|

市场调查报告书

商品编码

1699267

鲑鱼市场机会、成长动力、产业趋势分析及 2025-2034 年预测Salmon Fish Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

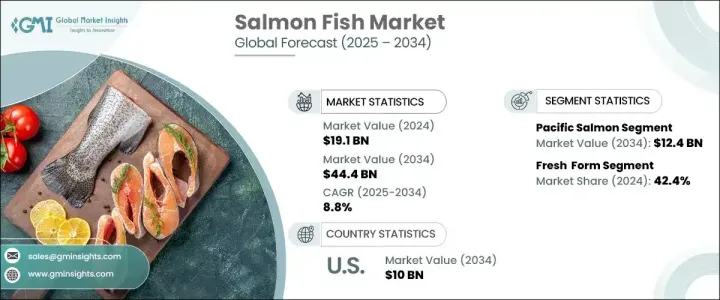

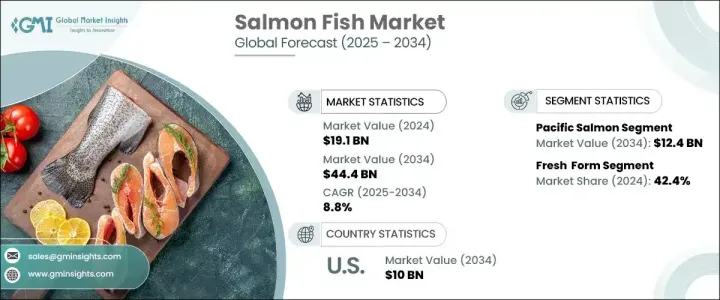

2024 年全球鲑鱼市场规模达到 191 亿美元,预计 2025 年至 2034 年的复合年成长率为 8.8%。消费者对营养丰富、高品质海鲜(尤其是富含蛋白质和 omega-3 脂肪酸的海鲜)的偏好日益增加,是主要促进因素。永续性也正在成为核心关注点,推动水产养殖业的进步。循环水产养殖系统和永续饲料等技术正在提高生产效率,同时减少对环境的影响。然而,过度捕捞、栖息地破坏、气候变迁和污染等挑战给野生族群带来压力,影响生物多样性和依赖鲑鱼生存的物种。儘管存在这些担忧,农业和监管方面的创新正在帮助稳定供应并满足不断成长的全球需求。

根据品种,市场分为大西洋鲑鱼和太平洋鲑鱼。由于大西洋鱼类蛋白质和欧米伽 3 脂肪酸含量高,预计将占据 72.9% 的市场。预计新兴市场将对其成长做出重大贡献。同时,太平洋地区的市场规模在 2024 年为 51 亿美元,预计到 2034 年将达到 124 亿美元,复合年成长率为 9.2%。虽然以美味和营养成分而闻名,但过度捕捞和气候变迁正在影响野生资源。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 191亿美元 |

| 预测值 | 444亿美元 |

| 复合年成长率 | 8.8% |

从形式来看,预计到 2024 年新鲜鲑鱼将占据 42.4% 的市场占有率,复合年成长率为 8.5%。消费者优先考虑新鲜的食物,因为它们具有营养价值,其中鱼片和牛排是受欢迎的选择。由于冷冻食品保存期限长、使用方便,其复合年成长率预计将达到 8.6%,成为大型加工商和零售商的首选。熏鲑鱼仍然是一种高阶产品,需求强劲,尤其是在高收入地区。罐装鲑鱼有多种类型,是一种经济实惠的选择,在北美和欧洲广受欢迎。其他形式,包括鲑鱼子、肉干和即食食品,迎合了注重便利、寻求高蛋白替代品的消费者。

按配销通路分类,预计到 2024 年超市将占据主导地位,占有 54.2% 的占有率,提供丰富的新鲜、冷冻和罐装鲑鱼选择。便利商店的复合年成长率为 9.5%,对即食和包装鲑鱼产品的需求不断成长。线上零售额在 2024 年达到 37 亿美元,预计到 2034 年将达到 85 亿美元,这主要得益于订阅模式和批量折扣。

美国仍然是一个关键市场,预计 2024 年价值为 51 亿美元,到 2034 年将成长到 100 亿美元。养殖大西洋鲑鱼因其全年供应且与野生捕捞相比成本更低,继续受到青睐。新鲜和冷冻鲑鱼的出货量显着增加,显示市场势头强劲。

目录

第1章:方法论与范围

第2章:执行摘要

第3章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和举措

- 监管格局

- 产业衝击力

- 成长动力

- 消费者对健康且富含 Omega 3 的蛋白质的需求不断成长

- 水产养殖技术进步

- 永续性和生态意识的消费趋势

- 产业陷阱与挑战

- 野生鲑鱼族群数量下降

- 对鲑鱼养殖的环境影响

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第4章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第5章:市场估计与预测:按物种,2021 年至 2034 年

- 主要趋势

- 大西洋鲑鱼

- 太平洋鲑鱼

第6章:市场估计与预测:依形式,2021 年 - 2034年

- 主要趋势

- 新鲜的

- 《冰雪奇缘》

- 熏製

- 罐装

- 其他

第7章:市场估计与预测:按配销通路,2021 年 -2034年

- 主要趋势

- 超市/大卖场

- 便利商店

- 网路零售

- 其他

第8章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯联合大公国

第9章:公司简介

- Leroy

- Salmar

- Cermaq

- Mowi ASA

- Bakkafrost

- SEA DELIGHT GROUP

- Nordlaks Produkter

- Atlantic Sapphire

- Ideal Foods Ltd

- BluGlacier

The Global Salmon Fish Market reached USD 19.1 billion in 2024 and is expected to expand at a CAGR of 8.8% from 2025 to 2034. Increasing consumer preference for nutritious, high-quality seafood, particularly rich in proteins and omega-3 fatty acids, is a major driver. Sustainability is also becoming a core focus, pushing advancements in aquaculture. Technologies such as recirculating aquaculture systems and sustainable feeds are making production more efficient while reducing environmental impact. However, challenges such as overfishing, habitat destruction, climate change, and pollution are putting pressure on wild populations, affecting biodiversity and species dependent on salmon for survival. Despite these concerns, innovations in farming and regulatory efforts are helping stabilize supply and meet rising global demand.

By species, the market is divided into Atlantic and Pacific salmon. The Atlantic segment is projected to hold 72.9% of the market due to its high protein and omega-3 content. Emerging markets are expected to contribute significantly to its growth. Meanwhile, the Pacific segment, valued at USD 5.1 billion in 2024, is forecasted to reach USD 12.4 billion by 2034, with a CAGR of 9.2%. While known for its superior taste and nutritional profile, overfishing and climate change are impacting wild stocks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.1 Billion |

| Forecast Value | $44.4 Billion |

| CAGR | 8.8% |

By form, fresh salmon is anticipated to account for 42.4% of the market in 2024, expanding at a CAGR of 8.5%. Consumers prioritize fresh options for their nutritional value, with fillets and steaks being popular choices. The frozen segment is set to grow at a CAGR of 8.6% due to its extended shelf life and convenience, making it a preferred option for large-scale processors and retailers. Smoked salmon remains a premium product with strong demand, particularly in high-income regions. Canned salmon, available in various types, is a budget-friendly option widely accepted in North America and Europe. Other forms, including salmon roe, jerky, and ready-to-eat meals, cater to convenience-focused consumers seeking high-protein alternatives.

By distribution channel, supermarkets are expected to dominate with a 54.2% share in 2024, offering an extensive selection of fresh, frozen, and canned salmon. Convenience stores, growing at a CAGR of 9.5%, are seeing rising demand for ready-to-eat and packaged salmon products. Online retail, valued at USD 3.7 billion in 2024, is projected to reach USD 8.5 billion by 2034, driven by subscription models and bulk discounts.

The United States remains a key market, with an estimated value of USD 5.1 billion in 2024, set to grow to USD 10 billion by 2034. Farmed Atlantic salmon continues to gain traction due to its year-round availability and lower cost compared to wild-caught options. Shipments of fresh and frozen salmon have seen a notable increase, indicating strong market momentum.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Industry impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer demand for healthy & omega 3 rich protein

- 3.6.1.2 Advances in aquaculture technology

- 3.6.1.3 Sustainability and Eco conscious consumer trends

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 Decline of wild salmon population

- 3.6.2.2 Environmental impact on salmon farming

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Species, 2021 – 2034 (USD Bn) (Kg)

- 5.1 Key trends

- 5.2 Atlantic salmon

- 5.3 Pacific salmon

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034(USD Bn) (Kg)

- 6.1 Key trends

- 6.2 Freshed

- 6.3 Frozen

- 6.4 Smoked

- 6.5 Canned

- 6.6 Other

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 –2034 (USD Bn) (Kg)

- 7.1 Key trends

- 7.2 Supermarket / Hypermarket

- 7.3 Convenience stores

- 7.4 Online retail

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn) (Kg)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Leroy

- 9.2 Salmar

- 9.3 Cermaq

- 9.4 Mowi ASA

- 9.5 Bakkafrost

- 9.6 SEA DELIGHT GROUP

- 9.7 Nordlaks Produkter

- 9.8 Atlantic Sapphire

- 9.9 Ideal Foods Ltd

- 9.10 BluGlacier