|

市场调查报告书

商品编码

1911737

锂离子电池石墨阳极:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Graphite Anode For LIB - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

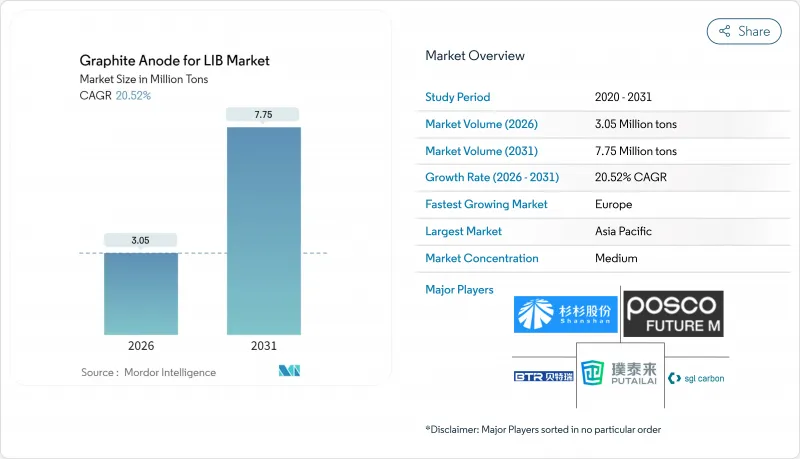

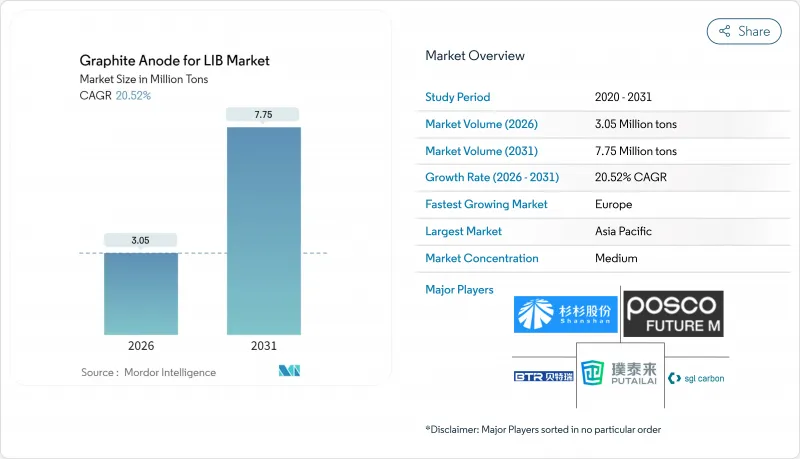

2025年锂离子电池(LIB)石墨阳极市场规模为253万吨,预计2031年将达到775万吨,高于2026年的305万吨。

预计在预测期(2026-2031 年)内,复合年增长率将达到 20.52%。

电动车电池容量的提升、固定式储能计划的扩张以及鼓励国内采购的在地采购政策,都在加速石墨的普及。合成石墨凭藉其能够满足快速充电需求的工程化微观结构,仍是市场主导。然而,成本敏感的天然石墨正透过精炼技术缩小与合成石墨的性能差距,这些技术能够以更低的成本达到车用级纯度。从美国的《通货膨胀控制法案》到印度的《生产连结奖励计画计画》,区域性激励措施正在推动供应链向超级工厂附近的区域丛集多元化发展。这种转变降低了物流成本,同时提高了对原产地规则的遵守程度。市场竞争依然激烈:中国现有企业正将业务垂直整合到前体焦炭领域;日本和韩国的专业企业则凭藉专有的涂层化学技术实现差异化;而西方新参与企业则利用政府融资建设低碳设施。同时,出口管制风险、排放法规以及富硅阳极的即将出现,促使电池製造商采用合成和天然原料的双重来源,进一步重塑了锂离子电池市场石墨阳极的筹资策略。

全球锂离子电池石墨阳极市场趋势及分析

由于电动车需求不断成长,锂离子电池产能迅速提升

2024年1月至2025年10月期间,已公布的超级工厂专案增加了标准石墨负载下的阳极材料需求。宁德时代(CATL)位于德布勒森的工厂和比亚迪位于罗勇的工厂预计将于2027年提供新增产能。同时,特斯拉位于德克萨斯的工厂通过为期10年的承购协议,获得了Sira Resources公司路易斯安那州产量的相当一部分。为了满足美国《通膨控制法案》和欧盟电池法规规定的含量标准,电池製造商现在必须将阳极生产线设定在距离最终组装厂200公里以内。这项策略不仅确保了合规性,也保障了来自本地供应商的上游供应。这种广泛的扩张,加上产能扩张速度超过需求成长,预计将在2027年之前造成锂离子电池(LIB)石墨阳极市场的结构性供不应求。

中国扩大生产规模降低了合成石墨的成本。

2024年,中国产合成石墨的单价显着下降。这项改变主要归功于内蒙古和四川省新炉的运作。一体化生产商利用与中国石油化工集团公司(中石化)的合同,以折扣价采购石油针状焦。高产运转率运行艾奇逊炉,降低了成本,并将这些成本优势传递给了电池製造商。价格下降使中国在入门级电动车和摩托车市场相对于日本和韩国的竞争对手获得了优势。然而,欧盟的临时反倾销税目前削弱了中国在欧洲市场的优势。因此,这种成本主导的替代现像不仅推动了销售成长,也加剧了锂离子电池石墨阳极市场的地缘政治紧张局势。

天然石墨的供应集中与出口管制

2024年,中国在全球天然石墨矿开采和球化加工能力方面占据主导地位。 2023年12月,随着出口许可证的扩大,北京当局目前控制所有电池石墨片的出口,导致中国以外地区的交货延误。 2024年初,由于许可证审批延误,LG能源解决方案公司位于弗罗茨瓦夫的工厂被迫关闭,而三星SDI则选择了成本更高的合成原料。儘管三星SDI扩大了位于莫三比克巴拉马矿和马达加斯加莫罗矿的营运规模,但预计到2026年,来自中国以外地区的石墨总供应量仍将持续短缺,这将加剧锂离子电池(LIB)石墨阳极市场的波动。

细分市场分析

由于合成石墨在NMC和NCA电池体系中拥有无与伦比的循环寿命,并且相容于超快充电通讯协定,预计到2025年,合成石墨将占电池供应量的56.78%。同时,天然石墨在入门级磷酸铁锂电池(LFP电池)领域找到了市场定位。儘管这些电池的首圈效率较低,但其成本优势却显着。这种成本效益正推动市场强劲成长,预计到2031年将达到24.10%的复合年增长率。因此,用于锂离子电池(LIB)石墨阳极的天然石墨产品市场预计将显着扩张。同时,合成石墨的产量预计将成长较为缓慢。先进的提纯技术,实现了金属杂质含量低于10 ppm和碳纯度高达99.95%的卓越性能,弥合了两者之间的性能差距。比亚迪Blade电池在其售价低于2.5万美元的电动车产品线中大量使用天然材料,便印证了这种新获得的可靠性。

涂层技术不断发展,目前两种材料都利用沥青衍生碳层或奈米碳管来提高初始库仑效率。儘管存在这种融合趋势,合成石墨在保持使用寿命方面仍然具有优势,这对于提供15万英里保固的汽车製造商至关重要。欧盟的碳排放法规正推动标准续航里程车型转向使用天然石墨,而美国的国内含量抵免计画则促使高阶车型重新采用合成石墨。这一趋势导致锂离子电池市场石墨阳极材料的替代呈现区域性而非全球性模式。由此产生的行业两极化,在高销量、价格敏感的天然石墨市场和专注于工程应用的高端合成石墨小众市场之间形成了明显的鸿沟。

本锂离子电池石墨阳极市场报告阳极材料类型(合成石墨与天然石墨)、最终用途(电动车、能源储存系统、家用电子电器及其他)和地区(亚太地区、北美地区、欧洲地区及世界其他地区)进行分析。市场预测以销售量(吨)和价值(美元)为单位。

区域分析

亚太地区将占2025年全球出货量的73.85%,这主要得益于中国庞大的製造能力。中国在一个省级产业丛集内实现了精炼焦炭煅烧、石墨化、球化和电池组装等製程的无缝整合。中国拥有许多优势,包括低成本电力、省级土地优惠和快速审批程序,巩固了其成本领先地位。同时,日本和韩国正将重点转向采用专有涂层技术增强的高利润合成石墨。特别是三菱化学的MAGE-M系列产品,凭藉其亚3奈米涂层技术实现了长循环寿命,在锂离子电池(LIB)石墨阳极市场占据了一席之地。

预计到2031年,欧洲将实现最快成长,复合年增长率将达到28.05%。这主要得益于汽车製造商为遵守欧盟电池法规所做的努力,该法规将于2027年强制执行国产化率基准值。瑞典的Northvolt公司已率先采用水性冶金製程进行大规模石墨回收,并计划扩大产能。同时,BASF位于施瓦茨海德的工厂正在利用可再生能源每年生产合成石墨,从而降低生产过程(从摇篮到大门)的碳排放强度。此外,法国的Vercors公司和义大利的Italvolt公司已成立合资企业,以扩大年产量,进一步巩固了欧洲市场的地位。然而,欧洲的现金成本仍远高于亚太地区,因此碳排放边境调整对于维持锂离子电池阳极市场的竞争力至关重要。

北美在2024年的石墨产量份额较低,但预计到2030年,在45X条款税收优惠政策的支持下,其份额将翻倍以上。席勒公司位于维达利亚的工厂在2025年实现了显着的产能提升,并利用国内生产溢价直接向特斯拉位于德克萨斯德克萨斯的超级工厂供货。在田纳西州,诺沃尼克斯公司在能源部贷款担保下,计划在2026年前推出合成石墨产能,并开始向附近的福特和通用汽车公司供货。同时,加拿大魁北克省的矿场正在提高天然石墨片的供应量,但联邦审批流程缓慢,这意味着其显着影响要到2027年或更晚才能显现。墨西哥在电极涂层和电池组组装方面具有成本竞争力,但缺乏关键的石墨化设备预计将在短期内限制北美的石墨供应。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 由于电动车需求不断成长,锂离子电池产能迅速提升

- 中国扩大生产规模降低了合成石墨的成本。

- 政府对国内电池供应链的激励措施

- 高能耗电子设备的需求快速成长

- 快速充电架构中对高倍率阳极的需求

- 市场限制

- 天然石墨供应集中度及出口限制

- 石墨炉排放气体法规

- 向富硅和锂金属阳极过渡

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模和成长预测(价值和数量)

- 依阳极材料类型

- 合成石墨

- 天然石墨

- 最终用途

- 电动车

- 能源储存系统

- 家用电子电器

- 其他(电动工具和电动车)

- 地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 世界其他地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Beterui New Materials Group Co. Ltd

- Guangdong Kaijin New Energy Technology Co. Ltd

- Hunan Zhongke Electric Co. Ltd(Hunan Zhongke Xingcheng Graphite Co. Ltd)

- JFE Chemical Corporation

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd

- POSCO CHEMICAL

- SGL Carbon

- Shanghai Putailai New Energy Technology Co. Ltd

- Shangtai Technology

- Shanshan Co. Ltd

- Shenzhen Sinuo Industrial Development Co. Ltd

- Shenzhen Xiangfenghua Technology Co. Ltd

- Showa Denko KK

- Tokai Carbon Co. Ltd

第七章 市场机会与未来展望

The Graphite Anode for LIB Market was valued at 2.53 million tons in 2025 and estimated to grow from 3.05 million tons in 2026 to reach 7.75 million tons by 2031, at a CAGR of 20.52% during the forecast period (2026-2031).

Rising electric-vehicle (EV) cell capacity, expanding stationary storage projects, and localization mandates that reward domestic content are collectively accelerating adoption. Synthetic graphite retains its volume leadership because its engineered microstructure tolerates fast-charge demands; however, cost-sensitive natural graphite is closing the performance gap as purification routes reach automotive-grade purity at a lower cost. Regional incentive packages-from the U.S. Inflation Reduction Act to India's Production-Linked Incentive scheme-are fragmenting supply chains into local clusters located near gigafactories, a shift that compresses logistics costs while improving compliance with origin rules. Competitive intensity remains high as Chinese incumbents extend vertical integration into precursor coke, Japanese and Korean specialists differentiate through proprietary coating chemistries, and Western newcomers attract government loans to build low-carbon facilities. Simultaneously, export-control risks, emissions regulations, and the impending arrival of silicon-rich anodes are prompting cell makers to dual-source synthetic and natural feedstocks, further reshaping procurement strategies for the graphite anode in the LIB market.

Global Graphite Anode For LIB Market Trends and Insights

Surging EV-Driven Li-ion Cell Capacity Expansions

Between January 2024 and October 2025, announced gigafactory projects led to an incremental anode requirement at standard graphite loadings. By 2027, CATL's Debrecen and BYD's Rayong projects are expected to contribute additional capacity. Meanwhile, Tesla's Texas facility has secured a significant portion of Syrah Resources' Louisiana output through a decade-long offtake agreement. To meet the content thresholds set by the U.S. Inflation Reduction Act and EU Battery Regulation, cell manufacturers are now required to position anode lines within 200 km of their final assembly points. This strategy not only ensures compliance but also secures upstream volumes from local suppliers. As commissioning struggles to keep pace with demand, this widespread expansion is set to create a structural deficit in the graphite anode market for lithium-ion batteries (LIB) until 2027.

Cost Decline of Synthetic Graphite from Chinese Scale-Ups

In 2024, unit prices for Chinese synthetic graphite experienced a significant decline, a shift attributed to the activation of new furnaces in Inner Mongolia and Sichuan. Integrated producers, leveraging Sinopec contracts, procure petroleum needle-coke at discounted rates. They operate Acheson furnaces at a high utilization rate, subsequently passing these savings on to their cell customers. While this price drop gives an edge over Japanese and Korean competitors in the entry-level EV and two-wheeler markets, provisional EU anti-dumping duties now moderate this advantage within the European market. As a result, this cost-driven substitution not only propels volume growth but also heightens geopolitical tensions in the graphite anode market for lithium-ion batteries.

Natural Graphite Supply Concentration and Export Controls

In 2024, China dominated the world's mined natural graphite production and global spheroidization capacity. Following an expansion of export licenses in December 2023, Beijing now oversees all battery-grade flake exports, causing delays for shipments outside China. In early 2024, LG Energy Solution faced a shutdown at its Wroclaw plant due to permit delays, while Samsung SDI opted for a pricier synthetic feedstock. Despite scaling operations at Mozambique's Balama and Madagascar's Molo mines, the total supply from non-Chinese sources is projected to fall short until 2026, leading to heightened volatility in the graphite anode market for lithium-ion batteries (LIBs).

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Domestic Battery Supply Chains

- High-Energy Consumer-Electronics Demand Spike

- Emissions Scrutiny on Graphitization Furnaces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic graphite captured 56.78% of 2025 volume, thanks to its unmatched cycle life in NMC and NCA chemistries, as well as its compatibility with ultra-fast charging protocols. Meanwhile, natural graphite found its niche in entry-level LFP batteries. These batteries, although they accept a lower first-cycle efficiency, offer a cost advantage. This cost efficiency is driving robust growth, forecasted to propel a 24.10% CAGR forecast to 2031. As a result, the market for natural graphite products used in graphite anodes for LIBs is set to surge significantly. In contrast, synthetic volumes are anticipated to grow at a more modest rate. Advanced purification techniques, which achieve metallic impurities below 10 ppm and carbon purity of 99.95%, have bridged the performance gap. This newfound confidence is evident as BYD's Blade Battery opts for a high percentage of natural feedstock in its sub-USD 25,000 EV line.

Coating technologies are evolving, with both materials now utilizing pitch-derived carbon or carbon-nanotube layers to boost initial coulombic efficiency. Despite this convergence, synthetic graphite maintains an edge in calendar-life retention. This advantage is pivotal for automakers providing 150,000-mile warranties. While EU carbon regulations may steer standard-range models towards natural graphite, U.S. domestic-content credits are incentivizing premium vehicles to lean back towards synthetic graphite. This dynamic is creating a regional, rather than a global, pattern of material substitution in the graphite anode for the LIB market. Consequently, the industry is splitting into two distinct segments: a high-volume, price-sensitive natural-graphite sector and a premium, engineered synthetic niche.

The Graphite Anode for LIB Market Report is Segmented by Anode Material Type (Synthetic Graphite and Natural Graphite), End-Use Application (Electric Vehicles, Energy Storage Systems, Consumer Electronics, and Others), and Geography (Asia-Pacific, North America, Europe, and Rest of the World). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific supplied 73.85% of 2025 shipments, largely driven by China's significant manufacturing capacity. This capacity seamlessly integrates processes like refinery coke calcination, graphitization, spheroidization, and cell assembly within single provincial clusters. China's edge comes from low-cost electricity, provincial land discounts, and expedited permitting, solidifying its cost leadership. Meanwhile, Japan and South Korea are pivoting towards high-margin synthetics, enhanced with proprietary coatings. Notably, Mitsubishi Chemical's MAGE-M series commands a premium for its sub-3 nm coatings, boasting high full-depth cycles, highlighting a performance-centric niche in the graphite anode market for lithium-ion batteries (LIB).

Europe is expected to exhibit the steepest regional growth, at a 28.05% CAGR, to 2031, driven by automakers' efforts to align with the EU Battery Regulation, which mandates a regional content threshold by 2027. Northvolt's site in Sweden is already ahead of the curve, recycling graphite through a hydrometallurgical loop with significant output and plans for expansion. Concurrently, BASF's Schwarzheide facility produces synthetic graphite annually, harnessing renewable energy to reduce its cradle-to-gate carbon intensity. Further bolstering the region, France's Verkor and Italy's Italvolt have initiated joint ventures aimed at increasing annual production. However, challenges loom as European cash costs are still significantly higher than those in the Asia-Pacific region, making carbon-border adjustments crucial for competitiveness in the graphite anode market for LIBs.

North America, which accounted for a smaller share of the 2024 volume, is poised to more than double its share by 2030, driven by Section 45X credits that offer subsidies. Syrah's Vidalia plant achieved a notable run-rate in 2025, directly supplying Tesla's Texas gigafactory, capitalizing on a premium for domestic origin. In Tennessee, Novonix, with backing from a Department of Energy loan guarantee, is set to launch synthetic capacity by 2026, catering to Ford and GM within a close radius. While Canada's Quebec mines are ramping up natural-flake supply, they're grappling with extended federal permitting, pushing their significant impact to post-2027. Mexico stands out for its cost-effective electrode coating and pack assembly, yet the absence of major graphitization assets keeps the North American supply constrained in the short term.

- Beterui New Materials Group Co. Ltd

- Guangdong Kaijin New Energy Technology Co. Ltd

- Hunan Zhongke Electric Co. Ltd (Hunan Zhongke Xingcheng Graphite Co. Ltd)

- JFE Chemical Corporation

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd

- POSCO CHEMICAL

- SGL Carbon

- Shanghai Putailai New Energy Technology Co. Ltd

- Shangtai Technology

- Shanshan Co. Ltd

- Shenzhen Sinuo Industrial Development Co. Ltd

- Shenzhen Xiangfenghua Technology Co. Ltd

- Showa Denko KK

- Tokai Carbon Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging EV-driven Li-ion cell capacity expansions

- 4.2.2 Cost decline of synthetic graphite from Chinese scale-ups

- 4.2.3 Government incentives for domestic battery supply chains

- 4.2.4 High-energy consumer electronics demand spike

- 4.2.5 Fast-charge architectures needing high-rate anodes

- 4.3 Market Restraints

- 4.3.1 Natural graphite supply concentration and export controls

- 4.3.2 Emissions scrutiny on graphitisation furnaces

- 4.3.3 Shift toward Si-rich and Li-metal anodes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Anode Material Type

- 5.1.1 Synthetic Graphite

- 5.1.2 Natural Graphite

- 5.2 By End-use Application

- 5.2.1 Electric Vehicles

- 5.2.2 Energy Storage Systems

- 5.2.3 Consumer Electronics

- 5.2.4 Others (Power Tools and e-Mobility)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 India

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Beterui New Materials Group Co. Ltd

- 6.4.2 Guangdong Kaijin New Energy Technology Co. Ltd

- 6.4.3 Hunan Zhongke Electric Co. Ltd (Hunan Zhongke Xingcheng Graphite Co. Ltd)

- 6.4.4 JFE Chemical Corporation

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Nippon Carbon Co. Ltd

- 6.4.7 POSCO CHEMICAL

- 6.4.8 SGL Carbon

- 6.4.9 Shanghai Putailai New Energy Technology Co. Ltd

- 6.4.10 Shangtai Technology

- 6.4.11 Shanshan Co. Ltd

- 6.4.12 Shenzhen Sinuo Industrial Development Co. Ltd

- 6.4.13 Shenzhen Xiangfenghua Technology Co. Ltd

- 6.4.14 Showa Denko KK

- 6.4.15 Tokai Carbon Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment