|

市场调查报告书

商品编码

1910478

针状焦:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Needle Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

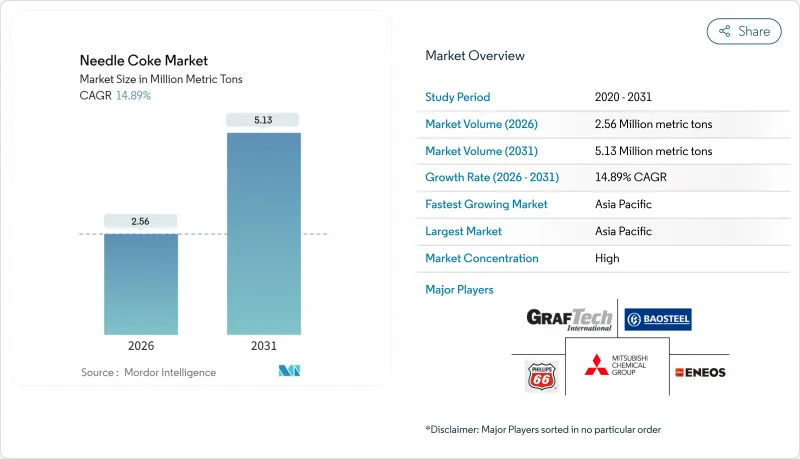

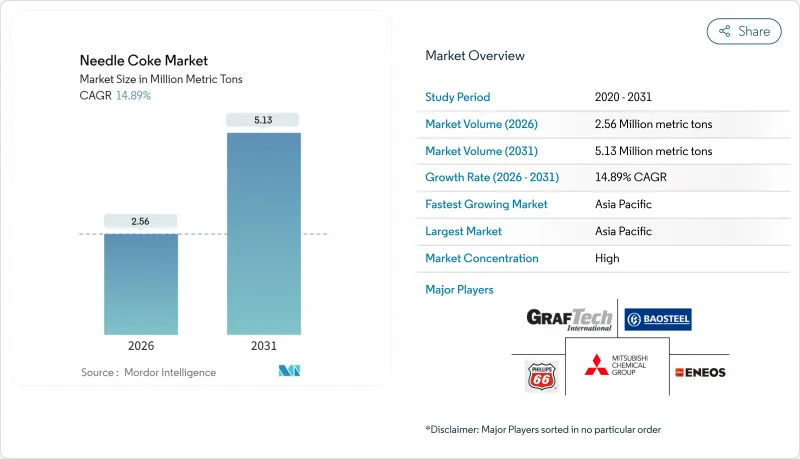

2025年针状焦市场价值为223万吨,预计2031年将达到513万吨,高于2026年的256万吨。

预测期(2026-2031 年)的复合年增长率预计为 14.89%。

这项急剧成长主要受电弧炉炼钢和锂离子电池製造的同步发展所驱动,这两个产业正在重塑全球碳材料需求格局。钢铁业向电弧炉技术的转型加速了对超高功率石墨电极的需求,而电动车的蓬勃发展则推动了对合成石墨负极材料的需求。原材料供应紧张、生产集中以及新的贸易限制等因素共同导致针状焦市场持续供不应求,加剧了价格上涨趋势。拥有稳定油料供应和先进延迟焦化设备的生产商仍然掌握定价权。

全球针焦市场趋势及展望

增加对电钢生产能力的投资

全球钢铁生产商正加速从高炉炼钢向电弧炉(EAF)技术转型,以减少碳排放并提高原料柔软性。目前,电弧炉产能已占全球钢铁产量的30%,并占2025年底计画新增产能的43%。印度的国家钢铁政策目标是到2030年电弧炉产能占比达到40%,而中国则计画在2025年实现15%的电弧炉产能占比。新建电弧炉需要使用由优质石油针状焦製成的超高功率电极,而钢铁脱碳直接导致针状焦需求总量增加。儘管亚太地区仍是电弧炉计划的主要运作来源地,但北美主要钢铁生产商也在增建电弧炉,以实现永续性目标并利用丰富的废钢供应。这一趋势正在推动综合焦炭生产商扩大产能,并已签订多年期承购协议。

电动车用锂离子电池生产快速扩张

锂离子电池製造业的扩张速度远超预期。预计到2023年,全球电动车电池工厂将消耗超过63万吨石墨,随着新的超级工厂投入运作,到2020年代中期,这一数字预计将翻倍。合成石墨在快速充电稳定性和纯度方面具有显着的性能优势,从而推动了高能量密度负极材料的日益普及。为确保供应,汽车製造商正与针状焦基合成石墨供应商签订长期合约。例如,Panasonic能源已与NOVONIX公司签署合同,并将于2025年开始交付。负极材料需求的快速成长正将石油基针状焦从其传统的炼钢客户转向其他用途,导致全球原料供应紧张。这也推高了针状焦市场主要生产商的利润率。

延迟焦炭生产中的职业和环境危害。

美国环保署 (EPA) 2024 年焦炉法规要求炉门零洩漏并持续监测苯排放,迫使业者对排放控制设备进行维修。 40 CFR 第 63 部分的类似措施加强了对炼油厂焦炭罐的监管,增加了遵循成本和停机风险。这些强制性规定可能在短期内对产量造成压力,抑制产能扩张,并将新增产能转移到监管较少的地区。供应限制很可能在需求放缓之前显现,从而加剧针状焦市场的价格波动。

细分市场分析

2025年,石油基原料占针状焦市场份额的85.12%,预计到2031年将以16.05%的复合年增长率成长。此细分市场受益于成熟的延迟焦化基础设施、可靠的FCC脱氢器油供应以及优异的晶体取向,从而满足高功率电极的精度要求。预计到2025年,市场规模将成长至约190万吨,到2031年将超过450万吨,凸显了石油基针状焦市场在整个碳材料价值链上的扩张趋势。虽然合成石墨阳极的应用将进一步推动市场成长,但美国和西欧炼厂的合理化改造正在造成区域性原料短缺。亚洲炼厂继续运作灵活的焦化装置,部分抵消了其他地区的供应下降。

煤焦油沥青基产品占据了剩余的市场份额,为电极和电池製造商提供了一条重要的多元化发展途径。儘管面临技术挑战,两家商业化煤针焦工厂仍维持了稳定的生产,直至2024年。与冶金焦炉的上游整合,为营运商在钢铁业蓬勃发展的周期中提供了额外的成本优势。沥青供应的限制限制了成长潜力,但逐步消除瓶颈将确保该细分市场保持其重要性。催化剂辅助石墨化技术的研究进展可望提高煤针焦的质量,并有可能提升该产品在针焦市场的份额。

本针状焦市场报告按产品类型(石油基针状焦、煤焦油沥青基针状焦)、应用领域(石墨电极、锂离子电池及其他应用)和地区(亚太地区、北美地区、欧洲地区、南美地区、中东和非洲地区)对市场进行分析。市场预测以数量(公吨)为单位。

区域分析

亚太地区占针状焦市场87.74%的份额,预计到2031年将维持15.49%的复合年增长率。中国是针状焦供需的双重驱动力,2023年粗钢产量超过9亿吨,并拥有全球最大的电池负极材料产能。 2023年底,中国开始实施高纯度石墨出口许可证制度,导致北京的出口量较去年同期下降91%。此举加剧了西方买家对供应链的担忧。印度已成为需求驱动力,其目标是到2035年实现年产2.4亿至2.6亿吨钢铁,并计划将其电弧炉(EAF)普及率提高到40%。

北美市场规模虽小,但其策略重要性正透过在地化策略日益凸显。美国提案对中国石墨征收93.5%的关税,凸显了对自给自足的重视。随着政策支持循环经济钢铁生产和电池回收,预计欧洲市场将出现温和的销售成长。芬兰斯道拉恩索的木质素和石墨工厂象征芬兰对低碳负极材料的承诺。

南美洲、中东和非洲等地区虽然仍处于技术应用的早期阶段,但已展现出日益浓厚的兴趣。沙乌地阿拉伯于2024年授予雪佛龙拉姆斯全球公司一项年产7.5万吨针状焦联合装置的生产许可证,这标誌着该地区首次大规模涉足特种焦领域。同时,埃及和巴西等新兴钢铁产业丛集正在探索在地化供应电极的可能性,以减少对进口的依赖。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 增加电炉炼钢产能的投资

- 电动车用锂离子电池产量快速成长

- 中国和欧盟的废钢强制回收规定

- 炼油厂升级改造增加了低硫离心油的供应。

- 闭合迴路石墨回收计划

- 市场限制

- 延迟焦化过程中的职业和环境危害。

- 原料价格波动(蒸馏油、煤焦油)

- 生物基硬碳负极材料的前景

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格概览

第五章 市场规模与成长预测

- 依产品类型

- 石油基针状焦

- 煤焦油沥青基针状焦

- 透过使用

- 石墨电极

- 锂离子电池

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Baosteel Group

- China National Petroleum Corporation

- ENEOS Corporation

- GrafTech International

- Indian Oil Corporation

- Mitsubishi Chemical Group Corporation

- Nippon Steel Corporation

- PetroChina

- Phillips 66 Company

- POSCO Future M

- Shandong Yida New Materials Co., Ltd.

- Shanxi Hongte Coal Chemical Co Ltd

- Sinopec

- Tokai Carbon Co., Ltd

第七章 市场机会与未来展望

The Needle Coke Market was valued at 2.23 million metric tons in 2025 and estimated to grow from 2.56 million metric tons in 2026 to reach 5.13 million metric tons by 2031, at a CAGR of 14.89% during the forecast period (2026-2031).

This rapid upswing stems from the parallel rise of electric-arc-furnace (EAF) steelmaking and lithium-ion battery manufacturing, two sectors that together reshape global carbon material demand. The steel industry's move toward EAF technology is intensifying the call for ultra-high-power graphite electrodes, while the electric-vehicle boom is expanding synthetic-graphite anode requirements. Tight feedstock availability, geographic concentration of production, and new trade controls are creating persistent supply tension that reinforces upward pricing trends across the needle coke market. Producers with secure decant-oil supply and advanced delayed-coking assets continue to control pricing power.

Global Needle Coke Market Trends and Insights

Increasing Investments in EAF Steel Capacity

Global steelmakers are accelerating the shift from blast furnaces to EAF technology to cut carbon emissions and improve raw-material flexibility. EAF installations already contribute 30% of world steel output and account for 43% of planned capacity additions slated for late 2025. India's National Steel Policy targets an EAF share of up to 40% by 2030, while China seeks a 15% EAF contribution by 2025. Each new furnace requires ultra-high-power electrodes that rely on premium petroleum-needle coke, so steel decarbonization directly enlarges overall needle coke market demand. Capital spending on EAF projects remains focused in Asia-Pacific, yet North American steel majors are also adding arc furnaces to meet sustainability goals and capitalize on abundant scrap supply. The trend locks in multi-year offtake commitments and encourages integrated coke producers to expand capacity.

Soaring Li-ion Battery Production for EVs

Lithium-ion battery manufacturing is scaling at a pace that exceeds earlier forecasts. Global EV battery plants consumed more than 630,000 tons of graphite in 2023, a figure expected to multiply by mid-decade as new giga-factories begin operations. Synthetic graphite holds critical performance advantages in fast-charge stability and purity, underpinning rising penetration rates within high-energy-density anodes. To secure supply, automotive OEMs have struck long-term agreements with needle-coke-based synthetic-graphite suppliers such as Panasonic Energy's pact with NOVONIX that commences deliveries in 2025. The surge in anode demand draws petroleum-based needle coke away from traditional steel customers, tightening the global feedstock pool and supporting elevated margins for qualified producers inside the needle coke market.

Occupational and Environmental Hazards in Delayed Coking

The U.S. Environmental Protection Agency's 2024 coke-oven rule mandates zero leaking doors and continuous benzene monitoring, pushing operators to retrofit emission controls. Similar measures under 40 CFR Part 63 tighten oversight of refinery coking drums, escalating compliance spend and downtime risk. These obligations strain output in the near term, curb expansion appetite, and may shift new capacity to regions with less stringent frameworks. For the needle coke market, supply constraints materialize faster than demand moderation, amplifying volatility.

Other drivers and restraints analyzed in the detailed report include:

- Scrap-Steel Mandates in China and EU

- Refinery Upgrades Boosting Low-Sulphur Decant-Oil Supply

- Raw-Material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petroleum-based material captured 85.12% of the needle coke market share in 2025 and is forecast to advance at a 16.05% CAGR to 2031. The segment benefits from established delayed-coking infrastructure, reliable FCC decant-oil supply, and superior crystalline orientation that meets ultra-high-power electrode tolerances. It grew to roughly 1.90 million tons in 2025 and should exceed 4.50 million tons by 2031, underscoring the rising petroleum needle coke market size within the larger carbon-materials value chain. Adoption of synthetic-graphite anodes injects additional momentum, but refinery rationalization in the United States and Western Europe introduces regional feed shortages. Asian refiners continue to commission flexi-coker units, offsetting partial supply loss elsewhere.

Coal-tar-pitch-based products occupy the remaining volume but supply an important diversification lever for electrode and battery producers. Despite technical hurdles, the two commercial coal-needle plants maintained stable output through 2024. Upstream integration with metallurgical coke ovens gives operators incremental cost advantages when steel cycles are favorable. Growth potential stays capped by limited pitch availability, yet incremental debottlenecking keeps the segment relevant. Ongoing research into catalyst-assisted graphitization may elevate coal-needle quality, broadening its addressable share in the needle coke market.

The Needle Coke Market Report is Segmented by Product Type (Petroleum-Based Needle Coke and Coal-Tar Pitch-Based Needle Coke), Application (Graphite Electrodes, Lithium-Ion Batteries, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Metric Tons).

Geography Analysis

Asia-Pacific leads with 87.74% of the needle coke market and is projected to preserve a 15.49% CAGR through 2031. China anchors both supply and demand, producing more than 900 million tons of crude steel in 2023 and operating the world's largest battery-anode capacity. Beijing's export license requirement for high-purity graphite introduced in late 2023 reduced outbound shipments by 91% year on year, a development that heightened supply-chain vigilance among Western buyers. India emerges as a demand multiplier as it targets 240-260 million tons of annual steel by 2035 and intends to lift EAF penetration to 40%.

North America accounts for a smaller base yet gains strategic relevance through localization. Tariff proposals of 93.5% on Chinese graphite underscore Washington's focus on self-reliance. Europe holds moderate volume growth as policy favors circular-economy steel production and battery recycling. Stora Enso's lignin-graphite plant in Finland signals commitment to lower-carbon anode material.

Other territories such as South America, the Middle East, and Africa are at earlier adoption stages but record growing interest. Saudi Arabia awarded Chevron Lummus Global a 75,000 TPA needle-coke complex license in 2024, marking the Middle East's first large-scale entry into specialty coke, while emerging steel clusters in Egypt and Brazil explore local electrode supply to reduce import exposure.

- Baosteel Group

- China National Petroleum Corporation

- ENEOS Corporation

- GrafTech International

- Indian Oil Corporation

- Mitsubishi Chemical Group Corporation

- Nippon Steel Corporation

- PetroChina

- Phillips 66 Company

- POSCO Future M

- Shandong Yida New Materials Co., Ltd.

- Shanxi Hongte Coal Chemical Co Ltd

- Sinopec

- Tokai Carbon Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Investments in EAF Steel Capacity

- 4.2.2 Soaring Li-Ion Battery Production for Evs

- 4.2.3 Scrap-Steel Mandates in China and EU

- 4.2.4 Refinery Upgrades Boosting Low-Sulphur Decant Oil Supply

- 4.2.5 Closed-Loop Graphite Recycling Initiatives

- 4.3 Market Restraints

- 4.3.1 Occupational and Environmental Hazards in Delayed Coking

- 4.3.2 Raw-Material Price Volatility (Decanter Oil, Coal Tar)

- 4.3.3 Prospect of Bio-Based Hard-Carbon Anode Materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Price Overview

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Petroleum-based Needle Coke

- 5.1.2 Coal-tar Pitch-based Needle Coke

- 5.2 By Application

- 5.2.1 Graphite Electrodes

- 5.2.2 Lithium-ion Batteries

- 5.2.3 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Baosteel Group

- 6.4.2 China National Petroleum Corporation

- 6.4.3 ENEOS Corporation

- 6.4.4 GrafTech International

- 6.4.5 Indian Oil Corporation

- 6.4.6 Mitsubishi Chemical Group Corporation

- 6.4.7 Nippon Steel Corporation

- 6.4.8 PetroChina

- 6.4.9 Phillips 66 Company

- 6.4.10 POSCO Future M

- 6.4.11 Shandong Yida New Materials Co., Ltd.

- 6.4.12 Shanxi Hongte Coal Chemical Co Ltd

- 6.4.13 Sinopec

- 6.4.14 Tokai Carbon Co., Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment