|

市场调查报告书

商品编码

1667075

真菌蛋白市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Fungal Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

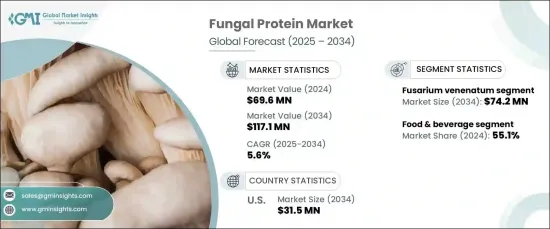

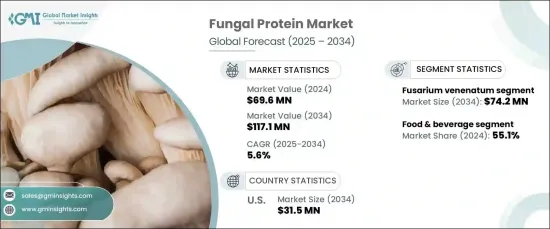

2024 年全球真菌蛋白市场价值为 6,960 万美元,预计 2025 年至 2034 年期间的复合年增长率为 5.6%。消费者对真菌蛋白的营养和环境效益的认识不断提高,推动了其在食品、饮料、药品和动物饲料等主要行业的应用。作为传统蛋白质来源的可持续替代品,真菌蛋白质在全球蛋白质市场中发挥重要作用。

对植物性和环保性蛋白质解决方案的需求不断增长是主要的成长动力。消费者寻求永续的饮食选择,推动真菌蛋白质生产的创新。这种转变与日益增长的环境问题和对更健康生活方式的关注相一致,鼓励食品和饮料行业将真菌蛋白纳入各种产品中。此外,真菌蛋白的多功能性使其可应用于药品、营养补充剂和动物饲料,从而扩大市场机会并支持整个行业多样化。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6960 万美元 |

| 预测值 | 1.171亿美元 |

| 复合年增长率 | 5.6% |

预计镰刀菌属将占据市场主导地位,到 2034 年将达到 7,420 万美元,复合年增长率为 5.6%。这种真菌菌株以其生产菌蛋白的能力而闻名,因其高营养价值和可持续的生产过程而受到广泛认可。其在替代蛋白质产品中的日益广泛的应用凸显了市场向更清洁的植物性解决方案的转变,以满足注重健康的消费者和环境驱动的需求。

食品和饮料行业占据最大份额,到 2024 年占据 55.1% 的市场份额。 该细分市场价值 3850 万美元,预计到 2034 年将以 5.4% 的复合年增长率增长。由于消费者偏好更健康和永续的选择,它们被广泛应用于植物性食品、肉类替代品、蛋白粉和乳製品替代品。

预计到 2034 年美国真菌蛋白市场规模将达到 3,150 万美元,复合年增长率为 5.3%。可持续蛋白质替代品的采用日益增多,加上人们健康饮食意识的不断增强,正在推动需求。技术创新,特别是发酵过程的创新,提高了生产效率和可扩展性,使真菌蛋白更实惠,更容易消费者获取。

总体而言,在饮食偏好转变、永续发展趋势和生产技术进步的推动下,真菌蛋白市场预计将稳定成长。随着消费者越来越重视健康和环境影响,真菌蛋白质成为不断发展的全球蛋白质格局中的关键解决方案。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 产业衝击力

- 成长动力

- 对植物性和可持续蛋白质来源的需求不断增加

- 应用程式扩充

- 真菌菌株开发和生产方法的技术突破

- 市场挑战

- 严格的监管挑战

- 成长动力

- 法规和市场影响

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场规模与预测:按类型,2021-2034 年

- 主要趋势

- 麵包酵母

- 啤酒酵母

- 镰刀菌

第 6 章:市场规模与预测:按应用,2021-2034 年

- 主要趋势

- 食品和饮料

- 加工食品

- 饮料

- 麵包店

- 乳製品

- 其他的

- 动物营养

- 家禽

- 猪

- 水产养殖

- 宠物食品

- 马

- 药品

第 7 章:市场规模及预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- AB Mauri

- Angel Yeast

- Biospringer

- DSM

- Halcyon Proteins

- Kerry Group

- Lesaffre Group

- Lallemand, Inc.

- Mycotechnology, Inc.

- Synergy Flavors

The Global Fungal Protein Market was valued at USD 69.6 million in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. This growth is fueled by advancements in fungal strain development and production techniques, which enhance efficiency and product quality. Increasing consumer awareness of the nutritional and environmental benefits of fungal protein is driving its adoption across key industries, including food, beverages, pharmaceuticals, and animal feed. As a sustainable alternative to conventional protein sources, fungal proteins are positioned to play a significant role in the global protein market.

Rising demand for plant-based and eco-friendly protein solutions is a major growth driver. Consumers seek sustainable dietary options, prompting innovation in fungal protein production. This shift aligns with growing environmental concerns and a focus on healthier lifestyles, encouraging the food and beverage industry to incorporate fungal proteins into various products. Furthermore, the versatility of fungal proteins allows for their application in pharmaceuticals, nutritional supplements, and animal feed, expanding market opportunities and supporting overall industry diversification.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.6 Million |

| Forecast Value | $117.1 Million |

| CAGR | 5.6% |

The fusarium venenatum segment is expected to dominate the market, reaching USD 74.2 million by 2034, with a CAGR of 5.6%. Known for its ability to produce mycoprotein, this fungal strain is widely recognized for its high nutritional value and sustainable production process. Its increasing use in alternative protein products highlights the market's evolution toward cleaner, plant-based solutions that cater to health-conscious consumers and environmentally driven demand.

The food and beverage sector accounted for the largest share, holding 55.1% of the market in 2024. Valued at USD 38.5 million, this segment is anticipated to grow at a 5.4% CAGR through 2034. Fungal proteins are gaining traction as an alternative to traditional animal-based proteins, offering nutritional benefits and reduced environmental impact. They are widely incorporated into plant-based foods, meat alternatives, protein powders, and dairy substitutes, driven by consumer preference for healthier and sustainable options.

U.S. fungal protein market is expected to achieve USD 31.5 million by 2034, growing at a CAGR of 5.3%. The increasing adoption of sustainable protein alternatives, combined with rising awareness of health-conscious eating, is driving demand. Technological innovations, particularly in fermentation processes, improve production efficiency and scalability, making fungal proteins more affordable and accessible to consumers.

Overall, the fungal protein market is poised for steady growth, driven by shifting dietary preferences, sustainability trends, and advancements in production technology. As consumers increasingly prioritize health and environmental impact, fungal proteins emerge as a key solution in the evolving global protein landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for plant-based and sustainable protein sources

- 3.7.1.2 Expansion of applications

- 3.7.1.3 Technological breakthroughs in fungal strain development and production methods

- 3.7.2 Market challenges

- 3.7.2.1 Stringent regulatory challenges

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Baker’s yeast

- 5.3 Brewer’s yeast

- 5.4 Fusarium venenatum

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverages

- 6.2.1 Processed food

- 6.2.2 Beverages

- 6.2.3 Bakery

- 6.2.4 Dairy

- 6.2.5 Others

- 6.3 Animal nutrition

- 6.3.1 Poultry

- 6.3.2 Swine

- 6.3.3 Aquaculture

- 6.3.4 Pet food

- 6.3.5 Equine

- 6.4 Pharmaceuticals

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AB Mauri

- 8.2 Angel Yeast

- 8.3 Biospringer

- 8.4 DSM

- 8.5 Halcyon Proteins

- 8.6 Kerry Group

- 8.7 Lesaffre Group

- 8.8 Lallemand, Inc.

- 8.9 Mycotechnology, Inc.

- 8.10 Synergy Flavors