|

市场调查报告书

商品编码

1906975

中东和非洲油漆涂料:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Middle-East And Africa Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

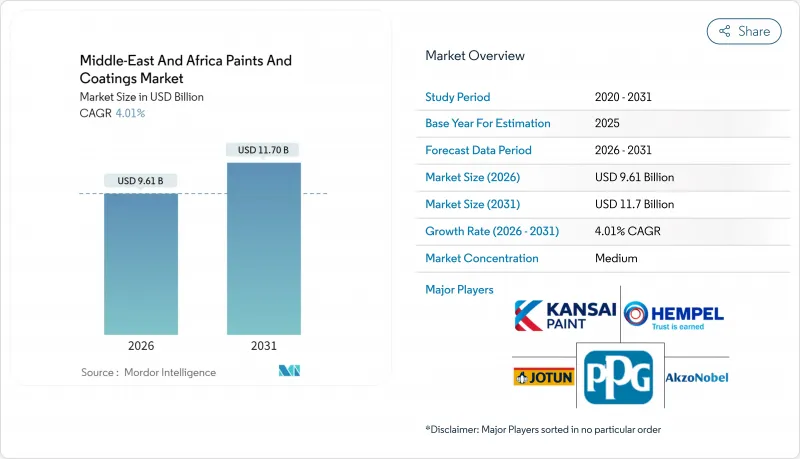

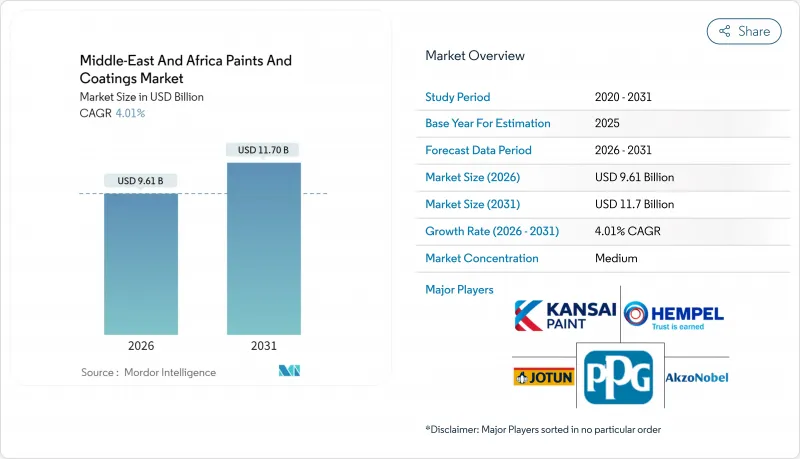

预计中东和非洲油漆和涂料市场将从 2025 年的 92.4 亿美元成长到 2026 年的 96.1 亿美元,到 2031 年将达到 117 亿美元,2026 年至 2031 年的复合年增长率为 4.01%。

沿岸地区和北非地区强劲的住宅和旅游建设计划、工业本地化政策以及基础设施现代化是支撑需求的关键驱动因素。开发商为遵守杜拜市政府对新建建筑的总挥发性有机化合物(TVOC)含量上限,并指定使用低VOC水性涂料系统,这表明市场对优质、耐用且环保配方的需求明显增加。由于液化天然气(LNG)大型企划和石化联合企业需要耐化学腐蚀、耐盐雾和耐紫外线的高性能环氧树脂和聚氨酯涂料系统,防护涂料的需求也十分旺盛。然而,占配方成本约三分之二的石化原料价格波动较大,在原油价格高企期间持续挤压利润空间。此外,由于汽车组装量下降,南非和伊朗的汽车喷漆市场也出现疲软。儘管面临这些不利因素,但随着跨国公司扩大区域产能,灵活的本地製造商加强分销网络,行业整合的势头正在增强。竞争格局仍保持适度多元化,并日益趋向技术主导。

中东及非洲油漆涂料市场趋势及分析

海湾合作委员会国家和红海地区旅游业主导的建筑热潮

海湾国家政府正投资兴建世界一流的机场、主题乐园和海滨度假村,以实现经济多元化并吸引国际观光。阿勒马克图姆国际机场的扩建、伊玛尔地产公司毗邻的酒店区以及沙乌地阿拉伯的红海计划都需要大量的耐褪色外墙涂料、防污船舶涂料和符合LEED认证标准的内墙乳胶漆。开发商需要能够承受沙粒磨损、高盐湿度和极端昼夜温差的涂料系统,这促使配方师在涂料中添加陶瓷颗粒、紫外线吸收剂和防腐颜料。随着计划竞标文件中对低VOC(挥发性有机化合物)标准的要求日益严格,能够本地化生产水性涂料配方和着色剂的製造商在规格方面获得了优势。因此,旅游业的蓬勃发展同时推动了建筑涂料和防护涂料两个细分市场的成长,从而为中东和非洲涂料市场的长期销售量成长提供了保障。

公共大型企划规划(NEOM、卢赛尔、世博城)

NEOM的多丛集开发项目正分阶段推进,需要采用自清洁建筑幕墙涂料、抗菌内墙饰面以及可降低冷却负荷的太阳能反射屋顶膜。在卡达,北田液化天然气扩建计划将重工业规格作为首要任务,该计画要求自然气处理厂采用耐高温环氧酚醛衬里,储气球采用耐腐蚀聚氨酯面漆。计画于2028年完工的阿联酋鲁瓦伊斯LNG接收站也仰赖能够抵御硫化氢侵蚀的厚膜防腐蚀系统。这些计划週期长达六至八年,供应商可从中受益于可预测的订单安排,证明在该地区投资树脂配製和着色是合理的。这些大型企划进一步巩固了中东和非洲涂料市场的优质化趋势,为技术领导企业带来了利润成长的机会。

南非和伊朗汽车组装速度放缓

由于电力短缺导致钢板冲压产能停滞,南非2024年的汽车产量预计将有所下降,进而降低了整车製造商对底漆、底涂层和透明涂层的需求。伊朗的组装也因零件短缺和电力限制等因素而缩减产量。此外,由于车辆更换週期延长,修补漆的需求也在下降。供应商正将业务拓展至工业维护和建筑涂料领域,但重新培训销售团队和调整混配工厂以适应大批量装饰涂料的生产需要时间。儘管南非政府目前鼓励电动车的生产,但汽车产业对涂料的短期需求仍然疲软,限制了中东和非洲油漆涂料市场的成长。

细分市场分析

预计到2025年,丙烯酸涂料将成为中东和非洲涂料市场的主要收入来源,占整个市场33.98%。丙烯酸涂料具有良好的柔软性、保色性和成本效益,因此在沙乌地阿拉伯和苏丹等高温和紫外线照射地区的室外石材涂料和室内乳化涂料生产线中广泛应用。聚氨酯涂料预计将以4.28%的年复合成长率,这主要得益于液化天然气运输船、化学品储存槽和高流量地板材料等小批量应用的需求,在这些应用中,耐磨性和耐化学性使其价格溢价合理。随着下游石化一体化进程的推进,当地二异氰酸酯原料供应量增加,中东和非洲聚氨酯涂料市场规模预计将稳定扩大。环氧树脂在沿岸地区的炼油厂和管线沿线市场需求强劲。同时,聚酯树脂在铝合金窗框和家用电器粉末涂料领域市场份额不断增长,提高了耐刮擦性和涂料转移效率。特殊树脂(例如用于高层建筑自清洁建筑幕墙的氟聚合物和用于耐热烟囱的硅酮)的增长速度较慢,反映了全部区域树脂化学日益多样化的趋势。

随着永续性法规日益严格,丙烯酸树脂的市场份额预计将逐渐下降,因为聚氨酯-环氧树脂混合材料在严苛的应用环境中具有更优的生命週期成本优势。然而,装饰涂料配方生产商不断创新,将氧化石墨烯、中空玻璃珠和生物基塑化剂等成分融入丙烯酸树脂中,从而在住宅和中型商业计划中保持了市场份额。跨国公司正利用全球研发资源,对配方进行在地化改造,以进行加速老化测试。同时,区域领导者正利用低成本进口散装丙烯酸乳胶,以更低的价格捍卫其市场份额。这些趋势意味着,树脂的选择仍然是中东和非洲涂料市场竞争的关键领域。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 海湾合作委员会和红海地区旅游业主导的建筑热潮

- 公共大型企划规划(NEOM、卢赛尔、世博城)

- 产业本地化政策促进了OEM涂料需求。

- 非洲主要经济体的城市住宅需求正在復苏

- 利用透气矿物涂层修復文化遗产的资金筹措

- 市场限制

- 南非和伊朗汽车组装速度放缓

- 与原油价格相关的原物料价格波动

- 贸易制裁限制了原材料流入伊朗

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依树脂类型

- 丙烯酸纤维

- 醇酸树脂

- 聚氨酯

- 环氧树脂

- 聚酯纤维

- 其他(硅胶、乙烯基、氟树脂)

- 透过技术

- 水溶液

- 溶剂型

- 粉末涂装

- 紫外光固化涂料

- 按最终用户行业划分

- 大楼

- 车

- 工业木材

- 保护涂层

- 运输

- 一般工业

- 包装

- 按地区

- 沙乌地阿拉伯

- 卡达

- 科威特

- 阿拉伯聯合大公国

- 伊朗

- 伊拉克

- 奈及利亚

- 南非

- 土耳其

- 坦尚尼亚

- 肯亚

- 阿尔及利亚

- 摩洛哥

- 埃及

- 其他中东和非洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Akzo Nobel NV

- Al-Tabieaa Company

- Atlas Peintures

- Axalta Coating Systems

- Basco Paints

- BASF SE

- Beckers Group

- Crown Paints Kenya PLC

- DAW SE(Caparol)

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings

- PACHIN

- PPG Industries Inc.

- Qemtex

- RPM International Inc.

- Saba Shimi Aria

- Terraco Holdings Limited

- The Sherwin-Williams Company

- Thermilate Middle East

- Wacker Chemie AG

第七章 市场机会与未来展望

The Middle-East and Africa Paints and Coatings Market is expected to grow from USD 9.24 billion in 2025 to USD 9.61 billion in 2026 and is forecast to reach USD 11.7 billion by 2031 at 4.01% CAGR over 2026-2031.

Solid residential and tourism-oriented construction pipelines, industrial localization mandates, and infrastructure modernization across the Gulf and North Africa are the foremost forces sustaining demand. A shift toward premium, durable, and environmentally safer formulations is clearly visible as developers specify low-VOC water-based systems to comply with Dubai Municipality's TVOC ceiling for new buildings. Protective coating consumption also stays robust because LNG megaprojects and petrochemical complexes require high-performance epoxy and polyurethane systems resistant to chemicals, salt spray, and UV radiation. However, the volatile cost of petrochemical feedstocks, which account for roughly two-thirds of formulation costs, continues to compress margins during crude price spikes, and the automotive repaint segment softens in South Africa and Iran as assembly volumes retreat. Despite these headwinds, consolidation gains momentum, with multinationals scaling regional capacity while agile local producers strengthen distribution reach, leaving the competitive field moderately fragmented but increasingly technology-driven.

Middle-East And Africa Paints And Coatings Market Trends and Insights

Tourism-Led Construction Boom Across GCC and Red Sea

Gulf governments are investing in world-scale airports, theme parks, and waterfront resorts to diversify their economies and attract international visitors. The Al Maktoum International airport expansion, Emaar's adjacent hospitality districts, and Saudi Arabia's Red Sea Project collectively require large volumes of fade-resistant exterior paints, anti-fouling marine coatings, and LEED-compliant interior emulsions. Developers require coating systems that can tolerate sand abrasion, saline humidity, and sharp diurnal temperature swings, prompting formulators to embed ceramic microspheres, UV absorbers, and rust-inhibiting pigments. As project tender documents increasingly specify low-VOC thresholds, manufacturers that localize water-borne blending and tinting capacity capture specification advantages. The tourism boom, therefore, elevates both architectural and protective sub-segments simultaneously, underpinning long-term volume visibility across the Middle East and Africa paints and coatings market.

Public Megaproject Pipelines (NEOM, Lusail, Expo City)

NEOM's multi-cluster development progresses in phases, requiring self-cleaning facade coatings, antimicrobial interior finishes, and solar-reflective roof membranes that can lower cooling loads. In Qatar, the North Field LNG build-out requires heat-resistant epoxy phenolic linings for gas processing trains and corrosion-resistant polyurethane topcoats for storage spheres, keeping heavy-duty industrial specifications at the forefront. The UAE's Ruwais LNG terminal, scheduled for 2028, also relies on high-build anti-corrosion systems capable of withstanding hydrogen-sulfide exposure. Because these projects extend six to eight years, suppliers benefit from predictable call-off schedules that justify regional resin synthesis and tinting investments. Such megaproject pipelines reinforce the premiumization trend within the Middle East and Africa paints and coatings market, unlocking margin headroom for technology leaders.

Automotive Assembly Slowdown in South Africa and Iran

South Africa's 2024 vehicle output declined amid power shortages that disrupted steel stamping capacity, resulting in reduced demand for OEM primer, basecoat, and clearcoat. Iranian assemblers similarly trimmed production as part shortages and electricity curbs converged, causing refinish volumes to contract as vehicle replacement cycles extended. Suppliers diversify toward industrial maintenance and architectural lines, but retraining sales teams and recalibrating mixing plants for higher-volume decorative grades takes time. Although South Africa's government now incentivizes electric vehicle production, near-term coatings demand in the automotive sector industry remains subdued, shaving incremental growth from the Middle East and Africa paints and coatings market.

Other drivers and restraints analyzed in the detailed report include:

- Industrial Localization Policies Lifting OEM Coatings Demand

- Urban Housing Rebound in Key African Economies

- Volatile Crude-Linked Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic segment generated the largest revenue in 2025, accounting for 33.98% of the Middle-East and Africa paints and coatings market. Its flexibility, color retention, and cost efficiency underpin widespread use in exterior masonry and interior emulsion lines across hot, high-UV geographies such as Saudi Arabia and Sudan. Polyurethane, although smaller in volume, is forecast to compound at 4.28%, driven by LNG vessels, chemical storage tanks, and high-traffic flooring, where abrasion and chemical resistance justify premium pricing. The Middle East and Africa paints and coatings market size for polyurethane systems is projected to widen steadily as downstream petrochemical integration supplies local diisocyanate feedstocks. Epoxy enjoys strong uptake around Gulf refineries and pipeline corridors, whereas polyester gains share within powder coating for aluminum window frames and household appliances, improving scratch resistance and transfer efficiency. Specialty resins, including fluoropolymers for self-cleaning skyscraper facades and silicones for heat-stable stacks, expand albeit from a low base, reflecting the progressive diversification of resin chemistries across the region.

The acrylic share is expected to erode modestly as sustainability regulations intensify and polyurethanes, epoxies, and hybrid chemistries deliver superior lifecycle costs in aggressive service environments. Nevertheless, decorative formulators continue to innovate within acrylic by integrating graphene oxide, hollow glass beads, and bio-based plasticizers, thereby sustaining relevance in mass housing and mid-tier commercial projects. Multinationals leverage global research and development to localize weathering-accelerated formulas, while regional champions exploit cost-advantaged bulk acrylic latex imports to defend share in budget lines. These dynamics ensure that resin choice remains a critical battlefield within the Middle East and Africa paints and coatings market.

The Middle-East and Africa Paints and Coatings Market Report is Segmented by Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Others), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV-Cured Coating), End-User Industry (Architectural, Automotive, Industrial Wood, Protective, and More), and Geography (Saudi Arabia, Qatar, Kuwait, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Al-Tabieaa Company

- Atlas Peintures

- Axalta Coating Systems

- Basco Paints

- BASF SE

- Beckers Group

- Crown Paints Kenya PLC

- DAW SE (Caparol)

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings

- PACHIN

- PPG Industries Inc.

- Qemtex

- RPM International Inc.

- Saba Shimi Aria

- Terraco Holdings Limited

- The Sherwin-Williams Company

- Thermilate Middle East

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tourism-led construction boom across GCC and Red Sea

- 4.2.2 Public megaproject pipelines (NEOM, Lusail, Expo City)

- 4.2.3 Industrial localisation policies lifting OEM coatings demand

- 4.2.4 Urban housing rebound in key African economies

- 4.2.5 Heritage-site restoration funding for breathable mineral paints

- 4.3 Market Restraints

- 4.3.1 Automotive assembly slowdown in South Africa and Iran

- 4.3.2 Volatile crude-linked raw-material prices

- 4.3.3 Trade sanctions limiting raw-material inflows into Iran

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Others (Silicone, Vinly, Fluoropolymer)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 By End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Industrial Wood

- 5.3.4 Protective

- 5.3.5 Transportation

- 5.3.6 General Industrial

- 5.3.7 Packaging

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 Qatar

- 5.4.3 Kuwait

- 5.4.4 United Arab Emirates

- 5.4.5 Iran

- 5.4.6 Iraq

- 5.4.7 Nigeria

- 5.4.8 South Africa

- 5.4.9 Turkey

- 5.4.10 Tanzania

- 5.4.11 Kenya

- 5.4.12 Algeria

- 5.4.13 Morocco

- 5.4.14 Egypt

- 5.4.15 Rest of Middle-East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Al-Tabieaa Company

- 6.4.3 Atlas Peintures

- 6.4.4 Axalta Coating Systems

- 6.4.5 Basco Paints

- 6.4.6 BASF SE

- 6.4.7 Beckers Group

- 6.4.8 Crown Paints Kenya PLC

- 6.4.9 DAW SE (Caparol)

- 6.4.10 Hempel A/S

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd.

- 6.4.14 National Paints Factories Co. Ltd.

- 6.4.15 Nippon Paint Holdings

- 6.4.16 PACHIN

- 6.4.17 PPG Industries Inc.

- 6.4.18 Qemtex

- 6.4.19 RPM International Inc.

- 6.4.20 Saba Shimi Aria

- 6.4.21 Terraco Holdings Limited

- 6.4.22 The Sherwin-Williams Company

- 6.4.23 Thermilate Middle East

- 6.4.24 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment