more than 650 million users, prompting operators to locate compute clusters and corresponding cooling assets locally Submarine-cable density has reached 15 routes, enabling high-availability architectures that rely on redundant chilled-water loops and independent plant rooms. Land costs 30-40% below Singapore allow purpose-built campuses to incorporate chilled-to-liquid conversion rooms and dedicated thermal reservoirs that lower total cost of ownership. Microsoft's Malaysia West cloud region deploys three discrete cooling lines per hall to preserve uptime in AI-heavy zones. As regional digital-economy revenue is forecast to triple to USD 1 trillion by 2030, new campuses continue to allocate capital toward high-efficiency chillers and hot-aisle containment that safeguard performance under tropical conditions.

Surge in Hyperscale and Colocation Investments Accelerating Cooling Demand

Johor recorded 1.6 GW of installed IT load in 2024, and signed commitments could push regional demand beyond 5 GW by 2035. Rack densities above 40 kW necessitate liquid-cooling loops with approach temperatures below 2 °C to maintain chip reliability. Princeton Digital Group's 150 MW campus allocates 35% of built-out space to cooling plant and utility corridors, reflecting the growing footprint required for thermal assets. Hyperscale procurements spur local manufacturing of pumps and heat exchangers, and Tenaga Nasional Berhad reports double-digit power demand growth from the segment, reinforcing the long-term outlook for innovative thermal platforms.

Higher Energy Consumption and Water Needs for DC Cooling

Cooling consumes roughly 40% of total facility energy. Malaysia's grid demand could rise 130% by 2026, testing generation reserves Water pressure is more immediate: Johor regulators expect data center demand to hit 673 million L/day while the network can supply only 142 million L/day. A mandate for zero potable-water use within three years forces adoption of air-cooling and recycled-water plants, lifting capital outlays by as much as 35%. Operators able to deploy sealed-loop liquid systems achieve 80-90% electrical savings, but up-front costs remain a hurdle amid intense capex cycles.

Other drivers and restraints analyzed in the detailed report include:

- Government Tax Incentives and MyDIGITAL Blueprint Supporting DC Build-out

- AI / GPU Workload Density Triggering Shift to Advanced Liquid Cooling

- Rising Electricity Tariffs and Emerging Carbon-Pricing Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-based architectures maintained 71.20% Malaysia data center cooling market share in 2025 owing to established deployments and operator familiarity. Yet liquid platforms are advancing at 25.85% CAGR, contributing the largest incremental slice of Malaysia data center cooling market size through 2031. Chiller-plus-CRAH designs remain preferred for sub-20 kW racks, but indirect evaporative-assist and economizer coils enable PUE gains that defend air solutions in moderate-density halls. Liquid immersion tanks cut fan energy to near zero, reducing operating overhead amid rising tariff pressure. Hybrid rear-door heat exchangers provide bridge technology, letting operators migrate workloads without wholesale plant upgrades. Component vendors are localizing heat-exchanger skid production to shorten lead times and capture opportunities tied to AI deployments.

Energy and sustainability goals also catalyze liquid investment. Immersion and direct-to-chip loops keep component exit temperatures stable despite 500 kW rack loads, permitting higher compute density per square foot and lowering land expenditure in land-constrained corridors. Princeton Digital Group's Johor campus reported 20% footprint reduction after switching its GPU clusters to two-phase immersion, underlining the long-run cost advantages. As AI clouds scale, liquid systems are likely to displace air in new hyperscale blocks, yet a sizable retrofit business will persist, keeping air players relevant across secondary and enterprise sites.

CRAH and CRAC units account for the largest revenue share of 32.40% of Malaysia data center cooling market size thanks to their ubiquity in both greenfield and brownfield halls. Indirect-liquid chillers pair with plate heat exchangers to boost water-side economization hours, cutting annual electricity by double digits. Cooling towers with intelligent fan drives modulate airflow to track wet-bulb fluctuation, preserving compressor life and shaving peak demand charges. Pumps, valves and variable-frequency drives deliver fine-grained flow control, extending maintenance intervals. Control-and-monitoring platforms emerge as a growth hotspot, offering predictive analytics that prevent component failure and tune valve positions for optimum thermal efficiency.

Software gains prominence as operators chase marginal PUE reductions to offset tariff hikes. University of Maryland's control retrofit raised capacity by 100% and cut PUE 5.5% after installing AI-driven flow analytics. Comparable deployments in Malaysia's Cyberjaya corridor use fiber sensors embedded in cold-aisle tiles to orchestrate fan-speed modulation, resulting in 8% annual energy savings. Vendors able to bundle hardware, software and field services win preference during tender rounds, illustrating market movement toward integrated life-cycle solutions rather than discrete equipment buys.

Malaysia Data Center Cooling Market is Segmented by Cooling Technology (Air-Based Cooling, Liquid-Based Cooling), Cooling Component (Computer-Room Air Handlers (CRAH/CRAC), Chillers and Heat-Exchanger Units, and More), Data Center Type (Hyperscale (Owned and Leased), and More), End-User Industry (IT and Telecom, Retail and Consumer Goods, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Vertiv Group Corp.

- Johnson Controls Inc.

- Geoclima S.r.l.

- Carrier Global Corporation

- GIGA-BYTE Technology Co. Ltd

- Eaton Corporation PLC

- Right Power Technology Sdn Bhd

- Huawei Digital Power Technologies Co. Ltd

- Alfa Laval AB

- Iceotope Technologies Limited

- Daikin Industries Ltd.

- Stulz GmbH

- Munters Group AB

- Delta Electronics Inc.

- Fujitsu Ltd.

- Nortek Data Center Cooling

- NTT Facilities Inc.

- Trane Technologies plc

- Green Revolution Cooling (GRC)

- CoolIT Systems Inc.

- Asperitas BV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of Key Cost Overheads Related to DC Operations (Cooling Focus)

- 4.2.2 Comparative Study of Cooling Technologies (Design Complexity, PUE, Pros/Cons, Weather Utilization)

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy-Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strategic Location of Malaysia as Regional Hub in Asia-Pacific

- 5.1.2 Surge in Hyperscale and Colocation Investments Accelerating Cooling Demand

- 5.1.3 Government Tax Incentives and MyDIGITAL Blueprint Supporting DC Build-out

- 5.1.4 Singapore Data Center Cap Driving Spill-over Build-outs in Johor

- 5.1.5 AI / GPU Workload Density Triggering Shift to Advanced Liquid Cooling

- 5.1.6 National Grid-Modernization (CRESS, RE Power Purchase) Enabling High-Power DCs

- 5.2 Market Restraints

- 5.2.1 Higher Energy Consumption and Water Needs for DC Cooling

- 5.2.2 Rising Electricity Tariffs and Emerging Carbon-Pricing Uncertainty

- 5.2.3 Limited Recycled-Water Infrastructure for Sustainable Cooling

- 5.2.4 Skills Gap in Liquid-Cooling Design and Maintenance Workforce

- 5.3 Market Opportunities

- 5.3.1 Sustainability Push and Emergence of Green / Renewable Data Centers

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN MALAYSIA

- 6.1 Analysis of IT Load Capacity (MW) and Area footprint (Sq. Ft.) of Data Centers (for the period of 2019-2031)

- 6.2 Analysis of the major Data Center Hotspots in Malaysia

- 6.3 Analysis of Major Upcoming Hyperscale Facilities in Malaysia

7 MARKET SIZE AND GROWTH FORECAST (VALUE)

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH (Computer-Room Air Handler)

- 7.1.1.3 Cooling Tower (Direct, Indirect, Two-Stage)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Cooling Component

- 7.2.1 Computer-Room Air Handlers (CRAH/CRAC)

- 7.2.2 Chillers and Heat-Exchanger Units

- 7.2.3 Cooling Towers and Dry Coolers

- 7.2.4 Pumps and Valves

- 7.2.5 Control and Monitoring Software

- 7.3 By Data Center Type

- 7.3.1 Hyperscale (Owned and Leased)

- 7.3.2 Enterprise (On-Premise)

- 7.3.3 Colocation

- 7.4 By End-user Industry

- 7.4.1 IT and Telecom

- 7.4.2 Retail and Consumer Goods

- 7.4.3 Healthcare

- 7.4.4 Media and Entertainment

- 7.4.5 BFSI

- 7.4.6 Other End users

8 COMPETITIVE LANDSCAPE

- 8.1 Market Share Analysis

- 8.2 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 8.2.1 Schneider Electric SE

- 8.2.2 Rittal GmbH & Co. KG

- 8.2.3 Vertiv Group Corp.

- 8.2.4 Johnson Controls Inc.

- 8.2.5 Geoclima S.r.l.

- 8.2.6 Carrier Global Corporation

- 8.2.7 GIGA-BYTE Technology Co. Ltd

- 8.2.8 Eaton Corporation PLC

- 8.2.9 Right Power Technology Sdn Bhd

- 8.2.10 Huawei Digital Power Technologies Co. Ltd

- 8.2.11 Alfa Laval AB

- 8.2.12 Iceotope Technologies Limited

- 8.2.13 Daikin Industries Ltd.

- 8.2.14 Stulz GmbH

- 8.2.15 Munters Group AB

- 8.2.16 Delta Electronics Inc.

- 8.2.17 Fujitsu Ltd.

- 8.2.18 Nortek Data Center Cooling

- 8.2.19 NTT Facilities Inc.

- 8.2.20 Trane Technologies plc

- 8.2.21 Green Revolution Cooling (GRC)

- 8.2.22 CoolIT Systems Inc.

- 8.2.23 Asperitas BV