|

市场调查报告书

商品编码

1910848

北美自行车市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)North America Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

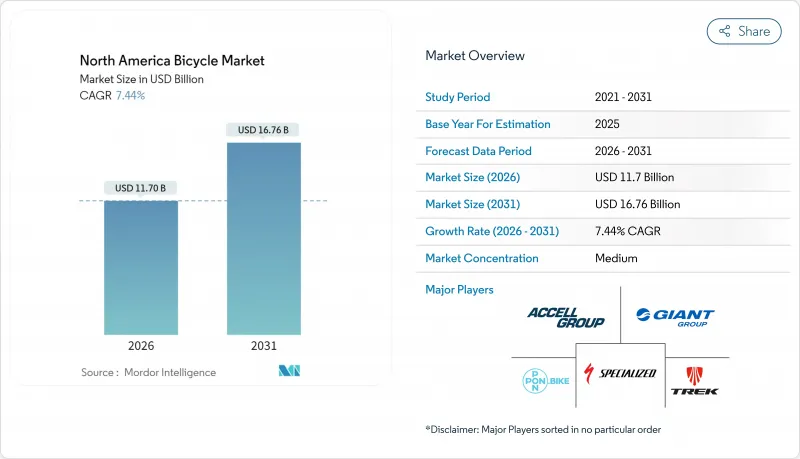

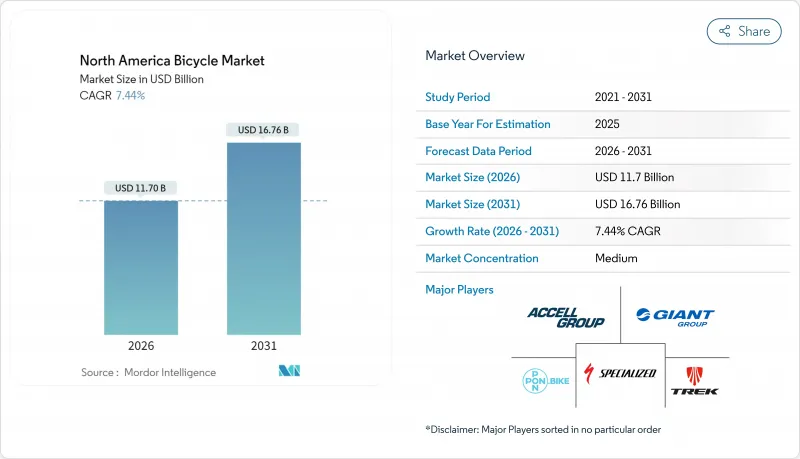

预计到2026年,北美自行车市场规模将达到117亿美元,高于2025年的108.9亿美元。预计到2031年,该市场规模将达到167.6亿美元,2026年至2031年的复合年增长率为7.44%。

这种乐观前景主要得益于公共部门投资、企业ESG采购以及供应链近岸外包。在美国,高达4,450万美元的预算拨款用于积极交通途径,凸显了市场需求,支持基础建设,并推广自行车作为一种永续的交通途径。遵循科学碳目标的企业正在扩大自行车车队,以减少范围3排放(与供应链和产品使用相关的间接排放)。这一趋势正在创造机构需求,并显着推动北美自行车市场的成长。同时,电池即服务(BaaS)模式的兴起,透过提供灵活的订阅式电池解决方案和降低拥有成本,推动了消费者对电动自行车的接受度。即使在疫情初期自行车热潮消退之后,这项创新也帮助北美自行车市场保持了强劲势头。此外,墨西哥的组装工厂透过缩短前置作业时间和降低关税风险,为製造商提供了新的成本优势。这些工厂不仅提高了营运效率,还巩固了该地区作为具有竞争力的製造地的地位,从而支持其在市场上的长期竞争优势。

北美自行车市场趋势与洞察

城市交通资金计画推动基础设施主导的需求

北美自行车市场的成长主要得益于消费者的热情以及强有力的基础设施津贴。美国《基础设施投资与就业法案》拨款4,450万美元,用于2025年前的积极交通计划,专注于建造自行车专用道、绿道和共用出行枢纽。这些计划旨在改善都市区交通、缓解交通拥堵并促进环境永续交通途径。加拿大也透过设立4亿美元的积极交通基金来支持这项工作,其中1,900万美元专门用于不列颠哥伦比亚省。该基金支持建造自行车友善基础设施,例如专用自行车道和步行区,以促进积极通勤。各州政府也扮演重要角色。例如,加州将在四年内投资9.3亿美元用于建造专用自行车道和人行道。这项投资预计将显着改善骑乘者和行人的交通便利性和安全性。这些全面的投资使自行车成为一种准基础设施资产,市政和企业车队也开始普遍采用自行车。随着这些交通网络的发展,预计北美自行车市场将迎来稳定的需求,这得益于更新计划、车队扩张以及与公共预算计划相符的维护合约。

微行程订阅平台改变城市交通

订阅服务让高品质硬体更容易取得,并创造了稳定的收入来源。这些服务降低了消费者的经济门槛,使他们无需支付高额前期费用即可获得高品质产品。在美国主要城市,微出行业者每年的出行量超过1.5亿次,凸显了共用出行解决方案的普及和日益增长的依赖性。都市区正越来越多地将电动自行车共享纳入其缓解交通拥堵和减少排放的策略,鼓励人们减少单人驾驶车辆,并促进永续的城市交通。这种转变使自行车製造商能够从不可预测的一次性销售转向稳定的多年租赁模式,从而增强现金流并建立可预测的收入模式。由此产生的翻新产品源源不绝地流入管理完善的二手产品通路,不仅延长了产品的使用寿命,也强化了对ESG投资者而言永续性理念。这些通路确保了翻新产品的有效利用,减少了废弃物,并实现了环境目标。

都市区缺乏自行车失窃保险阻碍了自行车的普及。

自行车骑行者的年失窃率约为4.2%,造成的损失高达14亿美元。然而,这些损失的保险覆盖不足,许多产物保险将价格超过1000美元的自行车排除在承保范围之外,而且通常不包括其他昂贵的骑行者。这种保险覆盖不足的情况对低收入社区的影响尤其严重,因为高盗窃风险阻碍了他们拥有和使用自行车。这些障碍使得公共机构难以有效地服务关键人群,并限制了市场公平成长的潜力。电动自行车领域的挑战尤其严峻,其零售价格起价为2,000美元,使得弱势族群更加难以负担。除非扩大保险产品的覆盖范围,并且城市投资建设安全的自行车停放基础设施,否则对盗窃的担忧将继续削弱消费者的信心,并阻碍北美自行车市场的成长。

细分市场分析

到2025年,山地自行车和全地形车将占北美自行车市场35.02%的份额,这主要得益于消费者对户外活动和越野骑行的热情日益高涨。步道维护津贴和投资扩大了该细分市场的骑行区域,从而提升了山地自行车对更广泛人群的吸引力。爱好者们被这些自行车坚固耐用、用途广泛的特点所吸引,尤其重视它们在崎岖地形上的表现。随着骑乘者越来越追求优质车架、先进的悬吊系统和专业的越野配件,山地自行车的选择性消费仍然强劲。製造商们正在不断优化产品线,推广兼顾强度和重量的设计,以满足骑乘者不断变化的需求。儘管其他类型的自行车也在崛起,但山地自行车仍拥有一批忠实的拥趸,并巩固了其作为各大自行车品牌重要收入来源的地位。

预计混合动力自行车将超越其他所有自行车类别,以7.62%的复合年增长率成长,成为北美成长最快的细分市场。这一快速增长的驱动力在于越来越多的通勤者和休閒骑行者寻求能够在铺装路面和非铺装路面上都表现优异的多功能自行车。基础设施的进步,例如专用车道和碎石连接道的建设,使得混合动力自行车骑乘者无需频繁更换自行车即可轻鬆应对各种地形。混合动力自行车兼具舒适性、耐用性和适应性,是注重实用性的都市区骑乘者的理想之选。为此,领先的製造商正在拓展产品线,并将研发资源集中在开发兼具耐用性和轻量化设计的车架。随着混合动力自行车逐渐成为市场的核心实用交通工具,其崛起凸显了消费者对多功能出行方式和积极生活方式的偏好正在发生更广泛的转变。

截至2025年,标准车架自行车仍占自行车总出货量的绝大部分,占所有出货量的92.05%。其经典的菱形车架确保了骑乘的稳定性,且易于维护。这种传统设计因其结构简单而广受欢迎,适用于从休閒到竞技骑行的各种活动。这种简单性也带来了价格实惠,使其成为初学者、家庭和休閒骑乘者的理想选择。製造商致力于在耐用性、重量和成本之间取得平衡,以确保这些自行车的广泛供应。易于取得的备件和熟悉的维修流程进一步巩固了它们在不同市场的受欢迎程度。总而言之,标准车架自行车是北美自行车市场的基石,因其在休閒和运动中的多功能性而备受青睐。

折迭式自行车已成为市场中成长最快的细分领域,预计将以9.86%的强劲复合年增长率成长。这一快速成长主要由空间有限的都市区推动。折迭自行车紧凑便携的设计使其成为公寓居住者和在繁忙城市中使用多种交通途径通勤者的理想选择。纽约、多伦多和温哥华等主要城市的交通管理部门已放宽了尖峰时段对折迭自行车的限制,进一步提升了折迭式自行车在公共交通中的便利性。儘管目前折迭式自行车在北美的市场份额不大,但随着城市居民寻求更便捷的出行方式,其需求正在显着增长。一个值得关注的趋势是「双车」生活方式的兴起,人们在工作日休閒时选择折迭式自行车,週末休閒骑行时则换用普通自行车或电动自行车。这种适应性凸显了折迭式自行车在解决都市区交通难题方面的重要作用,以及其与现代偏好的契合度。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 城市交通资金计画推动基础设施主导的需求

- 微行程订阅平台改变城市交通

- 在墨西哥的OEM製造投资创造了供应链替代方案

- 以ESG为重点的企业车队采购将使需求制度化。

- 利用电池即服务(BaaS)模式降低电动自行车的总拥有成本(TCO)

- 健身潮流正让骑乘越来越受欢迎。

- 市场限制

- 自行车失窃保险的缺乏阻碍了自行车在都市区的广泛使用。

- 零件供应链中的漏洞造成生产瓶颈

- 提高对中国进口商品的反倾销税

- 拓展二手市场,为我们自己的产品赢得市场份额

- 价值/价值链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 道路/城市

- 山地/全地形

- 杂交种

- 电动自行车

- 其他类型

- 有意为之

- 通常

- 折迭式

- 最终用户

- 男性

- 女士

- 孩子们

- 透过分销管道

- 线上零售商

- 线下零售店

- 按地区

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- Trek Bicycle Corporation

- Specialized Bicycle Components

- Giant Manufacturing Co.

- Accell Group(Raleigh, Haibike)

- Cannondale(Cycling Sports Group)

- Pon Bike(Santa Cruz, Gazelle)

- Schwinn(Pacific Cycle)

- Rad Power Bikes

- Lectric eBikes

- Aventon

- Mongoose

- Diamondback

- Marin Bikes

- Salsa Cycles

- QuietKat

- Serial 1(Harley-Davidson)

- Propella

- Ride1Up

- Juiced Bikes

- Brompton Bicycle

第七章 市场机会与未来展望

North American bicycle market size in 2026 is estimated at USD 11.7 billion, growing from 2025 value of USD 10.89 billion with 2031 projections showing USD 16.76 billion, growing at 7.44% CAGR over 2026-2031.

Public-sector investments, corporate ESG procurement, and supply-chain near-shoring are driving this optimistic outlook. In the U.S., a notable USD 44.5 million allocation for active transportation underscores the visibility of demand, supporting infrastructure development and encouraging the adoption of bicycles as a sustainable mode of transport. Companies adhering to science-based climate targets are increasingly adopting bicycle fleets to reduce Scope 3 emissions, which include indirect emissions from their supply chains and product use. This trend is significantly contributing to the growth of the North American bicycle market by adding institutional demand. Meanwhile, the rise of battery-as-a-service models is alleviating ownership costs by offering flexible subscription-based solutions for battery usage, making electric bicycles more accessible to consumers. This innovation is helping the North American bicycles market stay robust as the initial pandemic-driven enthusiasm for cycling normalizes. Additionally, assembly hubs in Mexico are shortening lead times and reducing tariff exposure, providing manufacturers with new cost advantages. These hubs not only enhance operational efficiency but also strengthen the region's position as a competitive manufacturing base, reinforcing long-term competitiveness in the market.

North America Bicycle Market Trends and Insights

Urban-mobility funding programs drive infrastructure-led demand

In North America, the bicycle market thrives not just on consumer enthusiasm but significantly on robust infrastructure grants. Under the U.S. Infrastructure Investment and Jobs Act, a notable USD 44.5 million is allocated for active-transportation projects in 2025, focusing on protected lanes, greenways, and shared-mobility hubs. These projects aim to enhance urban mobility, reduce traffic congestion, and promote environmentally sustainable transportation options. Canada bolsters this initiative with its USD 400 million Active Transportation Fund, designating USD 19 million specifically for British Columbia. This fund supports the development of bike-friendly infrastructure, including dedicated cycling paths and pedestrian-friendly zones, to encourage active commuting. States, too, play a pivotal role; for instance, California is channeling a substantial USD 930 million over four years into bike and pedestrian corridors. This investment is expected to significantly improve connectivity and safety for cyclists and pedestrians alike. Such comprehensive investments elevate bicycles to the status of quasi-infrastructure assets, with municipal agencies and corporate fleets acquiring them on a predictable basis. As these transportation networks evolve, the North American bicycle market sees consistent demand, driven by replacement programs, fleet expansions, and maintenance contracts, all synchronized with public budgeting timelines.

Micro-mobility subscription platforms reshape urban transportation

Subscription services are making premium hardware more accessible and generating steady revenue streams. These services lower the financial barrier for consumers, enabling them to access high-quality products without significant upfront costs. In major U.S. cities, micromobility operators are now logging over 150 million annual rides, a clear sign of mainstream acceptance and growing reliance on shared mobility solutions. Cities are increasingly incorporating e-bike sharing into their strategies to combat congestion and reduce emissions, steering commuters away from single-occupancy vehicles and promoting sustainable urban transportation. This shift allows bicycle manufacturers to transition from unpredictable one-time sales to stable multi-year leasing contracts, bolstering their cash flow and creating predictable revenue models. As a result, there's a consistent influx of refurbished units into well-managed second-life channels, not only extending product life but also bolstering sustainability narratives that appeal to ESG investors. These second-life channels ensure that refurbished products are efficiently utilized, reducing waste and aligning with environmental goals.

Bike-theft insurance gaps undermine urban adoption

Active riders face annual theft rates of about 4.2%, leading to losses of USD 1.4 billion. Coverage for these losses is inconsistent; many property insurers exclude bicycles valued over USD 1,000, unless policyholders opt for expensive riders. This lack of coverage disproportionately impacts lower-income neighborhoods, where higher theft risks create significant barriers to bicycle ownership and use. These barriers prevent public agencies from effectively serving key demographics, limiting the potential for equitable market growth. The challenge is particularly severe in the electric bicycle segment, where retail prices start at USD 2,000, making them even less accessible to vulnerable groups. Without broader insurance offerings or city investments in secure parking infrastructure, theft concerns will continue to undermine consumer confidence and hinder the growth of North America's bicycle market.

Other drivers and restraints analyzed in the detailed report include:

- OEM manufacturing investments in Mexico create supply-chain alternatives

- ESG-driven corporate fleet procurement institutionalizes demand

- Component supply-chain fragility creates production bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, mountain and all-terrain bikes command a 35.02% share of the North American bicycle market, fueled by a surge in consumer enthusiasm for outdoor escapades and off-road cycling. Bolstered by trail-building grants and investments, this segment has broadened accessible riding zones, amplifying mountain biking's allure across diverse demographics. Enthusiasts, drawn to the rugged versatility and durability of these bikes, prioritize performance on challenging terrains. As riders increasingly seek premium frames, advanced suspension systems, and specialized trail accessories, discretionary spending on mountain bikes remains strong. Manufacturers are fine-tuning product lines, emphasizing a balance between strength and weight to align with shifting rider demands. While other categories gain traction, mountain bikes retain a devoted following, solidifying their status as a primary revenue source for leading bicycle brands.

Hybrid bicycles are set to outstrip all other categories, boasting a projected CAGR of 7.62%, positioning them as North America's fastest-growing segment. This surge is driven by a rising tide of commuters and leisure riders gravitating towards versatile bikes adept on both paved and unpaved surfaces. Infrastructure advancements, like the melding of protected lanes with gravel connectors, empower hybrid riders to navigate diverse terrains without the hassle of switching bikes. With their blend of comfort, durability, and adaptability, hybrids cater perfectly to urban riders prioritizing practicality. In response, top manufacturers are refining product ranges and channeling research and development into crafting frames that strike a balance between sturdiness and lightweight design. As hybrids cement their status as the market's utility cornerstone, their ascent underscores a broader consumer shift towards versatile mobility and active living.

In 2025, regular bike frames command a dominant 92.05% share of total shipments. Their established diamond geometries ensure consistent ride comfort and easy maintenance. These traditional designs, favored in both leisure and sports cycling, boast straightforward constructions. This simplicity translates to affordability, making regular frames particularly attractive to first-time buyers, families, and casual riders. Manufacturers are honing in on the delicate balance of durability, weight, and cost, ensuring these bikes remain widely accessible. The ready availability of spare parts and familiar repair processes further bolsters their popularity across diverse markets. In essence, regular frame bikes stand as the cornerstone of the North American bicycle market, celebrated for their versatility in both recreational and sporting arenas.

Folding bikes are emerging as the market's fastest-growing segment, boasting a robust projected CAGR of 9.86%. This surge is largely fueled by urban centers grappling with space constraints. Their compact, portable design caters perfectly to apartment dwellers and those navigating multi-modal commutes in bustling cities. Major metropolitan transit authorities, including those in New York, Toronto, and Vancouver, have relaxed restrictions on carrying folding bikes during peak hours, further bolstering their appeal in public transport. While they currently hold a modest slice of the North American market, folding bikes are witnessing a notable uptick as urban residents hunt for convenient mobility solutions. A notable trend sees weekday commuters opting for folding bikes for practical travel, then transitioning to regular or electric bikes for leisurely weekend rides, highlighting a growing trend of dual ownership. This adaptability accentuates folding bikes' pivotal role in navigating urban mobility challenges and aligning with modern lifestyle preferences.

The North America Bicycle Market Report Segments the Industry Into Type (Road Bicycles, Hybrid Bicycles, All-Terrain/Mountain Bicycles, E-Bicycles, Other Types), Distribution Channel (Offline Retail Stores, Online Retail Stores), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Trek Bicycle Corporation

- Specialized Bicycle Components

- Giant Manufacturing Co.

- Accell Group (Raleigh, Haibike)

- Cannondale (Cycling Sports Group)

- Pon Bike (Santa Cruz, Gazelle)

- Schwinn (Pacific Cycle)

- Rad Power Bikes

- Lectric eBikes

- Aventon

- Mongoose

- Diamondback

- Marin Bikes

- Salsa Cycles

- QuietKat

- Serial 1 (Harley-Davidson)

- Propella

- Ride1Up

- Juiced Bikes

- Brompton Bicycle

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban-mobility funding programs drive infrastructure-led demand

- 4.2.2 Micro-mobility subscription platforms reshape urban transportation

- 4.2.3 OEM manufacturing investments in Mexico create supply-chain alternatives

- 4.2.4 ESG-driven corporate fleet procurement institutionalizes demand

- 4.2.5 Battery-as-a-service models lowering e-bike TCO

- 4.2.6 Fitness trends increase the popularity of cycling activities

- 4.3 Market Restraints

- 4.3.1 Bike-theft insurance gaps undermine urban adoption

- 4.3.2 Component supply-chain fragility creates production bottlenecks

- 4.3.3 Rising anti-dumping duties on Chinese imports

- 4.3.4 Growing second-hand marketplace cannibalisation

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Road/City

- 5.1.2 Mountain/All-Terrain

- 5.1.3 Hybrid

- 5.1.4 E-Bicycle

- 5.1.5 Other Types

- 5.2 By Design

- 5.2.1 Regular

- 5.2.2 Folding

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Kids

- 5.4 By Distribution Channel

- 5.4.1 Online Retail Stores

- 5.4.2 Offline Retail Stores

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Trek Bicycle Corporation

- 6.4.2 Specialized Bicycle Components

- 6.4.3 Giant Manufacturing Co.

- 6.4.4 Accell Group (Raleigh, Haibike)

- 6.4.5 Cannondale (Cycling Sports Group)

- 6.4.6 Pon Bike (Santa Cruz, Gazelle)

- 6.4.7 Schwinn (Pacific Cycle)

- 6.4.8 Rad Power Bikes

- 6.4.9 Lectric eBikes

- 6.4.10 Aventon

- 6.4.11 Mongoose

- 6.4.12 Diamondback

- 6.4.13 Marin Bikes

- 6.4.14 Salsa Cycles

- 6.4.15 QuietKat

- 6.4.16 Serial 1 (Harley-Davidson)

- 6.4.17 Propella

- 6.4.18 Ride1Up

- 6.4.19 Juiced Bikes

- 6.4.20 Brompton Bicycle