|

市场调查报告书

商品编码

1910931

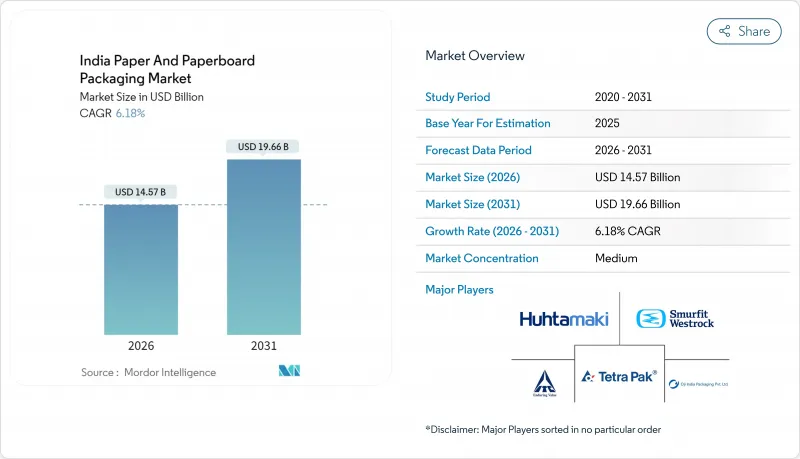

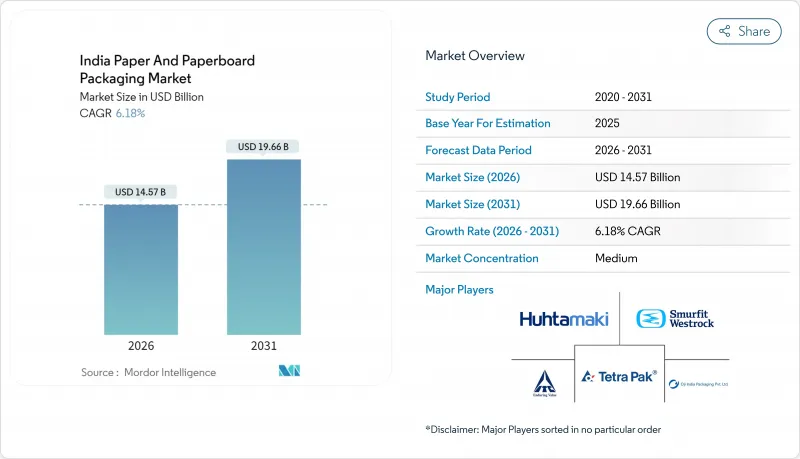

印度纸和纸板包装市场:市场份额分析、行业趋势与统计、成长预测(2026-2031)India Paper And Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计到 2026 年,印度纸和纸板包装市场规模将达到 145.7 亿美元,高于 2025 年的 137.2 亿美元。

预计到 2031 年将达到 196.6 亿美元,2026 年至 2031 年的复合年增长率为 6.18%。

需求动能反映了全国逐步淘汰一次性塑胶製品、电子商务物流的快速扩张以及品牌对循环经济包装的承诺。瓦楞纸箱因其抗震且轻巧的运输需求,在网路零售领域占据主导地位。同时,液体纸盒受益于高端饮料的成长和无菌填充技术的投资。食品饮料品牌正在加速采用可回收的单一材料包装,而一二线城市快速商业中心的扩张也扩大了小型二次包装的潜在市场。在供应方面,再生纤维产能、农业废弃物纸浆生产线和高速柔版印刷机的扩建工作正在取得进展,但由于能源价格上涨和进口再生纸价格波动,利润率仍面临压力。

印度纸和纸板包装市场趋势及展望

电子商务对瓦楞纸包装的需求不断增长

订单量的快速增长以及电商快递35公斤的新重量限制促使加工商寻求兼顾强度和纸张重量的瓦楞纸板设计,以提高最后一公里配送效率。 Flipkart 淘汰塑胶包装的倡议已导致数百万小包裹转为纸质包装。像 Adani Wilmar 这样的快速消费品供应商正在为线上通路推出更大容量的 SKU,从而推动了瓦楞纸板使用量的成长。位于班加罗尔和德里的区域枢纽网络加快了补货速度,同时增加了触点,并推动了对能够维护品牌价值的高品质印刷图案的需求。因此,瓦楞纸板製造商正在采用在线连续柔版摺页机和数位印刷模组来缩短准备时间并减少废弃物。因此,在电子商务渗透率和材料中性永续性要求的交汇点,印度纸和纸板包装市场正经历结构性成长。

食品品牌正逐步转向可再生单一材料包装

随着都市区消费者越来越关注包装标籤的最终使用寿命,可回收性已成为影响购买决策的重要因素。领先的食品加工企业正在重新设计复合材料,采用水性或生物聚合物涂层的单基材纸板,无需多层塑胶即可提供防油防潮性能。 Huhtamaki 与印度工业联合会合作创建了一份开放原始码设计指南,展示了单一材料形式如何促进机械回收流程。由于品牌所有者的目标是在 2026 年实现更高的生产者延伸责任 (EPR) 目标,因此能够保证纤维纯度和可追溯性的供应商将优先考虑。涂层化学品可以大规模在线连续应用,为加工商带来利润率和速度方面的优势,从而增强印度纸和纸板包装市场的长期发展动力。

进口再生纸价格波动

印度约30%的再生纸板原料依赖海运,而运输中断和竞标战推高了现货价格,挤压了造纸厂的利润空间。印度造纸工业协会已要求对从中国和智利进口的多层纸板征收关税,理由是价格暴跌。 JK Paper公司2024财年获利下降58%就是一个鲜明的例子,说明成本飙升如何直接影响利润。虽然北美一条新的纸浆生产线在2025年中期有助于抑制全球纸价,但外汇波动和红海航运风险仍导致市场波动性居高不下,减缓了印度纸和纸板包装市场近期的成长速度。

细分市场分析

到2025年,瓦楞纸板将占总收入的48.23%,这主要得益于履约中心对缓衝和托盘效率的重视。液体纸盒虽然尺寸较小,但预计将以7.28%的复合年增长率成长,这主要得益于高端乳製品、果汁和无菌预製食品解决方案的需求。印度瓦楞纸和纸板包装市场预计在2026年至2031年间将成长22.9亿美元,主要得益于在线连续印刷和模切技术的投资,这些技术降低了换线成本。在利乐公司突破性地推出5% ISCC PLUS认证的再生聚合物层的引领下,UFlex等液体纸盒产业的领导者计画将年产量扩大到120亿包。同时,由于符合单一材料标准的水性阻隔涂层的改进,折迭纸盒在消费品领域保持着稳固的地位。小众市场保护要求和环保意识品牌推广带来了溢价差异,从而缓衝了特种纸板和模塑纤维原材料价格的波动。

从竞争角度来看,像ITC这样的大型集团掌控着从农场到成品纸板的整个流程,这使它们能够对冲原材料成本并缩短产品开发週期。瓦楞纸板製造商则透过将印刷工序设在更靠近数位市场的地区来应对,从而实现当日补货。随着印度纸和纸板包装市场朝向超本地化配送模式发展,这成为一项营运优势。

预计到2025年,食品饮料品牌将占总收入的39.35%,这主要得益于严格的卫生标准和不断扩展的低温运输。同时,个人护理和化妆品领域预计将以7.72%的复合年增长率实现更高成长。在餐饮服务业,速食店正在采用由再生纤维和PLA分散体製成的防油翻盖式容器,以遵守一次性塑胶禁令。预计到2031年,印度个人保健产品纸和纸板包装市场规模将成长5.68亿美元,主要得益于高端品牌从塑胶容器转向硬纸板和胶印纸套。

在医疗保健领域,由于国内药品产量增加,对泡壳包装内衬和医用纸盒的需求保持稳定。电子产品製造商虽然在寻求防静电织物托盘,但由于其与发泡材的功能等效性存在成本差异,因此增长速度受到限制。在工业和汽车领域,多层瓦楞纸箱以及「印度製造」倡议带来的采购量增加,确保了在广泛的终端用户领域拥有均衡的收入基础。

其他福利

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务的扩张带动了对瓦楞纸包装需求的成长。

- 食品品牌正逐步转向可再生单一材料包装

- 政府禁止使用一次性塑胶製品

- 快速商业区域中心的崛起

- 投资自动化高速柔版印刷

- 提高农业废弃物纸浆生产能力

- 市场限制

- 进口再生纸价格波动

- 货柜纸板能源成本持续上涨

- 中小加工商的消费税退税延迟

- 计费和出版领域的数位化替代方案

- 工业供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 产业间竞争

第五章 市场规模与成长预测

- 依产品类型

- 可折迭瓦楞纸箱

- 纸板包装

- 液体纸盒

- 其他的

- 按最终用户行业划分

- 饮食

- 处方药

- 个人护理及化妆品

- 电气和电子设备

- 工业与汽车

- 按包装类型

- 主要零售包装

- 二级运输包装

- 可直接上架/展示包装

- 保护性衬垫和缓衝垫

- 按材料等级

- 原生纸浆

- 再生纤维

- 混纺/混合纤维

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TCPL Packaging Limited

- Parksons Packaging Limited

- Smurfit WestRock plc

- KCL Limited

- Borkar Packaging Private Limited

- Canpac Trends Private Limited

- Trident Paper Box Industries

- Tetra-Pak India Private Limited

- UFlex Ltd

- Oji India Packaging Private Limited

- ITC Limited-Paperboards and Specialty Papers Division

- JK Paper Limited

- Horizon Packs Private Limited

- Astron Packaging Limited

- ANY Graphics Private Limited

- Meghna Packaging Private Limited

- GPA Global India

- Huhtamaki India Limited

- Mayur Uniquoters Limited

第七章 市场机会与未来展望

India paper and paperboard packaging market size in 2026 is estimated at USD 14.57 billion, growing from 2025 value of USD 13.72 billion with 2031 projections showing USD 19.66 billion, growing at 6.18% CAGR over 2026-2031.

Demand momentum reflects the nationwide shift away from single-use plastics, the rapid scale-up of e-commerce logistics, and brand commitments to circular-economy packaging.Corrugated boxes dominate because online retail requires impact-resistant yet lightweight transit formats, while liquid cartons are benefiting from premium beverage growth and aseptic filling investments. Food and beverage brands accelerate the adoption of recyclable mono-material packs, and quick-commerce hubs in Tier-1 and Tier-2 cities enlarge the addressable base for small-format secondary packs. On the supply side, recycled fiber capacity, agro-residue pulp lines, and high-speed flexo presses are expanding, yet margin pressure persists due to energy inflation and volatile imported waste-paper prices.

India Paper And Paperboard Packaging Market Trends and Insights

Rising E-commerce Corrugated Demand

Order-volume surges and heavier quick-commerce shipments now permitted up to 35 kg are pushing converters to engineer corrugated designs that balance strength and grammage for last-mile efficiency. Flipkart's commitment to eliminating plastic cushioning has already converted millions of parcels to paper-based formats. FMCG suppliers such as Adani Wilmar have introduced larger stock-keeping units tailored for online channels, fueling incremental box tonnage. Regional hub networks in Bengaluru and Delhi enable faster replenishment but also multiply touch-points, widening demand for high-print graphics that preserve brand equity. As a result, corrugators are installing inline flexo folders and digital print modules to shorten make-ready times and cut waste. The India paper and paperboard packaging market, therefore, derives a structural uplift from the intersection of e-commerce penetration and material-neutral sustainability mandates.

Food Brand Shift to Recyclable Mono-Material Packs

Recyclability is now a purchase driver as urban consumers scrutinize pack labels for end-of-life credentials. Large food processors are reformulating laminates toward single-substrate paperboard combined with aqueous or biopolymer coatings that deliver grease and moisture barriers without multi-layer plastics. Huhtamaki's partnership with the Confederation of Indian Industry created open-source design guides that clarify how mono-material formats ease mechanical recycling workflows. As brand owners chase Extended Producer Responsibility targets that ramp up in 2026, vendors able to guarantee fiber purity and traceability gain preference.Because coating chemistries can be applied in-line at scale, converters capture both margin and speed advantages, reinforcing the long-run tailwind on the India paper and paperboard packaging market.

Price Volatility of Imported Waste Paper

India relies on seaborne recovered fiber for roughly 30% of recycled-board furnish; freight disruptions and bidding wars push spot prices, squeezing mill margins. The Indian Paper Manufacturers Association has petitioned for duties on multi-layer board imports from China and Chile, citing price undercutting. JK Paper's FY 2024 profit drop of 58% exemplifies how cost spikes flow through earnings. Although new North American pulp lines tempered global prices in mid-2025, currency swings and Red Sea routing risks keep volatility elevated, dampening the near-term growth tempo of the India paper and paperboard packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Government Ban on Single-Use Plastics

- Emergence of Quick-Commerce Regional Hubs

- Chronic Containerboard Energy-Cost Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated stock generated 48.23% of 2025 revenue, buoyed by e-commerce fulfillment centers that prize cushioning and pallet efficiency. Liquid cartons, though smaller, are slated for a 7.28% CAGR on the back of premium dairy, juice, and aseptic meal solutions. The India paper and paperboard packaging market size for corrugated grades is projected to increase by an additional USD 2.29 billion between 2026 and 2031, driven by investments in inline print-and-die-cut technology that lowers changeover costs. Liquid-carton leaders such as UFlex plan to lift output to 12 billion packs annually, helped by Tetra Pak's landmark rollout of 5% ISCC PLUS certified recycled-polymer layers. In parallel, folding cartons maintain a stable FMCG base, upgraded by water-based barrier coats that meet mono-material guidelines. Specialty paperboards and molded fiber trade on niche protection requirements and ecological branding, commanding premium spreads that cushion input volatility.

From a competitive stance, large groups like ITC control the full chain from agro-forestry to finished board, enabling raw-material hedging and shorter product-development cycles. Corrugators respond by co-locating print cells near digital marketplaces to deliver same-day box replenishment, an operational edge as the India paper and paperboard packaging market pivots toward hyperlocal delivery.

Food and beverage brands captured 39.35% revenue in 2025 due to stringent hygiene codes and an expanding cold chain, while personal care and cosmetics outperformed with an 7.72% CAGR forecast. Within food-service, quick-serve restaurants adopt grease-resistant clamshells built from recycled fiber plus PLA dispersion, aligning with the single-use-plastic ban. The India paper and paperboard packaging market size for personal-care items is slated to advance by USD 568 million through 2031 as premium labels trade plastic jars for rigid paperboard tubes and offset-printed sleeves.

On the healthcare front, blister backing and medical-grade cartons enjoy secure demand as domestic pharma output climbs. Electronics brands seek static-safe fiber trays but weigh cost against functional parity with foam, damping runaway growth. Industrial and automotive parts rely on multi-wall corrugated crates that dovetail with the Make in India sourcing expansion, ensuring a broad, balanced revenue footprint across end-use bands.

The India Paper and Paperboard Packaging Market Report is Segmented by Product Type (Folding Cartons, Corrugated Packaging, Liquid Cartons, and More), End-User Vertical (Food and Beverage, Healthcare and Pharma, Automotive, and More), Packaging Format (Primary Retail Packs, Secondary Transit Packs, and More), Material Grade (Virgin Fiber, Recycled Fiber, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- TCPL Packaging Limited

- Parksons Packaging Limited

- Smurfit WestRock plc

- KCL Limited

- Borkar Packaging Private Limited

- Canpac Trends Private Limited

- Trident Paper Box Industries

- Tetra-Pak India Private Limited

- UFlex Ltd

- Oji India Packaging Private Limited

- ITC Limited - Paperboards and Specialty Papers Division

- JK Paper Limited

- Horizon Packs Private Limited

- Astron Packaging Limited

- A N Y Graphics Private Limited

- Meghna Packaging Private Limited

- GPA Global India

- Huhtamaki India Limited

- Mayur Uniquoters Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising e-commerce corrugated demand

- 4.2.2 Food brand shift to recyclable mono-material packs

- 4.2.3 Government ban on single-use plastics

- 4.2.4 Emergence of quick-commerce regional hubs

- 4.2.5 Automated high-speed flexo printing investments

- 4.2.6 Agro-residue pulp capacity additions

- 4.3 Market Restraints

- 4.3.1 Price volatility of imported waste paper

- 4.3.2 Chronic containerboard energy-cost inflation

- 4.3.3 Delayed GST refunds for SME converters

- 4.3.4 Digital substitution in billing and publishing

- 4.4 Industry Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Folding Cartons

- 5.1.2 Corrugated Packaging

- 5.1.3 Liquid Cartons

- 5.1.4 Other Product Types

- 5.2 By End-User Vertical

- 5.2.1 Food and Beverage

- 5.2.2 Healthcare and Pharma

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Automotive

- 5.3 By Packaging Format

- 5.3.1 Primary Retail Packs

- 5.3.2 Secondary Transit Packs

- 5.3.3 Shelf-ready / Display Packs

- 5.3.4 Protective Inserts and Cushioning

- 5.4 By Material Grade

- 5.4.1 Virgin Fiber

- 5.4.2 Recycled Fiber

- 5.4.3 Hybrid/Mixed Fiber

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TCPL Packaging Limited

- 6.4.2 Parksons Packaging Limited

- 6.4.3 Smurfit WestRock plc

- 6.4.4 KCL Limited

- 6.4.5 Borkar Packaging Private Limited

- 6.4.6 Canpac Trends Private Limited

- 6.4.7 Trident Paper Box Industries

- 6.4.8 Tetra-Pak India Private Limited

- 6.4.9 UFlex Ltd

- 6.4.10 Oji India Packaging Private Limited

- 6.4.11 ITC Limited - Paperboards and Specialty Papers Division

- 6.4.12 JK Paper Limited

- 6.4.13 Horizon Packs Private Limited

- 6.4.14 Astron Packaging Limited

- 6.4.15 A N Y Graphics Private Limited

- 6.4.16 Meghna Packaging Private Limited

- 6.4.17 GPA Global India

- 6.4.18 Huhtamaki India Limited

- 6.4.19 Mayur Uniquoters Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment