|

市场调查报告书

商品编码

1664893

二手车融资市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Used Car Financing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

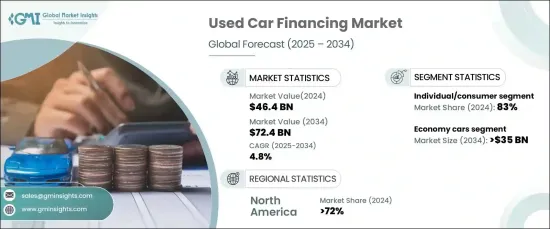

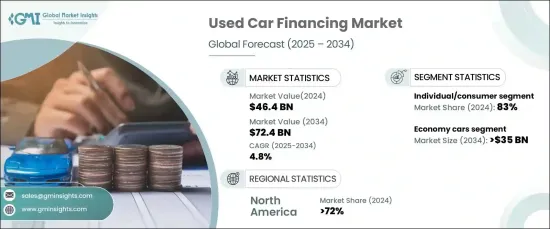

2024 年全球二手车融资市场估值达到 464 亿美元,预计 2025 年至 2034 年期间将以 4.8% 的复合年增长率稳步增长。这些创新简化了融资流程、增强了可近性并改善了整体消费者体验。自动化系统也加快了贷款核准速度,提供了更快、更方便消费者的选择。数位转型正在提高市场效率和吸引力。

二手车需求的不断成长是推动市场成长的关键因素。随着新车成本不断上涨,二手车已成为注重预算的消费者、首次购车者以及寻求经济型交通解决方案的消费者的经济实惠的替代品。这一趋势反映了向价值驱动型购买的转变,尤其是在经济不确定性和生活费用上涨压力日益增大的情况下。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 464亿美元 |

| 预测值 | 724亿美元 |

| 复合年增长率 | 4.8% |

市场分为经济型轿车、豪华轿车和 SUV/跨界车。 2024年经济型汽车将引领市场,占总份额的52%。预计到 2034 年,这些汽车将因其经济实惠、实用性和燃油效率而创造 350 亿美元的收入。它们在註重预算的消费者中很受欢迎,凸显了对可靠而又经济高效的交通选择的需求日益增长,尤其是在经济波动期间。

就最终用途而言,市场分为个人消费者和企业/商业用户。 2024 年,个人消费者将占据该领域的主导地位,占有 83% 的份额。对于个人买家来说,经济承受能力仍然是主要动机,他们倾向于购买二手车,将其作为应对新车价格上涨和资金限制的可行解决方案。这些买家优先考虑具有成本效益的选择,这些选择既可靠又能满足他们的日常旅行需求,而且不需要超出他们的预算。

2024 年,北美二手车融资市场占有 72% 的份额。郊区和农村地区公共交通选择有限进一步凸显了对私家车的依赖。随着负担能力成为主要考虑因素,越来越多的消费者选择二手车,从而维持了整个地区对融资解决方案的强劲需求。

目录

第 1 章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场估计的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 贷款人

- 经销商和网路平台

- 保险提供者

- 支付和技术提供者

- 最终用户

- 供应商概况

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 消费者对二手车的需求不断成长

- 融资选择日益增多

- 借贷平台和流程的技术创新

- 消费者偏好的改变

- 产业陷阱与挑战

- 信用风险与贷款挑战

- 二手车折旧率高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按贷方,2021 - 2034 年

- 主要趋势

- 银行和信用合作社

- OEM/专属融资

- 网路直接贷款人

- 经销商内部融资

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 经济型轿车

- 豪华轿车

- SUV/跨界车

第七章:市场估计与预测:依贷款期限,2021 - 2034 年

- 主要趋势

- 短期(12-36个月)

- 中期(37-60个月)

- 长期(61-84个月)

- 长期(超过 84 个月)

第 8 章:市场估计与预测:按最终用途,2021 - 2034 年

- 主要趋势

- 个人/消费者

- 企业/商业

第 9 章:市场估计与预测:按车龄,2021 - 2034 年

- 主要趋势

- 较新(最多 3 年)

- 年龄较大(4 岁以上)

第 10 章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东及非洲

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Ally Financial

- AmeriCredit

- AutoCreditExpress

- AutoNation

- Bank of America Auto Loans

- Capital One Auto Finance

- CarMax

- CarsDirect

- Carvana

- Chase Auto

- Credit Union Direct Lending (CUDL)

- DriveTime

- LightStream (a division of SunTrust Bank)

- OpenRoad Lending

- PenFed Credit Union

- RoadLoans

- Santander Consumer USA

- TD Auto Finance

- US Bank Auto Loans

- Wells Fargo Auto

The Global Used Car Financing Market achieved a valuation of USD 46.4 billion in 2024 and is projected to expand at a steady CAGR of 4.8% from 2025 to 2034. This growth is underpinned by rapid advancements in lending technologies, including digital platforms and mobile applications, which are revolutionizing the sector. These innovations streamline the financing process, enhance accessibility, and improve the overall consumer experience. Automated systems have also expedited loan approvals, offering faster, more consumer-friendly options. This digital transformation is driving greater market efficiency and appeal.

The rising demand for used vehicles is a key factor propelling market growth. As the cost of new cars continues to rise, pre-owned vehicles have emerged as an affordable alternative for budget-conscious consumers, first-time car buyers, and those seeking economical transportation solutions. This trend reflects a shift toward value-driven purchases, especially amidst economic uncertainties and the growing pressures of rising living expenses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.4 Billion |

| Forecast Value | $72.4 Billion |

| CAGR | 4.8% |

The market is segmented into economy cars, luxury cars, and SUVs/crossovers. Economy cars led the market in 2024, accounting for 52% of the total share. These vehicles are projected to generate USD 35 billion by 2034, driven by their affordability, practicality, and fuel efficiency. Their popularity among budget-conscious consumers underscores the increasing demand for reliable yet cost-effective transportation options, especially during economic fluctuations.

In terms of end use, the market is divided into individual consumers and businesses/commercial users. Individual consumers dominated the segment in 2024, capturing an 83% share. Affordability remains the primary motivator for personal buyers, who are gravitating toward pre-owned vehicles as a viable solution to rising new car prices and financial constraints. These buyers prioritize cost-effective options that deliver reliability and meet their daily mobility needs without stretching their budgets.

North America used car financing market held a commanding 72% share in 2024. The region's strong car ownership culture, coupled with a high demand for personal mobility, continues to drive market growth. Limited public transportation options in suburban and rural areas further underscore the reliance on private vehicles. With affordability emerging as a key concern, consumers are increasingly opting for pre-owned vehicles, sustaining robust demand for financing solutions across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Lenders

- 3.1.2 Dealers and online platforms

- 3.1.3 Insurance providers

- 3.1.4 Payment and technology providers

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising consumer demand for used cars

- 3.8.1.2 Growing access to financing options

- 3.8.1.3 Technological innovations in lending platforms and processes

- 3.8.1.4 Changing consumer preferences

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Credit risk and lending challenges

- 3.8.2.2 High depreciation of used cars

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Lender, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Banks and credit unions

- 5.3 OEM/captive financing

- 5.4 Online direct lenders

- 5.5 Dealership in-house financing

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Economy cars

- 6.3 Luxury cars

- 6.4 SUVs/crossovers

Chapter 7 Market Estimates & Forecast, By Loan Duration, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Short-term (12-36 months)

- 7.3 Medium-term (37-60 months)

- 7.4 Long-term (61-84 months)

- 7.5 Extended-term (over 84 months)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Individuals/consumers

- 8.3 Businesses/commercial

Chapter 9 Market Estimates & Forecast, By Age of Vehicle, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Newer (upto 3 years)

- 9.3 Older (4 years and above)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Ally Financial

- 11.2 AmeriCredit

- 11.3 AutoCreditExpress

- 11.4 AutoNation

- 11.5 Bank of America Auto Loans

- 11.6 Capital One Auto Finance

- 11.7 CarMax

- 11.8 CarsDirect

- 11.9 Carvana

- 11.10 Chase Auto

- 11.11 Credit Union Direct Lending (CUDL)

- 11.12 DriveTime

- 11.13 LightStream (a division of SunTrust Bank)

- 11.14 OpenRoad Lending

- 11.15 PenFed Credit Union

- 11.16 RoadLoans

- 11.17 Santander Consumer USA

- 11.18 TD Auto Finance

- 11.19 U.S. Bank Auto Loans

- 11.20 Wells Fargo Auto