|

市场调查报告书

商品编码

1665342

模组化包装设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Modular Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

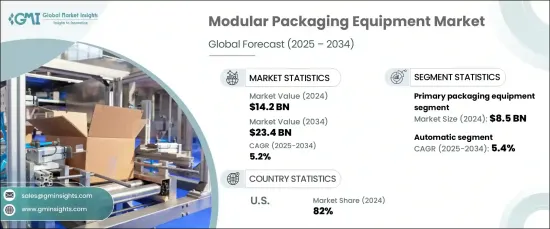

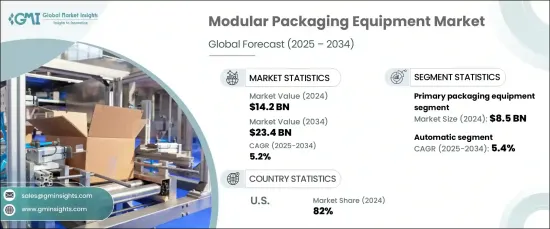

2024 年全球模组化包装设备市场规模达到 142 亿美元,预计 2025 年至 2034 年期间将以 5.2% 的复合年增长率强劲增长。随着越来越多的企业采用线上平台,对灵活、可扩展的包装解决方案的需求激增。模组化包装系统正在加紧满足这一需求,为不同产品尺寸、个人化包装需求和优化的运输配置提供适应性解决方案,这在当今快节奏的商业环境中至关重要。

市场分为初级和二级包装设备类型。 2024 年,初级包装设备部门的产值达到 85 亿美元,预计到 2034 年的复合年增长率将达到 5.3%。製造商越来越多地采用灵活的初级包装系统来适应多样化的产品形式和不断变化的消费者偏好。这些系统提高了效率、适应性以及满足市场动态需求的能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 142亿美元 |

| 预测值 | 234亿美元 |

| 复合年增长率 | 5.2% |

在自动化方面,市场分为手动、半自动和全自动系统。自动包装设备领域在 2024 年占据了 45% 的市场份额,预计在整个预测期内以 5.4% 的复合年增长率增长。製药、食品和饮料以及消费性电子产品等大量生产的行业正在迅速采用自动化模组化系统。这些系统可以加快处理速度,减少人工干预的需要,并支援大规模操作,同时保持高效製造所需的精度和一致性。

2024 年,美国模组化包装设备市场占据 82% 的主导份额。消费者对更快、更安全、更具成本效益的包装解决方案的需求不断增长,推动了模组化包装系统的发展。这些系统不仅简化了生产流程,也优化了材料使用,促进了各行业可持续、高效的包装实践。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析。

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 电子商务产业蓬勃发展

- 食品饮料产业蓬勃发展

- 产业陷阱与挑战

- 市场饱和且竞争激烈

- 永续性问题

- 成长动力

- 技术概览

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 初级包装设备

- 灌装机

- 封口机

- 贴标机

- 编码和标记设备

- 二次包装设备

- 装盒机

- 装箱系统

- 收缩包装机

- 码垛装置

第六章:市场估计与预测:依自动化水平,2021-2034 年

- 主要趋势

- 手动模组化设备

- 半自动系统

- 自动系统

第 7 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 药品

- 化妆品和个人护理

- 化学及农业化学品

- 电子产品

- 其他(汽车等)

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第 9 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Bosch Packaging Technology

- Coesia

- Combi Packaging Systems

- IMA Group

- Krones

- Marchesini Group

- Marel

- Multivac

- NJM Packaging

- Packaging Automation

- ProMach

- Rockwell Automation

- Sidel Group

- Tetra Pak

- Unipak Machinery

The Global Modular Packaging Equipment Market reached USD 14.2 billion in 2024 and is expected to experience robust growth at a CAGR of 5.2% from 2025 to 2034. A major driver behind this expansion is the increasing shift toward e-commerce and direct-to-consumer (DTC) business models. As more businesses embrace online platforms, the need for flexible, scalable packaging solutions has surged. Modular packaging systems are stepping up to meet this demand, providing adaptable solutions for varying product sizes, personalized packaging needs, and optimized shipping configurations, which are crucial in today's fast-paced business environment.

The market is divided into primary and secondary packaging equipment types. The primary packaging equipment segment generated USD 8.5 billion in 2024 and is anticipated to grow at a CAGR of 5.3% through 2034. The rising demand for innovative and customized packaging solutions is fueling the growth of this segment. Manufacturers are increasingly adopting flexible primary packaging systems to accommodate diverse product formats and ever-evolving consumer preferences. These systems offer enhanced efficiency, adaptability, and the ability to meet the dynamic demands of the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 5.2% |

In terms of automation, the market is segmented into manual, semi-automatic, and automatic systems. The automatic packaging equipment segment accounted for 45% of the market share in 2024 and is projected to grow at a CAGR of 5.4% throughout the forecast period. Industries with high-volume production, such as pharmaceuticals, food and beverages, and consumer electronics, are rapidly adopting automated modular systems. These systems enable faster processing, reduce the need for manual intervention, and support large-scale operations, all while maintaining the precision and consistency required for efficient manufacturing.

The U.S. modular packaging equipment market held a dominant share of 82% in 2024. The rapid expansion of e-commerce in the region has further amplified the need for versatile packaging systems that can handle a wide range of product types and diverse shipping requirements. Increasing consumer demands for faster, more secure, and cost-effective packaging solutions have propelled the growth of modular packaging systems. These systems not only streamline production processes but also optimize material usage, promoting sustainable and efficient packaging practices across industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing e-commerce industry

- 3.6.1.2 Growing food and beverage industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary packaging equipment

- 5.2.1 Filling machines

- 5.2.2 Sealing machines

- 5.2.3 Labeling machines

- 5.2.4 Coding and marking equipment

- 5.3 Secondary packaging equipment

- 5.3.1 Cartoning machines

- 5.3.2 Case packing systems

- 5.3.3 Shrink wrapping machines

- 5.3.4 Palletizing equipment

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual modular equipment

- 6.3 Semi-automatic systems

- 6.4 Automatic systems

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Food and beverage

- 7.3 Pharmaceuticals

- 7.4 Cosmetics and personal care

- 7.5 Chemical and agrochemical

- 7.6 Electronics

- 7.7 Others (automotive, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bosch Packaging Technology

- 10.2 Coesia

- 10.3 Combi Packaging Systems

- 10.4 IMA Group

- 10.5 Krones

- 10.6 Marchesini Group

- 10.7 Marel

- 10.8 Multivac

- 10.9 NJM Packaging

- 10.10 Packaging Automation

- 10.11 ProMach

- 10.12 Rockwell Automation

- 10.13 Sidel Group

- 10.14 Tetra Pak

- 10.15 Unipak Machinery