|

市场调查报告书

商品编码

1699347

铝市场机会、成长动力、产业趋势分析及2025-2034年预测Aluminum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

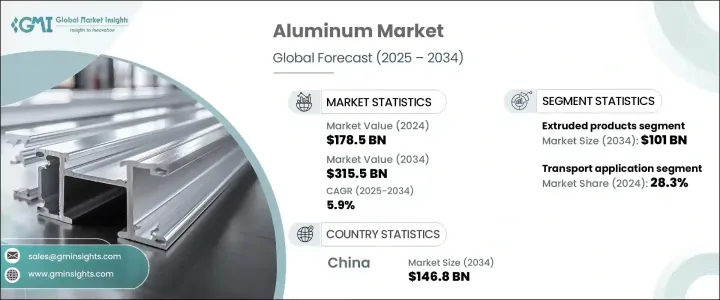

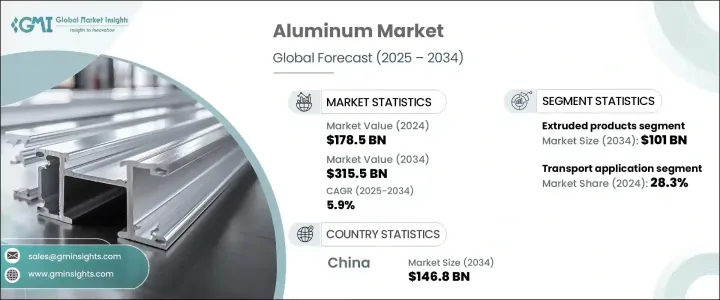

2024 年全球铝市场价值为 1,785 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.9%。作为最主要的商品之一,铝的需求强劲,尤其是在工业应用领域。 2023年全球原铝产量达7,230万吨,呈现稳定扩张态势。市场受益于各行业消费的增加,轻质材料、可回收性和製造工艺的效率推动了显着的成长。

依产品类型,铝市场分为扁平产品、锻造产品、挤压产品、长材产品、铸造产品等。挤压产品领域成长最快,到 2024 年将达到 564 亿美元。扁平产品紧随其后,由于其在汽车和包装行业的重要作用,到 2024 年将达到 491 亿美元。这些产品占据了市场主导地位,贡献了总销售额的40%以上。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1785亿美元 |

| 预测值 | 3155亿美元 |

| 复合年增长率 | 5.9% |

挤压产品的需求仍然很高,尤其是在建筑和运输领域。同时,由于汽车轻量化趋势的推动,扁平材产品在汽车产业中得到了广泛的应用,因而备受关注。光是汽车业就占铝总消费量的约30%。此外,航太、建筑施工和电气行业成为市场扩张的主要贡献者。铝在电网、输电线路和大型基础设施项目中发挥着至关重要的作用。

市场根据加工方法进一步细分,包括轧製、挤压、拉伸、铸造和锻造。预计拉丝製程将在未来几年占据主导地位,主要是因为它在高强度线材製造和航太零件中的应用。铝铸件占加工铝的20%,尤其是在汽车和工业机械领域。先进的加工技术专注于减少排放和提高能源效率,进一步加强产业的永续发展措施。

新技术有助于降低生产成本和环境影响。儘管竞争激烈,但高额的资本投入仍对新参与者构成了进入障碍。儘管原物料价格波动带来了挑战,尤其是在疫情后成本大幅飙升的情况下,轻质铝合金的需求也创造了新的机会。

市场按应用细分为运输、建筑、电气和电子、包装、设备和机械、耐用消费品、箔库存等。运输业在 2024 年占据 28.3% 的市场份额,预计到 2034 年将以 4.5% 的复合年增长率成长。电气和电子领域占有相当大的份额,铝广泛用于电力传输、电路板和热交换器。包装占了 15.2% 的市场份额,因为铝的可回收性使其成为食品和饮料容器的首选材料。包括工业自动化部件在内的设备和机械也实现了显着成长。

市场前景凸显了不断发展的促进铝可持续使用的法规,特别是在包装和运输领域。供应链中断带来了挑战,而铝箔库存和耐用消费品需求的增加增强了铝的市场地位。

2024 年,中国铝市场规模达 809 亿美元,预计到 2034 年将达到 1,468 亿美元。亚太地区凭藉其产业多样性和强大的製造能力占据主导地位。预计2024年中国将占全球铝产量的55%,占全球消费量的近50%,生产4,200万吨原铝,超过其2023年的产量。政府政策、丰富的铝土矿储量以及能源补贴促成了这种主导地位。城市化和基础设施扩张进一步刺激了该地区的铝需求。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

- 初步研究和验证

- 主要来源

- 资料探勘来源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 汽车轻量化材料需求不断成长

- 扩大低碳铝生产计划

- 加大对铝回收和循环经济的关注

- 建筑和基础设施项目的成长

- 包装产业需求强劲

- 铝加工技术的进步

- 政府政策支持永续金属生产

- 产业陷阱与挑战

- 能源限制和环境法规

- 原物料价格波动

- 贸易紧张局势影响全球供应链

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 扁平材

- 挤压产品

- 锻造产品

- 长材

- 铸件产品

- 其他的

第六章:市场估计与预测:按加工方法,2021 年至 2034 年

- 主要趋势

- 捲动

- 挤压

- 绘製

- 铸件

- 锻造

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 运输

- 建造

- 电气和电子产品

- 包装

- 设备和机械

- 耐久性消费品

- 铝箔库存

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Alcoa

- Aleris Rolled Products

- Arconic

- Emirates Global Aluminum

- Hangzhou Century Aluminium

- Hindalco

- Hongqiao Group

- JW Aluminium

- Logan Aluminium

- Norsk Hydro

- Novelis

- Rio Tinto

- Rusal

- Shandong Xinfa Aluminium Group

- South32

- SPIC

- Vedanta Limited

The Global Aluminum Market was valued at USD 178.5 billion in 2024 and is projected to grow at a 5.9% CAGR from 2025 to 2034. As one of the most prominent commodities, aluminum has seen strong demand, particularly in industrial applications. The global production of primary aluminum reached 72.3 million tons in 2023, demonstrating steady expansion. The market benefits from increasing consumption in various industries, with significant growth driven by lightweight materials, recyclability, and efficiency in manufacturing processes.

Based on product type, the aluminum market is categorized into flat products, forged products, extruded products, long products, cast products, and others. The extruded products segment recorded the highest growth, reaching USD 56.4 billion in 2024. Flat products followed closely, reaching USD 49.1 billion in 2024 due to their significant role in the automotive and packaging industries. These products dominated the market, contributing to over 40% of total sales.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $178.5 Billion |

| Forecast Value | $315.5 Billion |

| CAGR | 5.9% |

Extruded products remained in high demand, especially within the construction and transportation sectors. Meanwhile, flat products gained prominence due to their widespread use in the automotive industry, driven by the push for lightweight vehicles. The automotive sector alone accounted for approximately 30% of total aluminum consumption. Additionally, aerospace, building & construction, and the electrical industry emerged as key contributors to market expansion. Aluminum played a crucial role in power grids, transmission lines, and large-scale infrastructure projects.

The market is further segmented based on processing methods, including rolling, extruding, drawing, casting, and forging. The drawing process is expected to dominate in the coming years, mainly due to its application in high-strength wire manufacturing and aerospace components. Aluminum casting accounted for 20% of processed aluminum, particularly within automotive and industrial machinery. Advanced processing technologies focused on reducing emissions and enhancing energy efficiency, further strengthening the industry's sustainability initiatives.

New technologies helped lower production costs and environmental impact. Despite moderate competitive rivalry, high capital investments acted as entry barriers for new players. The demand for lightweight aluminum alloys created new opportunities, although raw material price fluctuations presented challenges, especially as costs surged significantly post-pandemic.

The market is segmented by application into transport, construction, electrical & electronics, packaging, equipment & machinery, consumer durables, foil stock, and others. The transportation sector led with a 28.3% market share in 2024 and is anticipated to grow at a 4.5% CAGR through 2034. The electrical & electronics segment held a substantial share, with aluminum widely used in power transmission, circuit boards, and heat exchangers. Packaging contributed 15.2% of the market, as aluminum's recyclability made it a preferred material for food and beverage containers. Equipment & machinery, including industrial automation components, also saw significant growth.

The market outlook highlighted evolving regulations promoting sustainable aluminum usage, particularly in packaging and transportation. Supply chain disruptions posed challenges, while the rise in foil stock and consumer durables demand reinforced aluminum's market presence.

The aluminum market in China generated USD 80.9 billion in 2024 and is projected to reach USD 146.8 billion by 2034. The Asia Pacific region dominated due to industrial diversity and strong manufacturing capabilities. China accounted for 55% of aluminum production and nearly 50% of global consumption in 2024, producing 42 million tons of primary aluminum, surpassing its 2023 output. Government policies, abundant bauxite reserves, and energy subsidies contributed to this dominance. Urbanization and infrastructure expansion further fueled aluminum demand in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for lightweight materials in automotive

- 3.6.1.2 Expanding low-carbon aluminium production initiatives

- 3.6.1.3 Increasing aluminium recycling and circular economy focus

- 3.6.1.4 Growth in construction and infrastructure projects

- 3.6.1.5 Strong demand from the packaging industry

- 3.6.1.6 Advancements in aluminium processing technologies

- 3.6.1.7 Government policies supporting sustainable metal production

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Energy restrictions and environmental regulations

- 3.6.2.2 Volatility in raw material prices

- 3.6.2.3 Trade tensions affecting global supply chains

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Carats)

- 5.1 Key trends

- 5.2 Flat products

- 5.3 Extruded products

- 5.4 Forged products

- 5.5 Long products

- 5.6 Cast products

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 – 2034 (USD Billion) (Carats)

- 6.1 Key trends

- 6.2 Rolling

- 6.3 Extruding

- 6.4 Drawn

- 6.5 Casting

- 6.6 Forging

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Carats)

- 7.1 Key trends

- 7.2 Transport

- 7.3 Construction

- 7.4 Electrical & electronics

- 7.5 Packaging

- 7.6 Equipment & machinery

- 7.7 Consumer durables

- 7.8 Foil stock

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Carats)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alcoa

- 9.2 Aleris Rolled Products

- 9.3 Arconic

- 9.4 Emirates Global Aluminum

- 9.5 Hangzhou Century Aluminium

- 9.6 Hindalco

- 9.7 Hongqiao Group

- 9.8 JW Aluminium

- 9.9 Logan Aluminium

- 9.10 Norsk Hydro

- 9.11 Novelis

- 9.12 Rio Tinto

- 9.13 Rusal

- 9.14 Shandong Xinfa Aluminium Group

- 9.15 South32

- 9.16 SPIC

- 9.17 Vedanta Limited