|

市场调查报告书

商品编码

1906284

欧洲航太与国防领域被动电子元件:市场份额分析、产业趋势、统计数据和成长预测(2026-2031 年)Europe Passive Electronic Components In Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

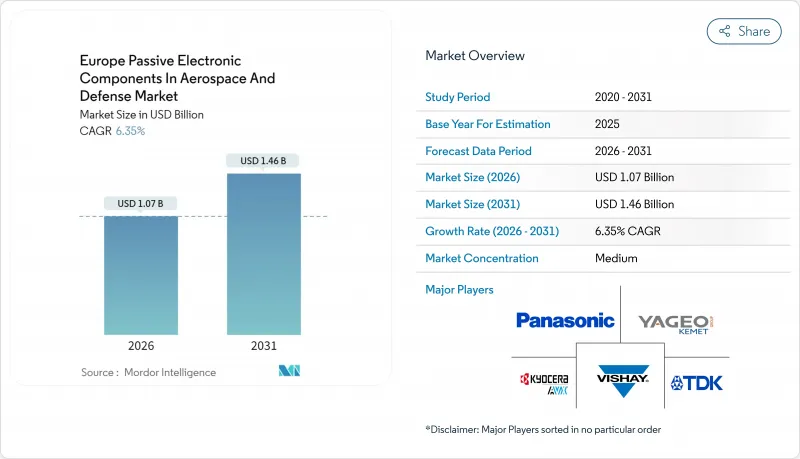

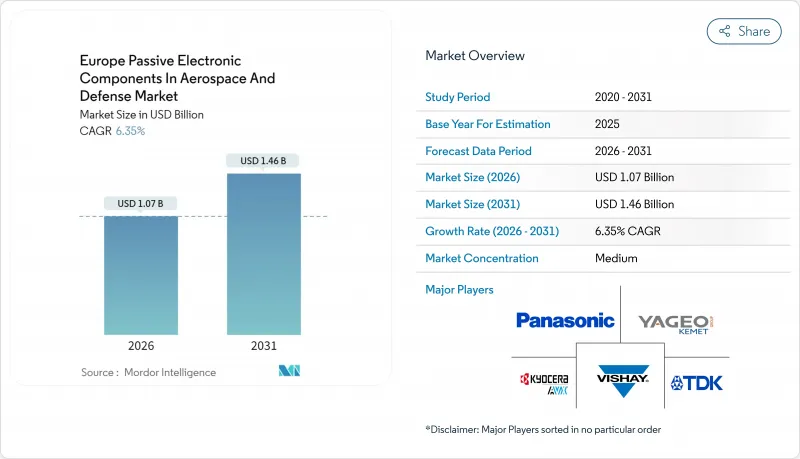

2025年欧洲航太和国防被动电子元件市场价值为10.1亿美元,预计2031年将达到14.6亿美元,高于2026年的10.7亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 6.35%。

国防现代化计画的推进、小型卫星星系的扩张以及向电动飞机(MEA)架构的转变,正在推动对坚固耐用、高可靠性被动元件的需求。供应方面的动力也源自于欧盟委员会的「重整欧洲」(ReArm Europe)倡议,该计画调动高达8,000亿欧元用于加强国防能力。这为符合欧盟严格在地采购要求的元件供应商带来了更广阔的机会。在平台层面,商用固定翼飞机仍占大部分支出,但随着欧洲各国政府和私人业者扩大用于观测、通讯和军事监视的轨道资产,卫星和太空船的采购量成长速度目前最快。同时,政策主导的在地化、氮化镓(GaN)功率元件的探索以及反无人机需求正在重塑竞争格局,迫使供应商加强其区域製造地并加速材料创新。

欧洲航太与国防被动电子元件市场趋势与洞察

欧洲国防电子现代化计画激增

2024年创纪录的3,260亿欧元国防预算加速了尖端航空电子设备、雷达和电子战系统的累计,这些系统广泛使用高密度电容器、电感器和滤波器。新武器支出从2021年的590亿欧元飙升至2024年的1020亿欧元,为战术无线电、主动相控阵雷达和数位飞行计算机提供了更多高品质的被动元件。欧洲防务基金2025年产业计画(10.65亿欧元)为联合感测器和电子战研发拨出大量津贴,使欧洲供应商在早期设计机会中领先。同时,一项到2030年将50%的国防采购预算分配给欧盟供应商的政策要求,奖励主要企业深化与本地被动元件专家的合作,从而巩固欧洲航太和国防被动电子元件市场的结构性成长路径。

由于小型卫星和发射服务的扩张,需求迅速增长

欧洲对微型和卫星星系的重视,使得每次发射所需的抗辐射加固被动元件数量翻了一番。欧洲太空总署(ESA)已为「新雅典娜」计画累计850万欧元,并为2024年潜在的M7任务拨款130万欧元,凸显了科学和安全有效载荷稳定供应的重要性。元件製造商正积极响应,推出小型化和密封设计,例如Exxelia公司专为低地球轨道(LEO)卫星星座设计的专有MML薄膜电容器。兼具民用和国防成像功能的两用卫星进一步扩大了市场,随着各国政府和私营运营商寻求更具韧性的空间基础设施,欧洲航太和国防被动电子元件市场的持续增长也因此得以实现。

钽和铁氧体供应的地缘政治波动

钽矿通常产自政治不稳定的地区,而铁氧体原料则严重依赖中国的加工能力。出口限制引发的紧张局势加剧,导致现货价格上涨和交货前置作业时间延长。欧洲企业被迫将资金转移到安全库存或寻求替代化学品,这给欧洲航太和国防市场被动电子元件的利润率带来了压力。欧盟的《关键材料法案》旨在2030年实现10%的国内开采和40%的国内加工,但供应不稳定在短期内仍将阻碍这一目标的实现。

细分市场分析

到2025年,电容器将占据欧洲航太和国防被动电子元件市场47.15%的主导份额,市场规模将达到4.8亿美元。陶瓷多层陶瓷电容器(MLCC)在飞行控制系统、雷达和飞弹探求者中发挥电源完整性和去耦功能。儘管价格波动,但其体积效率和抗辐射性能使其市场地位稳固。同时,在中东和非洲(MEA)地区,电感器预计将以7.05%的复合年增长率快速成长,这主要得益于子系统中高密度功率转换器和电磁干扰(EMI)滤波器的广泛应用。薄膜和模压功率电感器越来越多地应用于氮化镓(GaN)基转换器中,而环形扼流圈则用于保护航空电子讯号线免受干扰。

整合式被动元件 (IPD) 透过将电阻元件和电容元件共置于氧化铝基板上,模糊了不同类别之间的界限,从而实现了更小的尺寸和更高的可靠性。用于主动相控阵雷达 (AESA) 的新兴射频滤波器组件将共振器和电容器整合在单晶片模组中,并加快了认证流程。电阻器、变压器和射频滤波器仍然扮演着重要的角色,尤其是在电子战吊舱中,精确的电阻至关重要。各类别元件的整体动态变化印证了欧洲航太和国防市场被动电子元件的稳定多元化发展路径,从而支撑了其广泛的应用。

到2025年,陶瓷技术将占据欧洲航太和国防被动电子元件市场53.10%的份额,这主要得益于其广泛的应用,包括多层陶瓷电容器(MLCC)、共振器和基板。先进的钛酸钡配方技术可在军用温度范围内提供稳定的介电常数,而高温共烧陶瓷则为嵌入式被动元件提供了支撑。钽预计将以6.56%的复合年增长率(CAGR)实现最快增长,这主要归功于其卓越的体积电容,尤其是在卫星和飞弹的负载点转换器中,体积效率和突波抗扰度比其较高的成本更为重要。

电解电容器仍然是飞机雷达处理器中高容量储能的关键元件,但其在125°C以上温度下的寿命缩短限制了其在引擎室的应用。采用PPS和PTFE薄膜的薄膜电容器则用于定向能研究和航太推进系统中的脉衝功率线圈。铁氧体材料是电子战接收器中环形电感器和宽频变压器的基础,但供应风险迫使供应商对锰锌合金替代品进行认证。因此,材料的多样性有助于抵御地缘政治波动的影响,并维持欧洲航太和国防被动电子元件市场的成长动能。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧洲国防电子现代化计画激增

- 英国、法国和德国对小型卫星和发射服务的需求激增。

- 分子电飞机(MEA)架构牵引高温被动元件

- 欧盟支持的氮化镓功率元件研发:促进先进被动元件的集成

- 有利于区域被动元件供应商的抵销和在地采购要求

- 乌克兰衝突后迅速采取反无人机措施和部署精确导引武器

- 市场限制

- 钽和铁氧体供应的地缘政治波动

- 符合 REACH 标准的无铅重新设计所带来的成本负担

- 由于欧盟内部陶瓷电容器製造能力不足,导致前置作业时间延长。

- 透过整合SiP解决方案,减少了离散被动元件的数量。

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 激烈的竞争

- 欧洲国家国防费用分析

第五章 市场规模与成长预测

- 按类型

- 电容器

- 电阻器

- 电感器

- 变压器

- 高频/微波滤波器

- 其他(压敏电阻、热敏电阻器、电晶体)

- 材料

- 陶瓷製品

- 钽

- 电解电容器

- 电影

- 铁氧体

- 碳成分和厚膜

- 按平台

- 民用固定翼飞机

- 军用固定翼飞机

- 旋翼机

- 无人驾驶飞行器(UAV)

- 飞弹和精确导引武器

- 太空船和卫星

- 最终用户

- OEM生产线

- 维护、修理和大修 (MRO)

- 按国家/地区

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧国家(瑞典、芬兰、挪威、丹麦)

- 其他欧洲国家(波兰、荷兰、比利时等)

第六章 竞争情势

- 市场集中度

- 策略措施(合作、併购、资本投资)

- 市占率分析

- 公司简介

- KEMET(Yageo)

- Panasonic Corp.

- TDK Corp.

- Vishay Intertechnology Inc.

- AVX(Kyocera)

- Taiyo Yuden Co., Ltd.

- WIMA GmbH and Co. KG

- Cornell Dubilier Electronics Inc.

- API Delevan(Regal Rexnord)

- Bourns Inc.

- TE Connectivity plc

- Eaton plc

- TT Electronics plc

- Ohmite Manufacturing Co.

- Honeywell International Inc.

- Murata Manufacturing Co. Ltd.

- Exxelia Group

- Knowles Precision Devices

- Wurth Elektronik

- Smiths Interconnect

- NIC Components Corp.

- AVX Czech Republic sro

第七章 市场机会与未来展望

The Europe passive electronic components in aerospace and defense market was valued at USD 1.01 billion in 2025 and estimated to grow from USD 1.07 billion in 2026 to reach USD 1.46 billion by 2031, at a CAGR of 6.35% during the forecast period (2026-2031).

Rising defense modernization programmes, expanding small-satellite constellations, and the transition toward More-Electric-Aircraft architectures are intensifying demand for rugged, high-reliability passive parts. Supply-side momentum also stems from the European Commission's ReArm Europe initiative, which will mobilize up to EUR 800 billion for defense capability enhancement, opening wider opportunities for component suppliers that can meet stringent EU localization rules. At platform level, commercial fixed-wing aircraft still dominate spend, yet satellites and spacecraft now post the fastest unit growth as European governments and private operators scale orbital assets for observation, connectivity, and military surveillance. Meanwhile, policy-driven localization, GaN power research, and anti-drone requirements are reshaping the competitive playbook, compelling vendors to deepen regional manufacturing footprints and accelerate material innovation.

Europe Passive Electronic Components In Aerospace And Defense Market Trends and Insights

Surge in European defense-electronics modernization programmes

Record defense allocations of EUR 326 billion in 2024 accelerated procurement of cutting-edge avionics, radars, and EW suites that consume dense arrays of capacitors, inductors, and filters. New armaments spending jumped from EUR 59 billion in 2021 to EUR 102 billion in 2024, channeling larger volumes of qualified passives into tactical radios, active-electronically-scanned-array radars, and digital flight computers. The European Defence Fund's EUR 1.065 billion 2025 Work Programme earmarks sizable grants for collaborative sensor and EW R&D, giving European vendors a head-start on early design-in opportunities. In parallel, a policy mandate that 50% of defense procurement budgets flow to EU suppliers by 2030 incentivizes primes to deepen ties with regional passive specialists, reinforcing the Europe passive electronic components in aerospace and defense market's structural growth path.

Demand spike from small-sat and launch-service build-up

Europe's pivot toward constellations of micro and nano-satellites multiplies the number of radiation-tolerant passives required per launch. The European Space Agency set aside EUR 8.5 million for NewAthena and EUR 1.3 million for M7 mission candidates in 2024, underscoring a steady pipeline of science and security payloads. Component makers are responding with miniaturized, hermetic designs such as Exxelia's Trademarked MML film capacitors tailored to LEO constellations. Dual-use satellites that combine civil and defense imagery further expand total available market, positioning the Europe passive electronic components in aerospace and defense market for sustained upside as both governments and commercial operators pursue resilient space infrastructures.

Geopolitical volatility of tantalum and ferrite supply

Tantalum ore often originates from politically unstable regions, while ferrite raw materials depend heavily on Chinese processing capacity. Heightened tension around export controls raises spot prices and lengthens lead times. European firms must divert capital toward safety stock and explore alternate chemistries, squeezing margins within the Europe passive electronic components in aerospace and defense market. The EU's Critical Raw Materials Act aims to localize 10% of extraction and 40% of processing by 2030, yet interim volatility remains a drag on growth.

Other drivers and restraints analyzed in the detailed report include:

- More-Electric-Aircraft architectures driving high-temp passives

- EU-backed GaN power R&D catalysing advanced passives integration

- Cost burden of REACH-compliant lead-free redesigns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe passive electronic components in aerospace and defense market size for capacitors reached USD 0.48 billion in 2025, translating to a dominant 47.15% share. Ceramic MLCCs underpin power-integrity and decoupling functions across flight controls, radar, and missile seekers. Their volumetric efficiency and radiation tolerance keep them entrenched despite price swings. Inductors, however, are scaling faster at a 7.05% CAGR as high-density power converters and EMI filters proliferate in MEA subsystems. Thin-film and molded power inductors gain traction inside GaN-based converters, while toroidal chokes secure avionics signal lines against interference.

Integrated Passive Devices (IPDs) are blurring categorical lines by co-locating resistive and capacitive elements onto alumina substrates, shrinking size and boosting reliability. Emerging RF filter assemblies for AESA radar merge resonators and capacitors within monolithic modules to expedite qualification. Resistors, transformers, and RF filters sustain niche but critical roles, particularly in electronic warfare pods where precision impedance matching is essential. The aggregate dynamism across categories confirms a steady diversification path underpinning the broader Europe passive electronic components in aerospace and defense market.

Ceramic technology captured 53.10% of the Europe passive electronic components in aerospace and defense market share in 2025 thanks to its wide utility across MLCCs, resonators, and substrates. Advanced barium-titanate formulations deliver stable dielectric constants across military-temperature ranges, while high-temperature cofired ceramics support embedded passives. Tantalum's superior volumetric capacitance positions it for fastest growth at 6.56% CAGR, particularly within point-of-load converters on satellites and missiles where volumetric efficiency and surge reliability outweigh cost premiums.

Aluminum electrolytics remain indispensable for bulk energy storage inside airborne radar processors, though life-time derating above 125 °C limits their use in engine bays. Film capacitors leveraging PPS and PTFE films cater to pulse-power coils in directed-energy research and space propulsion. Ferrite materials underpin toroidal inductors and broadband transformers in EW receivers, yet supply risk forces vendors to qualify manganese-zinc substitutes. Consequently, material diversity acts as a hedge against geopolitical volatility, sustaining momentum for the Europe passive electronic components in aerospace and defense market.

The Europe Passive Electronic Components in Aerospace and Defense Market Report is Segmented by Type (Capacitors, Resistors, Inductors, and More), Material (Ceramic, Tantalum, Aluminum Electrolytic, Film, Ferrite, and More), Platform (Commercial Fixed-Wing Aircraft, Military Fixed-Wing Aircraft, Rotorcraft and More), End-User (OEM Production Lines, and MRO), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- KEMET (Yageo)

- Panasonic Corp.

