|

市场调查报告书

商品编码

1666546

海上平台电气化市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Offshore Platform Electrification Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

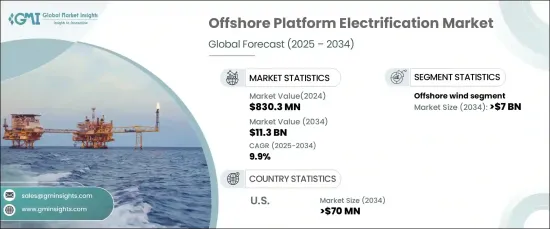

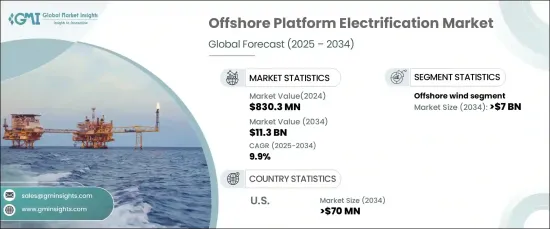

2024 年全球海上平台电气化市场价值为 8.303 亿美元,预计在 2025 年至 2034 年期间的复合年增长率为 9.9%。对可靠且经济高效的电气化网路的需求不断增长,在促进市场发展方面发挥着至关重要的作用,从而确保了海上平台稳定的电源解决方案。随着世界转向更清洁、可持续的能源,海上平台对创新电气化组件的需求预计将进一步加速市场成长。

离岸风电产业尤其有望大幅成长,预计到 2034 年该产业将创造 70 亿美元的产值。先进的离岸风电技术的应用进一步推动了这一成长,例如具有卓越发电能力和更高营运效率的大型涡轮机。政府为减少碳排放而推出的优惠政策正在创造支持市场积极势头的环境。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.303 亿美元 |

| 预测值 | 113亿美元 |

| 复合年增长率 | 9.9% |

在美国,到 2034 年,离岸平台电气化市场预计将产生 7,000 万美元的收入。海底电力传输的技术进步,特别是高压直流 (HVDC) 电缆技术和尖端电缆设计,大大增强了海上平台的能力。这些创新确保了更有效率的电力分配并提高了海上设施之间的连通性,从而推动了市场扩张。

随着世界各国政府继续对再生能源项目实施有利的监管框架,国家再生能源目标正在推动基础设施发展的财政诱因。这些措施为海上平台电气化的发展创造了有利环境,刺激了对促进向更永续能源解决方案转变的技术的进一步投资。随着对清洁能源的需求不断增加,预计海上电气化市场在预测期内将保持强劲的成长轨迹。

目录

第 1 章:方法论与范围

- 市场定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第 5 章:市场规模与预测:依技术,2021 – 2034 年

- 主要趋势

- 离岸风电

- 地下电缆

- 涡轮

第六章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 挪威

- 英国

- 荷兰

- 丹麦

- 亚太地区

- 中国

- 印度

- 韩国

- 越南

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 阿曼

- 拉丁美洲

- 巴西

- 墨西哥

第七章:公司简介

- ABB

- ADNOC

- Aker Solutions

- BP

- Cerulean Winds

- Equinor

- GE Vernova

- Havfram

- LS Cable

- Nexans

- NKT

- Norddeutsche Seekabelwerke

- Prysmian

- SLB

- Siemens Energy

- Southwire

- ZTT

The Global Offshore Platform Electrification Market, valued at USD 830.3 million in 2024, is set to expand at a CAGR of 9.9% from 2025 to 2034. This expansion is driven by ongoing breakthroughs in renewable energy technologies, including floating solar arrays, offshore wind turbines, and energy storage systems. The rise in the demand for reliable and cost-effective electrification networks is playing a crucial role in boosting the market, thus ensuring stable power supply solutions for offshore platforms. As the world shifts toward cleaner, sustainable energy sources, the need for innovative electrification components in offshore platforms is expected to further accelerate market growth.

The offshore wind sector is particularly poised for major growth, with projections indicating it could generate USD 7 billion by 2034. The consistent expansion of offshore wind power installations, fueled by ambitious renewable energy goals and growing energy needs, directly benefits the offshore electrification market. This growth is further driven by the adoption of advanced offshore wind technologies, such as larger turbines that offer superior power generation capabilities and enhanced operational efficiency. Favorable government policies aimed at reducing carbon emissions are creating an environment that supports the market's positive momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $830.3 Million |

| Forecast Value | $11.3 Billion |

| CAGR | 9.9% |

In the United States, the offshore platform electrification market is predicted to generate USD 70 million by 2034. This growth is fueled by the ongoing development of offshore wind farms, which have garnered substantial investment from both the government and private sectors. Technological advancements in subsea power transmission, particularly high-voltage direct current (HVDC) cable technology and cutting-edge cable designs, are significantly enhancing the capabilities of offshore platforms. These innovations ensure more efficient power distribution and improve connectivity across offshore installations, thus fueling market expansion.

As governments around the world continue to implement favorable regulatory frameworks for renewable energy projects, national renewable energy targets are driving financial incentives for infrastructure development. These measures create a supportive environment for the growth of offshore platform electrification, spurring further investments in technologies that promote the shift toward more sustainable energy solutions. With increasing demand for clean energy, the offshore electrification market is expected to maintain a strong growth trajectory through the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Offshore wind

- 5.3 Underground cable

- 5.4 Turbine

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 UK

- 6.3.3 Netherlands

- 6.3.4 Denmark

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 South Korea

- 6.4.4 Vietnam

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Qatar

- 6.5.4 Oman

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Mexico

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 ADNOC

- 7.3 Aker Solutions

- 7.4 BP

- 7.5 Cerulean Winds

- 7.6 Equinor

- 7.7 GE Vernova

- 7.8 Havfram

- 7.9 LS Cable

- 7.10 Nexans

- 7.11 NKT

- 7.12 Norddeutsche Seekabelwerke

- 7.13 Prysmian

- 7.14 SLB

- 7.15 Siemens Energy

- 7.16 Southwire

- 7.17 ZTT