|

市场调查报告书

商品编码

1716462

基于交通运输的氢能储存市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Transportation Based Hydrogen Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

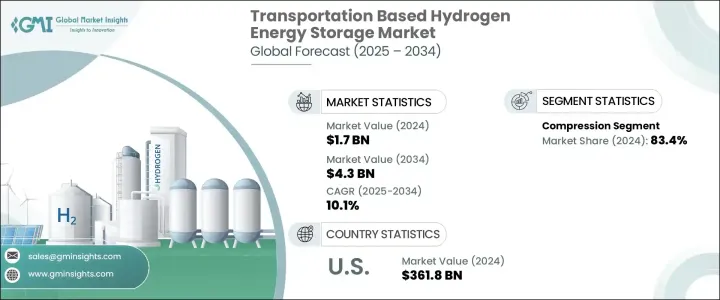

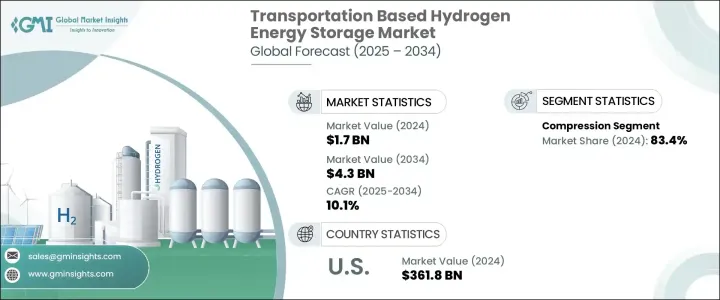

2024 年全球交通运输氢能储存市场规模估计为 17 亿美元,预计在氢储存技术进步的推动下,2025 年至 2034 年期间的复合年增长率将达到 10.1%。金属氢化物、高压罐和液态氢储存解决方案的日益普及提高了系统的效率、安全性和性能。氢基能源储存作为卡车、火车和飞机等长距离电动车的可持续替代方案,正日益受到关注。电动车销售的成长,尤其是在新兴经济体,促进了对氢储存解决方案的需求不断增长,而政府的激励措施和支持绿色能源采用的政策也进一步支持了这一需求。

氢燃料电池因其高能量密度、轻重量和长使用寿命而成为电动车的首选。燃料电池技术的不断创新正在突破能源效率的界限,使储氢成为未来永续交通的关键组成部分。世界各国政府都在积极推动氢能储存,特别是在交通运输领域,以减少碳排放。旅游业的成长和出行频率的上升也推动了对飞机和重型卡车等长途车辆高效储能解决方案的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 43亿美元 |

| 复合年增长率 | 10.1% |

基于交通运输的氢能储存市场依方法分为压缩、液化和基于材料的储存。 2024 年,压缩领域占据主导地位,占总市占率的 83.4%。由于氢能能够长时间储存能量,人们也在探索将其与再生能源和电网储能结合。世界各国都在实施优惠政策和大型能源计画来支持这些措施。抽水蓄能广泛应用于再生能源整合,在扩大氢能储存应用方面发挥关键作用。

全球电动车销量的成长正在加速对氢燃料电池的需求,清洁能源汽车的采用率也稳定成长。随着各国优先考虑脱碳工作,欧洲、北美和亚太地区的市场正在强劲扩张。太阳能产业也正在经历显着成长,预计到 2025 年底装置容量将超过 2 TW。预计向太阳能的转变将为交通运输领域带来对氢燃料电池的强劲需求。

城市化、工业扩张和老化电网的现代化进一步推动了交通运输对氢能储存的需求。各国政府正在投资氢能中心、再生能源储存项目和大规模基础设施改进,以促进永续能源解决方案。

在美国,交通运输类氢能储存市场规模在2022年达到3.051亿美元,2023年达到3.319亿美元,2024年达到3.618亿美元。对储能技术的策略性投资预计将推动未来的市场成长。中国和印度等新兴经济体也正在加速采用具成本效益的能源储存系统,从而推动整个亚太地区的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 年至 2034 年

- 主要趋势

- 压缩

- 液化

- 基于材料

第六章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 世界其他地区

第七章:公司简介

- Air Liquide

- Air Products and Chemicals

- Cockerill Jingli Compressed hydrogen

- ENGIE

- FuelCell Energy

- GKN Compressed Hydrogen

- Gravitricity

- ITM Power

- Linde plc

- McPhy Energy

- Nel

- SSE

The Global Transportation Based Hydrogen Energy Storage Market was estimated at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 10.1% from 2025 to 2034, driven by advancements in hydrogen storage technology. The increasing adoption of metal hydrides, high-pressure tanks, and liquid hydrogen storage solutions enhances system efficiency, safety, and performance. Hydrogen-based energy storage is gaining traction as a sustainable alternative for long-range electric vehicles, including trucks, trains, and airplanes. The rise in electric vehicle sales, particularly in emerging economies, contributes to the growing demand for hydrogen storage solutions, further supported by government incentives and policies favoring green energy adoption.

Hydrogen fuel cells are becoming a preferred choice in battery electric vehicles due to their high energy density, lightweight properties, and extended lifespan. Continuous innovations in fuel cell technology are pushing the boundaries of energy efficiency, positioning hydrogen storage as a key component in the future of sustainable transportation. Governments worldwide are actively promoting hydrogen energy storage, particularly in the transportation sector, to reduce carbon emissions. Increasing tourism and rising travel frequency are also fueling the demand for efficient energy storage solutions for long-haul vehicles, including planes and heavy-duty trucks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 10.1% |

The transportation-based hydrogen energy storage market is segmented by method into compression, liquefaction, and material-based storage. The compression segment dominated in 2024, accounting for 83.4% of the total market share. Due to its ability to store energy for extended periods, hydrogen storage is also being explored for integration with renewable energy sources and grid energy storage. Countries worldwide are implementing favorable policies and large-scale energy projects to support these initiatives. Pumped hydro, widely used in renewable energy integration, is playing a critical role in expanding hydrogen-based energy storage applications.

Rising global electric vehicle sales are accelerating demand for hydrogen fuel cells, with a steady increase in the adoption of clean energy vehicles. The market is witnessing robust expansion in Europe, North America, and Asia-Pacific as nations prioritize decarbonization efforts. The solar energy sector is also experiencing significant growth, with installed capacity expected to surpass 2 TW by the end of 2025. This transition toward solar power is projected to create a strong demand for hydrogen fuel cells in the transportation sector.

Urbanization, industrial expansion, and the modernization of aging power grids are further fueling the demand for transportation-based hydrogen energy storage. Governments are investing in hydrogen hubs, renewable energy storage projects, and large-scale infrastructure improvements to promote sustainable energy solutions.

In the United States, the transportation-based hydrogen energy storage market reached USD 305.1 million in 2022, USD 331.9 million in 2023, and USD 361.8 million in 2024. Strategic investments in energy storage technologies are expected to drive future market growth. Emerging economies such as China and India are also accelerating the adoption of cost-effective energy storage systems, boosting demand across the Asia-Pacific region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Compression

- 5.3 Liquefaction

- 5.4 Material-based

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Netherlands

- 6.3.6 Russia

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.5 Rest of World

Chapter 7 Company Profiles

- 7.1 Air Liquide

- 7.2 Air Products and Chemicals

- 7.3 Cockerill Jingli Compressed hydrogen

- 7.4 ENGIE

- 7.5 FuelCell Energy

- 7.6 GKN Compressed Hydrogen

- 7.7 Gravitricity

- 7.8 ITM Power

- 7.9 Linde plc

- 7.10 McPhy Energy

- 7.11 Nel

- 7.12 SSE