|

市场调查报告书

商品编码

1667082

碳信用市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

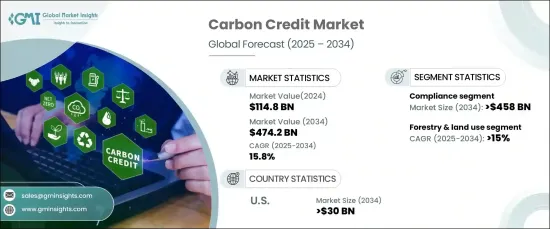

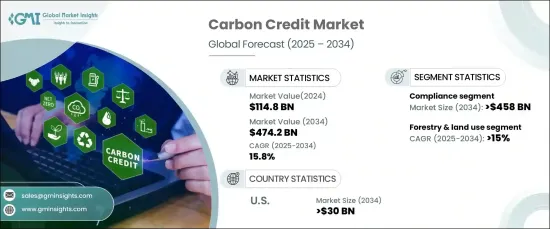

2024 年全球碳信用市场价值为 1,148 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 15.8%。这个充满活力的市场受到满足环境、社会和治理 (ESG) 目标日益增长的重要性以及更严格的法规和企业对碳中和的承诺的推动。随着各行各业越来越重视环境责任,对碳信用的需求激增,催化了交易平台和碳补偿计画的创新。碳信用与再生能源证书和生物多样性信用的结合强调了向整体环境解决方案的转变,进一步推动了市场成长。

合规碳信用部分预计到 2034 年将产生 4,580 亿美元的收入,这反映了全球对受监管碳市场的承诺日益增加。在科学措施和全球合作的推动下,超过一百个计画正在进行中,以建立统一的标准和方法。这些措施正在推动市场扩张并促进合规市场与更广泛的环境策略的协调。随着碳信用交易所与其他环境市场的联繫,全面永续发展解决方案的道路变得更加明确,为企业有效减少碳足迹提供了机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1148亿美元 |

| 预测值 | 4742亿美元 |

| 复合年增长率 | 15.8% |

林业和土地利用措施在碳信用市场中的地位日益突出,预计到 2034 年这一领域的复合年增长率将达到 15%。这些项目通常被称为“自然气候解决方案”,带来了重要的环境效益,例如碳封存、生态系统恢復和生物多样性保护。此外,它们还促进社区参与,使其成为气候缓解策略的重要组成部分。随着企业和政府越来越多地采用这些基于自然的解决方案,它们在抵消排放和实现全球永续发展目标方面的作用不断增强。

预计到 2034 年,美国碳信用市场将产生 300 亿美元的收入,这得益于企业对永续性和自愿性碳补偿计画的关注。企业正在利用高品质、经过验证的碳信用来实现雄心勃勃的净零排放目标。人工智慧和区块链等技术进步正在提高碳信用交易的透明度和效率,使该过程更加易于获取和值得信赖。对社区发展和生物多样性保护等共同利益的日益重视也推动了需求。随着企业将这些额外的好处纳入其永续发展计划,美国市场正在成为全球碳信用领域创新和成长的中心。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 市场估计和预测参数

- 预测计算

- 资料来源

- 基本的

- 次要

- 有薪资的

- 民众

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL 分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第 5 章:市场规模与预测:按类型,2021 – 2034 年

- 主要趋势

- 自愿

- 遵守

第 6 章:市场规模与预测:依最终用途,2021 – 2034 年

- 主要趋势

- 农业

- 碳捕获和储存

- 化学工艺

- 能源效率

- 工业的

- 林业和土地利用

- 再生能源

- 运输

- 废弃物管理

- 其他的

第 7 章:市场规模及预测:按地区,2021 – 2034 年

- 主要趋势

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第八章:公司简介

- 3Degrees

- Allcot

- Atmosfair

- Carbon Clear

- Carbon Collective

- Carbon Trust

- Climeco

- Climate Impact Partners

- EcoAct

- Ecosecurities

- Green Mountain Energy

- Shell

- South Pole

- Sterling Planet

- Terrapass

- Verra

- WGL Holdings

The Global Carbon Credit Market, valued at USD 114.8 billion in 2024, is projected to expand at a remarkable CAGR of 15.8% between 2025 and 2034. Carbon credits have become a cornerstone in tackling climate challenges, offering businesses and governments a mechanism to offset emissions while advancing sustainability. This dynamic market is driven by the growing importance of meeting Environmental, Social, and Governance (ESG) goals, alongside stricter regulations and corporate commitments to carbon neutrality. As industries increasingly prioritize environmental accountability, demand for carbon credits has surged, catalyzing innovation in trading platforms and carbon offset initiatives. The integration of carbon credits with renewable energy certificates and biodiversity credits underscores a shift toward holistic environmental solutions, further fueling market growth.

The compliance carbon credit segment is expected to generate USD 458 billion by 2034, reflecting the expanding global commitment to regulated carbon markets. Enhanced by science-based initiatives and global collaboration, over a hundred projects are underway to establish uniform standards and methodologies. These initiatives are driving market expansion and facilitating the alignment of compliance markets with broader environmental strategies. As carbon credit exchanges link with other environmental markets, the path to comprehensive sustainability solutions is becoming more defined, offering opportunities for businesses to reduce their carbon footprints effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $114.8 Billion |

| Forecast Value | $474.2 Billion |

| CAGR | 15.8% |

Forestry and land-use initiatives are gaining prominence in the carbon credit market, with this segment projected to grow at a CAGR of 15% through 2034. Reforestation and afforestation efforts are pivotal in generating carbon credits while addressing climate change. These projects, often referred to as "natural climate solutions," deliver critical environmental benefits, such as carbon sequestration, ecosystem restoration, and biodiversity preservation. Additionally, they foster community engagement, making them a vital part of climate mitigation strategies. As corporations and governments increasingly adopt these nature-based solutions, their role in offsetting emissions and achieving global sustainability goals continues to grow.

The US carbon credit market is forecasted to generate USD 30 billion by 2034, bolstered by corporations' focus on sustainability and voluntary carbon offset programs. Companies are leveraging high-quality, verified carbon credits to meet ambitious net-zero emission targets. Technological advancements, including artificial intelligence and blockchain, are enhancing transparency and efficiency in carbon credit trading, making the process more accessible and trustworthy. The rising emphasis on co-benefits, such as community development and biodiversity conservation, is also driving demand. As businesses incorporate these additional benefits into their sustainability plans, the US market is becoming a hub for innovation and growth in the global carbon credit landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Agriculture

- 6.3 Carbon capture & storage

- 6.4 Chemical process

- 6.5 Energy efficiency

- 6.6 Industrial

- 6.7 Forestry & land use

- 6.8 Renewable energy

- 6.9 Transportation

- 6.10 Waste management

- 6.11 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.3 Europe

- 7.4 Asia Pacific

- 7.5 Middle East & Africa

- 7.6 Latin America

Chapter 8 Company Profiles

- 8.1 3Degrees

- 8.2 Allcot

- 8.3 Atmosfair

- 8.4 Carbon Clear

- 8.5 Carbon Collective

- 8.6 Carbon Trust

- 8.7 Climeco

- 8.8 Climate Impact Partners

- 8.9 EcoAct

- 8.10 Ecosecurities

- 8.11 Green Mountain Energy

- 8.12 Shell

- 8.13 South Pole

- 8.14 Sterling Planet

- 8.15 Terrapass

- 8.16 Verra

- 8.17 WGL Holdings