|

市场调查报告书

商品编码

1667033

石油和天然气碳捕获和储存市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测Oil and Gas Carbon Capture and Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

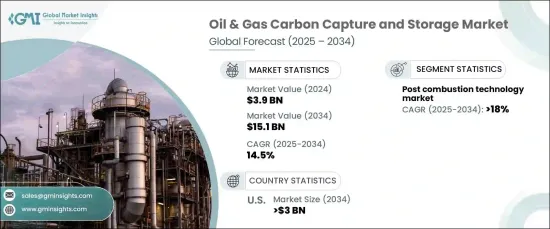

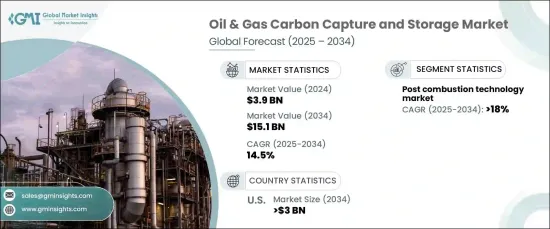

2024 年全球石油和天然气碳捕获与储存市场规模达到 39 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 14.5%。碳捕获技术正成为减轻二氧化碳排放不可或缺的一部分,尤其是在石油和天然气产业,该产业是全球温室气体排放的最大贡献者之一。随着对气候变迁的担忧加剧,越来越多的政府和组织优先开发和实施永续技术来实现这些目标。 CCS 提供了一种减少碳足迹的有效方法,特别是在石油和天然气等高排放行业。

未来十年,市场预计将呈指数级增长,预计到 2034 年将创收 150 亿美元。预计石油和天然气行业的上游业务以及对可持续发电的不断增长的需求将在塑造市场未来方面发挥重要作用。这些产业是二氧化碳排放的最大贡献者之一,因此 CCS 解决方案的整合就显得更加重要。二氧化碳的捕获和储存正成为石油和天然气开采和生产过程的核心,这些过程通常涉及大规模的勘探活动,从而产生大量的二氧化碳排放。最常见的 CCS 技术,包括富氧燃烧、预燃烧和后燃烧,正在用于捕获天然气加工厂、炼油厂和提高石油采收率 (EOR) 作业中的二氧化碳。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 151亿美元 |

| 复合年增长率 | 14.5% |

在这些 CCS 技术中,燃烧后技术预计将实现最高成长,到 2034 年的预期复合年增长率为 18%。随着全球对石油和天然气的需求不断增长,这项技术正迅速成为减少排放的关键因素。后燃烧技术为业界提供了一种实用的解决方案,使其能够在不中断现有营运的情况下实现永续发展目标。

在美国,受更严格的排放法规和永续技术投资增加的推动,石油和天然气碳捕获和储存市场规模预计到 2034 年将达到 30 亿美元。人们将重点关注提高石油采收率(EOR)和天然气处理,其中 CCS 解决方案被广泛采用以减少排放和提高产量。此外,公共和私营部门的合作正在加速大型CCS计画的发展,巩固美国在碳捕获产业全球领先地位。这些倡议预计将在减少全球排放方面发挥关键作用,同时推动该行业的持续成长和创新。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模与预测:依技术,2021 – 2034 年

- 主要趋势

- 预燃烧

- 燃烧后

- 富氧燃烧

第六章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 丹麦

- 亚太地区

- 中国

- 澳洲

- 韩国

- 世界其他地区

第七章:公司简介

- Air Products

- Aker Solutions

- Chevron

- Dakota Gasification Company

- Equinor

- Exxon Mobil

- Fluor

- General Electric

- Halliburton

- Linde

- Mitsubishi Heavy Industries

- NRG Energy

- Shell Cansolv

- Siemens

- SLB

- Sulzer

- TotalEnergies

The Global Oil And Gas Carbon Capture And Storage Market reached USD 3.9 billion in 2024 and is projected to experience a CAGR of 14.5% from 2025 to 2034. This surge is largely driven by tightening environmental regulations and the increasing commitment to achieving global carbon neutrality goals. Carbon capture technology is becoming an indispensable part of mitigating CO2 emissions, especially in the oil and gas sector, one of the largest contributors to greenhouse gas emissions worldwide. As concerns about climate change intensify, more governments and organizations are prioritizing the development and implementation of sustainable technologies to meet these goals. CCS offers an effective means of reducing carbon footprints, particularly in industries with high emissions like oil and gas.

Over the next decade, the market is expected to grow exponentially, with projections estimating that it will generate USD 15 billion by 2034. The increased focus on reducing carbon emissions, along with the growing demand for energy, is expected to be a driving force for the adoption of CCS technologies. Upstream operations in the oil and gas industry, as well as the rising need for sustainable power generation, are expected to play a major role in shaping the market's future. These industries are among the largest contributors to CO2 emissions, making the integration of CCS solutions even more critical. The capture and storage of carbon dioxide are becoming central to oil and gas extraction and production processes, which often involve large-scale exploration activities that generate significant CO2 emissions. The most common CCS technologies, including oxy-fuel combustion, pre-combustion, and post-combustion, are being adopted to capture CO2 from natural gas processing plants, refineries, and enhanced oil recovery (EOR) operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $15.1 Billion |

| CAGR | 14.5% |

Among these CCS technologies, post-combustion is projected to see the highest growth, with an expected CAGR of 18% through 2034. Post-combustion captures CO2 from flue gases produced during the combustion of fossil fuels, a major byproduct of power generation, refining, and petrochemical industries. This technology is quickly becoming a key player in efforts to reduce emissions as global demand for oil and gas continues to rise. Post-combustion technology offers a practical solution for industries to meet sustainability goals without disrupting existing operations.

In the U.S., the oil and gas carbon capture and storage market is projected to reach USD 3 billion by 2034, driven by stricter emissions regulations and increased investments in sustainable technologies. Significant focus is being placed on enhanced oil recovery (EOR) and natural gas processing, where CCS solutions are being widely adopted to both reduce emissions and enhance production. Moreover, the collaboration between public and private sectors is accelerating the development of large-scale CCS projects, solidifying the U.S. position as a global leader in the carbon capture industry. These initiatives are expected to play a key role in reducing emissions on a global scale while also driving continued growth and innovation within the sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (MTPA, USD Billion)

- 5.1 Key trends

- 5.2 Pre combustion

- 5.3 Post combustion

- 5.4 Oxy-Fuel combustion

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (MTPA, USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 Denmark

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 South Korea

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Air Products

- 7.2 Aker Solutions

- 7.3 Chevron

- 7.4 Dakota Gasification Company

- 7.5 Equinor

- 7.6 Exxon Mobil

- 7.7 Fluor

- 7.8 General Electric

- 7.9 Halliburton

- 7.10 Linde

- 7.11 Mitsubishi Heavy Industries

- 7.12 NRG Energy

- 7.13 Shell Cansolv

- 7.14 Siemens

- 7.15 SLB

- 7.16 Sulzer

- 7.17 TotalEnergies