|

市场调查报告书

商品编码

1911325

印度居住市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)India Senior Living - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

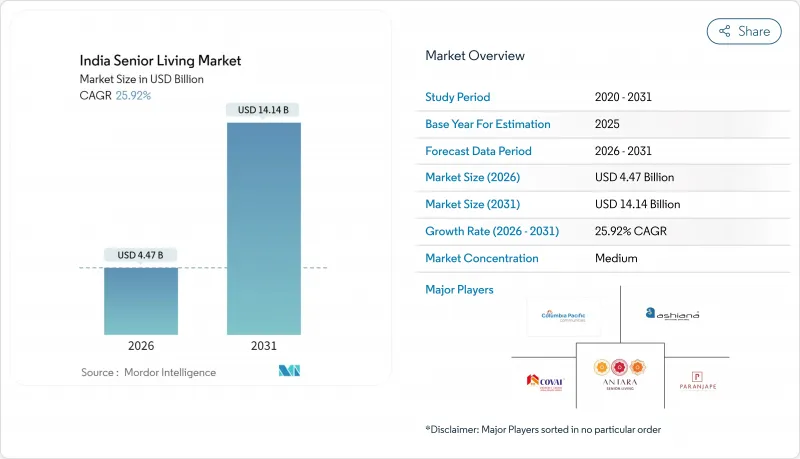

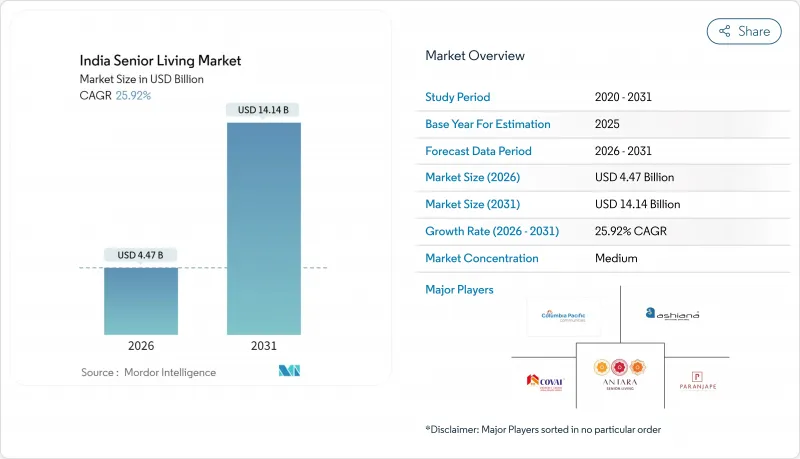

2025年印度居住市场价值为35.5亿美元,预计到2031年将达到141.4亿美元,而2026年为44.7亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 25.92%。

随着60岁以上人口比例的增加和多代同堂家庭的减少,需求正在加速成长。日益壮大的富裕中产阶级正在扩大拥有医疗设施和健康项目的豪华退休社区的覆盖范围。在各州政府降低老年购屋者交易成本的诱因的推动下,开发商正从传统的南方市场向北部和西部的大都会圈扩张。竞争格局正在从小规模区域营运商转向整合预防保健、远端医疗和社交服务的房地产和医疗保健合作模式。

印度老年住宅市场趋势与洞察

人口快速老化催生了对老年住宅解决方案的需求。

印度的人口结构变化曲线陡峭。 60岁以上人口将从2020年的1.53亿增至2050年的3.47亿,增加超过一倍,老年人口比例也将从11%上升至21%。全国预测显示,到2050年,老年抚养比将从2020年的16%上升至34%。南部各邦将率先感受到这项变化。喀拉拉邦的老年人口比例已达16.5%,对老年住宅的需求即时。目前,印度老年居住社区的普及率仅为1%,而美国则高达11%,这意味着该领域仍有巨大的成长空间。为满足预计的需求,到2030年,印度大约需要新建240万套专为老年人设计的住宅。