- TDK Corp.

- Vishay Intertechnology Inc.

- AVX (Kyocera)

- Taiyo Yuden Co., Ltd.

- WIMA GmbH and Co. KG

- Cornell Dubilier Electronics Inc.

- API Delevan (Regal Rexnord)

- Bourns Inc.

- TE Connectivity plc

- Eaton plc

- TT Electronics plc

- Ohmite Manufacturing Co.

- Honeywell International Inc.

- Murata Manufacturing Co. Ltd.

- Exxelia Group

- Knowles Precision Devices

- Wurth Elektronik

- Smiths Interconnect

- NIC Components Corp.

- AVX Czech Republic s.r.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in European defense-electronics modernization programmes

- 4.2.2 Demand spike from small-sat and launch-service build-up in United Kingdom, France and Germany

- 4.2.3 More-Electric-Aircraft (MEA) architectures driving high-temp passives

- 4.2.4 EU-backed GaN power R&D catalysing advanced passives integration

- 4.2.5 Offset and localisation mandates favouring regional passive suppliers

- 4.2.6 Rapid anti-drone and precision-munition deployment post-Ukraine conflict

- 4.3 Market Restraints

- 4.3.1 Geopolitical volatility of tantalum and ferrite supply

- 4.3.2 Cost burden of REACH-compliant lead-free redesigns

- 4.3.3 Limited EU ceramic-capacitor fab capacity lengthening lead-times

- 4.3.4 Integration of SiP solutions reducing discrete passive counts

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

- 4.7 Defense Spending Analysis - European Countries

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Capacitors

- 5.1.2 Resistors

- 5.1.3 Inductors

- 5.1.4 Transformers

- 5.1.5 RF and Microwave Filters

- 5.1.6 Others (Varistors, Thermistors, Quartz)

- 5.2 By Material

- 5.2.1 Ceramic

- 5.2.2 Tantalum

- 5.2.3 Aluminum Electrolytic

- 5.2.4 Film

- 5.2.5 Ferrite

- 5.2.6 Carbon Composition and Thick Film

- 5.3 By Platform

- 5.3.1 Commercial Fixed-Wing Aircraft

- 5.3.2 Military Fixed-Wing Aircraft

- 5.3.3 Rotorcraft

- 5.3.4 Unmanned Aerial Vehicles (UAVs)

- 5.3.5 Missiles and Precision Munitions

- 5.3.6 Spacecraft and Satellites

- 5.4 By End-User

- 5.4.1 OEM Production Lines

- 5.4.2 Maintenance, Repair and Overhaul (MRO)

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 France

- 5.5.3 United Kingdom

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Nordics (Sweden, Finland, Norway, Denmark)

- 5.5.7 Rest of Europe (Poland, Netherlands, Belgium and Others)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Partnerships, M&A, CapEx)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 KEMET (Yageo)

- 6.4.2 Panasonic Corp.

- 6.4.3 TDK Corp.

- 6.4.4 Vishay Intertechnology Inc.

- 6.4.5 AVX (Kyocera)

- 6.4.6 Taiyo Yuden Co., Ltd.

- 6.4.7 WIMA GmbH and Co. KG

- 6.4.8 Cornell Dubilier Electronics Inc.

- 6.4.9 API Delevan (Regal Rexnord)

- 6.4.10 Bourns Inc.

- 6.4.11 TE Connectivity plc

- 6.4.12 Eaton plc

- 6.4.13 TT Electronics plc

- 6.4.14 Ohmite Manufacturing Co.

- 6.4.15 Honeywell International Inc.

- 6.4.16 Murata Manufacturing Co. Ltd.

- 6.4.17 Exxelia Group

- 6.4.18 Knowles Precision Devices

- 6.4.19 Wurth Elektronik

- 6.4.20 Smiths Interconnect

- 6.4.21 NIC Components Corp.

- 6.4.22 AVX Czech Republic s.r.o.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment