|

市场调查报告书

商品编码

1848187

全球和中国的AI资料中心市场(2025年):展开及预测2025 Global and China AI Data Centers: Deployment and Outlook |

|||||||

价格

简介目录

本报告重点关注美国和中国通讯服务供应商 (CSP) 的人工智慧资料中心扩张。美国公司在全球扩张并增加国内投资,而中国公司则透过自主研发晶片进行扩张,双方都将未来的能源安全放在首位。

主要亮点:

- 美国通讯服务供应商正透过整合运算和能源来加速其全球人工智慧资料中心的部署,而中国通讯服务供应商则奉行由BBAT和三大营运商主导的双轨发展模式。

- 能源可用性、电网稳定性以及政策环境是选址的关键因素,因为能源成本和监管政策的调整决定了投资的速度和部署规模。

- 美国通讯服务供应商正在单一专案上投资数百亿至数千亿美元,并将容量扩展到吉瓦级,以满足人工智慧和高效能运算 (HPC) 的需求。

- 在国家政策的推动下,中国通讯服务供应商(CSP)正致力于自主研发晶片和建构自主云端策略,在维护国内核心基础设施的同时,积极拓展海外市场。

- 高压直流(HVDC)供电架构正逐步取代传统模式,成为支撑千兆瓦级运算和降低能耗的关键。

样品

目录

第1章 简介

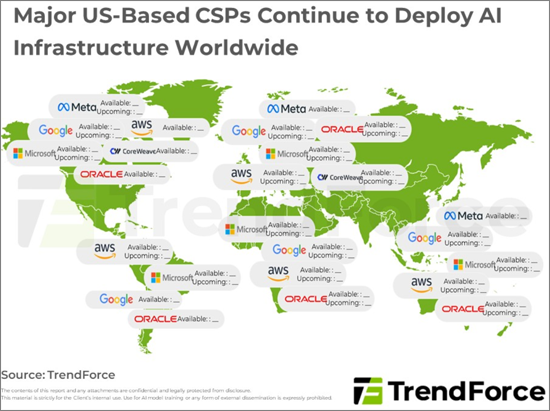

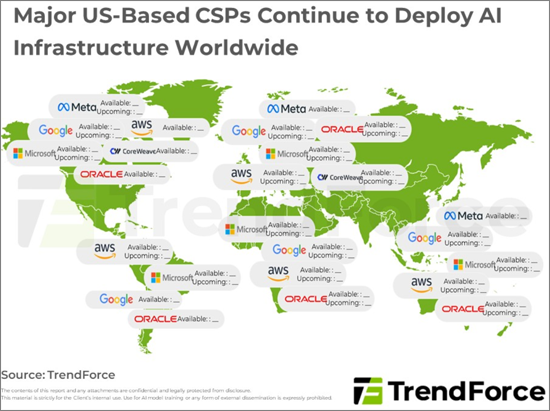

- 总部位于美国的大型通讯服务供应商(CSP)持续在全球部署人工智慧基础设施,力求在运算能力方面取得竞争优势。

第二章:北美主要云端服务供应商正积极向千兆位元组级人工智慧资料中心转型,因此能源相关因素在选择未来选址时至关重要。

- Google的北美策略主要集中在美国各地建立多个资料中心,但其位于德国米滕瓦尔德的专案因能源供应问题而被取消。

- 为了回应美国政府的需求,Meta公司的Hyperion超级运算计画大幅提高了投资目标,达到500亿美元。

第三章:甲骨文公司正在推进美国首个自主人工智慧项目,该项目的基础设施建设大量依赖NVIDIA GPU。

- 未来三年,Starget的目标是实现7吉瓦的发电容量,而甲骨文公司计划提供超过5.5吉瓦的发电容量。

第四章:NVIDIA宣布投资OpenAI,以增强其在云端AI市场GPU伺服器领域的影响力。

第五章:受地缘政治与国家政策的引导,中国云端服务供应商同步在新兴市场扩张资料中心。

- 中国云端服务供应商积极建置国内外资料中心。

第六章:受自主云端需求和公共建设的驱动,中国三大电信业者推出本土化伺服器和资料中心,成为国家政策的关键驱动力。

- 中国电信业者作为中国伺服器和人工智慧市场的关键参与者,正在启动国家级项目

第七章:持续参与中美CSP专用人工智慧资料中心项目,为电力基础设施(高压直流输电等)发展创造机会

简介目录

Product Code: TRi-0092

The report highlights AI data center expansion by U.S. and Chinese CSPs. U.S. firms scale globally and invest more at home, while Chinese firms expand with self-developed chips, but both prioritize energy stability going forward.

Key Highlights:

- U.S. CSPs are accelerating global AI data center deployments with a trend toward integrated compute and energy, while Chinese CSPs pursue a dual-track model led by BBAT and the three major telecoms.

- Energy availability, grid stability, and policy environments have become critical in site selection, with power costs and regulatory collaboration shaping investment pace and deployment.

- U.S. CSPs commit single-project investments ranging from tens to hundreds of billions of dollars, scaling to gigawatt-level capacity to support AI and HPC demand.

- Chinese CSPs, backed by national policies, are advancing self-developed chips and sovereign cloud strategies, maintaining core domestic builds while expanding overseas.

- High-voltage direct current (HVDC) power architectures are gradually replacing traditional models, becoming essential to support gigawatt-scale compute and reduce energy consumption.

SAMPLE VIEW

Table of Contents

1. Introduction

- Major US-Based CSPs Continue to Deploy AI Infrastructure Worldwide, Aiming to Gain a Competitive Edge in Computing Power

2. Leading North American CSPs Are Actively Transitioning to GW-Scale AI Data Centers, with Energy-Related Considerations Becoming Critical for Future Site Selection

- Google's Strategy for North America Primarily Involves Establishing Numerous Sites Across the Country, While Its Mittenwald Project in Germany Is Canceled Due to Energy Supply Issues

- Investment Target of Meta's Hyperion Supercomputing Project Has Been Raised Significantly to US$50 Billion in Response to US Government's Needs

3. Oracle Pushes Forward with the First Sovereign AI Project in the US and Relies Heavily on NVIDIA's GPUs for Infrastructure Build-Out

- In Next Three Years, Starget Is Targeted to Reach 7GW, with Oracle Providing Over 5.5GW of Capacity

4. NVIDIA Has Announced Investment in OpenAI to Strengthen Its GPU Server Influence in the Cloud AI Market

5. Chinese CSPs Expand Data Centers in Emerging Markets Simultaneously under Geopolitics and Guidance of National Policies

- Aggressive Construction of Domestic and Overseas Data Centers by Chinese CSPs BBAT

6. Three Major Chinese Telecom Operators Actuate Localized Servers and Data Centers as Key Advocators for National Policies under Demand for Sovereign Cloud and Public Construction

- Chinese Telecom Operators Responsible for Establishment of National Projects as Key Actuators of China's Server and AI Market

7. Ongoing Involvement in AI Data Centers among US and Chinese CSPs to Generate Development Opportunities for Power Infrastructures (e.g. HVDC)

02-2729-4219

+886-2-2729-4219