|

市场调查报告书

商品编码

1910578

中国包装市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)China Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

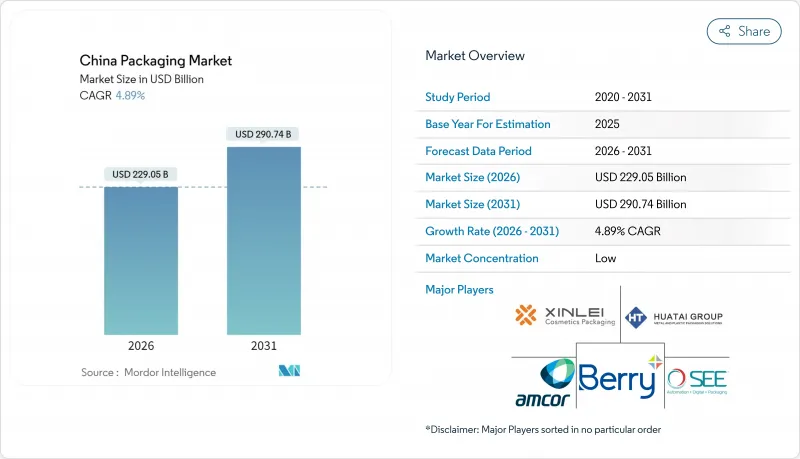

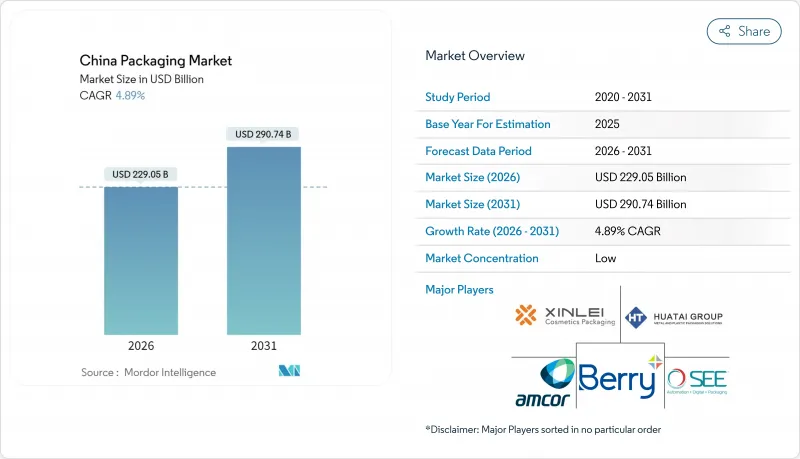

预计到2026年,中国包装市场规模将达到2,290.5亿美元,较2025年的2,183.7亿美元持续成长。预计到2031年,该市场规模将达到2,907.4亿美元,2026年至2031年的复合年增长率为4.89%。

在全球最大的电子商务生态系统的推动下,中国包装市场持续扩张。预计到2024年,小包裹量将达到1750亿件,这将推动对耐用、易于自动化处理的包装的需求。此外,强制宅配包装标准(GB 43352-2023)正在推动中国包装市场转型为低毒材料和标准化尺寸。同时,九龙纸业等国内领先製造商和安姆科等全球企业正利用规模经济、智慧工厂投资和生物开发平臺来增强自身竞争力。针对一次性塑胶的监管压力,以及2025年PET饮料容器回收率达到96.48%的目标,正在加速再生材料和纤维性包装的转型。

中国包装市场趋势与洞察

电子商务小包裹量爆炸性成长

中国包装市场与小包裹量密切相关,预计到2024年,包裹量将达到1,750亿件。这给缓衝材料、防篡改封条和自动化分类能力带来了前所未有的压力。主要城市的履约中心正在部署人工智慧路线规划系统,将从仓库到目的地的运输前置作业时间缩短了35%,迫使加工商在不影响结构完整性的前提下减少批量。瓦楞纸板加工商正在投资高速数位印刷生产线,将条码和QR码与物流平台集成,以实现最后一公里追踪。采用模组化纸箱设计的市场参与企业报告称,空隙率降低了两位数,这在宅配业者转向按体积收费的情况下尤其重要。这些发展正在推动中国包装市场的成长,同时也使那些能够将资料载体功能直接整合到包装基材中的加工商受益。

人们越来越倾向于选择永续的纸质形式

中国的政策议程优先考虑可回收原料,鼓励品牌商在饮料、个人护理和电商物流包装中优先选择纤维基解决方案。国务院的《绿色运输条例》要求零售商提供商店回收设施并公开包装减量指标。箱板纸厂正在向高性能、轻质纸板转型,这得益于涂布技术的创新,这些创新可以减少水分渗入。产能扩张的一个例子是维美德公司位于安徽省临平市的OptiConcept M纸板生产线,该生产线计划于2025年底运作(投资额为4,000万至6,000万欧元/4,300万至6,400万美元)。纤维基包装的普及也推动了消费者意识的提高:一项全国性调查发现,如果性能相当,68%的消费者会选择纸质包装来包装网上生鲜食品。

塑胶禁令和生产者延伸责任

在中国,零售和宅配领域一次性塑胶製品的禁令正在扩大,这增加了合规成本,并加速了材料替代的进程。生产者延伸责任制(EPR)要求生产者为回收系统资金筹措,而各省缺乏统一的执法标准,使得成本转嫁策略的发展变得复杂。品牌商不确定性透过建构闭合迴路纸製品系统来规避风险,而其他企业则寻求与废弃物管理公司成立合资企业以确保原料供应。在标准稳定之前,预计中国包装市场的资金配置将更倾向于现有设施的维修,而非新建聚合物计划。

细分市场分析

到2025年,纸和纸板产业将占中国包装市场份额的42.65%,这主要得益于瓦楞纸箱对电商物流的支持以及消费者对纺织品回收利用的持续高涨信心。此外,中国PET饮料瓶回收率达到96.48%这一里程碑式的成就也推动了该行业的发展,使大众更加关注纤维素回收系统。造纸厂的维修倾向于生产高强度、轻质纸板,使承运商能够满足中国国家标准GB 43352-2023的尺寸和负载测试要求。同时,预计到2031年,随着瓦楞纸包装出口需求以每年略低于5%的速度成长,中国纸和纸板包装市场将持续扩张。

其他材料(生物基聚合物、黄麻混纺薄膜和木质素复合材料)儘管增速较慢,但仍以7.09%的复合年增长率实现了最快增长。学术突破表明,黄麻混纺可使纤维产量提高24.42%,从而加速防潮淀粉黄麻内衬的大规模生产。木质素生物复合材料具有抗氧化性能,适用于糖果甜点包装,满足了不含合成添加剂的活性包装的需求。儘管确保生物聚合物的成本竞争力仍然是一项挑战,但主要的快速消费品公司正在利用生产者责任延伸(EPR)费用返还政策来试行这些材料。

初级包装形式(纸盒、瓶装和泡壳包装)占中国包装市场规模的69.20%,对产品保护和展示效果仍然至关重要。食品安全要求和QR码追踪法规促使企业持续投资高速填充线和装饰技术。此外,法规环境也要求膳食补充剂必须使用防篡改密封,从而维持了对多层复合材料的需求。

受履约中心自动化堆迭和跨境电商带来的承重需求三倍成长的推动,三级包装市场正以5.93%的复合年增长率快速扩张。出口宅配业者指定使用耐压且具备RFID功能的托盘,这些托盘能够向仓库管理系统提供即时数据,使其成为极具吸引力的获利来源。新兴参与企业提供由再生纤维和生物树脂製成的复合托盘,缩短了线上零售商的前置作业时间,并进一步巩固了中国包装市场的成长动能。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务小包裹量爆炸性成长

- 人们越来越偏好永续的纸质形式

- 对便利性的需求/对即食食品包装的需求

- 扩大药品低温运输

- 智慧物流(物联网)赋能的可追溯包装

- 超低温生物製药包装衝击

- 市场限制

- 塑胶禁令法规和生产者延伸责任制

- 纸浆和聚合物原料成本波动;

- 各地区的回收基础设施状况不尽相同。

- 都市区可重复使用托特包的试点计画削弱了对纸板的需求

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场宏观经济趋势的评估

第五章 市场规模与成长预测

- 透过包装材料

- 塑胶

- 纸和纸板

- 玻璃

- 金属

- 其他材料

- 按包装类型

- 初级包装

- 二级包装

- 三级包装

- 按包装类型

- 硬包装

- 软包装

- 按最终用户行业划分

- 食品/饮料

- 医疗和药品

- 美容及个人护理

- 工业的

- 其他终端用户产业

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Nine Dragons Paper(Holdings)Ltd.

- Lee and Man Paper Manufacturing Ltd.

- Shanying International Holdings Co., Ltd.

- Hexing Packaging Co., Ltd.

- Greatview Aseptic Packaging Co., Ltd.

- Wuxi Huatai Co.,Ltd

- Shanghai Zijiang Enterprise Group Co., Ltd.

- YUTO Packaging Technology Co., Ltd.

- Zhejiang Xinlei Packaging Co., Ltd.

- Guangdong Champ New Material Co., Ltd.

- Crown Holdings, Inc.

- Amcor Plc

- Berry Global Group, Inc.

- International Paper Company

- WestRock Company

- Sealed Air Corporation

- Tetra Pak(China)Ltd.

- Beijing Hualian Printing Co., Ltd.

- Zhejiang Jiashan Dingxin Packaging Co., Ltd.

- Shenzhen Yutong Packaging Technology Co., Ltd.

第七章 市场机会与未来展望

The China packaging market size in 2026 is estimated at USD 229.05 billion, growing from 2025 value of USD 218.37 billion with 2031 projections showing USD 290.74 billion, growing at 4.89% CAGR over 2026-2031.

The China packaging market continues to expand on the back of the world's largest e-commerce ecosystem; parcel volumes touched 175 billion units in 2024, intensifying demand for durable, automation-ready pack formats. Mandatory express packaging standards (GB 43352-2023) are also steering the China packaging market toward low-toxicity substrates and standardised dimensions. Concurrently, large domestic producers such as Nine Dragons Paper and global majors like Amcor are leveraging scale, smart-factory investments and bio-based R&D pipelines to strengthen competitive positions. Regulatory pressure on single-use plastics, coupled with a 96.48% PET beverage recovery rate in 2025, is accelerating the shift to recycled and fibre-based formats.

China Packaging Market Trends and Insights

Explosive Growth of E-commerce Parcel Volume

The China packaging market is tightly linked to parcel throughput, which reached 175 billion units in 2024, driving unprecedented pressure on cushioning, tamper-evident seals and automated sorting compatibility. Fulfilment centres in Tier 1 cities now rely on AI routing systems that reduce dock-to-door lead-times by 35%, obliging converters to shorten run lengths without compromising structural integrity. Corrugated converters are investing in high-speed digital print lines that align barcodes and QR codes with logistics platforms, supporting last-mile traceability. Market participants adopting modular carton designs report double-digit reductions in void space, a priority as courier firms pivot toward volumetric pricing. These developments sustain the momentum of the China packaging market while rewarding converters able to integrate data carrier features directly into pack substrates.

Rising Preference for Sustainable Paper-Based Formats

China's policy agenda prioritises recyclable inputs, prompting brand owners to favour fibre-based solutions across beverages, personal care and e-commerce mailers. The State Council's eco-friendly delivery rules oblige retailers to offer in-store take-back facilities and publicly disclose packaging reduction metrics. Containerboard mills are shifting to higher-performance lightweight grades, helped by coating innovations that mitigate moisture ingress. Capacity expansions include Valmet's OptiConcept M board line for Anhui Linping, scheduled online by end-2025 (EUR 40-60 million; USD 43-64 million). Fibre-based adoption also benefits from consumer recognition: nationwide surveys show 68% of shoppers prefer paper wrappers for online grocery deliveries when performance is comparable.

Plastic-Ban and Extended-Producer-Responsibility Rules

China prohibits a widening list of single-use plastics in retail and courier channels, increasing compliance costs and accelerating material substitutions. Producers must finance recycling systems under EPR, and the absence of uniform provincial enforcement complicates cost pass-through strategies. Brands face uncertainty over forthcoming recycled-content thresholds for PET and PP food-contact packs. Leading converters are hedging by building closed-loop paper systems; others form joint ventures with waste-management firms to secure feedstock. Until standards stabilise, capital allocation in the China packaging market skews toward retrofits rather than green-field polymer projects.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Convenience/RTD Food Packs

- Pharmaceutical Cold-Chain Expansion

- Volatile Pulp and Polymer Feedstock Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and Paperboard captured 42.65% of China packaging market share in 2025 as corrugated boxes underpinned e-commerce fulfilment and consumer confidence in fibre recyclability remained high. The segment benefits from China's 96.48% PET beverage recycling milestone that shifts public attention to cellulose-based loops. Mill revamps are oriented toward high-strength light-weight grades, enabling shippers to meet express standard GB 43352-2023 dimensional and stacking tests. Concurrently, the China packaging market size for Paper and Paperboard is expected to rise in tandem with export-oriented corrugated demand growing at a mid-single-digit pace to 2031.

Other Materials-bio-based polymers, jute-blend films and lignin composites-record the fastest 7.09% CAGR, albeit from a low base. Academic breakthroughs reveal jute hybridisation delivering 24.42% fibre-yield gains, accelerating scale-up of moisture-resistant starch-jute liners. Lignin-bionanocomposites imbue antioxidant properties suitable for confectionery wraps, meeting demand for active packaging without synthetic additives. Investment hurdles linger-biopolymer cost parity remains elusive-but leading FMCG firms are piloting such materials, incentivised by EPR fee rebates.

Primary formats-cartons, bottles, blister packs-represent 69.20% of the China packaging market size and remain critical to product protection and shelf appeal. Food-safety expectations and QR-code traceability rules ensure persistent capital expenditure in high-speed filling lines and decoration technologies. The regulatory environment also requires tamper-proof seals for nutraceuticals, sustaining demand for multi-layer laminates.

Tertiary packaging grows at 5.93% CAGR as fulfilment centres automate palletising and cross-border e-commerce triples load-bearing requirements. Export couriers specify crush-proof, RFID-enabled pallets that feed real-time data to warehouse-management systems, creating an attractive profit pool. Market entrants offering composite pallet blocks made with recycled fibre and bio-resins shorten lead times for online retailers and reinforce the growth curve of the China packaging market.

The China Packaging Market Report is Segmented by Packaging Material (Plastic, Paper and Paperboard, Glass, and More), Types of Packaging (Primary Packaging, Secondary Packaging, and Tertiary Packaging), Packaging Format (Rigid Packaging, and Flexible Packaging), End-User Industry (Food and Beverage, Healthcare and Pharmaceutical, Beauty and Personal Care, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nine Dragons Paper (Holdings) Ltd.

- Lee and Man Paper Manufacturing Ltd.

- Shanying International Holdings Co., Ltd.

- Hexing Packaging Co., Ltd.

- Greatview Aseptic Packaging Co., Ltd.

- Wuxi Huatai Co.,Ltd

- Shanghai Zijiang Enterprise Group Co., Ltd.

- YUTO Packaging Technology Co., Ltd.

- Zhejiang Xinlei Packaging Co., Ltd.

- Guangdong Champ New Material Co., Ltd.

- Crown Holdings, Inc.

- Amcor Plc

- Berry Global Group, Inc.

- International Paper Company

- WestRock Company

- Sealed Air Corporation

- Tetra Pak (China) Ltd.

- Beijing Hualian Printing Co., Ltd.

- Zhejiang Jiashan Dingxin Packaging Co., Ltd.

- Shenzhen Yutong Packaging Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth of e-commerce parcel volume

- 4.2.2 Rising preference for sustainable paper-based formats

- 4.2.3 Demand for convenience/RTD food packs

- 4.2.4 Pharmaceutical cold-chain expansion

- 4.2.5 Smart-logistics (IoT) enabled track-and-trace packs

- 4.2.6 Ultra-low-temperature bio-pharma packaging surge

- 4.3 Market Restraints

- 4.3.1 Plastic-ban and extended-producer-responsibility rules

- 4.3.2 Volatile pulp and polymer feedstock costs

- 4.3.3 Patchy provincial recycling infrastructure

- 4.3.4 Reusable tote pilots eroding urban corrugated demand

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Packaging Material

- 5.1.1 Plastic

- 5.1.2 Paper and Paperboard

- 5.1.3 Glass

- 5.1.4 Metal

- 5.1.5 Other Materials

- 5.2 By Types of Packaging

- 5.2.1 Primary Packaging

- 5.2.2 Secondary Packaging

- 5.2.3 Tertiary Packaging

- 5.3 By Packaging Format

- 5.3.1 Rigid Packaging

- 5.3.2 Flexible Packaging

- 5.4 By End-user Industry

- 5.4.1 Food and Beverages

- 5.4.2 Healthcare and Pharmaceutical

- 5.4.3 Beauty and Personal Care

- 5.4.4 Industrial

- 5.4.5 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nine Dragons Paper (Holdings) Ltd.

- 6.4.2 Lee and Man Paper Manufacturing Ltd.

- 6.4.3 Shanying International Holdings Co., Ltd.

- 6.4.4 Hexing Packaging Co., Ltd.

- 6.4.5 Greatview Aseptic Packaging Co., Ltd.

- 6.4.6 Wuxi Huatai Co.,Ltd

- 6.4.7 Shanghai Zijiang Enterprise Group Co., Ltd.

- 6.4.8 YUTO Packaging Technology Co., Ltd.

- 6.4.9 Zhejiang Xinlei Packaging Co., Ltd.

- 6.4.10 Guangdong Champ New Material Co., Ltd.

- 6.4.11 Crown Holdings, Inc.

- 6.4.12 Amcor Plc

- 6.4.13 Berry Global Group, Inc.

- 6.4.14 International Paper Company

- 6.4.15 WestRock Company

- 6.4.16 Sealed Air Corporation

- 6.4.17 Tetra Pak (China) Ltd.

- 6.4.18 Beijing Hualian Printing Co., Ltd.

- 6.4.19 Zhejiang Jiashan Dingxin Packaging Co., Ltd.

- 6.4.20 Shenzhen Yutong Packaging Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment