|

市场调查报告书

商品编码

1351161

6G通讯:材料与硬体市场与技术(2024-2044)6G Communications: Materials and Hardware Markets and Technology 2024-2044 |

||||||

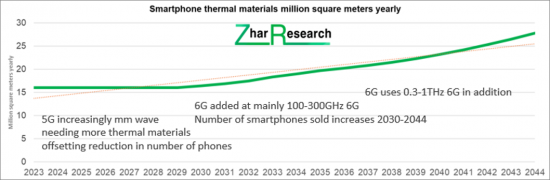

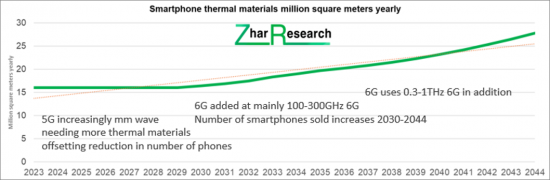

如果6G成功,预计2023年至2044年全球智慧型手机导热材料市场规模将达到每年100万平方公尺。

本报告全面调查了全球6G通讯材料和硬体市场,提供了市场概况/背景、现状/主要趋势、市场影响因素分析、市场成长预测、技术路线图和研究管线,并对主要项目进行了总结分析。 。

目录

第 1 章执行摘要/15 预测

- 本书的目的

- 调查方法

- 6G 的必要性、频率、其他选项、13 个重要结论

- 6G优势、标准环境及部署

- 全球6G架构提案(含补充系统)

- 6G硬体及相关厂商预测

- 6G通信的SWOT评估

- 6G 材料和设备的机会激增

- 可支援 6G 的最新硬体进展

- 设想的 6G 系统对先进材料的关键需求

- 系统方面新的硬体需求

- 6G导热材料:市场大

- 市场与技术路线图/16 项预测

- 全球主要6G材料及零件活动地点

第 2 章 简介

第 3 章热管理:6G 材料、装置和设备

- 概述

- 不同类型新挑战的出现:促使新供应商出现

- 6G 通讯热材料的机会:SWOT 评估

- 6G 智慧型手机和其他客户端设备的导热材料和结构

- 能量收集和现场零排放电力:对于 6G 很重要

- 6G温控及电源用热电元件

第 4 章 可重构智慧表面

- 概述

- 6G RIS 和其他超材料

- RIS 材料的可能领域、单位数量成本和成分

- 6G RIS 材料和组件机会

- 6G RIS 调谐装置系列:我们的评估与参考(来自最近的研究管道)

- 其他进展

- RIS 在 6G 通讯中的机会:SWOT 评估

第五章 装置发展现况与潜力:6G光电子电器件

- 概述

- 太赫兹间隙

- 二极体:肖特基有所改善,但挑战仍然存在

- CMOS与HEMT之间的衝突

- 光纤:材料、设计、介绍、问题、6G SWOT 评估

- 太赫兹波导:材料、设计、介绍、问题、6G SWOT 评估

第六章 用于6G通讯的石墨烯和其他二维材料

- 太赫兹二维材料概述

- 石墨烯情况

- 6G超级电容/LiC/赝电容

- 石墨烯晶体管替代品和超表面

- 石墨烯太赫兹装置结构

第七章 其他材料:6G光学、电子、电力、微机械

- 概述

- 14 种应用中的 46 种元素和化合物:6G 通讯潜力比较

- 与超表面相比,选择一些物理调整的材料

- 半导体製造材料市场竞争态势

- 碳化硅电光调製器

- 用于 6G 电子产品的相变材料:概述

- 二氧化钒:许多 6G 应用

- 硫系相变材料

- 液晶聚合物 LCP 向列液晶 NLC

- 6G 基础设施和客户端设备中的光伏材料

- 用于太赫兹和光学的 ENZ 和低损耗材料

- 6G 微机械/MEMS/微流体

第八章 全球6G通讯专案资料及零件研究

- 概述

- 领先者:支出/专利

- 世界:国际联盟 "Development of High Power Terahertz Science and Technology"

- 加拿大

- 中国

- 欧盟和芬兰

- 德国

- 印度

- 日本

- 韩国

- 北美

- 巴基斯坦

- 台湾

- 英国

- 美国

Contents include:

- SWOT appraisals: 5

- Chapters: 8

- Key conclusions: 13

- Forecast lines (2024-2044): 15

- Comparison tables and infograms: 89

- Companies: 101

- Pages: 298

Questions answered include:

- Likely winners and losers

- Progress and intentions by region

- Unbiassed appraisal of pros and cons

- Gaps in the market that you can address

- Analysis of research pipeline and its trends

- Your potential partners, acquisitions, competitors

- What 6G frequencies are likely and in what sequence

- Types of materials and hardware needed, when and why

- 15 forecasting lines for the materials. Devices, host equipment

- Technology, launches and standards roadmaps for 2024-2044

- The unsolved problems that are opportunities for materials, devices

- Preferred compounds, devices, frequencies and active regions emerging

- The 20-year roadmap of decision making, technical capability and adoption

New report gives latest 6G materials and hardware opportunities

The materials and devices needed for 6G Communications will be a large market but the situation is changing with new breakthroughs and setbacks. Necessarily up-to-date reports critically assessing the latest needs and market sizes are hard to find. The answer is the new, affordable Zhar Research report, "6G Communications: Materials and Hardware Markets, Technology 2024-2044" (298 pages). There is a Glossary at the start of the report but terms are also explained in the text with a minimum of jargon because this is a commercially oriented analysis, emphasising clarity, business opportunities and your best ways to participate, including possible business partners and acquisitions.

The Executive Summary and Conclusions (50 pages) are easy to absorb by those in a hurry. Here are the basics, targets, challenges, players, 13 key conclusions, a 6G SWOT appraisal and many infograms clearly showing your opportunities in materials and devices. The precise materials needed and their function gets particular attention from the latest data-based analysis. An additional 12 pages gives 15 forecast lines as data and graphs and the action geographically.

Chapter 2 Introduction (20 pages) is frank about impediments to 6G and possible delay in its implementation, not just the many benefits and possible business cases. It explains the serious problems that are your opportunities such as cost, power consumption, green credentials and reach of the massive infrastructure and frequency choices, including tackling the Terahertz Gap. Your required manufacturing technologies are covered.

Chapter 3 (23 pages) concerns burgeoning 6G thermal management including for closer packing of hotter client electronics, thermal interfaces and heat spreaders, cooling ubiquitous 6G photovoltaics and base stations. Understand why 6G thermal management opportunities are greater than those for 5G. See SWOT appraisal. Identify 5G thermal materials suppliers and their leading-edge products that are appropriate. Learn how they can enter 6G and who they should buy for what missing thermal management capability.

Chapter 4 (21 pages) does much the same for reconfigurable intelligent surfaces - a curiosity for 5G but essential for 6G. Understand passive vs semi-passive vs active RIS opportunities. SWOT appraisal. Chapter 5 (33 pages) is on 6G devices - optical, electronic and electrical. It scopes development status and potential including semiconductors, THz alternatives and THz waveguides. There are two SWOT appraisals.

Chapter 6 (21 pages) explores the considerable variety of opportunities for graphene and other 2D materials for 6G Communications. It finds graphene to be the most significant of these, spanning 6G plasmonics, transistor surrogates, RIS, modulators, splitters, routers, pseudocapacitors, supercapacitors. Chapter 7 takes a full 36 pages to cover the considerable scope for other emerging materials for 6G: optical, electronic, electrical and micro-mechanical. The big recent advances feature strongly and there is a forecast for indium phosphide.

The report closes with Chapter 8 (48 pages) on 6G Communications projects world-wide involving material and component research. This is very revealing about the nature of the 6G material and components development that is most-strongly funded and why.

In short, this report surfaces how billion-dollar businesses can emerge that make 6G added-value materials and components. That means from fine metal patterning, flexible and thin film electronics to the heavy end of facility energy harvesting, giant base-station thermal management and RIS facades across skyscrapers. The time to get involved is now.

Smartphone thermal materials million square meters yearly globally 2023-2044 if 6G succeeds. Source: Zhar Research report, "6G Communications: Materials and Hardware Markets, Technology 2024-2044" .

Table of Contents

1. Executive Summary and 15 forecasts 2024-2044

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. 6G need, frequency and other choices and 13 key conclusions

- 1.3.1. New needs and 5G inadequacies

- 1.3.2. Arguments against and challenges ahead

- 1.3.3. Disruptive 6G aspects

- 1.3.4. Widening list of 6G aspirations - impact on hardware

- 1.3.5. Some key conclusions - incremental aspects

- 1.3.6. Some key conclusions - disruptive aspects

- 1.4. Detailed 6G benefits, standards situation and rollouts 1980-2044

- 1.5. Some 6G global architecture proposals including complementary systems

- 1.6. Likely 6G hardware and allied manufacturers

- 1.7. SWOT appraisal of 6G Communications as currently understood

- 1.8. Proliferation of 6G materials and device opportunities

- 1.8.1. General aspects

- 1.8.2. Frequency choice recommended

- 1.8.3. Considerable opportunities for thermal materials emerging

- 1.8.4. 8. tuning device families for RIS that are emerging

- 1.9. Recent hardware advances that can aid 6G 2024-2044

- 1.10. Primary needs for advanced materials in envisaged 6G systems

- 1.10.1. Overview

- 1.10.2. 14 applications of 20 emerging inorganic compounds in potential 6G communications

- 1.10.3. 14 applications of 10 elements in potential 6G communications

- 1.10.4. 14 applications of 16 families of organic compounds in potential 6G communications

- 1.10.5. Semiconductor 6G opportunities by device and material

- 1.11. System aspects of emerging hardware needs 2024-2044

- 1.11.1. 6G optical transmission system hardware opportunities

- 1.11.2. 6G Reconfigurable intelligent surfaces and metamaterials opportunities

- 1.11.3. 6G RIS and other metamaterial in action

- 1.11.4. RIS materials potential areas, costs in volume, formulations

- 1.12. 6G thermal materials become a large market

- 1.12.1. Extra thermal management challenges

- 1.13. Market and technology roadmaps and 16 forecasts 2024-2044

- 1.13.1. 6G hardware roadmap 2024-2032

- 1.13.2. 6G hardware roadmap 2033-2044

- 1.13.3. 6G RIS market yearly area added bn. sq. m., price, value market table 2024-2044

- 1.13.4. 6G RIS market yearly area added bn. sq. m. 2024-2044 graph

- 1.13.5. Average RIS price $/ square meter. ex-factory 2028-2044 graph with explanation

- 1.13.6. 6G reconfigurable intelligent surfaces cumulative panels number deployed billion by year end 2024- 2044 table and graph

- 1.13.7. Global yearly RIS sales by five types and total $ billion 2024-2044 table

- 1.13.8. Global yearly RIS sales by five types $ billion 2028-2048: graph with explanation

- 1.13.9. Smartphone units sold globally 2023-2044 if 6G is successful

- 1.13.10. Smartphone thermal materials market area million square meters 2023-2044

- 1.13.11. Smartphone thermal materials trend in location

- 1.13.12. Market for 6G vs 5G base stations units millions yearly 3 categories 2024-2044: table and graphs

- 1.13.13. 6G base stations thermal interface materials million square meters 2024-2044

- 1.13.14. X-Reality hardware market with possible 6G impact $ billion 2024-2044

- 1.14. Location of primary 6G material and component activity worldwide

2. Introduction

- 2.1. Methodology, presentation, situation

- 2.2. Situation in 2024

- 2.2.1. Troubled waters

- 2.2.2. Making 5G then 6G ubiquitous: land, airborne, underwater

- 2.2.3. 6G vertical ubiquity: SAGIN and under water

- 2.3. 6G is more than communications

- 2.4. Progress from 1G-6G rollouts 1980-2044

- 2.5. 6G adds equipment: opportunity or threat to viability?

- 2.6. Arguments against 6G and possible slippage

- 2.7. Transmission distance dilemma

- 2.8. The going green dilemma

- 2.9. SWOT appraisal of 6G Communications material and component opportunities

- 2.10. Manufacturing technologies for the main 6G high added value materials

3. Thermal management: 6G materials, devices, facilities

- 3.1. Overview

- 3.2. Diverse new challenges emerging allow in new suppliers

- 3.3. SWOT appraisal of 6G Communications thermal material opportunities

- 3.4. Thermal materials and structures for 6G smartphones and other client devices

- 3.4.1. Structures

- 3.4.2. Materials: Dow, GLPOLY, Laird, NeoGraf, Nitrium, Parker Lord etc.

- 3.4.3. Thermal interface materials TIM for all potential 6G devices: Henkel etc.

- 3.4.5. Aerogel thermal insulation W.L.Gore

- 3.5. Energy harvesting and on-site zero-emission power become important with 6G

- 3.5.1. Future needs and trends for 6G devices up to MW power provision for 6G

- 3.5.2. Thermal hydrogels for passive cooling of 6G microelectronics and photovoltaics

- 3.5.3. Thermal metamaterials for devices and photovoltaics

- 3.5.4. Radiative cooling of photovoltaics generally

- 3.5.5. Water-cooled photovoltaics for heating and electricity: Sunovate

- 3.5.6. Thermally conductive concrete for on-site 6G power transmission

- 3.6. Thermoelectrics for 6G temperature control and electricity

- 3.6.1. Overview

- 3.6.2. Thermoradiative photovoltaics

4. Reconfigurable Intelligent surfaces

- 4.1. Overview

- 4.1.1. Progression of functionality needed in 6G infrastructure

- 4.1.2. Terminology thicket

- 4.1.3. What is a metamaterial?

- 4.1.4. What is a metasurface?

- 4.1.5. Many benefits from RIS

- 4.1.6. Different levels of beam management

- 4.2. 6G RIS and other metamaterial in action

- 4.3. RIS materials potential areas, costs in volume, formulations

- 4.4. 6G RIS materials and component opportunities

- 4.5. 8. tuning device families for 6G RIS from recent research pipeline: our appraisal, references

- 4.6. Other progress

- 4.6.1. Joint modulations assist hardware

- 4.6.2. RIS for Industry-5

- 4.7. SWOT appraisal of 6G Communications RIS opportunities

5. Devices - 6G Optical, electronic and electrical devices: development status and potential

- 5.1. Overview

- 5.1.1. Different from 5G

- 5.1.2. Examples of component categories needed for 6G infrastructure and client devices

- 5.1.3. 6G component examples by material family: many reasons for graphene

- 5.1.4. Examples of formats considered for future 6G devices and infrastructure

- 5.2. The terahertz gap

- 5.2.1. Mature research and commercial products

- 5.2.2. Best research results

- 5.3. Diodes - Schottky better but still problematic

- 5.4. How CMOS and HEMT compete

- 5.4.1. Overview

- 5.4.2. CMOS and hybrid lll-V+CMOS approaches sub-THz

- 5.4.3. 6G CMOS design

- 5.4.4. PD-SOI CMOS and SiGe BiCMOS for 6G

- 5.4.5. High-Electron Mobility Transistor HEMT sub-THz

- 5.5. Fiber optics materials, designs, deployment, issues with SWOT appraisal for 6G

- 5.6. THz waveguides materials, designs, deployment, issues with SWOT appraisal for 6G

6. Graphene and other 2D materials for 6G Communications

- 6.1. Overview of THz 2D materials

- 6.2. Graphene landscape

- 6.3. Supercapacitors, LiC and pseudocapacitors for 6G

- 6.3.1. Addressing problems

- 6.3.2. Pseudocapacitor materials, mechanisms: MXenes etc.

- 6.3.3. Flexible supercapacitors for 6G client devices: graphene, MXenes, V Manganese dioxide

- 6.4. Graphene transistor surrogates and metasurfaces

- 6.4.1. Gated graphene

- 6.4.2. Graphene plasmonics at THz

- 6.5. Graphene THz device structures

- 6.5.1. Graphene THz modulator

- 6.5.2. Silicon plasmon graphene SPG sub-THz emitter

- 6.5.3. Graphene splitter and router

7. Other materials: 6G Optical, electronic, electrical and micro-mechanical

- 7.1. Overview

- 7.2. 14 applications of 46 elements and compounds in potential 6G communications compared

- 7.3. Some physical tuning material choices compared for metasurfaces

- 7.4. Semiconductor material choices

- 7.4.1. Lessons from 5G advances

- 7.4.2. Status of some 6G semiconductor and active layer candidates

- 7.4.3. lll-V compounds and SiGe

- 7.4.4. Photoactive materials for 6G around 1THz

- 7.5. Silicon carbide electro-optic modulator

- 7.6. Phase-Change Materials for 6G electronics overview

- 7.7. Vanadium dioxide for many 6G uses

- 7.7.1. Properties exploited

- 7.7.2. Developments for RIS tunability - review

- 7.7.3. Terahertz coding metasurface research trends

- 7.7.4. US DOE February 2022 onwards

- 7.8. Chalcogenide phase change materials

- 7.9. Liquid crystal polymers LCP Nematic liquid crystals NLC

- 7.9.1. Useful for 6G THz and optics

- 7.9.2. Current research trends

- 7.9.3. Future research trends

- 7.9.4. Advances in 2022

- 7.10. Materials for photovoltaics at 6G infrastructure and client devices

- 7.11. ENZ and low loss materials for THz and optical

- 7.12. Micro- mechanics, MEMS and microfluidics for 6G

8. 6G Communications projects worldwide involving material and component research

- 8.1. Overview

- 8.2. Leaders by expenditure and patents

- 8.3. Global: International Consortium for Development of High-Power THz Science and Technology

- 8.4. Canada

- 8.5. China

- 8.6. European Union with Finland important

- 8.7. Germany

- 8.8. India

- 8.9. Japan

- 8.10. Korea

- 8.11. North America

- 8.12. Pakistan

- 8.13. Taiwan

- 8.14. United Kingdom

- 8.15. USA