|

市场调查报告书

商品编码

1911449

印度通讯平台即服务 (CPaaS) 市场份额分析、行业趋势、统计数据和成长预测 (2026-2031)India Communication Platform As A Service (CPaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

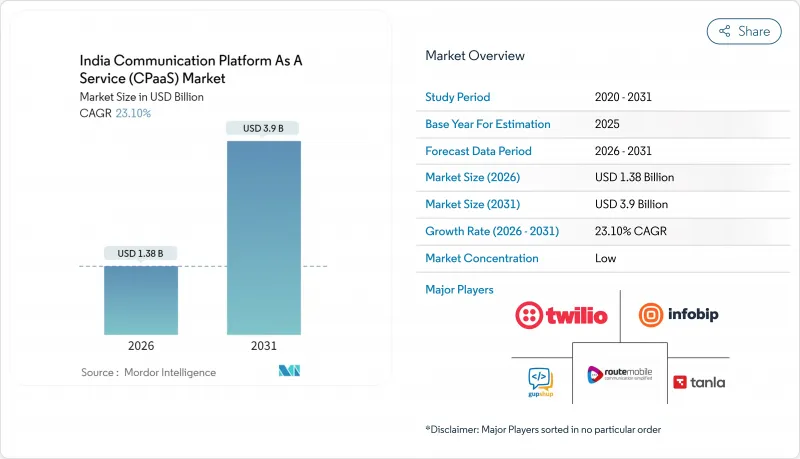

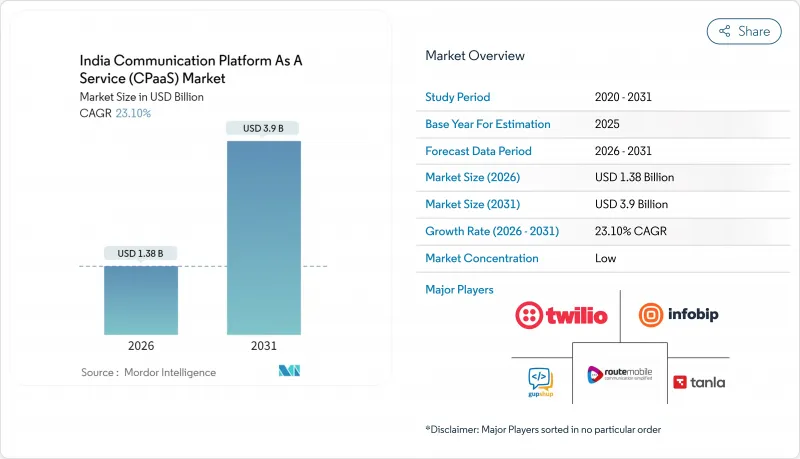

印度通讯平台即服务 (CPaaS) 市场预计将从 2025 年的 11.2 亿美元成长到 2026 年的 13.8 亿美元,预计到 2031 年将达到 39 亿美元,2026 年至 2031 年的复合年增长率为 23.1%。

即时支付、主权云端指令以及 5G 网路和 API 整合等因素共同推动可程式通讯成为企业经营团队的优先事项,从而促进了企业采用率的激增。在银行、金融服务和保险 (BFSI) 领域,身分验证和诈欺通知、利用 WhatsApp 和 RCS 的全通路功能以及低程式码开发工具的应用案例是成长要素。混合云端的采用、生成式人工智慧功能以及行业特定的合规性要求正在重塑竞争策略。传统技术堆迭的实施复杂性、A2P 简讯定价的波动以及增强的资料安全监控仍然是主要障碍。

印度通讯平台即服务 (CPaaS) 市场趋势与洞察

为最大限度减少资本支出,对计量收费模式的需求不断增长

付费使用制正在重塑采购方式,印度企业更倾向于采用可变营运支出而非固定电信资本支出。利润微薄的中小型企业在几週内即可采用通讯平台即服务 (CPaaS),并利用「数位印度」计画提供的云端采用补贴和部署简化服务。这种模式提高了成本透明度,释放了用于核心营运的资金,并可在无需重新谈判合约的情况下应对季节性流量高峰。大型企业也非常重视将支出与宣传活动效果关联起来的详细分析,这加速了印度零售和物流业对通讯平台即服务 (CPaaS) 市场的接受度。供应商也积极回应,发布透明定价并捆绑免费开发者积分,进一步降低了进入门槛。

全通路互动(WhatsApp 和 RCS)采用率激增

WhatsApp Business API 在印度拥有 4.87 亿用户,使其成为 2024 年客户服务和商务领域不可或缺的工具。然而,2025 年 7 月实施的价格调整增加了整体拥有成本,促使品牌商将 RCS 整合到其交易流程中。 RCS 在 Android 系统上提供原生已读回执、已验证的发送方 ID 和富媒体卡片,其功能可与 OTT 应用媲美,且无需担心专有技术锁定。与一家大型电商公司进行的初步试点表明,RCS 的点击率比简讯高出 30%,印度通讯平台即服务 (CPaaS) 市场正朝着多通路整合方向发展。 CPaaS 平台现在整合了路由逻辑,可根据成本、送达率和使用者偏好优化频道选择,从而确保在频道中断时服务的连续性。

异构遗留堆迭中的实作复杂度

大型企业通常混合使用大型主机时代的ERP系统、客製化CRM系统和专有中介软体,这些系统无法原生支援现代REST或gRPC端点。因此,CPaaS部署需要适配器、伫列层和资料映射,从而推高了计划预算。相关人员可能会发现隐藏的技术债务,例如嵌入在单体代码库中的硬编码简讯网关,导致专案週期超出最初的商业计划。资料保护法的合规性审核要求对每一次资料跳转进行可追溯,这进一步增加了工程开销。随着探索研讨会揭示记录系统的局限性,CPaaS即插即用的概念逐渐消退,变更管理成为成功的关键因素。

细分市场分析

中小企业发展势头强劲,预计到2031年将实现24.1%的复合年增长率,而大型企业在2025年仍维持着67.12%的收入份额。成本匹配的计量收费合约、捆绑式模板以及政府Start-Ups培养箱正在消除准入门槛,使中小企业无需电信资本支出即可提供企业级体验。旅游和零售等季节性产业在假日期间使用量激增,这反映了印度通讯平台即服务(CPaaS)市场灵活的收费模式。同时,大型企业正在数百个部门扩展全通路平台,并将人工智慧驱动的个人化引擎与客户关係管理系统(CRM)集成,以提高提升销售转换率。大规模推动了批量折扣合约的签订,并成为供应商收入的基础,但由于多层管治和资料居住要求,实施仍然十分复杂。

银行、金融和保险 (BFSI) 以及医疗保健行业日益严格的合规措施正在推动向混合架构的转变,这种架构在利用公共云端进行尖峰负载平衡的同时,透过主权区域路由受监管的资料。 Copilot(一款客服中心负责人的生成式人工智慧)的先导计画显示,平均处理时间实现了两位数的提升,这表明通讯平台即服务 (CPaaS) 的市场份额正在不断增长。与此同时,中小企业 (SME) 正在利用低程式码建构器来建立 WhatsApp 店铺和自动计费机器人,将开发週期从数月缩短至数週。这种可程式通讯的普及化正在将印度通讯平台即服务 (CPaaS) 市场的管道从大都会圈扩展到二线创业丛集。

到2025年,银行、金融和保险(BFSI)行业将占总收入的28.22%。监管部门对动态密码密码(OTP)、电子授权委託书提醒、诈欺通知等的要求,对资讯的可靠送达提出了极高的要求。为了遵守印度储备银行关于即时客户沟通的指令,各银行正在实施多通路冗余(简讯、推播通知、应用程式内通知)。人工智慧增强型聊天机器人能够对日常咨询进行分类,并将人工客服仅分配给复杂案例,从而降低支援成本并提高客户满意度。符合资料本地化法规的自主云端平台必不可少,这不仅缩小了供应商的选择范围,也提高了人们对服务品质的期望。

物流板块以24.6%的复合年增长率领跑,主要得益于电子商务的成长和国家物流政策的数位化目标。即时货物可视性、司机协调和异常处理依赖事件驱动型API,这些API透过简讯、RCS和语音管道传输更新资讯。统一物流介面平台的标准化促进了互通性,并强化了以API为中心的框架的需求。仓库营运商正在部署物联网感测器和CPaaS警报系统,以产生自动补货讯息,从而优化供应链闭环。随着远端医疗和全通路行销的成熟,医疗保健零售板块保持了稳定扩张,但其成长速度并未跟上物流板块高度垂直整合的步伐。

其他福利

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 为最大限度减少资本支出,对计量收费模式的需求不断增长

- 全通路互动(WhatsApp 和 RCS)采用率激增

- 企业级低程式码/API主导的数位转型

- 印度储备银行推动即时支付,为关键任务通讯API 提供动力

- 主权云端服务的兴起使得合规的CPaaS部署成为可能。

- 开放 5G 网路 API 将创造新的可程式通讯用例

- 市场限制

- 跨异构遗留技术栈的实作复杂度

- 网路攻击事件的增加引发了人们对安全和资料隐私的担忧。

- 各州电信监管法规分散,增加了合规成本。

- 批发A2P简讯价格的波动对通讯业者的利润率带来压力。

- 监管环境

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 定价和经营模式分析

- 主要趋势

- 产业生态系分析

- 纯粹的CPaaS提供商

- 通讯业者主导的CPaaS供应商

- 企业级 CPaaS 供应商

- 基于服务供应商的 CPaaS 整合商

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按公司规模

- 中小企业

- 大公司

- 按最终用户行业划分

- 资讯科技和电信

- BFSI

- 零售与电子商务

- 卫生保健

- 政府和公共部门

- 物流/运输

- 其他的

- 透过通讯管道

- SMS

- 声音的

- WhatsApp Business

- RCS 商业通讯

- 视讯 API

- 电子邮件

- 推播通知

- 按部署模式

- 公共云端

- 混合云端

- 本地部署

- 透过 CPaaS 功能

- 通讯API

- 语音 API

- 视讯 API

- 身份验证和安全 API

- 全通路编配API

- 按地区

- 印度北部

- 西印度群岛

- 南印度

- 印度东部和东北部

- 印度中部

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Twilio Inc.

- Tanla Platforms Limited

- Route Mobile Limited

- Gupshup Technology India Private Limited

- Infobip Ltd.

- Sinch AB

- MessageBird BV

- Vonage Holdings Corp.

- Telnyx LLC

- Plivo Inc.

- Netcore Cloud Private Limited

- Exotel Techcom Pvt. Ltd.

- EnableX.io Pte Ltd.

- Tata Communications Limited(Kaleyra)

- Bharti Airtel Limited(Airtel IQ)

- Bandwidth Inc.

- Link Mobility Group ASA

- ValueFirst Digital Media Private Limited(Tanla)

- Karix Mobile Private Limited

- CM.com NV

- Clickatell Inc.

- Unifonic Inc.

第七章 市场机会与未来展望

The India CPaaS market is expected to grow from USD 1.12 billion in 2025 to USD 1.38 billion in 2026 and is forecast to reach USD 3.9 billion by 2031 at 23.1% CAGR over 2026-2031.

Enterprise adoption surged as real-time payments, sovereign-cloud mandates, and 5G network-API exposure converged to make programmable communication a board-level priority. BFSI use cases for authentication and fraud alerts, omnichannel engagement on WhatsApp and RCS, and low-code development tooling are among the strongest growth catalysts. Hybrid-cloud deployments, generative-AI features, and industry-specific compliance requirements are reshaping competitive strategies. Implementation complexity across legacy stacks, volatile A2P SMS pricing, and heightened data-security scrutiny remain the chief obstacles.

India Communication Platform As A Service (CPaaS) Market Trends and Insights

Rising Demand for Pay-Per-Use Model to Minimise Capital Spending

Consumption-based pricing is redefining procurement as Indian organizations prefer variable opex over fixed telecom capex commitments. SMEs with thin margins implement CPaaS in weeks, riding Digital India incentives that subsidize cloud usage and streamline onboarding. The model improves cost visibility, releases cash for core operations, and supports seasonal traffic spikes without renegotiating contracts. Enterprises also value granular analytics that correlate spend with campaign performance, accelerating adoption of the India CPaaS market across retail and logistics sectors. Vendors are responding by publishing transparent rate cards and bundling free developer credits, lowering the entry barrier even further.

Exponential Surge in Omnichannel Engagement (WhatsApp and RCS) Adoption

WhatsApp Business API's audience of 487 million Indian users made it indispensable for customer service and commerce in 2024. Pricing revisions enacted in July 2025, however, raised the total cost of ownership, nudging brands to integrate RCS for transactional flows. RCS offers read receipts, verified sender IDs, and rich cards natively on Android, delivering parity with over-the-top apps minus proprietary lock-in. Early pilots by large e-commerce firms show 30% higher click-through than SMS, pushing the India CPaaS market toward multi-channel orchestration. CPaaS platforms now embed routing logic that optimizes channel selection by cost, deliverability, and user preference, ensuring continuity if one path fails.

Implementation Complexity Across Heterogeneous Legacy Stacks

Large enterprises often juggle mainframe-era ERPs, custom CRMs, and proprietary middleware that cannot natively consume modern REST or gRPC endpoints. CPaaS rollouts, therefore, require adapters, queuing layers, and data-mapping that inflate project budgets. Stakeholders may discover hidden technical debt, such as hard-coded SMS gateways embedded in monolithic codebases, extending timelines beyond initial business-case assumptions. Compliance audits under the Data Protection Act mandate traceability of every data hop, adding further engineering overhead. The perception that CPaaS is plug-and-play fades once discovery workshops reveal system-of-record constraints, making change management a critical success factor.

Other drivers and restraints analyzed in the detailed report include:

- Low-Code/API-Led Digital Transformation Across Enterprises

- RBI Real-Time-Payments Push Boosting Mission-Critical Messaging APIs

- Security and Data-Privacy Concerns Amid Rising Cyber-Attacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SMEs added momentum by posting a 24.1% CAGR through 2031 while large enterprises retained 67.12% revenue share in 2025. Cost-aligned pay-per-use contracts, bundled templates, and government start-up incubators remove entry barriers, allowing small firms to offer enterprise-grade experiences without telecom capex. Seasonal businesses in travel and retail spike usage during festival periods, showcasing the elastic billing models that define the India CPaaS market. In parallel, large enterprises scale omnichannel platforms across hundreds of departments, integrating AI-driven personalization engines with CRMs to enhance upsell conversions. Their sizeable traffic yields volume-discounted contracts that anchor vendor revenues, even as implementation remains complex due to multilayer governance and data residency requirements.

Heightened compliance defenses in BFSI and healthcare push many corporates toward hybrid architectures that route regulated data through sovereign zones while leveraging public cloud for peak offload. Pilot projects with generative-AI copilots for call-center agents exhibit double-digit improvements in average handling time, signaling further wallet-share gains for CPaaS. SMEs, meanwhile, tap low-code builders to craft WhatsApp storefronts and automated invoicing bots, shrinking development cycles from months to weeks. This democratization of programmable communications enlarges the India CPaaS market funnel beyond metro hubs into Tier-2 entrepreneurship clusters.

BFSI accounted for 28.22% of 2025 revenue as regulatory mandates for OTP, e-mandate alerts, and fraud notifications demand ultra-reliable delivery. Banks deploy multi-channel redundancy, SMS, push, and in-app to meet Reserve Bank circulars stipulating real-time customer communication. AI-enriched chatbots now triage routine queries, reserving human agents for complex cases, trimming support costs, and bolstering customer satisfaction. Sovereign-cloud platforms that satisfy data-localization statutes are prerequisites, narrowing vendor selection and heightening service-quality expectations.

Logistics recorded the fastest 24.6% CAGR, propelled by e-commerce growth and the National Logistics Policy's digitization targets. Real-time shipment visibility, driver coordination, and exception handling rely on event-driven APIs that stream updates across SMS, RCS, and voice channels. Unified Logistics Interface Platform standards spur interoperability, reinforcing demand for API-centric frameworks. Warehouse operators explore IoT sensors tied to CPaaS alerts, generating automated replenishment messages that tighten supply-chain loops. Healthcare and retail maintain steady expansion as telemedicine and omnichannel marketing mature, yet their growth trails the hyper-vertical momentum seen in logistics.

The India Communication Platform As A Service (CPaaS) Market is Segmented by Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (IT and Telecom, BFSI, and More), Communication Channel (SMS, Voice, and More), Deployment Model (Public Cloud, Hybrid Cloud, and On-Premise), Cpaas Function (Messaging API, Voice API, and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Twilio Inc.

- Tanla Platforms Limited

- Route Mobile Limited

- Gupshup Technology India Private Limited

- Infobip Ltd.

- Sinch AB

- MessageBird B.V.

- Vonage Holdings Corp.

- Telnyx LLC

- Plivo Inc.

- Netcore Cloud Private Limited

- Exotel Techcom Pvt. Ltd.

- EnableX.io Pte Ltd.

- Tata Communications Limited (Kaleyra)

- Bharti Airtel Limited (Airtel IQ)

- Bandwidth Inc.

- Link Mobility Group ASA

- ValueFirst Digital Media Private Limited (Tanla)

- Karix Mobile Private Limited

- CM.com N.V.

- Clickatell Inc.

- Unifonic Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for pay-per-use model to minimise capital spending

- 4.2.2 Exponential surge in omnichannel engagement (WhatsApp and RCS) adoption

- 4.2.3 Low-code/API-led digital transformation across enterprises

- 4.2.4 RBI real-time-payments push boosting mission-critical messaging APIs

- 4.2.5 Emergence of sovereign-cloud offerings enabling compliant CPaaS uptake

- 4.2.6 5G network-API exposure creating new programmable-communication use-cases

- 4.3 Market Restraints

- 4.3.1 Implementation complexity across heterogeneous legacy stacks

- 4.3.2 Security and data-privacy concerns amid rising cyber-attacks

- 4.3.3 Fragmented state-level telecom rules raising compliance cost

- 4.3.4 Volatile telco A2P-SMS wholesale pricing squeezing margins

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing and Business-Model Analysis

- 4.8 Key Trends

- 4.9 Industry Ecosystem Analysis

- 4.9.1 Pure-Play CPaaS Providers

- 4.9.2 Telco-Driven CPaaS Providers

- 4.9.3 Enterprise-Grade CPaaS Providers

- 4.9.4 Service-Provider-Based CPaaS Integrators

- 4.10 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Organisation Size

- 5.1.1 Small and Medium Enterprises (SMEs)

- 5.1.2 Large Enterprises

- 5.2 By End-user Industry

- 5.2.1 IT and Telecom

- 5.2.2 BFSI

- 5.2.3 Retail and E-commerce

- 5.2.4 Healthcare

- 5.2.5 Government and Public Sector

- 5.2.6 Logistics and Transportation

- 5.2.7 Other End-user Industries

- 5.3 By Communication Channel

- 5.3.1 SMS

- 5.3.2 Voice

- 5.3.3 WhatsApp Business

- 5.3.4 RCS Business Messaging

- 5.3.5 Video API

- 5.3.6 Email

- 5.3.7 Push Notifications

- 5.4 By Deployment Model

- 5.4.1 Public Cloud

- 5.4.2 Hybrid Cloud

- 5.4.3 On-premise

- 5.5 By CPaaS Function

- 5.5.1 Messaging API

- 5.5.2 Voice API

- 5.5.3 Video API

- 5.5.4 Verification and Security API

- 5.5.5 Omnichannel Orchestration API

- 5.6 By Region

- 5.6.1 North India

- 5.6.2 West India

- 5.6.3 South India

- 5.6.4 East and North-East India

- 5.6.5 Central India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Twilio Inc.

- 6.4.2 Tanla Platforms Limited

- 6.4.3 Route Mobile Limited

- 6.4.4 Gupshup Technology India Private Limited

- 6.4.5 Infobip Ltd.

- 6.4.6 Sinch AB

- 6.4.7 MessageBird B.V.

- 6.4.8 Vonage Holdings Corp.

- 6.4.9 Telnyx LLC

- 6.4.10 Plivo Inc.

- 6.4.11 Netcore Cloud Private Limited

- 6.4.12 Exotel Techcom Pvt. Ltd.

- 6.4.13 EnableX.io Pte Ltd.

- 6.4.14 Tata Communications Limited (Kaleyra)

- 6.4.15 Bharti Airtel Limited (Airtel IQ)

- 6.4.16 Bandwidth Inc.

- 6.4.17 Link Mobility Group ASA

- 6.4.18 ValueFirst Digital Media Private Limited (Tanla)

- 6.4.19 Karix Mobile Private Limited

- 6.4.20 CM.com N.V.

- 6.4.21 Clickatell Inc.

- 6.4.22 Unifonic Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment