|

市场调查报告书

商品编码

1404080

非接触式付款终端:市场占有率分析、产业趋势与统计、2024年至2029年成长预测Contactless Payment Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

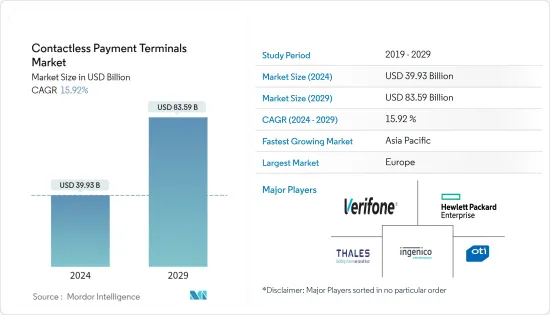

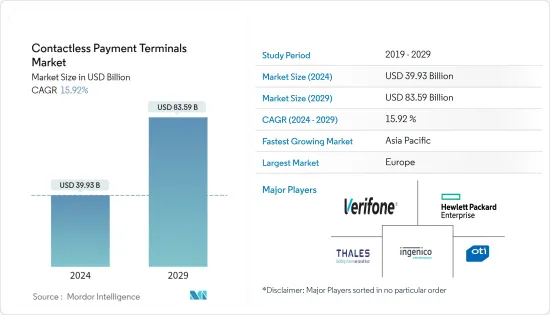

非接触式付款终端市场规模预计到 2024 年为 399.3 亿美元,预计到 2029 年将达到 835.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 15.92%。

由于企业和消费者数位转型的趋势不断增强以及智慧型手机的普及,全球付款和交易格局正在迅速变化。智慧型手机、数位付款卡和零售 POS 终端的技术进步正在推动市场成长。

主要亮点

- 越来越多的国家正在寻求向无现金经济转型,透过激励消费者进行数位付款来推动数位付款提供者的奖励。此外,全球非接触感应卡交易的扩展正在推动各个最终用户产业对非接触式付款终端的需求。

- 非接触式付款因其便利性和偏好而广受欢迎。因此,各种穿戴式装置製造商正在将近场通讯(NFC)技术整合到他们的大多数装置中,透过消除摆弄钱包、钱包和行动电话的需要来增加便利性。

- 此外,全球消费者对基于智慧型手机的付款方式的趋势正在以销售点系统上的非接触式付款方式的形式增加,因此卡片和金融服务提供者·我们提供解决方案或透过第三方供应商提供解决方案。

- 此外,近年来全球金融诈骗的增加促使政府监管机构推动提高付款交易的安全性。客户要求安全可靠的数位交易,增加了使用安全付款流程的需求。因此,这些监管机构对 POS 终端的采用有正面影响。随着全球行动趋势的兴起,行动 POS 系统越来越受欢迎。随着无现金交易技术的出现,POS 的采用率预计将会提高。

- 此外,技术进步正在塑造非接触式付款终端市场的未来。市场开拓供应商专注于开发敏捷、高效的付款管道,同时也努力提高非接触式付款的普及和普及。例如,去年 2 月,数位付款公司 Infibeam Avenues Limited (IAL) 宣布将推出无硬体非接触式行动 POS(资讯点系统),扩大其付款解决方案组合。

- 在 COVID-19大流行期间,世界各地的消费者开始寻找避免人际接触的方法,以保护自己免受感染。为此,非接触式付款的需求不断增加,许多产业对非接触式POS终端机等各种非接触式付款终端的需求不断增加。此外,即使在大流行之后,由于新兴国家数位付款的普及,对非接触式付款终端的需求预计将迅速增加。

非接触式付款终端的市场趋势

零售业预计将占据主要市场占有率

- 非接触式付款终端在零售业的使用越来越多,引入非接触式付款终端可以带来好处,例如促销和提高客户满意度,因此市场占有率,预计会很高。透过提供非接触式付款选项,零售商正在提高结帐流程的速度和效率,并透过更顺畅、更快的交易来培养客户忠诚度。

- 此细分市场的主要驱动力是经销店以及在零售店结帐时使用行动钱包的偏好。基于行动的 POS (mPOS) 的发展包括连接到平板电脑或智慧型手机上的基本 ePOS 应用程式的读卡器,虽然商家入门很简单,但该服务是「计量收费模式」提供的。在零售业,这些案例很可能导致非接触式付款终端的引入。

- 市场参与者正在为零售商提供创新和智慧的解决方案,预计这将推动非接触式付款终端在零售领域的采用。例如,去年,金融服务平台 Square 宣布向美国数百万商家推出适用于 iPhone 的 Tap to Pay 服务。此外,新推出的 iPhone 上的 Tap to Pay 功能让您可以直接从 iPhone 接受非接触式付款,无需任何硬体或额外费用。

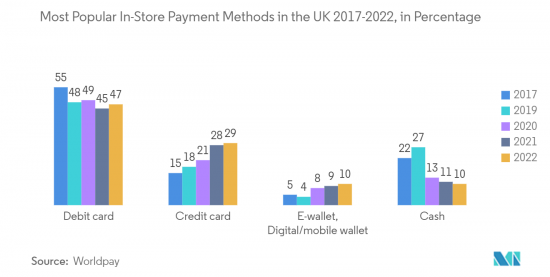

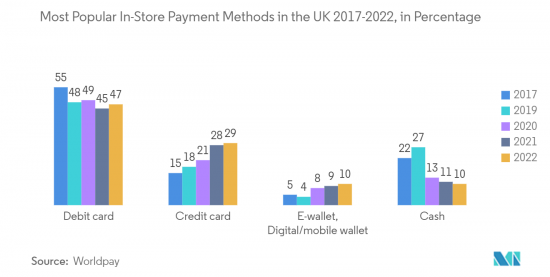

- 此外,零售店和商店的非接触式签帐金融卡和信用卡付款的增加预计将在预测期内推动零售业对非接触式终端的市场需求。例如,Worldplay统计数据显示,签帐金融卡是去年英国最常使用的付款方式,分别占POS终端所有付款的45%和28%。

预计欧洲将占据非接触式付款终端市场的较大份额

- 由于消费者习惯变化、监管环境不断变化、技术创新和市场形势等大流行原因,付款格局正在发生变化,预计欧洲地区将在未来一段时间内占据重要的市场占有率。此外,非接触式付款终端在各个最终用户行业的广泛采用是一个主要的成长要素,并可能在未来几年进一步推动市场发展。

- 在欧洲,随着消费者将这种相对较新的付款方式融入他们的日常生活,穿戴式付款设备继续普及。例如,戒指、穿戴式装置、手环和智慧型手錶都具有近场通讯(NFC)功能。穿戴式装置有两种类型:「主动」和「被动」。如果您穿着像戒指一样的被动手錶,则可以透过在付款终端输入 PIN 码来核准交易,就像塑胶卡一样。如果您穿戴的是活动手錶(例如智慧型手錶),PIN 码会插入装置本身,让您只需轻轻一按即可付款。

- 此外,在新冠肺炎 (COVID-19) 疫情期间,非接触式付款在欧洲推广,非接触式卡片限额也大幅增加。大流行后,该地区越来越多的消费者转向非接触式付款,预计将进一步推动市场。例如,根据欧洲央行(ECB)的报告,POS上的非接触式卡片付款在三年内大幅成长,从2019年占所有卡片付款的41%上升到去年的62%。

- 此外,该地区市场供应商的持续产品创新预计将在预测期内推动市场发展。例如,PayPal Holdings Inc. 去年 5 月为英国的小型企业推出了 Tap to Pay with Zettle by PayPal。这项新功能使个人卖家和小型企业能够直接在其 Android 行动装置上接受非接触式面对面付款,无需任何额外的硬体或费用。

非接触式付款终端产业概况

非接触式付款终端市场已整合,因为只有一些参与者拥有重要的市场占有率。此外,消费者对非接触感应卡的认识以及对安全问题的担忧使得新参与企业难以进入该市场。市场的主要企业包括 Thales Group、OTI、VeriFone Systems Inc.、Hewlett Packard 和 Ingenico Group SA。

- 2022 年 9 月 - 万事达卡、泰雷兹集团、ProvidusBank 和 Interswitch 宣布在奈及利亚推出新的触碰支付服务。触碰支付服务让持卡人透过非接触式付款终端轻触支援 NFC 的智慧型设备,即可快速、安全且方便地进行商店付款。

- 2022 年 3 月 - Softpay.io 是一款使用非接触式卡和行动钱包以及全新创新 SoftPOS 解决方案 Softpay 的行动付款应用程序,允许商家在 Android 手机或平板电脑上使用相同的付款终端,而无需额外的硬体Nets(Nexi 集团成员) ,已推出非接触式付款。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 减少等待时间并加快结帐速度

- 非接触式付款带来的便利与轻鬆

- 市场抑制因素

- 数位付款的安全问题

第六章市场区隔

- 依技术

- Bluetooth

- 红外线的

- 职业基础

- Wi-Fi

- 其他技术

- 按付款方式

- 基于帐户

- 信用卡/签帐金融卡

- 储值

- 智慧卡

- 其他付款方式

- 按设备

- 综合销售点

- mPOS

- PDA

- 无人值守终端

- 非接触式读卡机

- 其他设备

- 按最终用户产业

- 零售

- 运输

- 银行

- 政府机关

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第七章竞争形势

- 公司简介

- Thales Group

- On Track Innovation LTD.(OTI)

- VeriFone Inc.

- Hewlett Packard Enterprise Development LP

- Ingenico Group SA

- Visiontek Products LLC

- PayPal Holdings Inc.

- Castles Technologies

- ID Tech Solutions

- NEC Corporation

第八章投资分析

第9章市场的未来

The Contactless Payment Terminals Market size is estimated at USD 39.93 billion in 2024, and is expected to reach USD 83.59 billion by 2029, growing at a CAGR of 15.92% during the forecast period (2024-2029).

The global landscape of payments and transactions is changing rapidly, owing to the growing enterprises and consumer propensity toward digital transformation and the proliferation of smartphones. Technological advancements in smartphones, digital payment cards, and retail POS terminals fuel market growth.

Key Highlights

- More and more countries are moving toward becoming cashless economies, thus encouraging digital payment providers by incentivizing their consumers' digital forms of payments. In addition, growing contactless card transactions worldwide drive the demand for contactless payment terminals in various end-user industries.

- Contactless payments are gaining significant traction due to their convenience and preference. As a result, various wearable device manufacturers are incorporating near-field communication (NFC) technology as a standard into most devices to provide greater convenience by removing the need to fumble with a wallet, purse, or phone.

- In addition, the global consumer inclination toward payment methods involving smartphones is increasing in the form of contactless payment methods at POS systems, owing to which card and financial service providers are either offering their card solutions on smartphones or via third-party vendors.

- Additionally, the rising financial frauds worldwide have influenced government regulatory bodies to secure payment transactions over the past few years. With customers demanding safe and reliable digital transactions, the need for using secure payment processes has increased. Therefore, these regulatory bodies have positively impacted the adoption of POS terminals. With the increasing mobility trends worldwide, mobile POS systems are gaining traction. With the advent of cashless transactional technologies, POS is expected to witness an increase in adoption rates.

- Moreover, technological advancements are shaping the future of the contactless payment terminals market. Market vendors are focusing on developing payment platforms that are agile and efficient and also increase the penetration and reach of contactless payments. For instance, in February last year, digital payments player Infibeam Avenues Limited (IAL) announced to broaden its payment solutions portfolio by launching a no-hardware contactless mobile point of sale (POS), which will facilitate card payment transactions for small vendors through a tap-on-phone technology.

- During the COVID-19 pandemic, consumers worldwide started finding ways to avoid human contact in order to protect themselves from getting affected. Due to this, the demand for contactless payments has increased, boosting the demand for various contactless payment terminals, such as contactless POS terminals, in multiple industries. In addition, even after the pandemic, the demand for contactless payment terminals is expected to grow rapidly, owing to the proliferation of digital payments in emerging economies.

Contactless Payment Terminals Market Trends

Retail Industry is Expected to Hold Major Market Share

- With the increased use of contactless payment terminals in retail, together with benefits arising from placing them on offer like promotion of sales at merchants and improved customer satisfaction, it is expected to have a strong market share. Retailers provide a contactless payment option to enhance the speed and efficiency of the checkout process, fostering customer loyalty through smoother and quicker transactions.

- Point-of-sale terminals (POS) across retail stores and The primary drivers for this segment are outlets and a preference of mobile wallets to check out from retail stores. The evolution of mobile-based POS (mPOS) includes an card reader connected to a basic ePOS app on a tablet or smartphone, and while Merchant onboarding is simple, where the service is delivered on a 'pay-as-you-go model. In the retail sector, these cases are likely to lead to deployment of Contactless Payment Terminals.

- Market players offer innovative and smart solutions for retailers, expected to drive the adoption of contactless payment terminals in the retail segment. For instance, the previous year, Square, a financial services platform, It's announced to its millions of sellers in the United States that it will be launching a Tap To Pay service for iPhone. In addition, the newly launched Tap to Pay on iPhone enables all sizes of vendors Accepting contactless payments directly from their iPhones without any hardware or additional costs is also available as an application in Square Point Of Sale'siOS point of sale applications.

- Moreover, the growth in contactless debit card and credit card transactions in retail stores and outlets is anticipated to drive the market demand for contactless terminals in the retail sector over the forecast period. For example, the most popular payment method in the UK last year was debit cards which accounted for 45 % and 28 % respectively of all payments made at POS terminals according to statistics from Worldplay.

Europe is Expected to Hold Significant Share in the Contactless Payment Terminals Market

- The European region is expected to hold a significant market share over the upcoming period, owing to the changing payment landscape for various reasons: changing consumer habits, regulatory developments, innovation, and the COVID-19 pandemic. Moreover, the broader adoption of contactless payment terminals in different end-user industries is witnessing significant growth, further driving the market in the coming years.

- In Europe, consumers' wearable devices for payments continue to take off as they grate this relatively new payment method into their daily lives. For example, a ring, a wearable device, a bracelet, or a smartwatch, has Near-field Communication (NFC) capabilities. There exists 'active' and 'passive' wearables. The transaction which can be authorized by entering the PIN code on the payment terminal, just as with a plastic card, if you have your passive wristwatch that is like a ring. When you wear an active watch, such as a smartwatch, the PIN is inserted on your device itself and payments can be made using one tap.

- Additionally, amidst the COVID-19 situation, contactless card limits across Europe grew substantially as contactless payments were promoted across the continent. More and more consumers in the region are moving toward contactless payments after the pandemic, which is further expected to drive the market. For instance, according to European Central Bank (ECB) report, contactless card payments at the POS increased considerably in three years, from 41% of all card payments in 2019 to 62% in the last year.

- In addition, continuous product innovation by market vendors in the region is expected to drive the market over the forecast period. For instance, in May last year, PayPal Holdings Inc. launched Tap to Pay with Zettle by PayPal for small businesses in the United Kingdom. The new function will enable individual sellers and small businesses to accept contactless in-person payments directly on Android mobile devices without additional hardware and fees.

Contactless Payment Terminals Industry Overview

The contactless payment terminals market is consolidated because only some players have a significant market share. Moreover, consumers' need for more awareness toward contactless cards and concern over security issues make market entry challenging for new players. Some of the key players in the market include Thales Group, OTI, VeriFone Systems Inc., Hewlett Packard, and Ingenico Group SA.

- September 2022 - Mastercard, Thales Group, ProvidusBank, and Interswitch announced a new Tap-to-Pay service in Nigeria. The Tap-to-Pay service allows cardholders to make fast, secure, and convenient in-store payments by tapping their NFC-enabled smart device at any contactless-enabled payment terminal.

- March 2022 -With Softpay.io, a mobile payment with contactless cards and mobile wallets application, and A new and innovative softPOS solution, Softpay, which enables merchants to accept contactless payments on Android phones and tablets in the same way as payment terminals without additional hardware, has been launched by Nets, part of Nexi Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduction in Queuing Time and Quicker Checkout Time

- 5.1.2 Convenience and Ease Associated with Contactless Payments

- 5.2 Market Restraints

- 5.2.1 Security Concerns Regarding Digital Payment

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Bluetooth

- 6.1.2 Infrared

- 6.1.3 Carrier-based

- 6.1.4 Wi-Fi

- 6.1.5 Other Technologies

- 6.2 Payment Mode

- 6.2.1 Account-based

- 6.2.2 Credit/Debit Card

- 6.2.3 Stored Value

- 6.2.4 Smart Card

- 6.2.5 Other Payment Modes

- 6.3 Device

- 6.3.1 Integrated POS

- 6.3.2 mPOS

- 6.3.3 PDA

- 6.3.4 Unattended Terminal

- 6.3.5 Contactless Reader

- 6.3.6 Other Devices

- 6.4 End-user Industry

- 6.4.1 Retail

- 6.4.2 Transportation

- 6.4.3 Banking

- 6.4.4 Government

- 6.4.5 Healthcare

- 6.4.6 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Rest of Asia- Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Argentina

- 6.5.4.3 Mexico

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle-East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle-East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thales Group

- 7.1.2 On Track Innovation LTD. (OTI)

- 7.1.3 VeriFone Inc.

- 7.1.4 Hewlett Packard Enterprise Development LP

- 7.1.5 Ingenico Group SA

- 7.1.6 Visiontek Products LLC

- 7.1.7 PayPal Holdings Inc.

- 7.1.8 Castles Technologies

- 7.1.9 ID Tech Solutions

- 7.1.10 NEC Corporation