|

市场调查报告书

商品编码

1911811

欧洲滚筒式干衣机:市占率分析、产业趋势与统计、成长预测(2026-2031)Europe Tumble Dryers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

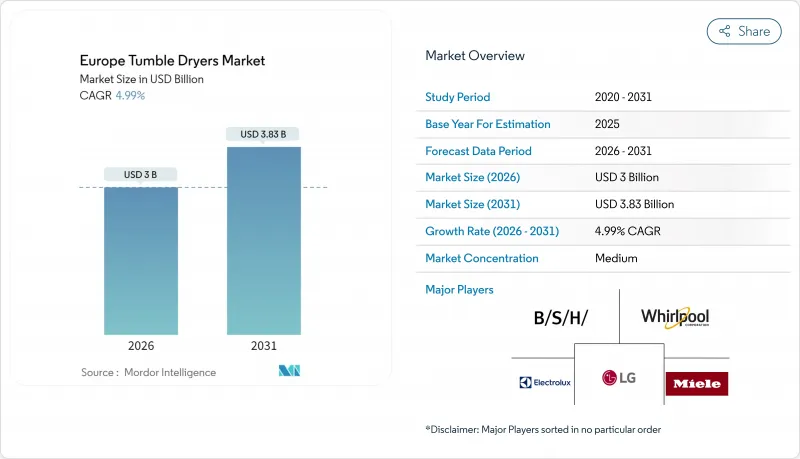

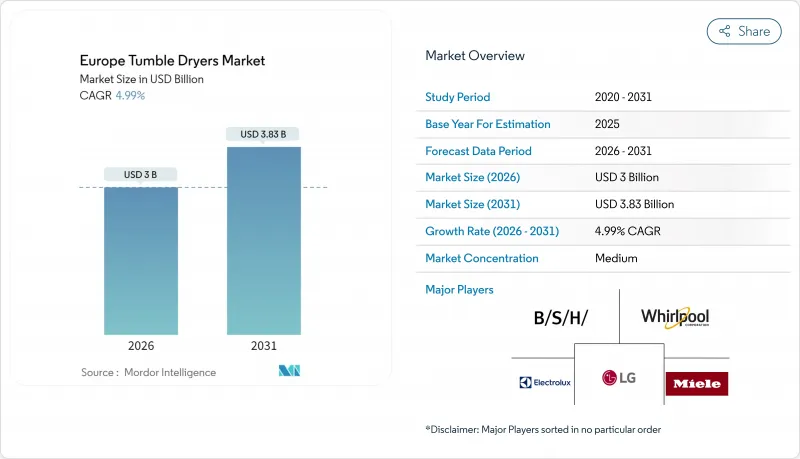

2025年欧洲滚筒式干衣机市值28.6亿美元,预计2031年将达到38.3亿美元,高于2026年的30亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.99%。

从绝对值来看,欧洲滚筒式干衣机市场正从成熟的、更换主导的家电品类向技术主导的升级週期转型,这一转型是由欧盟生态设计指令(该指令自2025年7月起禁止使用排气式和入门级冷凝式干衣机)引发的。热泵技术的创新、不断上涨的家庭能源成本以及后疫情时代对永续性的关注,共同支撑着在持续的宏观经济波动中保持强劲的需求势头。目前的竞争策略着重于合规性、高端定位和快速的产品线更新。区域差异显而易见,德国在普及率方面保持领先,而西班牙的成长速度最快。儘管东欧和南欧部分地区对价格的敏感度抑制了热泵的即时普及,但扶持性的融资方案和社会住宅的大量采购计画正在扩大目标客户群。同时,全通路分销,尤其是透过线上市场,正在重塑客户获取的经济模式,并使拥有直接面向消费者能力的品牌更具优势。与 R290 冷媒相关的供应链摩擦和持续的消防安全监控凸显了市场的营运风险,而物联网赋能的模式和公共产业需量反应试点项目则表明,在预测期内,相邻的收入来源将会成熟。

欧洲滚筒式干衣机市场趋势与洞察

欧盟节能法规加速了热泵的普及

将于2025年7月生效的生态设计法规将强制製造商从其欧洲产品线中淘汰非热泵技术,从而将欧洲滚筒式干衣机市场转变为单一技术竞争格局。仅此一项法规预计到2040年即可减少15兆瓦时(TWh)的电力消耗和二氧化碳当量(CO2-eq)排放,累积消费者节省28亿美元。目前,A级能效等级仅授予热泵机型,这意味着排气式或基本冷凝式干衣机实际上不符合标准。像Miele这样的高端品牌迅速做出反应,推出了配备InfinityCare滚筒和专用羊毛洗涤程序的T2 Nova Edition,强调其在节能之外的纤维保护优势。 BSH则利用过渡期调整了生产方向,转向热泵技术,在维持合规性的同时维持了利润率。该法规还引入了双层定价结构,使高端製造商能够在保持产品价值的同时,对低成本厂商施加压力。基于 ISO 14001永续性认证的符合性审核正逐渐成为采购的先决条件,这进一步增加了那些行动迟缓的公司所面临的竞争障碍。

西欧可支配所得成长与更换週期加快

宏观环境的改善和通膨的温和正在提振消费者的自由裁量权支配支出。欧盟耐久财销售额预计将从2023年的2.90%下降反弹至2025年的2.80%成长。平均更换週期为8-10年,不断上涨的电费促使家庭优先考虑生命週期成本而非购买价格。这推动了消费者对热泵解决方案的偏好,儘管其初始成本高出两到三倍。虽然现金回馈计划正在推动德国和荷兰的普及,但南欧市场的价格敏感度仍然很高。预计到2027年,欧洲家用电器市场将从384.8亿美元成长至424亿美元,其中智慧家电预计将成长26%,因为消费者追求能源效率和便利性。调查数据显示,80%的英国受访者担心能源帐单,促使他们愿意投资购买高效能烘干机。知名品牌正在利用其忠诚度优势,35%的全球消费者表示品牌声誉是决定性因素。总体而言,收入的成长加上更换的紧迫性,推动欧洲滚筒式干衣机市场以 1.2 个百分点的复合年增长率成长。

热泵机型初始价格溢价较高

热泵式干衣机的零售价通常超过1,000欧元(1,090美元),而排气式干衣机的价格仅为300-400欧元(327-436美元),这构成了较高的市场准入门槛。虽然终身节能效益可超过500美元,但较长的投资回收期阻碍了东欧低收入家庭的普及。儘管融资和政府补贴可以部分抵销成本,但只有规模经济效应降低单位成本后,热泵式干衣机的普及率才会提高。三星和LG正在试行推出入门级机型,这些机型具备人工智慧优化功能,售价低于800欧元(872美元),有望改变市场格局。欧洲现有製造商必须在保护利润率和以牺牲平均售价(ASP)为代价加速转型之间做出选择,无论哪种方式都会影响品牌价值和现有用户群的经济效益。短期来看,价格障碍将使欧洲干衣机市场的复合年增长率(CAGR)下降约1.4个百分点。

细分市场分析

到2025年,热泵式干衣机将占据欧洲干衣机市场35.44%的份额,年复合成长率(CAGR)为13.10%,这主要得益于2025年中期即将实施的排气式和基本冷凝式干衣机禁令。冷凝式干衣机曾是主流产品,到2025年仍将占据欧洲市场份额的50.92%,但随着市场需求转向符合新规的替代品,其市场地位正逐渐被淘汰。高阶产品定位仰赖降低70%的消费量和更卓越的衣物保护,这使得製造商即使在入门级产品出现的情况下也能维持价格优势。三星的「Bespoke AI Laundry Combo」融合了大容量设计和基于机器学习的循环优化技术。 LG则以其全热泵「Signature」系列产品与之抗衡,该产品将能耗降低至570瓦,展现了不同的技术概念。在预测期内,产品差异化将越来越依赖连接性、环保认证和售后服务,而不仅仅是机械性能。

欧洲滚筒式干衣机市场也正经历排气式干衣机逐渐微的趋势。这种干衣机在英国曾因其便于独立住宅外排而广受欢迎。然而,房主的房屋维修和建筑法规的变更正推动着干衣机安装转向闭式冷凝器或热泵式干衣机。製造商们正在积极应对,例如博世家电(BSH)已将生产线重新分配至利润更高的热泵系列产品。零件供应商也透过逐步淘汰电阻加热器并扩大R290压缩机的生产来应对这一变化。大量不合规库存迫使零售商透过降价清仓,暂时扭曲了平均售价。然而,从2025年起,随着欧洲干衣机市场全面转向热泵机型,并透过配套服务合约来保障利润,预计该品类的获利能力将出现復苏。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟能源效率法规加速了热泵的普及应用。

- 西欧可支配所得成长与更换週期加快

- MDA采购中电子商务管道的成长

- 社会住宅维修计画指定使用热泵烘干机

- 饭店业的ESG目标推动设施升级,以提高效率。

- 物联网赋能的烘干机用于公用事业需量反应试点项目

- 市场限制

- 热泵机型的初始成本较高

- 欧盟五大主要国家住宅市场饱和

- 消防安全召回事件损害消费者信心

- R290冷媒供应链的变异性

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争强度

第五章 市场规模与成长预测

- 依产品类型

- 热泵式滚筒烘干机

- 冷凝式滚筒干衣机

- 滚筒式烘干机排气

- 最终用户

- 住宅

- 商业

- 透过分销管道

- 离线

- 在线的

- 按国家/地区

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟

- 比利时

- 荷兰

- 卢森堡

- 北欧国家

- 丹麦

- 芬兰

- 冰岛

- 挪威

- 瑞典

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BSH Hausgerate GmbH(Bosch/Siemens)

- Whirlpool Corp.

- Electrolux AB

- Miele & Cie. KG

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Candy Hoover Group(Haier Europe)

- Gorenje(Hisense Europe)

- Indesit

- Beko

- Hotpoint

- AEG

- Zanussi

- Teka Group

- Blomberg

- Asko Appliances

- Smeg SpA

- Vestel

- Sharp Corp.

- Grundig

第七章 市场机会与未来展望

The European tumble dryer market was valued at USD 2.86 billion in 2025 and estimated to grow from USD 3.00 billion in 2026 to reach USD 3.83 billion by 2031, at a CAGR of 4.99% during the forecast period (2026-2031).

In absolute terms, the European tumble dryer market is evolving from a mature replacement-driven appliance category to a technology-led upgrade cycle triggered by the European Union's ecodesign mandate that bans vented and entry-level condenser units from July 2025. . Heat-pump innovation, the rising cost of household energy, and a post-pandemic focus on sustainability jointly underpin healthy demand momentum despite lingering macro volatility. Competitive strategies now hinge on regulatory compliance, premium positioning, and rapid portfolio renewal, while regional disparities remain pronounced as Germany maintains a lead in unit penetration but Spain posts the fastest incremental growth. Price sensitivity in Eastern and parts of Southern Europe tempers immediate heat-pump uptake, yet supportive financing schemes and bulk-procurement programs in social housing are widening the addressable base. Simultaneously, omnichannel distribution, especially via online marketplaces, is remolding customer acquisition economics and favoring brands with direct-to-consumer capabilities. Supply chain friction linked to R290 refrigerant and continued fire-safety scrutiny highlight the market's operational risks, but IoT-ready models and utility demand-response pilots represent adjacent revenue pools that will mature during the outlook period.

Europe Tumble Dryers Market Trends and Insights

EU Energy-Efficiency Mandates Accelerating Heat-Pump Adoption

The July 2025 ecodesign regulation compels manufacturers to eliminate non-heat-pump technology from their European portfolios, instantly transforming the Europe tumble dryer market into a single-technology contest. This rule alone is expected to save 15 TWh of electricity and 1.7 Mt CO2-equivalent by 2040, generating USD 2.8 billion in cumulative consumer savings. A-class ratings now appear exclusively on heat-pump models, effectively relegating vented or basic condenser dryers to non-compliant status. Premium brands such as Miele responded early, unveiling the T2 Nova Edition with InfinityCare drums and wool-specific cycles that showcase fabric-care benefits beyond raw energy efficiency. BSH capitalized on the transition by re-balancing production toward heat-pump units, thereby sustaining profit margins while meeting compliance. The regulation simultaneously introduces a two-tier pricing environment in which premium manufacturers can defend value, whereas value-oriented firms face intense margin pressure. Compliance audits based on ISO 14001 sustainability credentials are becoming procurement prerequisites, further raising competitive barriers for late adopters.

Rising Disposable Income & Replacement Cycles in Western Europe

Improved macro conditions and subdued inflation are rekindling discretionary spending, with EU consumer-durables sales swinging from a 2.90% decline in 2023 to a 2.80% upswing in 2025. Replacement cycles average 8-10 years, and rising electricity tariffs push households to prioritize life-cycle cost over sticker price, favoring heat-pump solutions despite a 2-3X upfront premium. Germany and the Netherlands reinforce adoption via cash-back schemes, while southern markets remain more price sensitive. The European household appliance market is projected to grow from USD 38.48 billion to USD 42.40 billion by 2027, with smart appliances experiencing 26% growth as consumers demand energy efficiency and convenience features. Survey data reveal 80% of UK respondents worried about utility bills, translating into a higher willingness to invest in efficient dryers. Established brands exploit loyalty advantages, as 35% of global consumers list brand reputation as a decisive factor. Altogether, income growth plus replacement urgency contribute a 1.2-percentage-point tailwind to the Europe tumble dryer market CAGR.

High Upfront Price Premium of Heat-Pump Models

Heat-pump dryers often retail for EUR 1,000 (USD 1,090) or more versus EUR 300-400 (USD 327-436) for vented alternatives, creating a steep affordability hurdle. Although lifetime energy savings can exceed USD 500, the payback horizon discourages adoption among lower-income households in Eastern Europe. Financing schemes and government rebates partially bridge the gap, but penetration lags until economies of scale lower unit costs. Samsung and LG are testing entry-level heat-pump SKUs with AI-driven optimization at sub-EUR 800 (USD 872) price points, potentially resetting market expectations. European incumbents must choose between defending margin or sacrificing ASP to accelerate conversion, with each approach influencing brand equity and installed-base economics. In the near term, price barriers shave roughly 1.4 percentage points off the CAGR of the Europe tumble dryer market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of E-Commerce Channels for MDA Purchases

- Social-Housing Retrofit Programs Specifying Heat-Pump Dryers

- Market Saturation in Core EU-5 Residential Segment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heat-pump models entered 2025 with a 35.44% contribution to the Europe tumble dryer market size and are advancing at a 13.10% CAGR, bolstered by the regulatory ban on vented and basic condenser units effective mid-2025. Condenser dryers, once dominant, still held 50.92% of Europe tumble dryer market share in 2025, yet they face an unavoidable sunset, funneling demand into compliant alternatives. Premium positioning hinges on 70% lower energy consumption and fabric-care advantages, allowing manufacturers to defend pricing even as entry-level SKUs emerge. Samsung's Bespoke AI Laundry Combo illustrates the convergence of large-capacity engineering and machine-learning-based cycle optimization. LG counters with a fully heat-pump Signature stack that reduces power draw to 570 W, demonstrating differing technological bets. Over the forecast horizon, product differentiation will increasingly rely on connectivity, environmental certifications, and after-sales services rather than core mechanical performance alone.

The Europe tumble dryer market also witnesses a gradual fadeout of vented designs, historically popular in the UK due to easy exterior venting in single-family homes. Landlord refurbishments and changing building codes shift those installations toward closed-cycle condensers or heat-pump units. Manufacturers retool factories accordingly, with BSH reallocating production lines to higher-margin heat-pump families. Component suppliers adapt by phasing out resistive heaters and scaling up R290 compressor output. The impending cliff on non-compliant stock encourages retailers to clear inventories through discounting, temporarily distorting average selling prices. Yet post-2025, category revenues rebound as the Europe tumble dryer market pivots to all-heat-pump portfolios linked with bundled service contracts that protect margins.

The Europe Tumble Dryer Market Report is Segmented by Product Type (Heat Pump Tumble Dryer, Condenser Tumble Dryer, Vented Tumble Dryer), End-User (Residential, Commercial), Distribution Channel (Offline, Online), and Geography (United Kingdom, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- BSH Hausgerate GmbH (Bosch/Siemens)

- Whirlpool Corp.

- Electrolux AB

- Miele & Cie. KG

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Candy Hoover Group (Haier Europe)

- Gorenje (Hisense Europe)

- Indesit

- Beko

- Hotpoint

- AEG

- Zanussi

- Teka Group

- Blomberg

- Asko Appliances

- Smeg S.p.A.

- Vestel

- Sharp Corp.

- Grundig

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU energy-efficiency mandates accelerating heat-pump adoption

- 4.2.2 Rising disposable income & replacement cycles in Western Europe

- 4.2.3 Growth of e-commerce channels for MDA purchases

- 4.2.4 Social-housing retrofit programs specifying heat-pump dryers

- 4.2.5 Hospitality ESG targets driving high-efficiency fleet upgrades

- 4.2.6 IoT-ready dryers for utility demand-response pilots

- 4.3 Market Restraints

- 4.3.1 High upfront price premium of heat-pump models

- 4.3.2 Market saturation in core EU-5 residential segment

- 4.3.3 Fire-safety recall incidents denting consumer trust

- 4.3.4 R290 refrigerant supply-chain volatility

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Heat Pump Tumble Dryer

- 5.1.2 Condenser Tumble Dryer

- 5.1.3 Vented Tumble Dryer

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Offline

- 5.3.2 Online

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX

- 5.4.6.1 Belgium

- 5.4.6.2 Netherlands

- 5.4.6.3 Luxembourg

- 5.4.7 NORDICS

- 5.4.7.1 Denmark

- 5.4.7.2 Finland

- 5.4.7.3 Iceland

- 5.4.7.4 Norway

- 5.4.7.5 Sweden

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BSH Hausgerate GmbH (Bosch/Siemens)

- 6.4.2 Whirlpool Corp.

- 6.4.3 Electrolux AB

- 6.4.4 Miele & Cie. KG

- 6.4.5 LG Electronics Inc.

- 6.4.6 Samsung Electronics Co. Ltd.

- 6.4.7 Candy Hoover Group (Haier Europe)

- 6.4.8 Gorenje (Hisense Europe)

- 6.4.9 Indesit

- 6.4.10 Beko

- 6.4.11 Hotpoint

- 6.4.12 AEG

- 6.4.13 Zanussi

- 6.4.14 Teka Group

- 6.4.15 Blomberg

- 6.4.16 Asko Appliances

- 6.4.17 Smeg S.p.A.

- 6.4.18 Vestel

- 6.4.19 Sharp Corp.

- 6.4.20 Grundig

7 Market Opportunities & Future Outlook

- 7.1 Demand-response-ready heat-pump dryers integrated into home-energy-management systems

- 7.2 Subscription-based "laundry-appliance-as-a-service" models for urban micro-apartments