|

市场调查报告书

商品编码

1685184

蜂蜜市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Honey Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

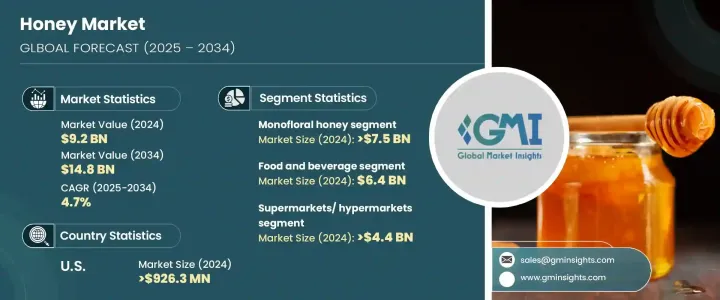

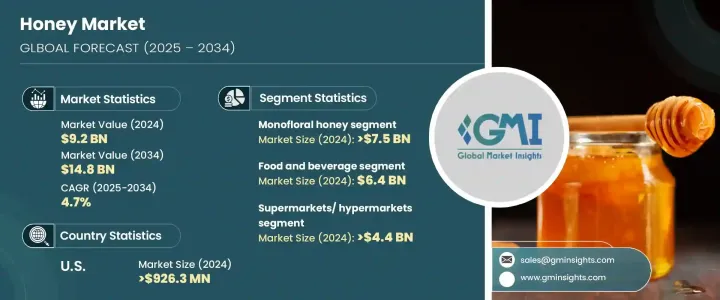

2024 年全球蜂蜜市场价值为 92 亿美元,预计将稳定成长,2025 年至 2034 年期间的复合年增长率为 4.7%。这一增长主要得益于消费者越来越多地转向天然甜味剂。随着越来越多的人远离加工糖,蜂蜜因其天然成分和健康益处而成为人们的首选替代品。消费者对清洁标籤产品(经过最低限度加工且不含人工添加剂的食品)的需求不断增长,进一步推动了这一趋势。蜂蜜作为一种天然、有益健康的成分,其声誉越来越符合现代人注重健康的选择。此外,随着人们对永续和道德食品生产的好处的认识不断提高,蜂蜜,特别是生蜂蜜和有机蜂蜜,在烹饪和健康圈越来越受欢迎。预计未来几年消费者偏好的这种动态转变将继续加速对蜂蜜的需求。

2024 年单花蜂蜜市场规模为 75 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.6%。单花蜂蜜源自单一花卉品种的花蜜,因其独特的风味和强大的健康益处而成为优质选择。消费者青睐这种蜂蜜,是因为其纯度高,而且具有与特定花朵相关的治疗效果。随着对高品质特色食品的需求不断增长,单花蜂蜜越来越被视为国内和全球市场的顶级产品。它在那些追求独特口味和自然疗法的人中越来越受欢迎,这使得它在更广泛的蜂蜜行业中脱颖而出。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 92亿美元 |

| 预测值 | 148亿美元 |

| 复合年增长率 | 4.7% |

在应用方面,食品和饮料产业处于领先地位,2024 年将产生 64 亿美元的产值。蜂蜜作为天然甜味剂的多功能性使其成为多个食品类别中不可或缺的一部分,包括烘焙食品、饮料、零食和糖果。它作为精製糖的更健康替代品的使用已显着增长,特别是在针对注重健康的消费者的产品中。随着市场继续优先考虑清洁、天然的成分,蜂蜜在各种食品配方中的作用预计将不断增长,预计从 2025 年到 2034 年,这一领域的复合年增长率将达到 4.5%。

仅美国蜂蜜市场规模在 2024 年就达到了 9.263 亿美元,预计到 2034 年复合年增长率为 5%。对天然甜味剂的需求激增以及对更健康食品的日益偏好推动了这一增长。美国市场受益于广泛的分销网络,使得蜂蜜在超市、保健食品商店和线上平台上均可轻鬆买到。随着越来越多的消费者选择有机和生蜂蜜品种,这种强大的基础设施支持广泛获得高品质的产品。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对优质和精酿饮料的需求不断增加

- 酿造製程的技术进步

- 家庭酿酒和小型酿酒厂的成长

- 产业陷阱与挑战

- 原料供应波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 有机野花蜂蜜

- 单花蜜(调味蜂蜜)

- 三叶草

- 橘子

- 荞麦

- 其他的

第 6 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 个人护理和化妆品

- 药品

- 其他的

第 7 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 超市/大卖场

- 便利商店

- 网路零售商

- 其他的

第 8 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Barkman Honey

- Bee Maid Honey

- Beeyond the Hive

- Billy Bee Honey Products

- Capilano Honey

- Comvita

- Dabur India

- Dutch Gold Honey

- GloryBee

- Golden Acres Honey

- Little Bee Impex

- New Zealand Honey

- Oha Honey LP

- Savannah Bee Company

- Streamland Biological Technology

The Global Honey Market was valued at USD 9.2 billion in 2024 and is projected to experience steady growth, expanding at a CAGR of 4.7% between 2025 and 2034. This growth is primarily driven by an increasing consumer shift toward natural sweeteners. As more people move away from processed sugars, honey is emerging as a preferred alternative due to its natural composition and health benefits. This trend is further fueled by a growing consumer demand for clean-label products-foods that are minimally processed and free from artificial additives. Honey's reputation as a natural, wholesome ingredient is increasingly aligning with modern health-conscious choices. In addition, as awareness around the benefits of sustainable and ethical food production grows, honey, particularly raw and organic varieties, is gaining popularity in both culinary and wellness circles. This dynamic shift in consumer preferences is expected to continue to accelerate the demand for honey in the coming years.

The monofloral segment of the honey market accounted for USD 7.5 billion in 2024 and is set to grow at a CAGR of 4.6% from 2025 to 2034. Monofloral honey, derived from the nectar of a single flower variety, has established itself as a premium choice due to its distinctive flavor profiles and potent health benefits. Consumers favor this type of honey for its purity and the therapeutic effects linked to the specific flowers from which it is sourced. As the demand for high-quality specialty foods rises, monofloral honey is increasingly seen as a top-tier product in both the domestic and global markets. Its growing popularity among those seeking unique tastes and natural remedies positions it as a standout within the broader honey industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $14.8 Billion |

| CAGR | 4.7% |

In terms of application, the food and beverage sector leads, generating USD 6.4 billion in 2024. Honey's versatility as a natural sweetener has made it indispensable across multiple food categories, including baked goods, beverages, snacks, and sweets. Its use as a healthier substitute for refined sugars has grown significantly, especially in products targeting health-conscious consumers. As the market continues to prioritize clean, natural ingredients, honey's role in various food formulations is expected to grow, with this segment projected to expand at a CAGR of 4.5% from 2025 to 2034.

The U.S. honey market alone reached USD 926.3 million in 2024, with expectations for a 5% CAGR through 2034. The surge in demand for natural sweeteners and the growing preference for healthier food choices have contributed to this increase. The U.S. market benefits from an extensive distribution network, making honey readily available in supermarkets, health food stores, and online platforms. As more consumers choose organic and raw honey varieties, this robust infrastructure supports widespread access to high-quality products.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for premium and craft beverages

- 3.6.1.2 Technological advancements in brewing processes

- 3.6.1.3 Growth in home brewing and microbreweries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuations in raw material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Organic Wildflower honey

- 5.3 Monofloral honey (flavoured honey)

- 5.3.1 Clover

- 5.3.2 Orange

- 5.3.3 Buckwheat

- 5.3.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food and beverages

- 6.3 Personal care and cosmetics

- 6.4 Pharmaceuticals

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets/ Hypermarkets

- 7.3 Convenience stores

- 7.4 Online retailers

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Barkman Honey

- 9.2 Bee Maid Honey

- 9.3 Beeyond the Hive

- 9.4 Billy Bee Honey Products

- 9.5 Capilano Honey

- 9.6 Comvita

- 9.7 Dabur India

- 9.8 Dutch Gold Honey

- 9.9 GloryBee

- 9.10 Golden Acres Honey

- 9.11 Little Bee Impex

- 9.12 New Zealand Honey

- 9.13 Oha Honey LP

- 9.14 Savannah Bee Company

- 9.15 Streamland Biological Technology