核心家庭的兴起推动了对自主型老年社区的需求。

长期的都市化加剧了成年子女离开父母家的趋势,削弱了传统的大家庭照顾体系。根据印度老化纵向调查,目前有26.7%的都市区老年人独居。随着家庭网络互动和日常支持的减少,人们对社区型养老社区的兴趣日益浓厚。许多老年人表示,与同侪互动的机会、安全保障以及现场健康监测是他们选择养老社区的重要因素。同行评审的研究证实了独居与老年忧郁症率增加之间的关联,这进一步凸显了结构化社交环境的吸引力。孟买、新德里和班加罗尔的趋势最为显着,因为这些地区的高昂房价和租金阻碍了多代同堂的居住。

强调以家庭为中心的养老护理的文化趋势推广缓慢。

孝道精神根深蒂固。 2007年颁布的《父母及老人照顾福利法》要求成年子女承担父母的生活费用,强化了居家照顾的观念。对许多家庭而言,将年长的家人送往养老机构会让他们感到被遗弃。这种观念在农村和中等城市尤其强烈,因为在这些地区,合住仍然是主流。学术研究表明,老年人如果感到缺乏家庭支持,在考虑入住养老机构时会更加焦虑。人口结构的变化正在逐渐改变这些传统观念,但这转变是渐进的,并且因地而异。

细分市场分析

截至2025年,独立生活设施占印度居住市场64.50%的份额。这类居住者购买或租赁的单元房与一般公寓类似,并享有紧急呼叫系统、家事服务和休閒等便利设施。许多计划都设有位置便利的俱乐部会所、图书馆和步行道,以支持积极的生活方式。辅助生活设施虽然规模较小,但仍维持了27.35%的复合年增长率。

开发商目前正在打造一个“连续照护园区”,将独立生活、辅助生活和失智症护理建筑并排而建。这种布局使居民无需离开熟悉的环境即可转换照顾等级。此外,由于老年人搬入养老院后空出的单元房可以迅速重新出租,因此也有助于提高运转率。与三级医疗机构的合作使得专家会诊成为可能,而远距离诊断技术则缩短了医疗紧急情况下的回应时间。采用先进技术,特别是穿戴式装置(用于传输血压和血糖值),有助于改善风险管理并降低责任责任险费用。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人口快速老化正在推动对老年住宅解决方案的需求。

- 核心家庭的兴起推动了对自主型老年居住社区的需求。

- 中产阶级财富的成长使得豪华老年住宅更具成本效益

- 医疗整合和以健康为中心的配套设施正成为关键的差异化因素。

- 私人开发商和医疗保健提供者越来越多地参与老年住宅计划

- 市场限制

- 以家庭为中心的养老护理的文化偏好减缓了新模式的采用。

- 人们对老年人住家周边设施的认知度和社会接受度较低

- 高昂的开发和营运成本限制了某些领域的可负担性

- 价值/供应链分析

- 政策和法律规范(州指导方针、许可、奖励)

- 对正在进行和即将开展的计划的见解

- 对数位技术支援措施(远端医疗、智慧型装置)的见解

- 对经营模式和营运商演变的洞察

- 对投资和资金筹措趋势的洞察

- 对永续性和设计创新的洞察

- 波特五力模型

- 供应商的议价能力

- 买方和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按属性类型

- 辅助生活设施

- 独立生活

- 记忆护理

- 护理服务

- 按经营模式

- 业主自售(永久产权)

- 长期租赁/租约

- 混合模式(销售+租赁)

- 按年龄组

- 55至64岁

- 65-74岁

- 75至85岁

- 85岁或以上

- 按地区

- 孟买大都会区

- 新德里

- 浦那

- 班加罗尔

- 海得拉巴

- 清奈

- 加尔各答

第六章 竞争情势

- 市场集中度

- 策略趋势

- 公司简介

- Antara Senior Care

- Columbia Pacific Communities

- Ashiana Housing Ltd

- Paranjape Schemes(Construction)Ltd

- Covai Property Centre(I)Pvt Ltd

- Oasis Senior Living

- Primus Lifespaces Pvt Ltd

- The Golden Estate

- Vedaanta Retirement Communities

- Bahri Realty Management Services Pvt Ltd

- Ananya's Nana Nani Homes

- Athashri(Paranjape)

- Casagrand Communities

- Tata Housing-Riva

- Brigade Group-Parkside

- Mahindra Lifespaces-Happinest Senior

- Godrej Properties-Godrej Seasons Senior Living

- Vardaan Senior Living

- Athulya Senior Care

- Ananta Living

- Gracias Living

第七章 市场机会与未来展望

The India senior living market was valued at USD 3.55 billion in 2025 and estimated to grow from USD 4.47 billion in 2026 to reach USD 14.14 billion by 2031, at a CAGR of 25.92% during the forecast period (2026-2031).

Demand accelerates as the share of citizens aged >=60 years rises and multi-generation households decline. Rising middle-class wealth is widening access to premium retirement communities with on-site health care and wellness programs. Developers are moving beyond southern strongholds into northern and western metros, encouraged by state incentives that cut transaction costs for older buyers. Competition is shifting from small local operators to integrated real-estate and health-care alliances that bundle preventive care, telemedicine, and social engagement services.

India Senior Living Market Trends and Insights

Rapidly Aging Population Creating Rising Demand for Senior-Focused Housing Solutions

India's demographic curve is steepening. Citizens aged >=60 years will more than double from 153 million in 2020 to 347 million in 2050, lifting the old-age share of the population from 11% to 21. The old-age dependency ratio is forecast to move from 16% in 2020 to 34% by 2050 as per national projections. Southern states feel the shift first; Kerala already records a 16.5% elderly share, creating immediate demand for purpose-built homes. Current penetration of senior living communities is at 1%, versus 11% in the United Kingdom, suggesting vast headroom. Meeting anticipated demand will require roughly 2.4 million new units designed for older residents by 2030.

Increasing Nuclear Family Structures Driving Need for Independent Senior Living Communities

Long-term urbanization pulls adult children away from parental homes, undercutting traditional joint-family care systems. The Longitudinal Ageing Study of India reports that 26.7% of urban elders now live alone. As companionship and daily assistance decline within family networks, interest in community-oriented retirement complexes climbs. Many seniors cite opportunities for peer engagement, safety, and on-site health monitoring as decisive factors. Peer-reviewed studies confirm a link between living alone and elevated geriatric depression, reinforcing the appeal of structured social settings. The greatest momentum is visible in Mumbai, Delhi NCR, and Bengaluru, where real-estate values and rental costs hinder multi-generation living.

Cultural Preference for Family-Based Elderly Care Slowing Adoption

Filial piety remains deeply ingrained. The Maintenance and Welfare of Parents and Senior Citizens Act 2007 obliges adult children to fund parental living expenses, reinforcing the expectation of at-home care. For many families, moving elders into organized communities feels akin to abandonment. The stigma is stronger in rural areas and mid-sized cities, where joint households still predominate. Academic research shows that older adults who perceive low family support experience higher anxiety when contemplating institutional options. While demographic reality is eroding these norms, the transition is gradual and varies by state.

Other drivers and restraints analyzed in the detailed report include:

- Growing Middle-Class Wealth Enabling Affordability of Premium Retirement Homes

- Health-Care Integration and Wellness-Focused Amenities Becoming Key Differentiators

- Limited Awareness and Social Acceptance of Institutional Senior Living

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Independent living accounted for 64.50% of the India senior living market share in 2025. Residents in this category purchase or rent units that resemble standard apartments yet benefit from emergency call systems, housekeeping, and recreational programs. Many projects cluster clubhouses, libraries, and walking tracks to support active lifestyles. Assisted living, though smaller, carries a 27.35% CAGR.

Developers are now creating continuum-of-care campuses where independent, assisted, and memory-care wings sit side by side. This arrangement allows residents to shift care levels without leaving familiar surroundings. It also lifts utilization ratios because apartments vacated by seniors moving to assisted facilities can be re-leased swiftly. Partnerships with tertiary hospitals provide visiting specialists, while tele-diagnostics reduce response time during medical events. Technology adoption, wearables that transmit blood-pressure and glucose levels, improves risk management and reduces liability insurance premiums.

The India Senior Living Market Report is Segmented by Property Type (Assisted Living, Independent Living, Memory Care, Nursing Care), by Business Model (Outright Sale (Freehold), Long-Lease / Rental, and More), by Age (55 To 64 Years, 65 To 74 Years, and More), and by Geography (Mumbai Metropolitan Region, Delhi NCR, Pune, Bengaluru, Hyderabad, Chennai, Kolkata). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Antara Senior Care

- Columbia Pacific Communities

- Ashiana Housing Ltd

- Paranjape Schemes (Construction) Ltd

- Covai Property Centre (I) Pvt Ltd

- Oasis Senior Living

- Primus Lifespaces Pvt Ltd

- The Golden Estate

- Vedaanta Retirement Communities

- Bahri Realty Management Services Pvt Ltd

- Ananya's Nana Nani Homes

- Athashri (Paranjape)

- Casagrand Communities

- Tata Housing - Riva

- Brigade Group - Parkside

- Mahindra Lifespaces - Happinest Senior

- Godrej Properties - Godrej Seasons Senior Living

- Vardaan Senior Living

- Athulya Senior Care

- Ananta Living

- Gracias Living

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly aging population creating rising demand for senior-focused housing solutions

- 4.2.2 Increasing nuclear family structures driving need for independent senior living communities

- 4.2.3 Growing middle-class wealth enabling affordability of premium retirement homes

- 4.2.4 Healthcare integration and wellness-focused amenities becoming key differentiators

- 4.2.5 Rising participation of private developers and healthcare operators in senior housing projects

- 4.3 Market Restraints

- 4.3.1 Cultural preference for family-based elderly care slowing adoption

- 4.3.2 Limited awareness and social acceptance of institutional senior living

- 4.3.3 High development and operating costs restricting affordability in certain segments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Policy & Regulatory Framework (state guidelines, licensing, incentives)

- 4.6 Insight on Upcoming and Ongoing Projects

- 4.7 Insights on Digital & Tech Enablers (telemedicine, smart amenities)

- 4.8 Insights on Business Model & Operator Evolution

- 4.9 Insights on Investment & Financing Trends

- 4.10 Insights Sustainability & Design Innovation

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Assisted Living

- 5.1.2 Independent Living

- 5.1.3 Memory Care

- 5.1.4 Nursing Care

- 5.2 By Business Model

- 5.2.1 Outright Sale (Freehold)

- 5.2.2 Long-Lease / Rental

- 5.2.3 Hybrid (Sale + Lease)

- 5.3 By Age

- 5.3.1 55 to 64 years

- 5.3.2 65 to 74 years

- 5.3.3 75 to 85 years

- 5.3.4 Above 85 years

- 5.4 By Region

- 5.4.1 Mumbai Metropolitan Region

- 5.4.2 Delhi NCR

- 5.4.3 Pune

- 5.4.4 Bengaluru

- 5.4.5 Hyderabad

- 5.4.6 Chennai

- 5.4.7 Kolkata

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Antara Senior Care

- 6.3.2 Columbia Pacific Communities

- 6.3.3 Ashiana Housing Ltd

- 6.3.4 Paranjape Schemes (Construction) Ltd

- 6.3.5 Covai Property Centre (I) Pvt Ltd

- 6.3.6 Oasis Senior Living

- 6.3.7 Primus Lifespaces Pvt Ltd

- 6.3.8 The Golden Estate

- 6.3.9 Vedaanta Retirement Communities

- 6.3.10 Bahri Realty Management Services Pvt Ltd

- 6.3.11 Ananya's Nana Nani Homes

- 6.3.12 Athashri (Paranjape)

- 6.3.13 Casagrand Communities

- 6.3.14 Tata Housing - Riva

- 6.3.15 Brigade Group - Parkside

- 6.3.16 Mahindra Lifespaces - Happinest Senior

- 6.3.17 Godrej Properties - Godrej Seasons Senior Living

- 6.3.18 Vardaan Senior Living

- 6.3.19 Athulya Senior Care

- 6.3.20 Ananta Living

- 6.3.21 Gracias Living

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment