|

市场调查报告书

商品编码

1911819

印度防水解决方案市场:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)India Waterproofing Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

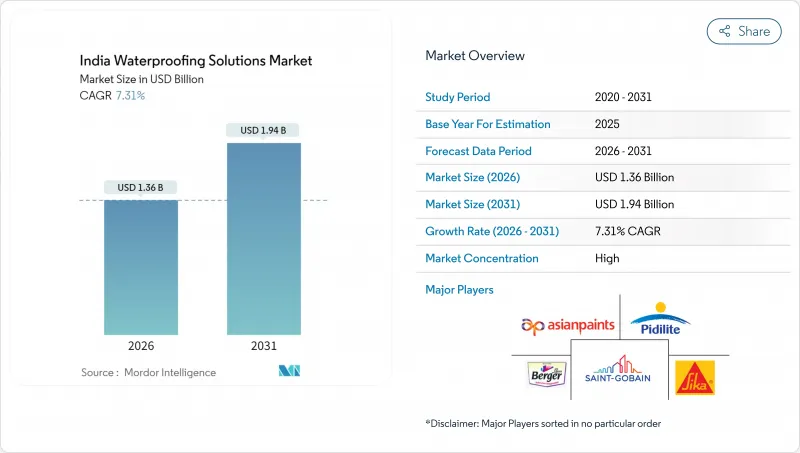

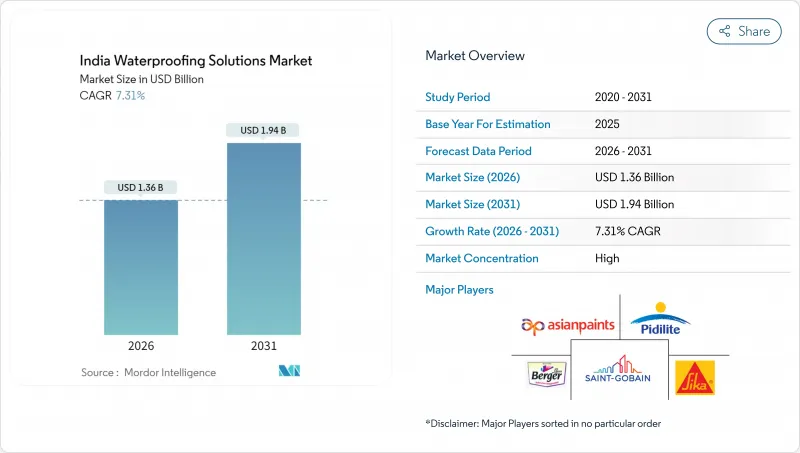

印度防水解决方案市场预计将从 2025 年的 12.7 亿美元成长到 2026 年的 13.6 亿美元,预计到 2031 年将达到 19.4 亿美元,2026 年至 2031 年的复合年增长率为 7.31%。

国家基础设施计画下的强劲公共支出、日益严格的建筑规范(尤其註重气候适应性)以及客户对预防性维护的明显重视,共同支撑了印度防水解决方案市场在原材料成本波动的情况下保持稳定成长。防水卷材仍然是领先技术,它不仅在恶劣的季风条件下拥有卓越的性能,还能提供开发商和富裕住宅所追求的长期质保。住宅推动了优质化,而商业、工业和基础设施计划则为隔热反射混合防水卷材等先进系统带来了规模化应用。随着多元化涂料巨头和特种化学品供应商竞相加大研发投入、扩大安装网路并遵守修订后的印度标准局 (BIS) 防水规范,市场竞争日益激烈。

印度防水解决方案市场趋势与洞察

快速都市化与经济适用住宅政策

印度的城市人口每年增长超过1000万,仅总理住房计划(PMAY)一项就计划在2025年提供2000万套新的经济适用住宅。由于维修可能高达新建成本的五倍,开发商越来越多地在设计阶段就指定采用预防性防水措施。 2024-2025财政年度累计1,440亿美元用于气候适应型基础建设,并将资金与符合印度标准局(BIS)标准的防水材料直接挂钩。 100个城市的智慧城市计画正在推动地铁站、多层停车场和综合用途塔楼等地下结构防水膜的需求。在人口密集的城市中心进行垂直建设时,冷浸式防水膜更受欢迎,因为它可以无缝适应复杂的几何形状,并降低因不均匀沉降造成的损坏风险。

采用具有热反射性能的混合型液态防水薄膜

这种兼具防水和近红外线反射特性的混合型液体防水膜,在夏季高峰期可将屋顶温度降低高达15°C。这不仅能减少空调能耗,还有助于获得印度绿色建筑委员会 (IGBC) 和 LEED(环境设计美国)认证积分。亚洲涂料和西卡公司正在加强聚合物研发力度,以解决印度紫外线强度高的气候条件下该材料的耐久性和色牢度问题。早期应用案例包括资料中心和製造工厂,在这些场所,大面积面积的节能效益可以迅速累积。这项技术也开始应用于高层住宅计划,对于中高端买家的开发商而言,降低屋顶热量吸收是一项重要的市场卖点。透过在地化原料采购和提高产量来降低产品成本,是实现长期应用的关键。

建筑公司分散化导致施工品质下降

在全国范围内,约80%的防水系统由缺乏正规训练的小规模承包商安装,导致安装品质参差不齐,并容易过早失效。儘管都市区开发商越来越倾向于强制使用OEM认证的安装人员,但打入印度庞大的建筑市场仍然是一项挑战。虽然製造商资助区域培训中心,但由于工人经常在短期计划之间流动,技术纯熟劳工的留存率仍然很低。短期来看,糟糕的安装正在削弱终端用户的信心,并阻碍向需要精准安装的高阶防水捲材的过渡。

细分市场分析

至2025年,防水卷材将占据印度防水解决方案市场65.62%的份额,并在2031年之前保持7.46%的复合年增长率,巩固其在严苛应用领域作为性能标竿的地位。冷粘捲材因其能在复杂的屋顶几何形状上形成无缝屏障且无需火炬固化,从而提高施工现场的安全性,而备受住宅建筑商的青睐。全黏结捲材系统广泛应用于大型商业屋顶和裙楼板,在这些专案中,长达20年的现场性能至关重要。热粘卷材主要面向化工厂和炼油厂,而预製卷材则透过预製化工艺,为快速基础设施计划提供支援。

先进的弹性体化学技术使膜材能够跨越宽达2毫米的裂缝,这在高层建筑中尤其重要,因为高层建筑的位移现象十分普遍。高端住宅市场的保固期已延长至12年,数位化检测工具使製造商能够在保固期内进行安装审核。虽然化学产品在局部修补和特殊基材方面仍然很重要,但随着规模的扩大,平方公尺成本降低,膜材市场持续成长。主要供应商对原料的策略性后向整合进一步保护了膜材价格免受油价波动的影响。

《印度防水解决方案报告》按子产品(化学品和防水布)和最终用途(商业、工业和公共、基础设施和住宅)进行细分。市场预测以以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速的都市化与经济适用住宅政策的推广

- 采用具有增强的热反射率的混合液体膜

- 季风强度加大,需制定气候智慧型建筑规范。

- 住宅偏好高端产品并要求10年保固

- 向低VOC奈米渗透技术过渡

- 市场限制

- 施工缺陷是由于施工承包商基地分散造成的。

- 与原油价格相关的原料价格波动将影响聚氨酯(PU)和沥青。

- 都市区地区对预防性防水的认知有限

- 价值链分析

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按子产品

- 化学品

- 环氧树脂基

- 聚氨酯基

- 水溶液

- 其他技术

- 防水膜

- 冷液应用

- 全黏性片材

- 热液应用

- 鬆散铺放的床单

- 化学品

- 按最终用途面积

- 商业的

- 工业和公共设施

- 基础设施

- 住宅

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Ardex Group

- Asian Paints

- Berger Paints India Limited

- Bostik(Arkema)

- Choksey FixGuruu

- CICO Group

- Kryton International Inc.

- MAPEI SpA

- MC-Bauchemie

- Pidilite Industries Ltd.

- Saint-Gobain

- Sika AG

- Soprema Group

- STP Limited, India

- Ultratech Cement Ltd.

- Xypex Chemical Corporation

第七章 市场机会与未来展望

The India Waterproofing Solutions Market is expected to grow from USD 1.27 billion in 2025 to USD 1.36 billion in 2026 and is forecast to reach USD 1.94 billion by 2031 at 7.31% CAGR over 2026-2031.

Robust public spending under the National Infrastructure Pipeline, stricter building codes focused on climate resilience, and a clear customer pivot toward preventive maintenance keep the India Waterproofing Solutions market on a stable growth path despite raw-material cost swings. Membranes remain the favored technology because they combine proven performance in aggressive monsoon conditions with the extended warranties demanded by developers and affluent homeowners. Residential construction drives premiumization, while commercial, industrial, and infrastructure projects create scale for advanced systems such as heat-reflective hybrid membranes. Competitive intensity is high as diversified paint majors and specialized chemical suppliers race to improve reseaarch and development, strengthen applicator networks, and comply with the Bureau of Indian Standards' upgraded waterproofing specifications.

India Waterproofing Solutions Market Trends and Insights

Rapid Urbanization and Affordable-Housing Stimulus

India adds more than 10 million urban residents each year, and the Pradhan Mantri Awas Yojana alone targets 20 million new affordable units by 2025. Developers increasingly specify preventive waterproofing at the design stage because retrofits cost up to five times more than original installation. Budget 2024-25 earmarked USD 144 billion for climate-resilient infrastructure, a move that directly links funding to BIS-compliant waterproofing. Smart-City projects in 100 municipalities have elevated demand for membranes that perform in underground metro stations, multilevel parking structures, and mixed-use towers. Vertical construction in dense urban cores favors cold liquid applied membranes, which adapt to complex geometries without joints that could fail under differential settlement.

Adoption of Hybrid Liquid Membranes with Heat-Reflectivity

Hybrid liquid membranes that combine waterproofing with near-infrared reflectance reduce rooftop temperatures by as much as 15 °C during peak summer, lowering HVAC energy loads and helping buildings qualify for IGBC and LEED points. Asian Paints and Sika AG have scaled polymer research and development to address durability and color-fastness concerns in India's ultraviolet-intense climate. Early adopters include data centers and manufacturing plants where energy savings compound quickly across large roof areas. The technology has begun penetrating residential high-rise projects, where reduced heat gain adds marketing value for developers targeting mid-premium buyers. Over the long term, broader rollout depends on lowering product cost through local raw-material sourcing and higher manufacturing volumes.

Fragmented Applicator Base Driving Workmanship Failures

Small contractors with limited formal training install about 80% of waterproofing systems nationwide, leading to inconsistent workmanship and premature failures.Urban developers increasingly mandate OEM-certified applicators, yet reaching India's sprawling construction market remains challenging. Manufacturers fund regional training centers, but retention of skilled labor is low because workers migrate between short-term projects. In the immediate term, workmanship failures erode end-user confidence and slow the shift toward premium membranes that require meticulous installation.

Other drivers and restraints analyzed in the detailed report include:

- Intensifying Monsoons Prompting Climate-Resilient Codes

- Shift Toward Low-VOC Nano-Penetrating Technologies

- Limited Tier-3/Rural Awareness for Preventive Waterproofing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Membranes represented 65.62% of the India Waterproofing Solutions market share in 2025 and will maintain a 7.46% CAGR to 2031, reinforcing their status as the functional benchmark for demanding applications. Cold liquid applied membranes attract residential builders because they form seamless barriers over complex roof lines and cure without torches, enhancing job-site safety. Fully adhered sheet systems dominate large-format commercial roofs and podium slabs where proven 20-year field performance matters. Hot liquid variants address chemical plants and refineries, while loose-laid sheets support fast-track infrastructure projects by enabling pre-fabricated installation sequences.

Advanced elastomeric chemistry helps membranes bridge cracks up to 2 mm, a critical advantage in high-rise structures subject to differential movement. Warranties now extend to 12 years in premium residential segments, and digital inspection tools allow manufacturers to audit installations before issuing coverage. While chemicals retain relevance for localized repairs and niche substrates, the India Waterproofing Solutions market size for membranes keeps increasing as cost per square meter falls with scale. Strategic raw-material backward integration by major suppliers further cushions membrane pricing against crude-driven volatility.

The India Waterproofing Solutions Report is Segmented by Sub Product (Chemicals and Membranes), and End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ardex Group

- Asian Paints

- Berger Paints India Limited

- Bostik (Arkema)

- Choksey FixGuruu

- CICO Group

- Kryton International Inc.

- MAPEI S.p.A.

- MC-Bauchemie

- Pidilite Industries Ltd.

- Saint-Gobain

- Sika AG

- Soprema Group

- STP Limited, India

- Ultratech Cement Ltd.

- Xypex Chemical Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanization and affordable-housing stimulus

- 4.2.2 Adoption of hybrid liquid membranes that add heat-reflectivity

- 4.2.3 Intensifying monsoons prompting climate-resilient codes

- 4.2.4 Home-owner premiumization and 10-year warranty demand

- 4.2.5 Shift toward low-VOC nano-penetrating technologies

- 4.3 Market Restraints

- 4.3.1 Fragmented applicator base driving workmanship failures

- 4.3.2 Crude-linked raw-material volatility hitting PU and bitumen

- 4.3.3 Limited tier-3 / rural awareness for preventive waterproofing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Sub Product

- 5.1.1 Chemicals

- 5.1.1.1 Epoxy-based

- 5.1.1.2 Polyurethane-based

- 5.1.1.3 Water-based

- 5.1.1.4 Other Technologies

- 5.1.2 Membranes

- 5.1.2.1 Cold Liquid Applied

- 5.1.2.2 Fully Adhered Sheet

- 5.1.2.3 Hot Liquid Applied

- 5.1.2.4 Loose-Laid Sheet

- 5.1.1 Chemicals

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Ardex Group

- 6.4.2 Asian Paints

- 6.4.3 Berger Paints India Limited

- 6.4.4 Bostik (Arkema)

- 6.4.5 Choksey FixGuruu

- 6.4.6 CICO Group

- 6.4.7 Kryton International Inc.

- 6.4.8 MAPEI S.p.A.

- 6.4.9 MC-Bauchemie

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 Saint-Gobain

- 6.4.12 Sika AG

- 6.4.13 Soprema Group

- 6.4.14 STP Limited, India

- 6.4.15 Ultratech Cement Ltd.

- 6.4.16 Xypex Chemical Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment