|

市场调查报告书

商品编码

1379504

网路扩展器和 CNNO的资本支出预测:2023 年第三季初步数据 - 全年资本支出预计将比 7/23 的预测低 5-10%,但科技业正在上升Capex Forecast Check, 3Q23 - Webscale & CNNO: Preliminary Results for 3Q23: Full-year Capex Likely to be 5-10% Lower than 7/23 Forecast, but Tech Portion of Spend is Trending Upwards |

|||||||

我们的官方 2023 年预测估计网路扩展器资本支出为 2,180 亿美元,营运商中立营运商 (CNNO) 资本支出为 390 亿美元。预计 2023 年第三季网路扩展器的实际资本支出将接近 2,000 亿美元,CNNO 的实际资本支出将接近 360 亿美元。

本报告对网路扩展器和 CNNO(营运商中立营运商)第三季资本支出和市场成长率进行了早期回顾。

视觉的

上市公司

|

|

目录

概括

介绍

分析

- 网路规模

- 职业中立

- 人工智慧世代

前景

附录

This short note provides an early review of 3Q23 market growth and capex spending figures for two of the three operator segments we cover: webscale, and carrier-neutral. (Our third segment, telco, will be addressed in a few weeks as more earnings reports are available.) The analysis is based on a review of over 80% of reporting companies in the two segments. Our official forecast for 2023 calls for $218B of capex for webscalers, and $39B for carrier-neutral operators (CNNOs). Market figures through 3Q23 suggest actual capex is likely to be closer to $200B and $36B for the two segments, respectively. This is a small change, however, and the tech portion of webscale capex is rising modestly. Moreover, new data from DigitalBridge makes clear that private equity-funded spend is strong in the data center CNNO market, helping to offset a weaker public CNNO market. Consequently, the vendor opportunity in selling to these two markets in 2023 is roughly the same size as forecast.

VISUALS

Organizations mentioned:

|

|

Table of Contents

Summary

Introduction

Analysis

- Webscale

- Carrier-neutral

- Generative AI

Outlook

Appendix

List of Figures

- Figure 1: Capex projection for Webscale and CNNO market (US$B), per 7/23 forecast

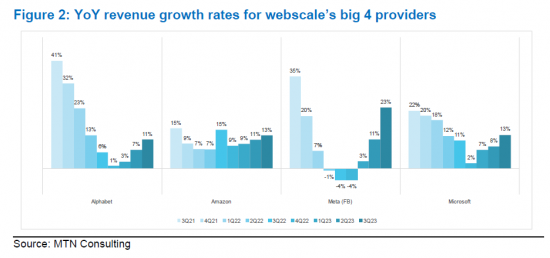

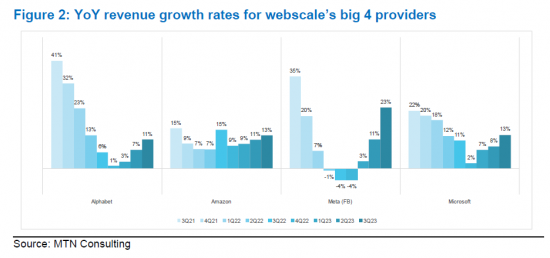

- Figure 2: YoY revenue growth rates for webscale's big 4 providers

- Figure 3: Capex for select* CNNOs in 3Q21-3Q23 (US$M)