|

市场调查报告书

商品编码

1911818

防水解决方案:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Waterproofing Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

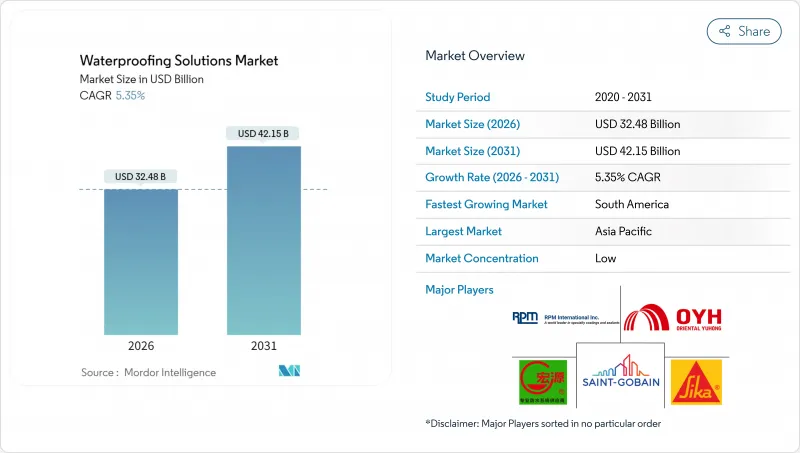

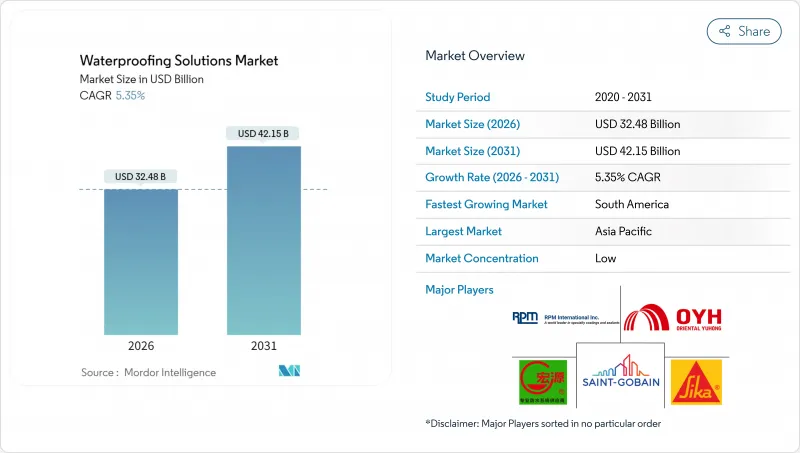

预计防水解决方案市场将从 2025 年的 308.3 亿美元成长到 2026 年的 324.8 亿美元,到 2031 年将达到 421.5 亿美元,2026 年至 2031 年的复合年增长率为 5.35%。

目前的扩张反映了建筑围护结构保护方式从被动维修向预防性保护的重大转变,这主要得益于绿色建筑规范、基础设施韧性目标以及节省劳动力的施工方法等因素的共同推动。液态防水捲材固化无缝,所需施工人员也更少,因此在新建和维修专案中,液态防水捲材正在取代许多片材防水系统。更严格的挥发性有机化合物(VOC)法规正在加速化学涂料向水性及生物基化学品的改良。公共部门的采购也更重视整体生命週期性能而非初始成本。此外,资料中心冷却系统、隧道修復和气候适应计划的应用范围不断扩大,使其在原材料价格波动的情况下仍能保持相对稳定的定价能力。

全球防水解决方案市场趋势与洞察

绿建筑中低挥发性有机化合物法规的普及

监管机构目前已将许多防水材料的挥发性有机化合物 (VOC) 含量限制在 50 克/公升或以下,这使得溶剂型涂料越来越不符合公共住宅和商业计划的规范。拥有先进乳化聚合物技术的製造商透过提供耐久性可与溶剂型涂料媲美甚至更优的水性防水卷材,正在赢得市场领先地位。承包商也开始采用这些产品,因为它们可以减少施工现场的异味,缩短房屋重新入住时间,并降低工人接触有害物质的风险。 LEED 和欧盟生态标章认证正成为建筑师重要的采购考量。同时,新兴的生物基树脂使企业能够证明其碳排放的降低,从而在满足 VOC 标准之外脱颖而出。

快速的都市化和基础建设

在亚洲和南美洲,特大城市不断扩张,每年新增数百万平方英尺的屋顶、平台和地下空间。大型水坝、地铁和防洪隧道需要特殊的防水膜,以承受持续的静水压力。由于高层建筑一旦防水失效,后果更为严重,设计团队通常会选用长期保固的多层液态防水系统。模组化预製公寓大楼也越来越倾向于使用工厂预涂的防水涂料,这种涂料运抵现场后即可完全固化,从而减少工时。随着各国政府将气候适应性条款纳入竞标,那些拥有标誌性基础设施项目经验的供应商在竞标候选名单中的排名也迅速上升。

石油树脂原料价格波动

环氧树脂、聚氨酯树脂和聚氯乙烯树脂的原料价格与原油价格波动密切相关,进而影响产品价格的季度性变化。供不应求导致原物料成本在2024年至2025年间上涨15%至20%,迫使厂商进行库存避险并迅速发布价格调整通知。采购能力有限的小型混炼企业难以取得供应,市占率逐渐被规模较大的综合性企业蚕食。一些承包商已开始尽可能地用水泥基涂料取代其他材料,但性能上的差距使得全面转型难以实现。持续的价格波动促使人们加强对生物基或再生聚合物的研发力度,以降低价格风险,但工业规模的生产仍处于起步阶段。

细分市场分析

到2025年,卷材将占总收入的73.42%,这反映了卷材和液体防水系统在防水解决方案市场的主导地位,这些产品具有厚度均匀、施工快速的优点。以细分市场来看,预计到2031年,卷材将以5.69%的最高复合年增长率成长,稳步扩大其在防水解决方案市场的份额。模组化建筑的成长推动了对冷浸聚氨酯的需求,用于在模组化模组周围形成无缝捲材。高温喷涂聚脲因其即时固化的特性,仍然是土木工程结构的首选,即使在潮湿气候下,也能在数小时内恢復交通。在低坡屋顶领域,全黏合捲材凭藉其在ASTM测试中验证的优异性能,继续保持主导地位。同时,松铺式组件在需要防根穿刺和可逆防水层的绿色屋顶和广场平台设计中找到了生态学定位。

製造商正在开发跨基材黏合底漆,以简化从混凝土到金属或热塑性塑胶的过渡。采用RFID标籤卷材的整合品质保证平台可记录批号、施工量和环境条件数据,从而确保设计人员获得一致的性能。同时,业界在ISO 22114测试方面的合作正在协调各国标准的结果,并促进跨国计划核准。总而言之,膜材料的进步和现场施工效率的提高,使其成为注重性价比、寻求更低生命週期成本的防水解决方案业主的首选。

区域分析

亚太地区将继续占据主导地位,预计到2025年将占总收入的36.70%,这主要得益于中国、印度和东南亚地区住宅、公路和发电工程的持续成长。大规模的公私合营(PPP)将为采购量提供保障,有利于那些能够在计划现场附近建立区域仓库和技术团队的供应商。日本和韩国严格的建筑规范促使高规格液体防水卷材的早期应用,为新兴邻国树立了标竿。随着各国政府将防水建筑支出纳入气候调适计划,并推出防洪和高架铁路结构等奖励策略,市场成长速度将进一步加速。

预计到2031年,南美洲将以6.22%的复合年增长率实现最高水准的成长,这主要得益于巴西恢復城市交通建设资金投入以及哥伦比亚跨安第斯隧道的竣工。外汇波动促进了聚合物树脂的本地化生产,并为跨国公司创造了合资机会。阿根廷经济復苏缓慢,导致住宅需求积压,经销商增加快速固化丙烯酸防水卷材的库存,这种卷材非常适合劳动力短缺的地区。该地区气候特征是降雨量大、紫外线强烈,因此需要保持柔软性的弹性体系统。政府竞标越来越多地将ASTM C836或EN 14891作为强制性标准。

北美和欧洲是成熟市场,成长率仅为个位数,但它们正引领全球技术趋势。美国的《基础设施投资与就业法案》已向桥面铺装和雨水隧道注入数十亿美元资金,为优质供应商提供了坚实的基础。欧洲绿色交易正在推动向完全可回收或生物基涂层的转变,给以石化产品为主的配方带来了压力。在中东和非洲市场,需求集中在沿岸地区的大型企划上,极端高温促使人们采用抗紫外线聚脲。同时,开发银行贷款正在为南非城市更新中的低收入住宅防水工程提供资金。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 绿建筑中低挥发性有机化合物法规的普及

- 快速的都市化和不断扩大的基础设施建设

- 超大规模资料中心的扩张

- 公共基础设施计划快速扩张

- 模组化建筑中液态防水膜的强势应用

- 市场限制

- 石油树脂原料价格波动

- 专业建筑工人人手不足

- 遵守微塑胶法规的负担

- 价值链分析

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 产业间竞争

第五章 市场规模与成长预测

- 副产品

- 化学品

- 环氧树脂基

- 聚氨酯基

- 水溶液

- 其他技术

- 电影

- 低温液体应用

- 高温液体应用

- 全黏性片材

- 鬆散的床上用品

- 化学品

- 按最终用途

- 商业的

- 工业和公共设施

- 基础设施

- 住宅

- 按地区

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 越南

- 亚太其他地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 欧洲

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Ardex Group

- Arkema(Bostik)

- Asian Paints Ltd.

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- Hongyuan Waterproof Technology Group Co., Ltd.

- Keshun Waterproof Technology Co., Ltd.

- Kingspan Group

- Minerals Technologies Inc.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Soprema

- Thermax Limited

第七章 市场机会与未来展望

第八章:执行长面临的关键策略问题

The Waterproofing Solutions market is expected to grow from USD 30.83 billion in 2025 to USD 32.48 billion in 2026 and is forecast to reach USD 42.15 billion by 2031 at 5.35% CAGR over 2026-2031.

The current expansion reflects a decisive pivot from reactive repairs to proactive building-envelope protection, as green-building mandates, infrastructure resilience goals, and labor-saving construction methods converge. Liquid-applied membranes, which cure seamlessly and require fewer skilled installers, are replacing many sheet-based systems in both new-build and retrofit settings. Tighter VOC regulations have accelerated the reformulation of chemical coatings toward water-borne and bio-based chemistries, while public-sector procurement now values total life-cycle performance over initial cost. Finally, data-center cooling intensity, tunnel rehabilitation, and climate-adaptation projects are broadening the application base, keeping pricing power relatively stable despite volatility in raw materials.

Global Waterproofing Solutions Market Trends and Insights

Surge in Green-Building Low-VOC Mandates

Regulators now limit VOC content to 50 g/L or lower for many waterproofing categories, pushing solvent-based coatings off specifications in public housing and commercial projects. Manufacturers with advanced emulsion-polymer chemistry are capturing premium positions by delivering water-based membranes that match or surpass the durability of solvent-borne membranes. Contractors embrace these products because reduced on-site odors shorten re-occupancy cycles and cut worker-exposure risks. Labels indicating LEED-compatible or EU Ecolabel compliance have become critical purchasing cues for architects. In parallel, emerging bio-based resins enable firms to advertise carbon footprint reductions, offering differentiation beyond simple VOC compliance.

Rapid Urbanization and Infrastructure Build-Out

Megacity expansion is adding millions of square feet of roof, podium, and below-grade surfaces each year across Asia and South America. Large dams, subways, and flood-control tunnels require specialized membranes that perform under sustained hydrostatic pressure. High-rise construction heightens the consequence of failure, so design teams specify multi-layer liquid-applied systems backed by long warranties. Modular-prefab apartment blocks further favor factory-applied waterproof coatings that arrive onsite fully cured, shrinking labor hours. As governments bundle climate-resilience clauses into tenders, suppliers with track records on landmark infrastructure quickly climb bid shortlists.

Volatile Petro-Resin Input Prices

Epoxy, polyurethane, and PVC feedstocks track crude oil fluctuations, which in turn affect finished goods prices every quarter. Natural-rubber shortfalls lifted raw-material costs by 15-20% between 2024 and 2025, forcing manufacturers to hedge inventory and issue rapid surcharge notices. Smaller formulators with limited purchasing power struggled to secure supplies, conceding market share to integrated majors. Some contractors substituted cementitious coatings where feasible, but performance gaps limit wholesale migration. Continuous volatility encourages research and development into bio-sourced or recycled polymers to buffer price risk, although industrial-scale volumes remain nascent.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Hyperscale Data Centers

- Rapid Growth in Public Infrastructure Projects

- Specialist-Installer Labor Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Membranes accounted for 73.42% of the revenue in 2025, reflecting the waterproofing solutions market share dominance of sheet and liquid systems, which deliver uniform thickness and rapid installation. At the segment level, membranes are projected to command the highest 5.69% CAGR to 2031, meaning their share of the waterproofing solutions market size is forecasted to widen steadily. Demand aligns with the growth of modular buildings, where cold-liquid-applied polyurethanes form seamless skins around volumetric modules. Hot-spray polyureas remain favored on civil structures because instant curing allows traffic reopening within hours, even in humid climates. Fully adhered sheets continue to lead the way in low-slope roofing, thanks to their well-documented ASTM test pedigree, while loose-laid assemblies find ecological niches in green-roof and plaza-deck designs that require root-resistant yet reversible layers.

Manufacturers are engineering primers that bond across dissimilar substrates to simplify transitions from concrete to metal or thermoplastic. Integrated QA platforms using RFID-tagged rolls now log batch, spread-rate, and ambient-condition data, assuring specifiers of performance consistency. Meanwhile, industry collaboration on ISO 22114 testing harmonizes outcomes across domestic codes, easing cross-border project approvals. Overall, membranes' materials evolution and job-site efficiencies keep them the go-to solution for value-driven owners seeking low life-cycle costs within the waterproofing solutions market.

The Global Waterproofing Solutions Market Report is Segmented by Product (Chemicals Including Epoxy-Based, Polyurethane-Based, Water-Based, and Other Technologies; Membranes Including Cold Liquid Applied, Hot Liquid Applied, Fully Adhered Sheet, and Loose-Laid Sheet), End-Use Sector (Commercial, Residential, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region retained a commanding 36.70% of 2025 revenue as China, India, and Southeast Asia continued to drive housing, expressway, and hydropower projects. Large public-private partnerships underpin volume commitments that reward suppliers who can establish regional warehouses and technical crews near project hubs. Japan and South Korea, with stringent building codes, adopted high-spec liquid membranes early, setting benchmarks that were later emulated in emerging neighbors. Growth accelerates when governments integrate waterproofing line items into broader climate-adaptation programs, channeling stimulus toward flood protection and elevated rail structures.

South America is projected to deliver the strongest 6.22% CAGR through 2031, as Brazil reinstates urban-mobility funding and Colombia completes cross-Andean tunnels. Exchange-rate swings encourage local manufacturing of polymer resins, creating joint-venture openings for multinationals. Argentina's gradual recovery drives pent-up residential demand, prompting distributors to stock fast-curing acrylic membranes suitable for labor-constrained sites. Regional climate, with heavy rainfall and high UV, favors elastomeric systems that stay flexible, and government tenders increasingly list ASTM C836 or EN 14891 as mandatory standards.

North America and Europe exhibit mature, low-single-digit growth, yet set the global technology pace. The U.S. Infrastructure Investment and Jobs Act steers billions into bridge-deck overlays and stormwater tunnels, maintaining a resilient base for premium suppliers. Europe's Green Deal shifts specifications toward fully recyclable or bio-based layers, pressuring petrochemical-heavy formulations. The Middle East and Africa markets concentrate demand in Gulf megaprojects, where extreme heat drives the uptake of UV-stable polyureas. Meanwhile, South Africa's urban renewal allocates funds to low-income housing waterproofing, financed by development banks.

- Ardex Group

- Arkema (Bostik)

- Asian Paints Ltd.

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- Hongyuan Waterproof Technology Group Co., Ltd.

- Keshun Waterproof Technology Co., Ltd.

- Kingspan Group

- Minerals Technologies Inc.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Soprema

- Thermax Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in green-building low-VOC mandates

- 4.2.2 Rapid urbanisation and infrastructure build-out

- 4.2.3 Expansion of hyperscale data centres

- 4.2.4 Rapid growth in public infrastructure projects

- 4.2.5 Robust shift towards liquid-applied membranes in modular construction

- 4.3 Market Restraints

- 4.3.1 Volatile petro-resin input prices

- 4.3.2 Specialist-installer labour shortage

- 4.3.3 Microplastic compliance burden

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Chemicals

- 5.1.1.1 Epoxy-based

- 5.1.1.2 Polyurethane-based

- 5.1.1.3 Water-based

- 5.1.1.4 Other Technologies

- 5.1.2 Membranes

- 5.1.2.1 Cold Liquid Applied

- 5.1.2.2 Hot Liquid Applied

- 5.1.2.3 Fully Adhered Sheet

- 5.1.2.4 Loose-Laid Sheet

- 5.1.1 Chemicals

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 South Korea

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 Canada

- 5.3.2.2 Mexico

- 5.3.2.3 United States

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 Spain

- 5.3.3.6 United Kingdom

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Argentina

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ardex Group

- 6.4.2 Arkema (Bostik)

- 6.4.3 Asian Paints Ltd.

- 6.4.4 Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- 6.4.5 Hongyuan Waterproof Technology Group Co., Ltd.

- 6.4.6 Keshun Waterproof Technology Co., Ltd.

- 6.4.7 Kingspan Group

- 6.4.8 Minerals Technologies Inc.

- 6.4.9 Nippon Paint Holdings Co., Ltd.

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 RPM International Inc.

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 Soprema

- 6.4.15 Thermax Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment