|

市场调查报告书

商品编码

1665333

模组化健身家具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Modular Fitness Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

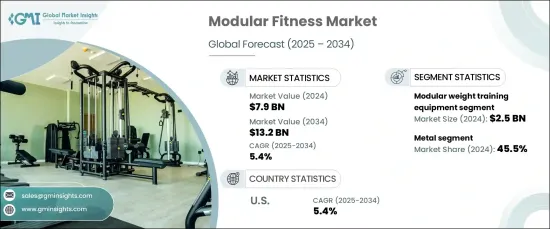

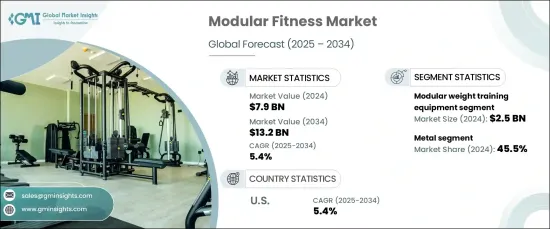

2024 年全球模组化健身家具市场价值为 79 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.4%。随着越来越多的人开始在家锻炼,对支持各种健身活动的多功能家具的需求也不断增加。

材料和设计的创新增强了模组化健身家具的吸引力。环保材料和可自订功能的日益使用引起了那些重视家居装饰的可持续性和适应性的消费者的共鸣。这一趋势反映了全球范围内更广泛的转变,人们开始追求个性化、环保的生活空间,将功能性和风格完美地融合在一起。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 79亿美元 |

| 预测值 | 132亿美元 |

| 复合年增长率 | 5.4% |

市场按类型分类,包括模组化重量训练设备、可变形有氧运动家具、适应性家庭健身站、多功能健身平台、紧凑型运动家具等。 2024 年,模组化重量训练设备将占据市场主导地位,贡献 25 亿美元,预计在预测期内的复合年增长率为 5.1%。这一领域的领先地位源于其多功能性,因为许多消费者更喜欢紧凑、可调节的设计来进行家庭力量训练。家庭健身房日益普及以及对节省空间、灵活的肌力训练设备的需求是推动这一类别成长的关键因素。

根据材料,市场分为金属、木材、塑胶和复合材料。 2024 年,金属占据了 45.5% 的市场份额,预计到 2034 年将以 5.7% 的复合年增长率增长。它的可靠性和与模组化设计的兼容性使其成为寻求实用且节省空间的解决方案的消费者的首选材料。

2024 年,北美模组化健身家具市场规模为 28 亿美元,预计 2025 年至 2034 年的复合年增长率为 5.4%。家庭健身房的兴起和对节省空间产品日益增长的兴趣推动了该市场的成长。透过不断创新,美国在推动模组化健身家具的普及和满足注重健康、节省空间的消费者需求方面仍然发挥着关键作用。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测参数

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 都市化进程加快,居住空间有限。

- 健身意识和居家运动趋势不断增强。

- 环保材料和设计的进步。

- 电子商务销售额成长。

- 产业陷阱与挑战

- 初始成本高。

- 对新兴市场的认知有限

- 成长动力

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 偏好价格范围

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 模组化重量训练器材

- 可适应的居家健身站

- 可变形有氧健身家具

- 多用途健身平台

- 紧凑型健身家具

- 其他的

第六章:市场估计与预测:按材料,2021 – 2034 年

- 主要趋势

- 木头

- 金属

- 塑胶

- 复合材料

第 7 章:市场估计与预测:按价格,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第 8 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业(健身房、健身工作室、办公室)

第 9 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 离线

第 10 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- BodyCraft

- Core Health & Fitness

- Ecore Athletic

- Eleiko

- Escape Fitness

- Hammer Strength

- Herman Miller

- Kimball International

- Life Fitness

- Matrix Fitness

- Nautilus

- Peloton

- Power Lift

- Precor

- Rogue Fitness

- Technogym

- YR Fitness

The Global Modular Fitness Furniture Market was valued at USD 7.9 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2034. This growth is driven by increasing urbanization and shrinking living spaces, which are fueling the demand for multifunctional, space-saving fitness furniture. As more individuals embrace home workout routines, the need for versatile furniture that supports a variety of fitness activities continues to rise.

Innovations in materials and design are enhancing the appeal of modular fitness furniture. The growing use of eco-friendly materials and customizable features is resonating with consumers who prioritize sustainability and adaptability in their home furnishings. This trend reflects a broader global shift toward personalized, environmentally conscious living spaces that seamlessly blend functionality and style.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $13.2 Billion |

| CAGR | 5.4% |

The market is categorized by type, including modular weight training equipment, transformable cardio furniture, adaptable home gym stations, multi-purpose fitness platforms, compact exercise furniture, and others. In 2024, modular weight training equipment dominated the market, contributing USD 2.5 billion, and is expected to grow at a CAGR of 5.1% over the forecast period. This segment's leadership is driven by its versatility, as many consumers prefer compact, adjustable designs for home-based strength training. The rising popularity of home gyms and the demand for space-efficient, flexible equipment for strength exercises are key factors propelling growth in this category.

By material, the market is segmented into metal, wood, plastic, and composite materials. In 2024, the metal segment captured 45.5% of the market share and is forecasted to grow at a CAGR of 5.7% through 2034. Metal remains the top choice for modular fitness furniture due to its superior durability and strength, which ensure stability and longevity, especially for heavy-duty applications. Its reliability and compatibility with modular designs make it the preferred material for consumers seeking practical and space-conscious solutions.

North America modular fitness furniture market accounted for USD 2.8 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2034. The United States leads the region, driven by strong fitness awareness and growing consumer demand for premium, multifunctional furniture solutions. The rise of home gyms and increasing interest in space-saving products are fueling growth in this market. With continuous innovation, the U.S. remains a pivotal player in advancing modular fitness furniture adoption and meeting the needs of health-conscious, space-savvy consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising urbanization and limited living spaces.

- 3.6.1.2 Increasing fitness awareness and at-home exercise trends.

- 3.6.1.3 Advancements in eco-friendly materials and design.

- 3.6.1.4 Growth in e-commerce sales.

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs.

- 3.6.2.2 Limited awareness in emerging markets

- 3.6.1 Growth drivers

- 3.7 Consumer buying behavior analysis

- 3.7.1 Demographic trends

- 3.7.2 Factors affecting buying decision

- 3.7.3 Consumer product adoption

- 3.7.4 Preferred distribution channel

- 3.7.5 Preferred price range

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Thousand units)

- 5.1 Key trends

- 5.2 Modular weight training equipment

- 5.3 Adaptable home gym stations

- 5.4 Transformable cardio furniture

- 5.5 Multi-purpose fitness platforms

- 5.6 Compact exercise furniture

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion) (Thousand units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Metal

- 6.4 Plastic

- 6.5 Composite materials

Chapter 7 Market Estimates and Forecast, By Price, 2021 – 2034 (USD Billion) (Thousand units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Thousand units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial (gyms, fitness studios, offices)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 BodyCraft

- 11.2 Core Health & Fitness

- 11.3 Ecore Athletic

- 11.4 Eleiko

- 11.5 Escape Fitness

- 11.6 Hammer Strength

- 11.7 Herman Miller

- 11.8 Kimball International

- 11.9 Life Fitness

- 11.10 Matrix Fitness

- 11.11 Nautilus

- 11.12 Peloton

- 11.13 Power Lift

- 11.14 Precor

- 11.15 Rogue Fitness

- 11.16 Technogym

- 11.17 YR Fitness