|

市场调查报告书

商品编码

1910613

延展实境(XR):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Extended Reality (XR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

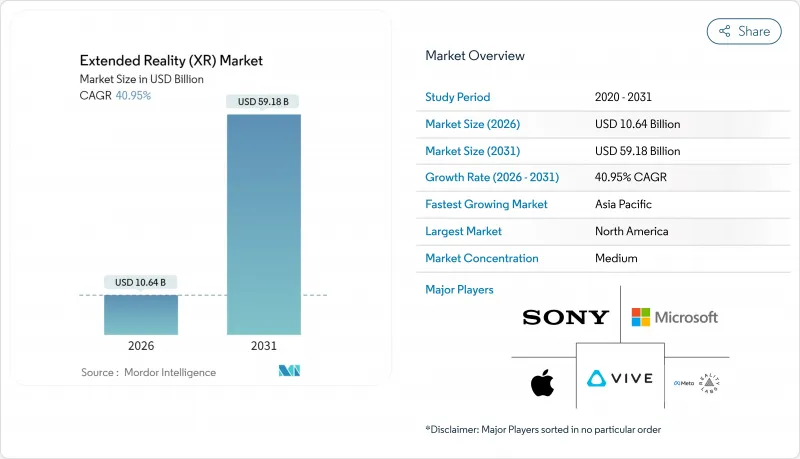

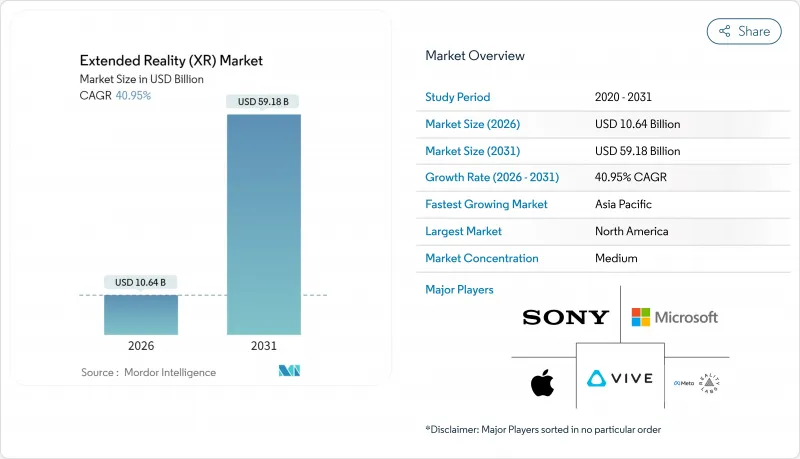

预计到 2026 年,延展实境(XR) 市场规模将达到 106.4 亿美元。

这意味着从 2025 年的 75.5 亿美元成长到 2031 年的 591.8 亿美元,2026 年至 2031 年的年复合成长率(CAGR)为 40.95%。

XR技术在製造业、医疗保健和国防领域的快速企业应用,其发展速度已超越消费娱乐领域,使其从游戏新奇玩意转变为必不可少的生产力工具。 5G行动网路与边缘运算的结合,正在消除延迟障碍,使毫秒精度的可视化在工厂车间和手术室等场所实用化。嵌入空间运算的人工智慧正在实现培训内容的个人化,而即时分析则正在完善反馈循环,从而进一步提升可衡量的盈利。美国和中国的政府资助,以及OpenXR等开放标准的推行,正在加速生态系统的成熟,并缓解人们对厂商锁定的担忧。供应链限制和不断上涨的零件价格仍然是阻碍因素,但随着新的半导体产能和替代材料来源投入生产,这些挑战正在逐步缓解。

全球延展实境(XR)市场趋势与洞察

扩展 5G 覆盖范围和边缘运算的协同效应

低于 20 毫秒的低延迟使得多人 VR 协作无需背负式设备即可实现,爱立信、AT&T、Dreamscape 和高通的试验均证实了这一点。中国钢铁集团公司 (CSCC) 的 5G 虚拟工厂参观整合了来自 85 个生产节点的即时数据,展现了其在重工业领域的价值。 DHL 的智慧眼镜试验表明,即时拣货指导能够提高物流效率。将运算能力转移到网路边缘可以减轻设备重量,从而提升使用者舒适度。为此,通讯业者正在用户 50 公里范围内部署微型资料中心,以维持身临其境型体验的流畅性。

加强XR技术与数位双胞胎和工业4.0框架的融合

和硕的 PEGAVERSE 基于 NVIDIA Omniverse 建造了五个虚拟工厂,实现了远距离诊断和场景测试,从而减少了停机时间和现场访问次数。BASF的 AR 赋能工厂规划将感测器数据与身临其境型视觉化相结合,能够更有效率地识别危险。西门子和SONY推出的 SRH-S1 工程头戴式显示器,用于实现像素级精确的设计协作,售价 4,750 美元。 OpenUSD 整合可以将不同的 CAD、PLM 和物联网资料来源整合到单一的空间层。平台供应商透过订阅式视觉化服务而非一次性授权费来获利。

高清光学元件和处理器的初始成本很高

镓和锗的供不应求导致光学设备价格上涨高达25%。 Meta公司的Reality Labs自2020年以来已累计亏损600亿美元,而其2024年第四季的XR硬体销售额仅为11亿美元,凸显了盈利方面的挑战。缺乏资金或投资收益率(ROI)的小型公司对进入市场持谨慎态度。云端渲染的XR技术虽然降低了设备负载,但会增加延迟,因此其应用范围仅限于5G网路覆盖良好的地区。

细分市场分析

儘管硬体在2024年将构成比营收的53.2%,但服务业务的成长速度最快,复合年增长率将达到42.5%。将设备、软体和管理支援结合的订阅方案模式,能够将资本支出(CapEx)转化为营运支出(OpEx),因此备受财务部门青睐。这种转变不仅为供应商创造了可预测的经常性收入,也降低了客户的进入门槛。 Meta的平台转型正是这一趋势的体现,该公司正在探索企业订阅模式,并将其与硬体更新换代相结合。

由于对专业内容的需求,託管式培训和模拟服务的单价很高。光是Vertex Solutions就已在全球范围内交付了500多台军用级模拟器,充分展现了其垂直领域的专业实力。这些合约通常为期多年,使供应商能够获得较高的终身价值。硬体製造商越来越多地选择与整合商合作,而非直接竞争,这反映了以服务主导的延展实境(XR)市场日趋成熟。

头戴式显示器在2024年占总营收的42.7%,但成长重心正转向空间和全像显示器,预计复合年增长率将达到43.1%。共用显示墙克服了个人头戴式显示器在卫生和舒适度方面的局限性,并支援协作式工程评审和客户演示。三星的「Project Moohan」就是一个很好的例子,它是一款针对工业部署最佳化的下一代独立式设备。

无需配戴眼镜的解决方案也正在涌现;Distance Technologies公司已筹集1,000万欧元(约1,173万美元),旨在将车辆车窗改造为动态混合实境画布。智慧型手机连接的手持设备在现场维护中仍然十分常见,抬头显示器)也在飞机和汽车驾驶座中找到了应用领域。从长远来看,像XPANCEO的原型产品这样的智慧隐形眼镜可能会将延展实境(XR)市场推向隐形穿戴装置领域。

延展实境(XR) 市场按产品/服务(硬体、软体、服务)、装置类型(头戴式显示器(有线、独立式)、抬头显示器等)、技术(虚拟实境 (VR)、扩增实境(AR)、混合实境(MR))和终端用户产业(游戏与娱乐、医疗保健与生命科学等)进行细分。市场预测以美元计价。

区域分析

在北美,受医疗、航太和国防领域持续采购的推动,XR设备的安装基础正在不断扩大。 Infinite Reality公司筹集了3.5亿美元的新资金,并以4.5亿美元收购了Landvault公司,这印证了投资者对空间运算平台的乐观态度。美国创新部门在空军基地部署了225套身临其境型训练设备,进一步巩固了XR技术在企业中的应用。随着模拟器精度逐渐接近实体驾驶座标准,航空领域对替代认证的监管支援正在推动设备订单的成长。

亚太地区发展最为快速。光是中国一国,到2024年就将推出超过100个VR计划。韩国正利用近乎全国覆盖的5G网络,为三星的「Project Moohan」计画做准备。在印度,Meta和HCLTech合作建立的公私合营培养箱正在扶持基层应用开发。庞大的製造业基础为持续的价值验证试点计画提供了支持,使亚太地区成为大众硬体经济的核心参与者。欧洲正努力成为负责任创新的中心。 Distance Technologies获得的1000万欧元(约1173万美元)种子轮资金筹措表明,市场对汽车级混合实境表面有着巨大的需求。BASF、西门子和SONY正在合作研发符合严格CE安全标准的头戴式设备。欧盟的隐私法规正在影响资料处理架构,并鼓励全球供应商建立符合GDPR的分析模组。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩展 5G 覆盖范围和边缘运算的协同效应

- 将XR技术日益融入数位双胞胎与工业4.0框架

- 企业对身临其境型远距培训的需求日益增长

- 将空间感测器整合到大众市场智慧型手机中

- 政府对元宇宙相关研究与发展(R&D)的资助

- 采用开放的XR标准可以减少厂商锁定。

- 市场限制

- 高清光学元件和处理器的初始成本很高

- 使用者稳定性不足和人体工学限制

- 眼动追踪追踪与手部侦测分析中的资料隐私挑战

- 内容创作工具的生态系支离破碎

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对影响市场的宏观经济因素进行评估

第五章 市场规模与成长预测

- 报价

- 硬体

- 软体

- 服务

- 依设备类型

- 头戴式显示器(有线和独立式)

- 抬头显示器

- 手持行动装置

- 其他的

- 透过技术

- 虚拟实境(VR)

- 扩增实境(AR)

- 混合实境(MR)

- 按最终用户行业划分

- 游戏与娱乐

- 医疗保健和生命科学

- 工业和製造业

- 零售与电子商务

- 教育和培训

- 航太/国防

- 建筑、工程及施工

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Meta Platforms Inc.(Reality Labs)

- Sony Group Corp.

- Microsoft Corp.

- Apple Inc.

- HTC Corp.(Vive)

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Alphabet Inc.(Google XR)

- Pico Interactive Inc.(ByteDance)

- Varjo Technologies Oy

- Magic Leap Inc.

- Nvidia Corp.

- Unity Technologies Inc.

- Vuzix Corp.

- Lenovo Group Ltd.

- Snap Inc.

- Niantic Inc.

- Ultraleap Ltd.

- HP Inc.

- Immersion Corp.

第七章 市场机会与未来展望

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩展 5G 覆盖范围和边缘运算的协同效应

- 将XR技术日益融入数位双胞胎与工业4.0框架

- 企业对身临其境型远距培训的需求日益增长

- 将空间感测器整合到大众市场智慧型手机中

- 政府对元宇宙相关研究与发展(R&D)的资助

- 采用开放的XR标准可以减少厂商锁定。

- 市场限制

- 高清光学元件和处理器的初始成本很高

- 使用者稳定性不足和人体工学限制

- 眼动追踪追踪与手部侦测分析中的资料隐私挑战

- 内容创作工具的生态系支离破碎

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对影响市场的宏观经济因素进行评估

第五章 市场规模与成长预测

- 报价

- 硬体

- 软体

- 服务

- 依设备类型

- 头戴式显示器(有线和独立式)

- 抬头显示器

- 手持行动装置

- 其他的

- 透过技术

- 虚拟实境(VR)

- 扩增实境(AR)

- 混合实境(MR)

- 按最终用户行业划分

- 游戏与娱乐

- 医疗保健和生命科学

- 工业和製造业

- 零售与电子商务

- 教育和培训

- 航太/国防

- 建筑、工程及施工

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Meta Platforms Inc.(Reality Labs)

- Sony Group Corp.

- Microsoft Corp.

- Apple Inc.

- HTC Corp.(Vive)

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Alphabet Inc.(Google XR)

- Pico Interactive Inc.(ByteDance)

- Varjo Technologies Oy

- Magic Leap Inc.

- Nvidia Corp.

- Unity Technologies Inc.

- Vuzix Corp.

- Lenovo Group Ltd.

- Snap Inc.

- Niantic Inc.

- Ultraleap Ltd.

- HP Inc.

- Immersion Corp.

第七章 市场机会与未来展望

Extended Reality market size in 2026 is estimated at USD 10.64 billion, growing from 2025 value of USD 7.55 billion with 2031 projections showing USD 59.18 billion, growing at 40.95% CAGR over 2026-2031.

Rapid enterprise adoption across manufacturing, healthcare, and defense now outpaces consumer entertainment, turning XR from a gaming novelty into a mission-critical productivity tool. Five-generation mobile networks paired with edge computing have erased latency barriers, making millisecond-accurate visualization practical on factory floors and in surgical suites. Artificial intelligence embedded in spatial computing personalizes training content while real-time analytics close feedback loops, further raising measurable returns. Government funding in the United States and China, coupled with open standards such as OpenXR, is accelerating ecosystem maturity and reducing vendor lock-in worries. Supply chain constraints and component price inflation remain headwinds but continue to ease as new semiconductor capacity and alternative material sourcing enter production.

Global Extended Reality (XR) Market Trends and Insights

Expanding 5G Coverage and Edge Computing Synergy

Sub-20 ms latency now enables multi-user VR collaboration without tethered backpack PCs, as trials by Ericsson, AT&T, Dreamscape, and Qualcomm have shown. China Steel Corporation's 5G-enabled virtual factory tours integrate live data from 85 production nodes, proving value for heavy industry. DHL smart-glasses pilots illustrate logistics gains from real-time pick guidance. Device weight drops as compute moves to the network edge, boosting shift-length comfort. Telcos therefore place micro-data-centers within 50 km of users to sustain immersive throughput.

Increased Integration of XR into Digital Twin and Industry 4.0 Frameworks

Pegatron's PEGAVERSE builds five virtual factories on NVIDIA Omniverse for remote diagnostics and scenario testing, lowering downtime and travel. BASF's AR-enabled plant planning links sensor data with immersive visualization to streamline hazard identification. Siemens and Sony priced the SRH-S1 engineering headset at USD 4,750 to deliver pixel-accurate design collaboration. OpenUSD alignment lets disparate CAD, PLM, and IoT feeds merge into a single spatial layer. Platform vendors thus monetize subscription-based visualization rather than one-off license fees.

High Upfront Costs of High-Fidelity Optics and Processors

Gallium and germanium shortages have inflated optics prices by up to 25%. Meta's Reality Labs has accumulated USD 60 billion losses since 2020 while selling USD 1.1 billion in Q4 2024 XR hardware, underscoring profitability challenges. Smaller firms hesitate without capital or clear ROI. Cloud-rendered XR lightens devices yet introduces latency trade-offs that limit usage to well-served 5G zones.

Other drivers and restraints analyzed in the detailed report include:

- Rising Enterprise Demand for Immersive Remote Training

- Mass-Market Smartphone Integration of Spatial Sensors

- User Motion-Sickness and Ergonomic Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware controlled 53.2% of revenue in 2024, yet Services is set to grow fastest at 42.5% CAGR. Subscription bundles that combine devices, software, and managed support convert capex into opex, a structure favored by finance departments. The shift drives predictable recurring income for suppliers and lowers barrier-to-entry for customers. Meta's platform pivot illustrates this movement, exploring enterprise-grade subscriptions alongside hardware refreshes.

Managed training and simulation services command premium rates thanks to specialized content needs. Vertex Solutions alone shipped more than 500 military-grade simulators worldwide, highlighting vertical expertise. As these contracts often span multi-year periods, vendors capture higher lifetime value. Hardware makers therefore partner with integrators rather than compete head-on, reflecting a maturing services-led Extended Reality market.

Head-Mounted Displays captured 42.7% revenue in 2024 but growth now shifts to Spatial and Holographic Displays, which head toward a 43.1% CAGR. Shared viewing walls overcome hygiene and comfort limits found in personal headsets, supporting collaborative engineering reviews and customer demonstrations. Samsung's Project Moohan exemplifies next-generation standalone units optimized for industrial deployment.

Glasses-free solutions also emerge, with Distance Technologies raising EUR 10 million (USD 11.73 million) to transform vehicle windows into dynamic mixed-reality canvases. Smartphone-tethered handheld devices remain common in field maintenance, while head-up displays secure niche positions in aviation and automotive cockpits. Longer term, smart contact lenses such as XPANCEO's prototype could push the Extended Reality market into invisible wearables.

Extended Reality (XR) Market is Segmented by Offering (Hardware, Software, Services), Device Type (Head-Mounted Displays (Tethered, Stand-Alone), Head-Up Displays and More), Technology (Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR)), End User Industry (Gaming and Entertainment Healthcare and Life Sciences, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's installed base expands through steady healthcare, aerospace, and defense procurement. Infinite Reality closed USD 350 million in new capital and bought Landvault for USD 450 million, underscoring investor optimism in spatial computing platforms. The US Defense Innovation Unit fielded 225 immersive trainers across Air Force sites, further entrenching enterprise XR usage. Regulatory support for alternative certification in aviation spurs equipment orders as simulator fidelity approaches physical cockpit standards.

Asia-Pacific scales fastest. China alone launched more than 100 VR projects in 2024. South Korea readies Samsung's Project Moohan release, leveraging the country's near-universal 5G coverage. India's public-private incubator with Meta and HCLTech cultivates grassroots application developers. Wide manufacturing bases feed continuous proof-of-value pilots, making APAC pivotal to hardware volume economics. Europe positions itself as the responsible innovation hub. Distance Technologies' EUR 10 million (USD 11.73 million) seed illustrates appetite for automotive-grade mixed-reality surfaces. BASF, Siemens, and Sony collaborate on engineering headsets that comply with strict CE safety norms. The EU's privacy regime shapes data-handling architectures, influencing global vendors to build GDPR-ready analytics modules.

- Meta Platforms Inc. (Reality Labs)

- Sony Group Corp.

- Microsoft Corp.

- Apple Inc.

- HTC Corp. (Vive)

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Alphabet Inc. (Google XR)

- Pico Interactive Inc. (ByteDance)

- Varjo Technologies Oy

- Magic Leap Inc.

- Nvidia Corp.

- Unity Technologies Inc.

- Vuzix Corp.

- Lenovo Group Ltd.

- Snap Inc.

- Niantic Inc.

- Ultraleap Ltd.

- HP Inc.

- Immersion Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding 5G coverage and edge computing synergy

- 4.2.2 Increased integration of XR into digital twin and Industry 4.0 frameworks

- 4.2.3 Rising enterprise demand for immersive remote-training

- 4.2.4 Mass-market smartphone integration of spatial sensors

- 4.2.5 Government funding for metaverse-related Rand

- 4.2.6 Adoption of open XR standards lowering vendor lock-in

- 4.3 Market Restraints

- 4.3.1 High upfront costs of high-fidelity optics and processors

- 4.3.2 User motion-sickness and ergonomic limitations

- 4.3.3 Data-privacy gaps in eye- and hand-tracking analytics

- 4.3.4 Fragmented content-authoring tool ecosystem

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Device Type

- 5.2.1 Head-Mounted Displays (Tethered, Stand-alone)

- 5.2.2 Head-Up Displays

- 5.2.3 Handheld and Mobile Devices

- 5.2.4 Others

- 5.3 By Technology

- 5.3.1 Virtual Reality (VR)

- 5.3.2 Augmented Reality (AR)

- 5.3.3 Mixed Reality (MR)

- 5.4 By End-user Industry

- 5.4.1 Gaming and Entertainment

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Industrial and Manufacturing

- 5.4.4 Retail and E-commerce

- 5.4.5 Education and Training

- 5.4.6 Aerospace and Defense

- 5.4.7 Architecture, Engineering and Construction

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Meta Platforms Inc. (Reality Labs)

- 6.4.2 Sony Group Corp.

- 6.4.3 Microsoft Corp.

- 6.4.4 Apple Inc.

- 6.4.5 HTC Corp. (Vive)

- 6.4.6 Qualcomm Technologies Inc.

- 6.4.7 Samsung Electronics Co. Ltd.

- 6.4.8 Alphabet Inc. (Google XR)

- 6.4.9 Pico Interactive Inc. (ByteDance)

- 6.4.10 Varjo Technologies Oy

- 6.4.11 Magic Leap Inc.

- 6.4.12 Nvidia Corp.

- 6.4.13 Unity Technologies Inc.

- 6.4.14 Vuzix Corp.

- 6.4.15 Lenovo Group Ltd.

- 6.4.16 Snap Inc.

- 6.4.17 Niantic Inc.

- 6.4.18 Ultraleap Ltd.

- 6.4.19 HP Inc.

- 6.4.20 Immersion Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment