|

市场调查报告书

商品编码

1906889

可程式逻辑控制器(PLC):市场占有率分析、产业趋势与统计资料、成长预测(2026-2031)Programmable Logic Controller (PLC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

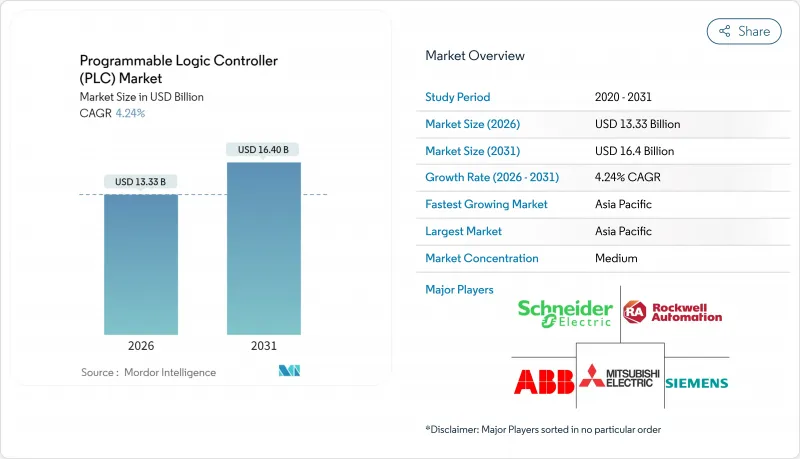

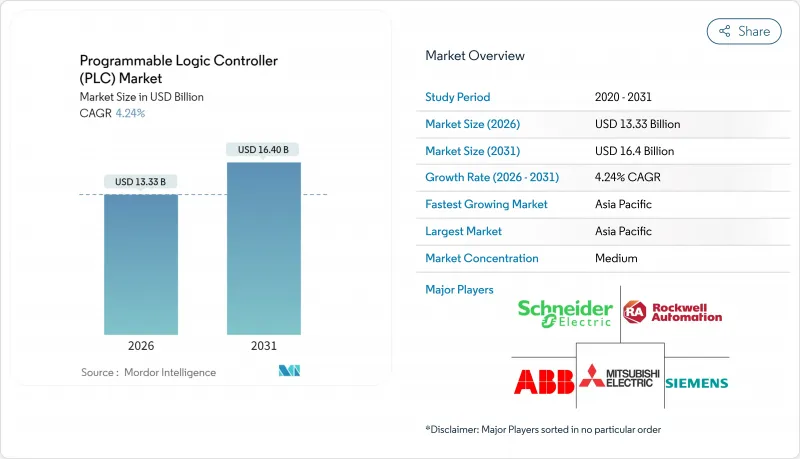

预计可程式逻辑控制器 (PLC) 市场将从 2025 年的 127.9 亿美元成长到 2026 年的 133.3 亿美元,并预计在 2031 年达到 164 亿美元,2026 年至 2031 年的复合年增长率为 4.24%。

这种稳步扩张反映了工厂车间的持续现代化、网路安全驱动的回流趋势以及从固定硬体向软体定义自动化的逐步转变。亚太地区在规模和发展势头方面均主导地位,中国和印度在补贴支持下扩大产能,推动了对紧凑型控制器平台的需求。儘管模组化架构在大型工厂中仍然至关重要,但随着用户寻求在标准工业用电脑上灵活部署,虚拟化解决方案的市场份额正在不断增长。公用事业、车辆电气化和电网边缘计划推动了近期采购,而预测性维护倡议则将收入来源拓展至服务领域。供应链中的双重采购和不断提高的网路安全要求推高了转换成本,使得老牌企业即使在零件短缺缓解的情况下也能维持价格。

全球可程式逻辑控制器 (PLC) 市场趋势与洞察

加速製造业采用工业4.0

工厂正在数位化以提高生产效率,而PLC则作为连接机器和企业软体的本地资料中心。德国联邦经济部的报告显示,工业4.0的普及率将从2023年的65%跃升至2024年的78%,印证了控制器升级的强劲势头。中国和印度的补贴计画进一步降低了中小生产商的自动化成本。同时,奥迪的虚拟PLC实施方案将试运行时间缩短了23%,提高了即时优化能力,并展现了向软体控制的转变。日益严格的ISO 9001可追溯性要求製造商用支援详细资料记录和无缝ERP整合的现代化控制器取代传统硬体。在离散製造和流程製造业,对内建边缘分析功能的PLC的需求不断增长,这种PLC能够在不影响网路安全通讯协定的前提下缩短回馈迴路。

透过工业物联网和云端整合实现预测性维护

边缘运算PLC可在本地分析振动、温度和功率指标,并将精炼后的资料传送到云端控制面板,从而实现全资产健康监控。Schneider Electric的EcoStruxure平台是混合模式的典范,它将本地逻辑与云端演算法结合,实现持续最佳化。 5G连接数位双胞胎软体使分散式PLC节点能够即时协作,帮助自主调整流程并减少计划外停机时间。已实施预测性维护的公共产业和金属加工厂报告称,其整体设备效率(OEE)显着提高,备件库存减少,证明了其投资回报,儘管网路安全问题依然存在。

中小製造商的初始资本成本较高

计划成本平均在1.5万至5万美元之间,对于许多小规模企业来说仍然是一大障碍,尤其是在考虑到整合、培训和停机时间等因素时。有限的资金往往导致新手负责人为了规避风险而采取「一刀切」的方式,过度配置系统。融资方案和供应商租赁可以帮助减轻负担,但无法彻底消除保守的投资文化。基于订阅的虚拟PLC部署成本低廉,但由于服务尚不成熟,尤其是在网路连线不稳定的地区,其普及程度因地区而异。

细分市场分析

到2025年,模组化架构将占据可程式逻辑控制器(PLC)市场41.56%的份额,这体现了其能够随着工厂升级而扩展I/O和运算能力。这种架构允许工程师在不更换堆高机的情况下添加运动控制、安全和人工智慧模组,从而支援汽车和消费性电子产业的混合型生产线。软PLC目前仍是一个小众市场,但随着虚拟机器管理程式提供确定性效能以及供应商整合增强型内核,其复合年增长率(CAGR)正以7.22%的速度成长。

离散製造和流程製造业对具备边缘分析功能的控制器(用于机器级异常检测)的需求日益增长。紧凑型PLC在独立机器领域仍然很受欢迎,而分散式PLC则被应用于大规模炼油厂和发电厂,在这些场所,容错性和地理位置分散的节点至关重要。随着基于TSN的OPC-UA技术的日趋成熟,使用者期望实现互通性,这将进一步降低硬体的同质化程度,并将差异化因素转移到软体工具炼和支援生态系统上。

2025年,硬体和软体将占可程式逻辑控制器(PLC)市场规模的84.67%,而随着用户从资本支出(CapEx)模式转向营运支出(OpEx)模式,业务收益将以7.76%的复合年增长率成长。工业物联网(IIoT)连接各层整合复杂性的不断增加,正在推动对厂商主导的咨询和应用工程服务的需求。

预测性维护方案整合了远端监控、韧体管理和人工智慧驱动的诊断功能,从而促成多年滚动合约的签订。供应商正在新兴市场拓展培训机构,以弥补技能差距并提升品牌知名度。基于云端的支援入口网站降低了差旅成本,扩增实境指南缩短了现场维修週期,即使是以硬体更换为主的计划,也因此增强了服务需求。

区域分析

亚太地区的製造业復苏将支撑规模和速度的提升,预计2025年将占全球收入的35.10%,到2031年将维持6.12%的复合年增长率。中国疫情后的经济奖励策略正在补贴汽车和电子产业的控制器升级,而印度的产业走廊建设正在推动PLC的初步应用。日本的「品质4.0」倡议将使电子元件贴片机对奈秒确定性控制设备的需求保持旺盛。韩国的造船厂和半导体工厂正在指定使用冗余PLC丛集,以确保关键任务的运作,从而支援高利润订单。

在欧洲,永续性倡议正推动以能源管理和循环经济支持为中心的控制器采购。 2024 年欧盟《网路安全韧性法案》要求原始设备製造商 (OEM) 从设计阶段就对安全性进行认证,从而推动了对具备加密通讯和内建异常检测功能的产品的需求。德国汽车製造商已开始试验软体定义 PLC 沙箱,而法国和义大利则在航太复合材料线中自动部署故障安全逻辑。

北美用户优先考虑安全的供应链和国产半导体元件的使用。 《基础设施投资与就业法案》正在资助变电站维修,以引入用于负载平衡和故障隔离的现代化控制器。墨西哥近海产业的蓬勃发展正在扩大汽车线束的生产,这需要快速采用紧凑型PLC。加拿大的采矿和林业部门偏好具有更宽温度范围的坚固耐用设备。总体而言,区域买家在评估竞标时优先考虑网路安全认证和国内维修支援。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速製造业采用工业4.0

- 中小企业对紧凑型自动化设备的需求日益增长

- 透过工业物联网和云端整合实现预测性维护

- 向软体定义PLC工作站的过渡

- 采用开放式工业通讯协定(基于TSN的OPC-UA)

- 基于网路安全措施的强制国内采购

- 市场限制

- 中小製造商的初始资本成本较高

- 互联PLC面临的网路安全威胁日益增加

- 工业用电脑和软PLC替代的风险

- 由于半导体供应不稳定,前置作业时间延长。

- 产业价值链分析

- 宏观经济因素的影响

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 小型PLC

- 模组化PLC

- 分散式PLC

- 软PLC

- 其他产品

- 按组件

- 硬体和软体

- 服务

- 安装与集成

- 培训和支持

- 维护

- 按产品尺寸

- Nano PLC

- 微型PLC

- 小规模PLC

- 中型PLC

- 大型PLC

- 按最终用户行业划分

- 车

- 食品/饮料

- 化工/石油化工

- 石油和天然气

- 能源与公共产业

- 供水和污水处理

- 製药

- 纸浆和造纸

- 金属和采矿

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- ABB Ltd.

- Omron Corporation

- Emerson Electric Co.

- Honeywell International Inc.

- Beckhoff Automation GmbH & Co. KG

- Delta Electronics Inc.

- Bosch Rexroth AG

- Panasonic Holdings Corporation

- Fuji Electric Co. Ltd.

- Hitachi Ltd.

- IDEC Corporation

- Keyence Corporation

- Toshiba Corporation

- General Electric Company

- Parker Hannifin Corporation

- Eaton Corporation plc

- Yokogawa Electric Corporation

- Inovance Technology Co. Ltd.

- Hollysys Automation Technologies Ltd.

- WAGO Kontakttechnik GmbH & Co. KG

- B&R Industrial Automation GmbH

第七章 市场机会与未来展望

The Programmable Logic Controller Market is expected to grow from USD 12.79 billion in 2025 to USD 13.33 billion in 2026 and is forecast to reach USD 16.4 billion by 2031 at 4.24% CAGR over 2026-2031.

Steady expansion reflects ongoing modernization of factory floors, rising cybersecurity-driven reshoring, and the gradual shift from fixed hardware to software-defined automation. The Asia-Pacific region leads in both scale and momentum, as subsidy-backed capacity additions in China and India boost baseline demand for compact controllers. Modular architectures remain the cornerstone of large plants; yet, virtualized solutions are gaining market share as users seek flexible deployments on standard industrial PCs. Utilities, automotive electrification, and grid-edge projects anchor near-term purchases, while predictive-maintenance initiatives extend the revenue stream toward services. Supply-chain dual-sourcing and stronger cybersecurity mandates raise switching costs, allowing established brands to protect pricing even as component shortages ease.

Global Programmable Logic Controller (PLC) Market Trends and Insights

Accelerated Industry 4.0 Adoption in Manufacturing

Factories digitalize to boost productivity, and PLCs act as the local data hubs that connect machines with enterprise software. The German Federal Ministry for Economic Affairs reported a jump to 78% Industry 4.0 adoption in 2024, up from 65% in 2023, underscoring the momentum behind controller upgrades. Subsidies in China and India further lower the cost of automation for small producers, while Audi's virtual PLC rollout cut commissioning time by 23% and improved real-time optimization, validating the transition toward software-centric control. Rising ISO 9001 traceability requirements obligate manufacturers to replace legacy hardware with modern controllers that support granular data logging and seamless ERP integration. Across discrete and process industries, demand concentrates on PLCs with built-in edge analytics that shorten feedback loops without compromising cybersecurity protocols.

IIoT and Cloud Integration Enabling Predictive Maintenance

Edge-ready PLCs analyze vibration, temperature, and power metrics locally, sending only refined insights to cloud dashboards for fleetwide health monitoring. Schneider Electric's EcoStruxure platform exemplifies the hybrid model, fusing on-premise logic with cloud algorithms for continuous optimization. 5G connectivity and digital-twin software now coordinate distributed PLC nodes in real time, supporting autonomous process adjustments that curb unplanned downtime. Utilities and metals plants that deploy predictive maintenance report sharper OEE gains and lower spare-parts inventories, validating the investment case despite residual cybersecurity concerns.

High Up-Front Capital Cost for Small Manufacturers

Average project outlays of USD 15,000-50,000 still deter many micro-scale firms, especially when integration, training, and downtime are counted. Limited cash reserves often lead to over-specification because novice buyers adopt a one-size-fits-all mindset to mitigate perceived risk. Financing schemes and vendor leasing ease pressure, but cannot fully offset conservative investment cultures. Subscription-based virtual PLCs promise lower entry points, yet nascent offerings leave adoption uneven, particularly in regions where internet reliability lags.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Compact Automation Among SMEs

- Shift to Software-Defined PLC Workstations

- Escalating Cybersecurity Threats to Connected PLCs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Modular configurations dominated with 41.56% programmable logic controller market share in 2025, reflecting their ability to expand I/O and compute power alongside plant upgrades. The architecture lets engineers add motion, safety, or AI cards without forklift replacements, supporting mixed-model lines in automotive and consumer electronics. Soft PLCs, though still niche, are advancing at a 7.22% CAGR as hypervisors deliver deterministic performance and vendors embed hardened kernels.

Across both discrete and process industries, demand centers on controllers that host edge analytics for anomaly detection at the machine level. Compact PLCs retain appeal for stand-alone machines, while distributed PLCs serve large refineries and power stations that favor fault-tolerant, geographically separated nodes. As OPC-UA over TSN matures, users expect seamless interoperability, further commoditizing hardware and shifting differentiation to software toolchains and support ecosystems.

Hardware and software together held 84.67% of the programmable logic controller market size in 2025, yet service revenue is expanding at 7.76% CAGR as users pivot from CapEx to OpEx models. Integration complexity climbs with each layer of IIoT connectivity, elevating demand for vendor-led consulting and application engineering.

Predictive maintenance packages bundle remote monitoring, firmware management, and AI-driven diagnostics, creating sticky multi-year contracts. Vendors also ramp training academies in emerging economies to close the skills gap and lock in brand familiarity. Cloud-hosted support portals lower travel costs, while augmented-reality guides shorten onsite repair cycles, reinforcing service pull even in hardware-centric replacement projects.

PLC Market Report is Segmented by Product Type (Compact PLC, Modular PLC, Distributed PLC, Soft PLC, Other Products), Component (Hardware and Software, Services), Product Size (Nano PLC, Micro PLC, Small PLC, Medium PLC, Large PLC), End-User Industry (Automotive, Food and Beverage, Chemical and Petrochemical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's manufacturing resurgence underpins both scale and speed, with 35.10% revenue in 2025 and 6.12% CAGR to 2031. China's post-pandemic stimulus subsidized controller upgrades in automotive and electronics, while India's industrial corridor builds encourage first-time PLC rollouts. Japan's Quality-4.0 initiatives keep demand high for deterministic, nano-second-level controllers used in electronics placement machines. South Korean shipyards and fabs specify redundant PLC clusters for mission-critical uptime, anchoring high-margin orders.

Europe's sustainability push frames controller purchases around energy management and circular-economy compliance. The EU Cyber Resilience Act of 2024 obliges OEMs to certify security-by-design, boosting demand for products with encrypted communications and built-in anomaly detection. German automakers pilot software-defined PLC sandboxes, while France and Italy automate aerospace composites lines with fail-safe logic.

North American users prioritize secure supply chains and domestic semiconductor content. The Infrastructure Investment and Jobs Act funds substation refurbishments that incorporate modern controllers for load-balancing and fault isolation. Mexico's nearshore boom ramps automotive harness production, requiring swift deployment of compact PLCs. Canada's mining and lumber sectors favor rugged gear with extended temperature ratings. Overall, regional buyers weigh cybersecurity credentials and on-shore repair support heavily in tender scoring.

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- ABB Ltd.

- Omron Corporation

- Emerson Electric Co.

- Honeywell International Inc.

- Beckhoff Automation GmbH & Co. KG

- Delta Electronics Inc.

- Bosch Rexroth AG

- Panasonic Holdings Corporation

- Fuji Electric Co. Ltd.

- Hitachi Ltd.

- IDEC Corporation

- Keyence Corporation

- Toshiba Corporation

- General Electric Company

- Parker Hannifin Corporation

- Eaton Corporation plc

- Yokogawa Electric Corporation

- Inovance Technology Co. Ltd.

- Hollysys Automation Technologies Ltd.

- WAGO Kontakttechnik GmbH & Co. KG

- B&R Industrial Automation GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Industry-4.0 adoption in manufacturing

- 4.2.2 Growing demand for compact automation among SMEs

- 4.2.3 IIoT and cloud integration enabling predictive maintenance

- 4.2.4 Shift to software-defined PLC workstations

- 4.2.5 Adoption of open industrial protocols (OPC-UA over TSN)

- 4.2.6 Cybersecurity-driven domestic sourcing mandates

- 4.3 Market Restraints

- 4.3.1 High up-front capital cost for small manufacturers

- 4.3.2 Escalating cybersecurity threats to connected PLCs

- 4.3.3 Substitution risk from industrial PCs and soft-PLCs

- 4.3.4 Semiconductor supply volatility inflating lead times

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Compact PLC

- 5.1.2 Modular PLC

- 5.1.3 Distributed PLC

- 5.1.4 Soft PLC

- 5.1.5 Other Products

- 5.2 By Component

- 5.2.1 Hardware and Software

- 5.2.2 Services

- 5.2.2.1 Installation and Integration

- 5.2.2.2 Training and Support

- 5.2.2.3 Maintenance

- 5.3 By Product Size

- 5.3.1 Nano PLC

- 5.3.2 Micro PLC

- 5.3.3 Small PLC

- 5.3.4 Medium PLC

- 5.3.5 Large PLC

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Food and Beverage

- 5.4.3 Chemical and Petrochemical

- 5.4.4 Oil and Gas

- 5.4.5 Energy and Utilities

- 5.4.6 Water and Wastewater Treatment

- 5.4.7 Pharmaceutical

- 5.4.8 Pulp and Paper

- 5.4.9 Metals and Mining

- 5.4.10 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core segments, Financials as available, Strategic information, Market rank/share for key companies, Products and Services, and Recent developments)

- 6.4.1 Siemens AG

- 6.4.2 Rockwell Automation Inc.

- 6.4.3 Schneider Electric SE

- 6.4.4 Mitsubishi Electric Corporation

- 6.4.5 ABB Ltd.

- 6.4.6 Omron Corporation

- 6.4.7 Emerson Electric Co.

- 6.4.8 Honeywell International Inc.

- 6.4.9 Beckhoff Automation GmbH & Co. KG

- 6.4.10 Delta Electronics Inc.

- 6.4.11 Bosch Rexroth AG

- 6.4.12 Panasonic Holdings Corporation

- 6.4.13 Fuji Electric Co. Ltd.

- 6.4.14 Hitachi Ltd.

- 6.4.15 IDEC Corporation

- 6.4.16 Keyence Corporation

- 6.4.17 Toshiba Corporation

- 6.4.18 General Electric Company

- 6.4.19 Parker Hannifin Corporation

- 6.4.20 Eaton Corporation plc

- 6.4.21 Yokogawa Electric Corporation

- 6.4.22 Inovance Technology Co. Ltd.

- 6.4.23 Hollysys Automation Technologies Ltd.

- 6.4.24 WAGO Kontakttechnik GmbH & Co. KG

- 6.4.25 B&R Industrial Automation GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment