|

市场调查报告书

商品编码

1910949

电动汽车电池管理系统:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Electric Vehicle Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

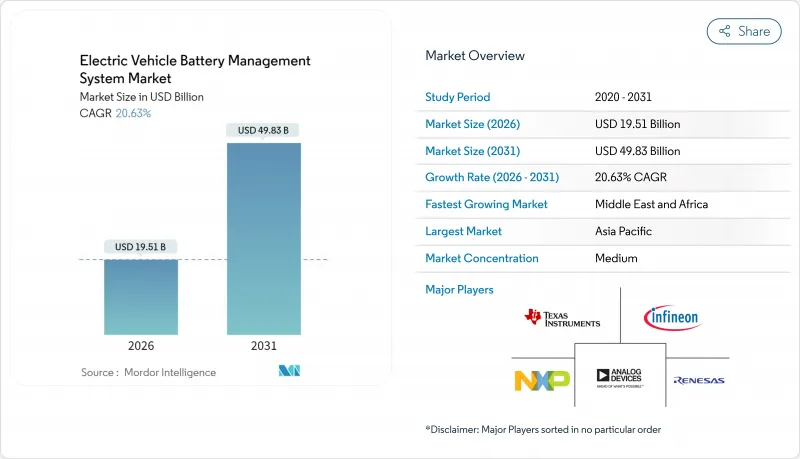

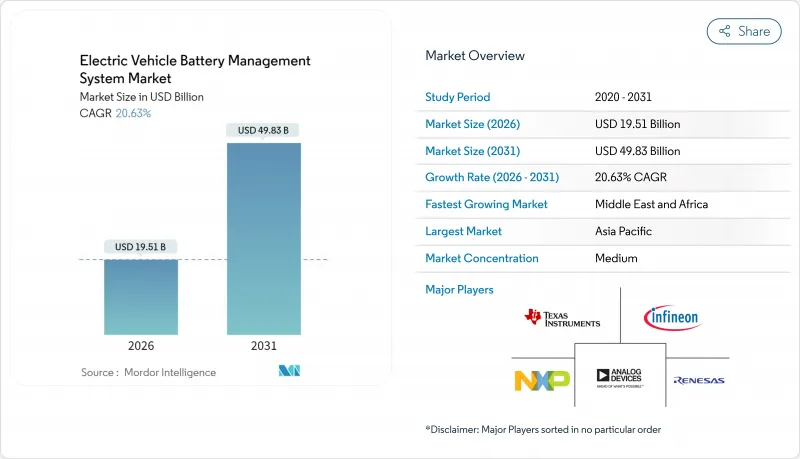

预计到 2026 年,电动车电池管理系统市场规模将达到 195.1 亿美元,高于 2025 年的 161.7 亿美元。预计到 2031 年,该市场规模将达到 498.3 亿美元,2026 年至 2031 年的复合年增长率为 20.63%。

快速的车辆电气化、锂离子电池价格的下降以及所有新型电动车必须符合ASIL-D安全标准的法规,都在推动市场需求。汽车製造商倾向于采用轻量化的无线拓扑结构,这种结构可减少高达90%的布线,支援空中软体更新,并简化电池组的维护。同时,一级供应商正在整合云端分析功能,使车队能够即时监控电池健康状况。半导体短缺的缓解、政府奖励以及能量密度提升至400-500 Wh/kg,都在进一步扩大潜在市场规模。

全球电动汽车电池管理系统市场趋势与洞察

全球电动车产量快速成长

2024年1月至5月,全球电动车电池消费量达到285.4吉瓦时(GWh),较去年同期成长23%。这一激增迫使製造商采用模组化电池管理系统(BMS)架构,以实现单一设计支援多种车辆平台。向800V乃至1200V电池组的过渡,要求BMS供应商提高监控精度、优化热模型并改善故障隔离逻辑。通用汽车在其Ultium平台上采用了无线BMS,实现了电池组的标准化并省去了繁重的线束。为了适应不断加快的生产速度,自动化BMS测试设备正在取代人工检验,供应商也正在整合云端仪錶板,以便车队能够远端查看电池单元层级的数据。

锂离子电池成本降低和能量密度提高

电池组价格暴跌使得人工智慧晶片、云端调变解调器和高精度电流感测器等组件的价格进入了主流电动车的范畴。随着能量密度从250-300Wh/kg提升至400-500Wh/kg,更小的封装尺寸会产生更多热量,这就要求电池管理系统(BMS)韧体的反应速度必须快于1毫秒,以避免热失控。宁德时代(CATL)的500Wh/kg高密度电池凸显了对荷电状态(SOC)和即时健康状态(SHS)预测精度达到±1%的必要性。电池成本的下降使得供应商能够将资金投入先进微控制器的研发中,从而整合片上神经网络,学习运作环境中的劣化模式。

半导体短缺延长了BMS IC的前置作业时间

汽车级模拟前端和碳化硅栅极驱动器的前置作业时间仍超过52週。供应商正在重新设计基板,以更大尺寸的替代晶片取代稀缺晶粒,这引发了新的检验流程。大型一级供应商利用大批量合约抢占市场先机,而小型供应商则被迫等待,导致行业整合。由于原始设备製造商 (OEM) 持有大量缓衝库存,占用了营运资金,电池管理系统市场的定价结构也受到了影响。预计2026年底,代工厂的长期晶圆代工厂投资将缓解供应压力,但目前主导动力传动系统电子产品的28奈米老旧製程节点仍存在不确定性。

细分市场分析

到2025年,积体电路将占总收入的35.62%,这表明价值已大幅转移到硅晶片上。精密模拟前端、带有人工智慧加速器的微控制器和射频收发器现在都整合在同一晶粒上,从而减少了基板面积和成本。无线通讯积体电路的复合年增长率将达到21.05%。这使得模组化电池组成为可能,并显着降低了线束重量,促使OEM厂商更多地采用这种技术,因为他们每个产品週期都会推出多个电池平台。

整合式类比讯号撷取、无线网路和加密模组的系统晶片设计,能够实现更小的基板尺寸和更快的认证流程。更高的整合度提升了可靠性,而生产线上的自动化校准则缩短了最终测试时间。供应商正在将这些晶片与符合 ISO 26262韧体库配合使用,从而缩短一级供应商的开发週期。同时,外部电量计 IC 整合了 24 位元 ADC,可将荷电状态误差降低至 ±1%,这对于从 250Wh/kg 升级到 500Wh/kg 的电池组至关重要。因此,组件创新仍是电池管理系统市场的核心。

到2025年,锂离子电池将占据87.35%的市场份额,为几乎所有电动车项目提供动力。成熟的供应链、已知的劣化特性以及不断下降的成本曲线巩固了其市场地位。同时,固态电池技术预计到2031年将以21.18%的复合年增长率成长,预计将实现更高的体积能量密度和固有的安全性。镍基电池组将继续应用于对低温性能要求极高的工业牵引领域,而铅酸电池仍将作为某些平台的12V辅助电源。虽然液流电池主要应用于固定式储能领域,但其电池单元的模组化设计使其能够重复利用汽车电池管理系统(BMS)的逻辑,使供应商能够重新设计并拓展在电池管理系统行业的业务机会。

化学成分的变化也会改变感测需求。固体电解质无需检测液态电解质,但新一代电池管理系统(BMS)整合了压力和声波感测器,以提高对电池堆压力和介面缺陷的灵敏度。锂离子模组越来越依赖基于机器学习的均衡演算法来延长循环寿命。拥有电化学专业知识的供应商正获得设计上的广泛认可,因为他们可以针对每种正极材料客製化韧体。在对成本敏感的细分市场,从NMC到LFP的转变也改变了电压范围,推动了基板采用16位元微处理器,这些微控制器可以在不降低解析度的情况下处理更宽的ADC范围。总而言之,化学成分的多样性使电池管理系统市场保持活力,并对拥有专业技术的新参与企业敞开大门。

模组化设计将在2025年占据42.55%的收入份额,因为它们在成本、冗余性和可製造性之间实现了良好的平衡。采用基板模组化设计,可使不同车型的电池组结构标准化,从而简化现场服务。无线架构将以21.40%的复合年增长率成长,大幅减少低压布线,缩短电池组组装时间,这对高产能工厂至关重要。对于微出行等低能耗应用,集中式布局仍然具有吸引力,因为基板成本最低。分散式拓扑结构将被应用于公车、卡车和固定式储能係统,这些系统需要在节点故障时实现平稳降级。

模组化和无线技术的普及促进了电池的二次利用。由于每个模组都拥有独立的控制器,因此报废车辆的电池模组只需进行少量维修即可整合到家用储能係统中。原始设备製造商(OEM)可以利用通用的模组化模俱生产轿车、SUV 和厢型车,从而降低资本支出。同时,每个模组内建的无线微网关支援空中升级,例如售后均衡或添加新的电池化学成分。因此,拓朴结构的选择不仅影响成本,也影响长期的收入来源,进而在电池管理系统市场创造超越硬体本身的价值。

区域分析

截至2025年,亚太地区维持了47.10%的收入份额。中国电池巨头宁德时代和比亚迪占据了全球电池出货量的大部分,并已建立起涵盖从锂原料加工到成品电池管理系统(BMS)组装的完整供应链。日本和韩国提供精密半导体和软体工具,而在印度,超过60家本土BMS企业为国内摩托车品牌客製化基板。儘管该地区的电动车普及已进入成熟阶段,但政府透过生产连结奖励计画和固态电池试点生产线提供的资金支持,正在推动BMS市场的大规模扩张。

中东和非洲地区实现了全球最快的成长速度,年复合成长率高达21.25%,这得益于各国正在摆脱传统引擎平台的束缚。加纳和摩洛哥正在大力推广摩托车电气化,并将其与太阳能微电网连接,刺激了对价格适中的电池管理系统(BMS)单板产品的需求。非洲Start-Ups正与亚洲积体电路供应商合作,设计适用于崎岖道路和高温环境的防潮基板)。政府的支持降低了电池的进口关税,使组装能够将资金集中用于电子元件,以提高可靠性。在北美,政府已颁布通膨控制法案,为本地采购BMS组件和电池提供税额扣抵。半导体製造商在美国的扩张将使高价值模拟前端元件的生产更靠近原始设备製造商(OEM)工厂,从而缓解未来的供应衝击。加拿大的采矿业正在确立其作为低碳镍来源的地位,而墨西哥的组装丛集正在吸引一级供应商前来建造整合无线BMS的电池组生产线。欧洲正着力推进电池护照制度,该制度将从2026年起强制实施端到端追踪,并积极推广云端连接基板,将生命週期数据传输至区块链註册表。儘管这两个地区都在稳步成长,但亚太地区的规模优势将有助于其维持电池管理系统市场的主导。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球电动车产量快速成长

- 锂离子电池成本降低和能量密度提高

- 严格的安全法规要求采用先进的电池管理系统(BMS)。

- 政府奖励和排放目标将加速电动车的普及。

- 采用无线电池管理系统架构以减轻线束重量

- 面向OEM厂商的订阅式电池分析服务

- 市场限制

- 半导体短缺导致电池管理系统积体电路前置作业时间延长

- ASIL-D 功能安全合规性的高成本

- 资料所有权纠纷阻碍了云端楼宇管理系统的采用。

- 严格的网路安全认证导致产品发布延迟

- 价值/价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元))

- 按组件

- 积体电路

- 截止场效电晶体和驱动器

- 温度感测器

- 燃油表/电流测量装置

- 微控制器

- 通讯介面积体电路

- 其他部件

- 电池化学

- 锂离子

- 固态

- 镍基

- 铅酸电池

- 液流电池

- 按拓扑学

- 集中管理

- 模组化的

- 去中心化

- 无线(无电缆)

- 透过通讯技术

- 有线 CAN

- 有线以太网

- 无线射频

- 依推进类型

- 电池式电动车(BEV)

- 混合动力电动车(HEV)

- 插电式混合动力汽车(PHEV)

- 燃料电池电动车(FCEV)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和重型商用车辆

- 摩托车和微型交通工具

- 非公路及特种车辆

- 按销售管道

- 原厂正品设备

- 售后/改装

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Texas Instruments

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- Renesas Electronics

- Vitesco Technologies

- Visteon Corporation

- CATL

- LG Energy Solution

- BYD Co.

- Panasonic Energy

- Denso Corporation

- TE Connectivity

- Sensata Technologies

- Hitachi Astemo

第七章 市场机会与未来展望

Electric Vehicle Battery Management System Market size in 2026 is estimated at USD 19.51 billion, growing from 2025 value of USD 16.17 billion with 2031 projections showing USD 49.83 billion, growing at 20.63% CAGR over 2026-2031.

Demand is powered by rapid vehicle electrification, falling lithium-ion cell prices, and regulations that now push every new electric model toward ASIL-D safety compliance. OEMs favour lighter wireless topologies that cut up to 90% of wiring, enable over-the-air updates and simplify pack service, while tier-one suppliers bundle cloud analytics so fleets can monitor battery health in real time. Declining semiconductor shortages, government incentive schemes, and energy-density gains to 400-500 Wh/kg further expand addressable volumes.

Global Electric Vehicle Battery Management System Market Trends and Insights

Rapid Scale-up of Global EV Production Volumes

Global EV battery consumption hit 285.4 GWh in the first five months of 2024, a 23% year-on-year jump. This surge forces manufacturers to adopt modular battery management system market architectures so that a single design works across multiple vehicle platforms. Transitioning to 800 V and even 1,200 V packs obliges BMS vendors to upgrade monitoring precision, thermal models and fault isolation logic. General Motors adopted a wireless BMS on its Ultium platform to standardize packs while removing heavy harnesses. Automated BMS test rigs replace manual validation to meet higher production cadence, and suppliers bundle cloud dashboards so fleets can view cell-level data remotely.

Declining Lithium-ion Battery Costs and Energy-density Gains

Pack prices fell fast enough that AI chips, cloud modems and precision current sensors now fit inside mainstream EV price points. Rising energy density from 250-300 Wh/kg toward 400-500 Wh/kg compresses more heat into smaller volumes, so BMS firmware must react within sub-millisecond windows to avoid thermal runaway. CATL's 500 Wh/kg condensed cell highlights the need for +-1% state-of-charge accuracy and real-time state-of-health prediction. Lower cell costs free capex for advanced microcontrollers, giving suppliers room to integrate on-chip neural nets that learn degradation patterns in the field.

Semiconductor Shortages Inflating BMS IC Lead-times

Automotive-grade analog front ends and SiC gate drivers still face lead times beyond 52 weeks. Suppliers redesign boards to swap scarce dies for larger-geometry alternatives, yet those changes trigger fresh validation loops. Larger tier-ones leverage volume contracts while smaller firms queue, prompting industry consolidation. Scarcity spills into the battery management system market price stack because OEMs hold buffer stock that ties up working capital. Long-term capital expansion among foundries should ease pressure by late 2026, but uncertainty lingers around older 28 nm nodes that dominate powertrain electronics.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Safety Regulations Mandating Advanced BMS

- Government Incentives and Emissions Targets Accelerating EV Uptake

- High Cost of ASIL-D Functional-safety Compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated circuits commanded 35.62% of 2025 revenue, signalling how much value has moved onto silicon. High-accuracy analog front ends, microcontrollers with AI accelerators and RF transceivers now live on the same die, trimming board area and cost. Wireless communication ICs record a 21.05% CAGR because they facilitate modular packs and slash harness weight, escalating adoption across OEMs that release multiple battery platforms per model cycle.

System-on-chip designs that fuse analog acquisition, wireless networking and cryptographic blocks enable smaller boards and faster certification. The density improvement lifts reliability, while automated calibration on the production line lowers end-of-line test time. Vendors pair these chips with firmware libraries for ISO 26262 compliance, reducing development cycles for tier-ones. In parallel, external fuel-gauge ICs integrate 24-bit ADCs that push state-of-charge error to +-1%, essential for packs moving from 250 Wh/kg toward 500 Wh/kg. As a result, component innovation remains the heartbeat of the battery management system market.

Lithium-ion held 87.35% share in 2025, underpinning almost every EV program. Its mature supply base, known ageing profile and falling cost curve keep it entrenched. Solid-state technologies, however, post a 21.18% CAGR to 2031 because they promise higher volumetric energy and intrinsic safety. Nickel-based packs survive in industrial traction where low-temperature performance matters, while lead-acid still backs 12 V auxiliaries on some platforms. Flow batteries appear mainly in stationary storage, but the modular nature of their cells invites reuse of automotive BMS logic, letting vendors repurpose designs and widen their serviceable opportunities inside the battery management system industry.

Chemistry shifts alter sensing requirements. Solid-state eliminates liquid electrolyte checks yet raises sensitivity to stack pressure and interface defects, so next-generation BMS integrates pressure and acoustic sensors. Lithium-ion modules increasingly rely on machine-learning balance algorithms that extend cycle life. Suppliers with electrochemistry know-how win design-in because they tune firmware to each cathode composition. The pivot from NMC to LFP in cost-sensitive segments also changes voltage windows, pushing boards to adopt 16-bit micro-controllers that handle wider ADC ranges without losing resolution. All told, chemistry diversity keeps the battery management system market vibrant and open to newcomers with niche expertise.

Modular designs secured 42.55% of 2025 revenue because they balance cost, redundancy and ease of manufacturing. Their board-per-module approach standardizes pack construction across vehicle classes and simplifies field service. Wireless architectures, rising at 21.40% CAGR, remove most low-voltage wiring and reduce pack build times, a decisive benefit for high-throughput plants. Centralized layouts still appeal for low-energy applications such as micro-mobility, where a single board is cheapest. Distributed topologies serve buses, trucks and stationary storage that need graceful degradation if any node fails.

The shift toward modular and wireless schemes supports second-life repurposing. Decommissioned automotive modules can slot into home storage systems with minimal rework because each module carries its own controller. OEMs also leverage the same modular tooling across sedans, SUVs and vans, cutting capital expenditure. In parallel, wireless pico-gateways inside each module enable over-the-air updates that fine-tune balancing or add new chemistries after sale. As a result, topology choice shapes not just cost but long-run revenue streams, embedding value beyond hardware in the battery management system market.

The Electric Vehicle Battery Management System Market Report is Segmented by Component (Integrated Circuits and More), Battery Chemistry (Lithium-Ion and More), Topology (Centralized and More), Communication Technology (Wired CAN and More), Propulsion Type (Battery Electric Vehicles and More), Vehicle Type (Passenger Car and More), Sales Channel, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 47.10% revenue in 2025. China's cell giants CATL and BYD jointly shipped more than half of global batteries, anchoring a supply chain that extends from raw lithium processing to finished BMS assembly. Japan and South Korea supply precision semiconductors and software tools, while India hosts more than 60 local BMS firms that tailor boards to indigenous two-wheeler brands. Government funding through production-linked incentives and solid-state pilot lines keeps the battery management system market expanding at scale even as EV adoption in the region matures.

The Middle East and Africa post 21.25% CAGR, the fastest worldwide, because countries leapfrog traditional engine platforms. Ghana and Morocco promote two-wheeler electrification tied to solar micro-grids, spurring demand for affordable BMS single-board products. African start-ups collaborate with Asian IC vendors to design humidity-tolerant boards that handle rough roads and high ambient heat. Agency support lowers import duties on cell imports, so assemblers can focus capital on electronics that differentiate reliability. North America benefits from the Inflation Reduction Act, which links tax credits to local BMS content and cell sourcing. Chip-maker expansion in the United States pulls high-value analog front-end production closer to OEM plants, mitigating future supply shocks. Canada's mining sector positions itself as a low-carbon nickel supplier, and Mexico's assembly clusters attract tier-ones building pack lines with embedded wireless BMS. Europe concentrates on battery passports that require end-to-end traceability from 2026, pushing cloud-connected boards that stream life-cycle data into blockchain registries. Both regions grow steadily, yet Asia-Pacific scale advantages preserve its lead in the battery management system market.

- Texas Instruments

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- Renesas Electronics

- Vitesco Technologies

- Visteon Corporation

- CATL

- LG Energy Solution

- BYD Co.

- Panasonic Energy

- Denso Corporation

- TE Connectivity

- Sensata Technologies

- Hitachi Astemo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Scale-up of Global EV Production Volumes

- 4.2.2 Declining Lithium-ion Battery Costs and Energy-density G\ains

- 4.2.3 Stringent Safety Regulations Mandating Advanced BMS

- 4.2.4 Government Incentives and Emissions Targets Accelerating EV Uptake

- 4.2.5 Shift Toward Wireless BMS Architectures to Cut Harness Weight

- 4.2.6 OEM Subscription-based Battery Analytics Services

- 4.3 Market Restraints

- 4.3.1 Semiconductor Shortages Inflating BMS IC Lead-times

- 4.3.2 High Cost of ASIL-D Functional-safety Compliance

- 4.3.3 Data-ownership Disputes Hindering Cloud-BMS Roll-outs

- 4.3.4 Stringent Cyber-security Certification Delaying Launches

- 4.4 Value/Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Component

- 5.1.1 Integrated Circuits

- 5.1.2 Cut-off FETs and Drivers

- 5.1.3 Temperature Sensors

- 5.1.4 Fuel-Gauge/Current-Measurement Devices

- 5.1.5 Microcontrollers

- 5.1.6 Communication Interface ICs

- 5.1.7 Other Components

- 5.2 By Battery Chemistry

- 5.2.1 Lithium-ion

- 5.2.2 Solid-state

- 5.2.3 Nickel-based

- 5.2.4 Lead-acid

- 5.2.5 Flow Batteries

- 5.3 By Topology

- 5.3.1 Centralized

- 5.3.2 Modular

- 5.3.3 Distributed

- 5.3.4 Wireless (Cable-less)

- 5.4 By Communication Technology

- 5.4.1 Wired CAN

- 5.4.2 Wired Ethernet

- 5.4.3 Wireless RF

- 5.5 By Propulsion Type

- 5.5.1 Battery Electric Vehicles (BEV)

- 5.5.2 Hybrid Electric Vehicles (HEV)

- 5.5.3 Plug-in Hybrid Vehicles (PHEV)

- 5.5.4 Fuel-Cell Electric Vehicles (FCEV)

- 5.6 By Vehicle Type

- 5.6.1 Passenger Cars

- 5.6.2 Light Commercial Vehicles

- 5.6.3 Medium and Heavy Commercial Vehicles

- 5.6.4 Two-Wheelers and Micro-mobility

- 5.6.5 Off-highway and Specialty Vehicles

- 5.7 By Sales Channel

- 5.7.1 OEM-fitted

- 5.7.2 Aftermarket/Retrofit

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Rest of North America

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 Australia and New Zealand

- 5.8.4.6 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 United Arab Emirates

- 5.8.5.2 Saudi Arabia

- 5.8.5.3 Turkey

- 5.8.5.4 South Africa

- 5.8.5.5 Egypt

- 5.8.5.6 Rest of Middle East and Africa

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Texas Instruments

- 6.4.2 Analog Devices

- 6.4.3 Infineon Technologies

- 6.4.4 NXP Semiconductors

- 6.4.5 Renesas Electronics

- 6.4.6 Vitesco Technologies

- 6.4.7 Visteon Corporation

- 6.4.8 CATL

- 6.4.9 LG Energy Solution

- 6.4.10 BYD Co.

- 6.4.11 Panasonic Energy

- 6.4.12 Denso Corporation

- 6.4.13 TE Connectivity

- 6.4.14 Sensata Technologies

- 6.4.15 Hitachi Astemo

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment