|

市场调查报告书

商品编码

1907340

聚碳酸酯(PC):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Polycarbonate (PC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

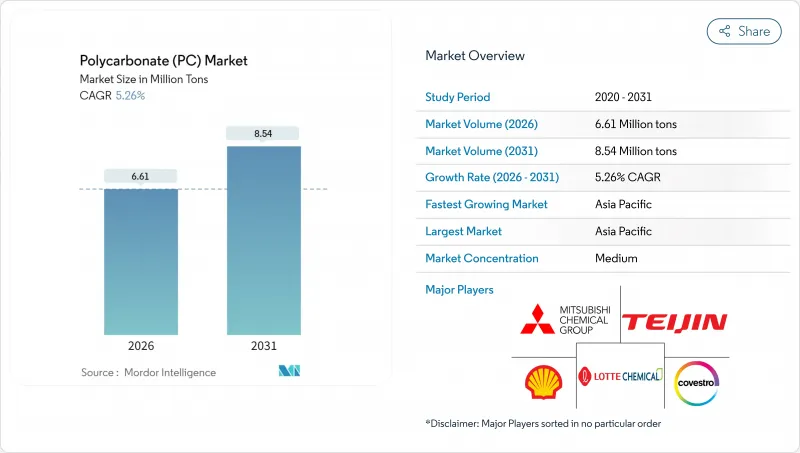

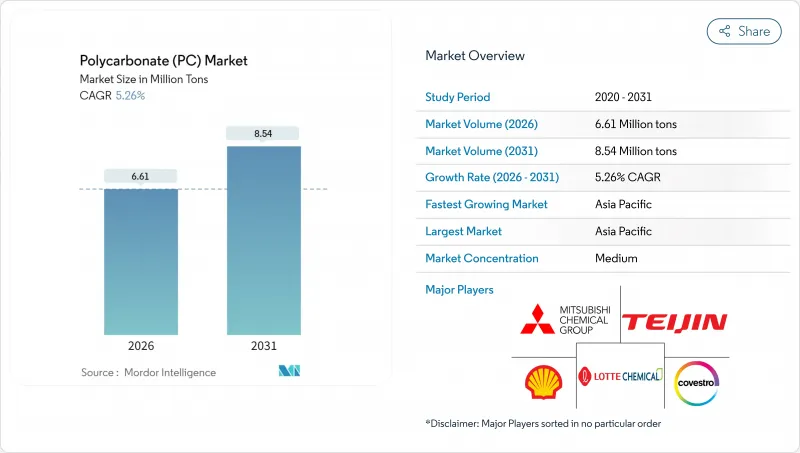

预计聚碳酸酯(PC)市场将从2025年的628万吨成长到2026年的661万吨,到2031年达到854万吨,2026年至2031年的复合年增长率为5.26%。

随着聚碳酸酯在电动车、5G基础设施和mini-LED显示器等领域取代更重、更不耐用的材料,市场需求正在加速成长。同时,其抗衝击性、光学透明度和热稳定性使其能够抵御经济波动。诸如沙乌地基础工业公司(SABIC)和中国石化在中国成立的年产26万吨的合资企业,以及乐天化学投资39亿美元的芝勒贡综合设施等投资项目,有助于保障亚洲地区的供应安全并降低物流成本。北美和欧洲仍然是受法规主导的买家。欧盟建筑产品法规强制要求使用阻燃建筑幕墙,而聚碳酸酯固有的阻燃性能恰好满足了这项要求。儘管人们对原材料成本波动和双酚A污染问题有所担忧,但技术创新、可再生原料等级的提升以及产业链的后向整合将有助于保障生产商的利润率并维持市场成长。

全球聚碳酸酯(PC)市场趋势及展望

主流电动车对汽车玻璃的需求

随着电动车的快速普及,汽车製造商纷纷用轻质透明面板取代玻璃,从而减轻40-50%的重量并延长续航里程,电动车市场正蓬勃发展。科思创的抗紫外线聚碳酸酯产品可保持透明度超过10年,彻底解决了传统玻璃泛黄的问题,并有助于全景天窗的整合。特斯拉Model S Plaid车型采用聚碳酸酯车顶面板,实现了15公斤的减重。自动驾驶座舱设计的演进导致玻璃表面积不断增加,进而推动了对能够容纳天线、加热器和感测器且不影响结构完整性的材料的需求。亚洲纯电动车平台的目标续航里程为500公里,每辆车最多使用6平方公尺的聚碳酸酯玻璃,这使得该细分市场成为推动聚碳酸酯整体市场需求的关键因素。

家用电子电器用迷你LED扩散透镜

Mini-LED面板每块萤幕需要数千个透镜,每个透镜都采用聚碳酸酯精密模製而成,以确保200微米以下像素的亮度均匀。三星2025年的旗舰电视采用了纹理聚碳酸酯光学元件,与传统LED背光相比,光提取效率提高了12%。苹果MacBook Pro的采用标誌着该技术在多种设备上的广泛应用,每块65吋显示器大约需要25,000个透镜,这极大地推动了聚碳酸酯市场产能的成长。 -20°C至85°C的热稳定性确保了屈光的一致性,而高填充率的模腔成型则缩短了生产週期并减少了废弃物。虽然元件小型化主要集中在韩国、台湾和中国当地,但北美工厂也正在扩大生产规模,以确保区域供应的稳定性。

双酚A的监管趋势

欧洲食品安全局 (EFSA) 2024 年发布的指南大幅降低了双酚 A (BPA) 的每日可接受摄取量,并将聚碳酸酯从大多数直接接触食品的产品中移除。加州 65 号提案的标籤强制令提高了消费者的意识,并鼓励零售商优先选择无BPA 的替代品。目前,医疗设备竞标必须提供无BPA 的认证,这不仅保障了高额利润,也增加了特种级聚碳酸酯的配製成本。儘管包装领域的损失抑制了聚碳酸酯市场的整体成长,但生产商正在加速使用生物基双酚 A 替代品和解聚回收技术,以期重新获得食品级聚碳酸酯的通路。

细分市场分析

预计到2025年,电气和电子产业将占聚碳酸酯市场份额的36.32%,并在2031年之前以6.75%的复合年增长率成长。这反映了该行业既是大规模生产的基础,也是技术创新的驱动力。半导体无尘室需要低挥发性组件,而迷你LED光学元件和5G收发器机壳需要耐热性和高频渗透性。 《晶片技术创新法案》(CHIPS Act)提供的520亿美元资金正在推动新建晶圆厂,每个晶圆厂都需要数千个聚碳酸酯滤波器外壳和工具罩。

汽车产业位居第二,其电动平台采用了轻质、尺寸合适的玻璃组件和电池机壳。汽车製造商看重聚碳酸酯与高级驾驶辅助系统 (ADAS) 感测器的兼容性。随着欧盟建筑产品法规 (CPR) 推荐使用阻燃板材,建筑业的需求稳定成长。包装产业在双酚A (BPA) 管制区域之外是一个小众市场,主要集中在五加仑水瓶和微波炉适用容器上。工业机械、航太和医疗设备的需求正在多元化,这支撑了聚碳酸酯市场对单一下游产业的不依赖性。

聚碳酸酯市场报告按终端用户产业(航太、汽车、建筑、电气电子、工业机械、包装及其他)、产品类型(片材、薄膜及其他)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以价值(美元)和销售量(吨)为单位。

区域分析

预计到2025年,亚太地区将占聚碳酸酯市场64.10%的份额,并在2031年之前以5.61%的复合年增长率持续成长。中国的Delta和珠三角电子Delta丛集对特种级聚碳酸酯的需求旺盛,而龙盛等国内製造商正在新增52万吨的年产能以抵销进口需求。日本在用于相机镜头的光学级聚碳酸酯复合材料技术方面处于领先地位,而韩国则推动了主要智慧型手机和电动车电池製造商的需求。印度的生产关联激励(PLI)计画正在促进LED照明灯具和白色家电的在地化生产,从而提振区域消费。

北美是第二大消费地区,这主要得益于中西部地区的电动车生产以及亚利桑那州和德克萨斯州新建的半导体工厂。科思创正在俄亥俄州投资数亿欧元,生产用于充电站和5G模组的导热复合复合材料。随着家电和汽车线束供应商从亚洲迁至墨西哥,墨西哥也受惠于近岸外包模式。

欧洲正在采购聚碳酸酯,用于高端汽车、医疗设备和阻燃建筑幕墙板。德国是聚碳酸酯的主要生产国,而法国和义大利则采用薄壁聚碳酸酯製造智慧电錶机壳。欧盟的CPR法规正在推动易燃塑胶被自熄性塑胶所取代。南美洲以及中东和非洲的市场规模较小,但具有重要的战略意义。巴西汽车产业的復苏以及利雅德和杜拜等海湾地区的大型计划,都代表着成长机会,未来可能需要建造树脂仓库和混炼生产线。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 主流电动车对汽车玻璃的需求

- 家用电子电器用迷你LED扩散透镜

- 5G基础设施的雷达罩和天线罩

- 加速推广节能型LED照明光学元件

- 符合欧盟化学物质法规 (CPR) 的阻燃建筑幕墙

- 市场限制

- 双酚A的监管

- 易挥发性苯酚和丙酮原料价格的波动

- 生物基共聚酯的OEM替代品

- 价值链分析

- 监管环境

- 进出口分析

- 价格趋势

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 新进入者的威胁

- 终端用户产业趋势

- 航太(航太零件生产收入)

- 汽车(汽车生产)

- 建筑与施工(新增建筑面积)

- 电气电子设备(电气电子设备生产收入)

- 包装(塑胶包装数量)

- 回收利用概述

第五章 市场规模及成长预测(价值及数量)

- 按最终用户行业划分

- 航太

- 车

- 建筑/施工

- 电气和电子设备

- 工业和机械

- 包装

- 其他终端用户产业

- 依产品类型

- 床单

- 电影

- 其他产品类型

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 亚太其他地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率**(%)/排名分析

- 公司简介

- Axxicon BV

- CHIMEI

- Covestro AG

- Formosa Chemicals & Fibre Corp.

- Idemitsu Kosan Co., Ltd.

- LG Chem

- LOTTE Chemical Corporation

- Luxi Chemical Group

- Mitsubishi Chemical Group Corporation

- RTP Company

- SABIC

- Samtion Chemical

- Samyang Corporation

- TEIJIN LIMITED

- Trinseo PLC

第七章 市场机会与未来展望

第八章:执行长面临的关键策略挑战

The Polycarbonate Market is expected to grow from 6.28 million tons in 2025 to 6.61 million tons in 2026 and is forecast to reach 8.54 million tons by 2031 at 5.26% CAGR over 2026-2031.

Demand accelerates as polycarbonate replaces heavier or less durable materials in electric vehicles, 5G infrastructure, and mini-LED displays, while remaining resilient to economic fluctuations due to its impact resistance, optical clarity, and thermal stability. Investments such as SABIC-SINOPEC's 260,000 tpa joint venture in China and Lotte Chemical's USD 3.9 billion Cilegon complex add supply security and lower logistics costs in Asia. North America and Europe follow as regulation-driven buyers; the EU Construction Products Regulation requires flame-retardant facades that favor polycarbonate's inherent fire resistance. Despite raw material cost swings and scrutiny of bisphenol-A, technology upgrades, renewable feedstock grades, and backward integration protect producer margins and sustain growth.

Global Polycarbonate (PC) Market Trends and Insights

Mainstream EV Demand in Automotive Glazing

Rapid electric-vehicle adoption is lifting the polycarbonate market as OEMs replace glass with lightweight transparent panels that cut 40-50% mass and extend driving range. Covestro's UV-stable grades maintain clarity for over a decade, which resolves earlier yellowing issues and encourages panoramic roof integration. Tesla's Model S Plaid illustrates the benefit with a 15 kg weight reduction from polycarbonate roof panels. Design evolution toward autonomous cabins increases glazed surface area, escalating demand for materials that host antennas, heaters, and sensors without losing structural strength. Asian battery-electric platforms targeting 500 km range now specify up to 6 m2 of polycarbonate glazing per vehicle, reinforcing the segment's pull on overall polycarbonate market volumes.

Consumer Electronics Mini-LED Diffusion Lenses

Mini-LED panels require thousands of lenslets per screen, each precision-molded in polycarbonate to maintain uniform luminance across sub-200 µm pixels. Samsung's 2025 flagship televisions use textured polycarbonate optics that raise light extraction by 12% versus legacy LED backlights. Apple's MacBook Pro adoption signals cross-device acceptance, and every 65-inch display consumes roughly 25,000 lenslets, creating large incremental tonnage for the polycarbonate market. Thermal stability from -20 °C to 85 °C ensures refractive-index consistency, while high-fill cavity molding cuts takt time and waste. Component miniaturization centers activity in Korea, Taiwan, and mainland China, but North American fabs are scaling to secure regional supply resilience.

Bisphenol-A Regulatory Scrutiny

The European Food Safety Authority's 2024 guidance slashed tolerable daily BPA intake, excluding polycarbonate from most direct food-contact products. California's Proposition 65 labels broaden consumer awareness, pushing retailers to favor BPA-free alternatives. Medical-device tenders now request BPA-free certification, raising formulation costs for specialty grades yet protecting premium margins once certified. Packaging losses temper overall polycarbonate market growth, but producers are accelerating bio-based bisphenol substitutes and depolymerization recycling to regain food-grade channels.

Other drivers and restraints analyzed in the detailed report include:

- 5G Infrastructure Radomes and Antenna Covers

- Accelerating Adoption of Energy-Efficient LED Lighting Optics

- Volatile Phenol-Acetone Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electrical and Electronics held 36.32% of the polycarbonate market share in 2025 and is forecast to log a 6.75% CAGR through 2031, reflecting its position as both volume anchor and innovation hub. Semiconductor cleanrooms need low-outgassing parts, while mini-LED optics and 5G transceiver bodies demand heat tolerance and RF transparency. The CHIPS Act funds of USD 52 billion stimulate the construction of new wafer fabs, each requiring thousands of PC filtration housings and tooling covers.

Automotive ranks second as electrified platforms adopt lightweight right-size glazing and battery enclosures. OEMs value polycarbonate's sensor compatibility for advanced driver assistance systems. The building and Construction Sector shows steady uptake because the EU CPR favors flame-retardant panels. Packaging remains niche outside BPA-restricted regions, with a focus on five-gallon water bottles and microwave-safe containers. Industrial machinery, aerospace, and medical devices complement diversified demand, ensuring that the polycarbonate market is not reliant on a single downstream sector.

The Polycarbonate Market Report is Segmented by End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, and Others), Product Type (Sheet, Film, and Other Product Types), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

Geography Analysis

Asia-Pacific controlled 64.10% of the polycarbonate market in 2025 and is projected to expand at a 5.61% CAGR to 2031. China's electronics clusters in the Yangtze and Pearl River Deltas consume specialty grades, while domestic producers such as Rongsheng add 520,000 tpa capacity to balance imports. Japan pioneers optical-grade formulations for camera lenses, and South Korea channels demand from smartphone and EV battery giants. India's Production-Linked Incentive scheme spurs the localized production of LED luminaires and white goods, thereby increasing regional consumption.

North America ranks second, driven by EV production in the Midwest and the construction of new chip fabs in Arizona and Texas. Covestro invested a low triple-digit million euros in Ohio to compound thermally conductive grades for charging stations and 5G modules. Mexico benefits from near-shoring as appliance and auto wire-harness suppliers migrate from Asia.

Europe buys polycarbonate for premium vehicles, medical devices, and flame-retardant facade panels. Germany leads volume, while France and Italy adopt thin-wall PC for smart-meter enclosures. EU CPR rules encourage replacement of combustible plastics with self-extinguishing grades. South America and the Middle East & Africa remain small but strategic; Brazil's automotive rebound and Gulf mega-projects in Riyadh and Dubai present pockets of growth that may justify future resin warehouses or compounding lines.

- Axxicon B.V.

- CHIMEI

- Covestro AG

- Formosa Chemicals & Fibre Corp.

- Idemitsu Kosan Co., Ltd.

- LG Chem

- LOTTE Chemical Corporation

- Luxi Chemical Group

- Mitsubishi Chemical Group Corporation

- RTP Company

- SABIC

- Samtion Chemical

- Samyang Corporation

- TEIJIN LIMITED

- Trinseo PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream EV demand in automotive glazing

- 4.2.2 Consumer-electronics mini-LED diffusion lenses

- 4.2.3 5G infrastructure radomes and antenna covers

- 4.2.4 Accelerating adoption of energy-efficient LED lighting optics

- 4.2.5 EU CPR-mandated flame-retardant facades

- 4.3 Market Restraints

- 4.3.1 Bisphenol-A regulatory scrutiny

- 4.3.2 Volatile phenol-acetone feedstock pricing

- 4.3.3 OEM substitution toward bio-based copolyesters

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Import and Export Analysis

- 4.7 Price Trends

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of Substitutes

- 4.8.4 Competitive Rivalry

- 4.8.5 Threat of New Entrants

- 4.9 End-use Sector Trends

- 4.9.1 Aerospace (Aerospace Component Production Revenue)

- 4.9.2 Automotive (Automobile Production)

- 4.9.3 Building and Construction (New Construction Floor Area)

- 4.9.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.9.5 Packaging(Plastic Packaging Volume)

- 4.10 Recycling Overview

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By End-user Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 By Product Type

- 5.2.1 Sheet

- 5.2.2 Film

- 5.2.3 Other Product Types

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 Canada

- 5.3.2.2 Mexico

- 5.3.2.3 United States

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share** (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Axxicon B.V.

- 6.4.2 CHIMEI

- 6.4.3 Covestro AG

- 6.4.4 Formosa Chemicals & Fibre Corp.

- 6.4.5 Idemitsu Kosan Co., Ltd.

- 6.4.6 LG Chem

- 6.4.7 LOTTE Chemical Corporation

- 6.4.8 Luxi Chemical Group

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 RTP Company

- 6.4.11 SABIC

- 6.4.12 Samtion Chemical

- 6.4.13 Samyang Corporation

- 6.4.14 TEIJIN LIMITED

- 6.4.15 Trinseo PLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment