|

市场调查报告书

商品编码

1910577

神经行销:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Neuromarketing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

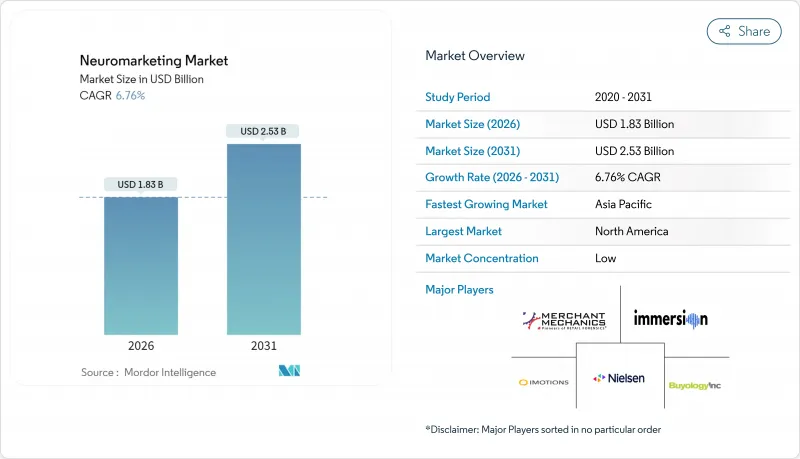

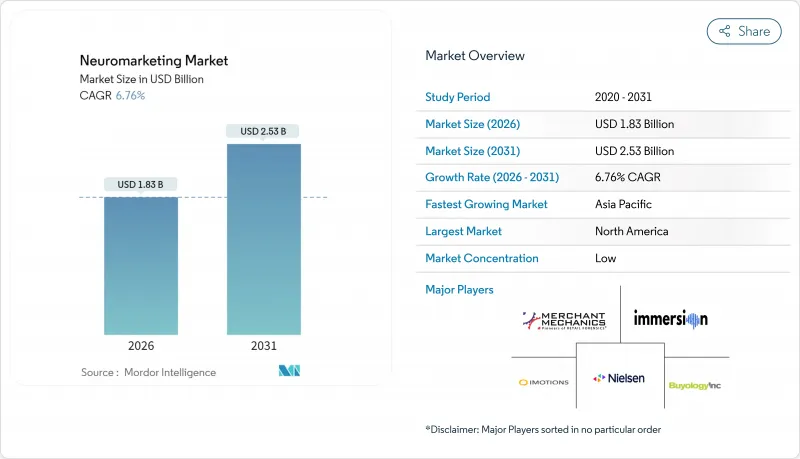

预计到 2026 年,神经行销市场价值将达到 18.3 亿美元,高于 2025 年的 17.1 亿美元,预计到 2031 年将达到 25.3 亿美元,2026 年至 2031 年的复合年增长率为 6.76%。

这项扩张的驱动力源自于脑电图 (EEG) 和机器学习系统在预测购买意愿方面高达 87.1% 的准确率,身临其境型和扩增实境测试环境的兴起,以及隐私法规与传统消费者洞察工具之间日益扩大的差距。全球品牌正将神经行销平台视为宣传活动预测试、受众细分和用户体验优化的基础,而投资者则在支持那些致力于将硬体小型化与云端分析相结合的新业务。加州 SB 1223 法案和欧盟 GDPR 等严格的资料保护法律迫使供应商采用保护隐私的设计原则,虽然增加了合规成本,但也创造了可持续的竞争优势。随着大型科技公司收购专业公司并将神经测量功能嵌入其更广泛的行销技术体系中,产业整合正在进行中。

全球神经行销市场趋势与洞察

对先进行销工具的需求不断增长

品牌行销人员面临着碎片化的数位化体验,这削弱了点击率和转换率作为衡量用户参与度的重要指标。基于脑电图 (EEG) 并结合机器学习的系统能够提供即时认知指标,例如认知负荷、情绪唤醒和购买意向,这些指标与销售成长直接相关。一项突破性研究表明,神经生物学测量方法在购买预测方面取得了显着成效,其准确率高达 87.1%,而传统问卷的准确率仅为 64%。采用这些工具的消费品公司能够更快地迭代创新,减少媒体浪费,并提高广告支出报酬率。在竞争激烈的线上市场中,对更深入的行为洞察的需求也日益增长。

引入人工智慧驱动的预测性注意力分析

神经行销供应商利用卷积类神经网路和梯度提升模型,在宣传活动启动前预测受众的注意力模式。基于大规模多模态集的训练,能够实现跨文化细分,区分不同人群之间微妙的情感征兆。功能性近红外线光谱 (fNIRS) 研究揭示了跨文化融合广告中存在性别特异性的前额叶活化模式,使品牌能够基于神经生物学兼容性优化通讯。预测范围不仅限于单一创新,还能预测长期的品牌价值轨迹,进而引导预算分配和投资组合指南。将这些预测引擎整合到媒体规划流程中的公司,可以将洞察週期从数週缩短至数小时。

黄金标准神经影像技术(fMRI)的高昂资本成本

一套完整的fMRI设备造价可能超过300万美元,每年的维修费用高达20万美元。虽然大型製药企业能够负担这样的支出,但大多数广告公司和Start-Ups却难以企及。这种资金壁垒加剧了资源匮乏的机构之间的两极化:资源雄厚的机构能够获得高解析度数据,而其他机构则依赖低成本的脑电图(EEG)和眼动追踪技术。携带式近红外线光谱(fNIRS)设备能够以fMRI十分之一的成本提供约75%的精度,但目前尚无法完全复製全脑成像。这项限制阻碍了fNIRS的大规模应用,并减缓了调查方法的创新。

细分市场分析

到2025年,零售和消费品品牌将占据神经行销市场37.12%的份额,主要得益于消费品产业的大规模宣传活动测试。然而,医疗保健和製药应用领域的成长速度最快,年复合成长率达7.12%。基于神经科学的内容能够提高患者的依从性和参与临床试验的意愿,从而推动医疗传播领域神经行销市场规模的成长。製药行销人员正在利用数位生物标记即时监测认知副作用。同时,医院网路正在测试远端保健入口网站的使用者体验流程,以减少使用者操作障碍和爽约率。

银行和保险公司正在将神经回馈技术融入新的客户获取流程,以缩短表格填写时间并降低客户流失率。市场调查机构正将生物识别面板整合到传统的调查体系中,以提高预测效度。学术机构正在利用公私津贴扩建脑机介面实验室,尤其是在亚太地区,各国政府正在资助转化神经科学研究。汽车和娱乐公司正在探索车载情绪监测和故事板优化技术,以创造多样化的终端用户环境,从而增强需求韧性。

脑电图 (EEG) 预计在 2025 年将维持 40.28% 的收入份额,这主要得益于成熟的研究通讯协定和感测器成本的下降。功能性近红外线光谱 (fNIRS) 将以 7.35% 的年增长率成长,随着携带式无纤维帽的推出,其市场份额将进一步缩小。该帽子能够绘製使用者在实体货架或虚拟商店浏览时前额叶皮质的血氧饱和度图。随着头戴式设备製造商将光电二极体整合到混合实境设备中,fNIRS 解决方案的神经行销市场规模预计将会扩大。眼动追踪模组也受益于与智慧眼镜的集成,可用于评估驾驶时的注意力分散情况以及在零售货架上的注视情况。

对于高解析度的隐性品牌联想研究而言,功能性磁振造影(fMRI)仍然至关重要,即便预算压力促使人们倾向于采用更轻的方法。结合皮肤电反应和光电容积脉搏波描记法的可穿戴生物辨识技术,能够持续追踪消费者在全天消费行为中的情绪变化。新兴的脑波耳塞和神经形态感测器处于技术前沿,能够实现免持被动资料流,一旦达到可靠性阈值,便有望重塑调查方法的规范。

区域分析

到2025年,北美将占据神经行销市场41.20%的份额,这反映了该地区充裕的创业投资、强大的神经科学学术丛集以及清晰的隐私指南。同年,美国神经科技领域的资金筹措达23亿美元,共达成129笔交易,推动了突破性感测器设计和人工智慧流程的发展。加拿大透过公共津贴促进跨国合作,发挥了补充作用;而在墨西哥,随着数位广告技术的日趋成熟,消费品公司正在采用价格亲民的眼动追踪技术。苹果以2,200万美元收购Datakalab等併购活动,凸显了该地区对嵌入式神经分析能力的强劲需求。

预计到2031年,亚太地区将以7.83%的复合年增长率成长,随着中国、印度、日本和韩国将神经行销融入全通路零售、游戏和汽车体验,区域收入差距将逐渐缩小。在中国,政府研究津贴正支持神经人工智慧Start-Ups与全球品牌合作,而印度的D2C平台则在其可用性实验室中部署脑电图(EEG)头带。强调群体和谐的文化规范放大了社会认知指标的影响,促使当地机构定制研究通讯协定以捕捉集体主义因素。一家日本电子巨头和一家韩国娱乐集团正在率先建立身临其境型XR实验室,将功能性近红外光谱(fNIRS)和触觉回馈相结合,以提高产品发布的精准度。

在欧洲,德国的汽车製造传统、法国的奢侈品创意以及英国媒体机构的创新能力,共同支撑着强劲的需求。严格的GDPR(一般资料保护规范)正在推动边缘分析和联邦学习解决方案的发展,这些方案限制了个人资料传输,使欧洲供应商成为全球神经行销领域道德规范的标竿。诸如「人类大脑计划」之类的学术网路正在推动测量技术的进步,这些技术正逐步应用于商业产品。注重隐私的声誉正在吸引那些面临消费者日益增长的疑虑的跨国品牌,并将合规性提升转化为营收成长的催化剂。随着数位基础设施的加速发展以及跨国零售商对其全通路策略的在地化,南美以及中东和非洲地区也涌现出长期机会。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对先进行销工具的需求不断增长

- 基于智慧型手机的即时体验追踪技术的兴起

- 引入人工智慧驱动的预测性注意力分析

- 对符合隐私权保护规定、采用选择加入模式的消费者洞察的需求日益增长

- 神经行销与身临其境型XR平台的整合

- 增加神经科技Start-Ups的创业融资

- 市场限制

- 黄金标准神经影像学(fMRI)的高昂资本成本

- 监管环境分散和资料隐私限制

- 缺乏跨学科人才

- 消费者对潜意识操纵的怀疑态度

- 产业生态系分析

- 监管环境

- 宏观经济因素的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 最终用户

- 银行、金融服务和保险

- 零售与消费品牌

- 市场研究机构

- 科学机构

- 医疗/製药

- 其他最终用户

- 透过技术

- 脑电图(EEG)

- 功能性磁振造影(fMRI)

- 眼动追踪

- 生物识别(皮肤电反应、心率)

- 脸部分析/情绪人工智慧

- 功能性近红外线光谱(fNIRS)

- 其他技术

- 报价

- 硬体/设备

- 软体/平台

- 服务

- 透过使用

- 广告与媒体测试

- 产品和包装设计

- 使用者体验与数位分析

- 零售和店内分析

- 价格调查

- 政治和社会宣传活动测试

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- The Nielsen Company LLC

- Neurons Inc.

- Immersion Neuroscience Inc.

- NVISO SA

- Cadwell Industries Inc.

- Compumedics Limited

- Merchant Mechanics Inc.

- Neural Sense(Pty)Ltd

- SR Labs SRL

- Synetiq Ltd.

- Mindspeller BV

- MindMetriks LLC

- Uniphore Technologies Inc.

- Tobii AB

- iMotions A/S

- Bitbrain Technologies SL

- Emotiv Inc.

- Shimmer Research Ltd.

- Myndlift Ltd.

- Blackbox Biometrics LLC

- Innerscope Research Inc.

- Eye Square GmbH

- HCL Technologies Limited(Neuromarketing Practice)

- Spark Neuro Inc.

- Affectiva Inc.

- Sensory Logic Inc.

- Neurotrend LLC

- SalesBrain LLC

- NeuroVision Marketing LLC

- Neuro-Insight Pty Ltd

第七章 市场机会与未来展望

Neuromarketing market size in 2026 is estimated at USD 1.83 billion, growing from 2025 value of USD 1.71 billion with 2031 projections showing USD 2.53 billion, growing at 6.76% CAGR over 2026-2031.

Expansion is fueled by the proven ability of electroencephalography-machine learning systems to predict purchase intent with 87.1% accuracy, the rise of immersive extended-reality testing environments, and the widening gap between privacy regulations and traditional consumer-insight tools. Global brands view neuromarketing platforms as infrastructure for campaign pre-testing, audience segmentation, and user-experience optimization, while investors support new ventures that bridge hardware miniaturization with cloud analytics. Strict data-protection laws, notably California SB 1223 and the European Union's GDPR, compel vendors to embed privacy-preserving design principles that add compliance costs yet create durable competitive advantages. Consolidation is underway as larger technology companies acquire specialist firms to embed neural measurement across wider marketing-technology stacks.

Global Neuromarketing Market Trends and Insights

Increasing Need for Advanced Marketing Tools

Brand marketers face fragmented digital journeys that weaken click-through and conversion metrics as proxies for engagement. EEG-based systems integrated with machine learning provide real-time readouts of cognitive load, emotional arousal, and motivational intent that correlate directly with sales lift. A landmark study reported 87.1% purchase-prediction accuracy against 64% for surveys, validating the shift toward neurobiological measurement. Consumer goods firms that deploy these tools achieve faster creative iteration, reduced media wastage, and higher return on advertising spend. Heightened competition inside crowded online marketplaces further elevates demand for deeper behavioral insight.

AI-Powered Predictive Attention Analytics Adoption

Neuromarketing vendors embed convolutional neural networks and gradient-boosting models to forecast attention patterns before campaigns launch. Training on large multi-modal datasets enables cross-cultural segmentation that distinguishes subtle emotional cues among demographic cohorts. Functional near-infrared spectroscopy studies reveal gender-specific prefrontal activation during mixed-culture adverts, allowing brands to tailor messaging by neurobiological fit. Forecasting extends beyond single creatives to long-term brand-equity trajectories, guiding budget allocation and portfolio strategy. Companies that integrate these predictive engines into media-planning workflows compress insights cycles from weeks to hours.

High Capital Cost of Gold-Standard Neuroimaging (fMRI)

Installing an fMRI suite can exceed USD 3 million, with recurrent maintenance topping USD 200,000 each year. Such spending is feasible for large pharmaceutical firms but unattainable for most agencies and start-ups. The capital hurdle entrenches a two-tier structure in which resource-rich organizations access high-resolution data while others rely on lower-cost EEG or eye-tracking alternatives. Portable fNIRS devices deliver roughly 75% of fMRI precision at 10% of its cost, but they cannot yet fully replicate whole-brain mapping. This constraint limits large-scale adoption and slows methodological innovation.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Privacy-Compliant, Opt-In Consumer Insights

- Integration of Neuromarketing with Immersive XR Platforms

- Fragmented Regulatory Landscape and Data-Privacy Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Retail and consumer brands captured 37.12% neuromarketing market share during 2025, driven by high-volume campaign testing across fast-moving consumer goods. Healthcare and pharma applications, however, are advancing at a 7.12% CAGR, the fastest among end users. The neuromarketing market size for healthcare communications will benefit from neuroscience-based content that improves patient adherence and clinical-trial engagement. Pharmaceutical marketers employ digital biomarkers to monitor cognitive side effects in real time, while hospital networks test user-experience flows of telehealth portals to reduce friction and missed appointments.

Banks and insurers integrate neural feedback into onboarding journeys that shorten form-completion times and lower abandonment. Market-research agencies embed biometric panels within traditional survey infrastructures to boost predictive validity. Academic institutions expand brain-computer-interface labs through public-private grants, particularly in Asia Pacific where governments fund translational neuroscience. Automotive and entertainment firms explore in-vehicle emotion monitoring and storyboarding optimization, rounding out a diversified end-user landscape that strengthens demand resilience.

Electroencephalography held 40.28% revenue in 2025 thanks to well-established research protocols and shrinking sensor costs. Functional near-infrared spectroscopy is growing 7.35% annually, narrowing the gap by offering mobile, fiber-less caps that map prefrontal blood oxygenation while users browse physical aisles or virtual storefronts. The neuromarketing market size for fNIRS solutions will expand as headset manufacturers embed optical diodes inside mixed-reality devices. Eye-tracking modules benefit from integration into smart glasses that assess driver distraction and retail shelf gaze.

Functional magnetic resonance imaging remains indispensable for high-resolution studies of subconscious brand associations, even as budget pressures favor lighter modalities. Wearable biometrics that combine galvanic skin response with photoplethysmography enable continuous emotion tracking during day-long consumer safaris. Emerging brain-sensing earbuds and neuromorphic sensors sit at the frontier, promising hands-free passive data streams that could reshape methodological norms once reliability thresholds are met.

The Neuromarketing Market Report is Segmented by End Users (BFSI, Retail and Consumer Brands, Market Research Agencies, Scientific Institutions, and More), Technology (EEG, Eye Tracking, Biometrics, Facial Coding, FNIRS, and More), Offering (Hardware, Software, and Services), Application (Advertising and Media Testing, Product and Packaging Design, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.20% neuromarketing market share in 2025, reflecting deep venture-capital pools, academic brain-science clusters, and clear privacy guidance. United States funding for neurotechnology reached USD 2.3 billion across 129 deals that year, catalyzing breakthrough sensor designs and AI pipelines. Canada supplements with public grants that encourage cross-border consortia, while Mexico's consumer-goods companies adopt budget-friendly eye-tracking as digital advertising sophistication rises. Acquisition activity, such as Apple's USD 22 million purchase of Datakalab, underscores the region's appetite for embedded neural-analysis capability.

Asia Pacific is growing at a 7.83% CAGR through 2031 and will narrow the regional revenue gap as China, India, Japan, and South Korea integrate neuromarketing into omnichannel retail, gaming, and automotive experiences. Government research grants in China support neuro-AI startups that partner with global brands, while India's direct-to-consumer platforms deploy EEG headbands in usability labs. Cultural norms that emphasize group harmony amplify the impact of social-cognition metrics, motivating local agencies to customize study protocols that capture collectivist cues. Japan's electronics giants and South Korea's entertainment groups pioneer immersive XR laboratories that fuse fNIRS with haptic feedback to refine product launches.

Europe maintains healthy demand anchored by Germany's automotive heritage, France's luxury-goods creativity, and the United Kingdom's media-agency innovation. Stringent GDPR enforcement propels edge-analytics and federated-learning solutions that limit personal-data transfer, positioning European vendors as global benchmarks for ethical neuromarketing. Academic networks such as the Human Brain Project spin off instrumentation advances that flow into commercial offerings. Privacy-focused reputation attracts multinational brands facing rising consumer skepticism, turning compliance sophistication into a revenue catalyst. Long-run opportunities also emerge in South America, the Middle East, and Africa as digital infrastructure accelerates and multinational retailers localize omnichannel strategies.

- The Nielsen Company LLC

- Neurons Inc.

- Immersion Neuroscience Inc.

- NVISO SA

- Cadwell Industries Inc.

- Compumedics Limited

- Merchant Mechanics Inc.

- Neural Sense (Pty) Ltd

- SR Labs SRL

- Synetiq Ltd.

- Mindspeller BV

- MindMetriks LLC

- Uniphore Technologies Inc.

- Tobii AB

- iMotions A/S

- Bitbrain Technologies SL

- Emotiv Inc.

- Shimmer Research Ltd.

- Myndlift Ltd.

- Blackbox Biometrics LLC

- Innerscope Research Inc.

- Eye Square GmbH

- HCL Technologies Limited (Neuromarketing Practice)

- Spark Neuro Inc.

- Affectiva Inc.

- Sensory Logic Inc.

- Neurotrend LLC

- SalesBrain LLC

- NeuroVision Marketing LLC

- Neuro-Insight Pty Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Advanced Marketing Tools

- 4.2.2 Proliferation of Smartphone-Based Real-Time Experience Tracking

- 4.2.3 AI-Powered Predictive Attention Analytics Adoption

- 4.2.4 Rising Demand for Privacy-Compliant, Opt-In Consumer Insights

- 4.2.5 Integration of Neuromarketing with Immersive XR Platforms

- 4.2.6 Growing Venture Funding in Neurotechnology Start-Ups

- 4.3 Market Restraints

- 4.3.1 High Capital Cost of Gold-Standard Neuroimaging (fMRI)

- 4.3.2 Fragmented Regulatory Landscape and Data Privacy Constraints

- 4.3.3 Shortage of Multidisciplinary Talent

- 4.3.4 Consumer Skepticism over Subconscious Manipulation

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End Users

- 5.1.1 Banking, Financial Services and Insurance

- 5.1.2 Retail and Consumer Brands

- 5.1.3 Market Research Agencies

- 5.1.4 Scientific Institutions

- 5.1.5 Healthcare and Pharma

- 5.1.6 Other End Users

- 5.2 By Technology

- 5.2.1 Electroencephalography (EEG)

- 5.2.2 Functional Magnetic Resonance Imaging (fMRI)

- 5.2.3 Eye Tracking

- 5.2.4 Biometrics (GSR, Heart Rate)

- 5.2.5 Facial Coding / Emotion AI

- 5.2.6 Functional Near-Infrared Spectroscopy (fNIRS)

- 5.2.7 Other Technologies

- 5.3 By Offering

- 5.3.1 Hardware / Devices

- 5.3.2 Software / Platforms

- 5.3.3 Services

- 5.4 By Application

- 5.4.1 Advertising and Media Testing

- 5.4.2 Product and Packaging Design

- 5.4.3 User Experience and Digital Analytics

- 5.4.4 Retail and In-Store Analytics

- 5.4.5 Pricing Research

- 5.4.6 Political and Social Campaign Testing

- 5.4.7 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Nielsen Company LLC

- 6.4.2 Neurons Inc.

- 6.4.3 Immersion Neuroscience Inc.

- 6.4.4 NVISO SA

- 6.4.5 Cadwell Industries Inc.

- 6.4.6 Compumedics Limited

- 6.4.7 Merchant Mechanics Inc.

- 6.4.8 Neural Sense (Pty) Ltd

- 6.4.9 SR Labs SRL

- 6.4.10 Synetiq Ltd.

- 6.4.11 Mindspeller BV

- 6.4.12 MindMetriks LLC

- 6.4.13 Uniphore Technologies Inc.

- 6.4.14 Tobii AB

- 6.4.15 iMotions A/S

- 6.4.16 Bitbrain Technologies SL

- 6.4.17 Emotiv Inc.

- 6.4.18 Shimmer Research Ltd.

- 6.4.19 Myndlift Ltd.

- 6.4.20 Blackbox Biometrics LLC

- 6.4.21 Innerscope Research Inc.

- 6.4.22 Eye Square GmbH

- 6.4.23 HCL Technologies Limited (Neuromarketing Practice)

- 6.4.24 Spark Neuro Inc.

- 6.4.25 Affectiva Inc.

- 6.4.26 Sensory Logic Inc.

- 6.4.27 Neurotrend LLC

- 6.4.28 SalesBrain LLC

- 6.4.29 NeuroVision Marketing LLC

- 6.4.30 Neuro-Insight Pty Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment