|

市场调查报告书

商品编码

1716708

二手车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Used Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

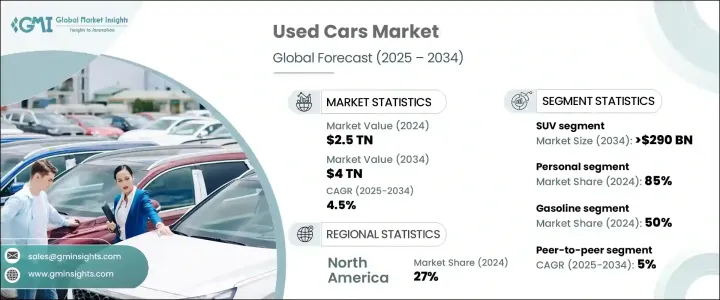

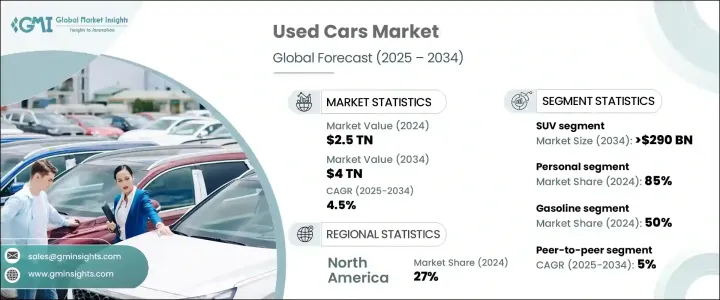

2024 年全球二手车市场价值为 2.5 兆美元,预计 2025 年至 2034 年期间的复合年增长率为 4.5%。二手车需求的成长源于其与新车相比价格更便宜,这使其成为注重预算的买家的理想选择。由于新车贬值速度很快,消费者可以以原价的一小部分购买相对较新的车型。这种可负担性因素推动了首次购车者、中等收入家庭以及希望在不产生重大财务负担的情况下扩大车队的企业的需求。

经济的不确定性和通膨压力进一步增强了二手车市场的吸引力。由于供应链中断、半导体短缺和製造费用增加导致新车成本上升,二手车提供了一种既经济又不影响品质的替代方案。如今的消费者比以往任何时候都更加重视价值,选择具有长期可靠性和转售价值的汽车。由汽车製造商和经销商支援的认证二手车 (CPO) 计划也越来越受欢迎,该计划提供延长保固和品质保证,增强了消费者对市场的信心。此外,数位平台的日益普及使得买家可以更轻鬆地在线上研究、比较和购买二手车,从而简化了整个购买体验。人工智慧定价工具和车辆历史报告的整合确保了透明度,进一步推动了市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.5兆美元 |

| 预测值 | 4兆美元 |

| 复合年增长率 | 4.5% |

许多高收入者为了生活方式和便利而继续青睐拥有私家车。除了节省资金之外,二手车还能满足日益增长的出行需求,尤其是在公共交通并不总是可靠的城市地区。各种各样的二手车型可满足不同的消费者喜好,从省油的紧凑型轿车到功能丰富的 SUV 和豪华车。共享旅游服务(如叫车和租赁计划)的扩张也促进了市场的成长,因为这些服务定期更新车队,提供源源不绝的保养良好的二手车。

市场按车辆类型细分,包括掀背车、轿车、SUV 等。预计到 2034 年,SUV 市场将创造 2,900 亿美元的市场价值,这得益于其坚固的结构、宽敞的内部空间以及在城市和越野驾驶中的多功能性。消费者青睐 SUV 是因为其安全性、更高的转售价值以及对不断变化的路况的适应性。随着天气模式越来越难以预测,买家开始转向耐用且高性能的车辆。紧凑型和中型 SUV 尤其受欢迎,重塑了市场并影响了汽车製造商的策略。

根据最终用途,二手车市场分为个人和商业部分。 2024年个人市场占据主导地位,占85%的市占率。二手车为消费者提供了实用且经济高效的拥有体验,提供更低的初始成本、更低的保险费以及有吸引力的融资选择。有竞争力的利率和灵活的分期付款计划使二手车更容易获得,从而刺激了这一领域的需求。

2024年,北美二手车市场价值5,830亿美元,美国在汽车保有量方面排名第一。美国道路上数百万辆註册车辆的周转率很高,确保了二手车的稳定供应。这个充满活力的市场受益于汽车的不断更新,因此可以随时获得多种多样的二手车选择。数位市场、经销商网路和 CPO 计画进一步支持产业扩张,巩固了北美作为全球二手车市场关键参与者的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件供应商

- 製造商

- 技术提供者

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 价格趋势

- 衝击力

- 成长动力

- 价格实惠,节省成本

- 可支配所得增加和都市化

- 新车折旧率高

- 线上平台和数位化的成长

- 融资和贷款选择的可用性

- 产业陷阱与挑战

- 缺乏标准化和品质保证

- 新车销售和租赁模式的竞争日益激烈

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 掀背车

- 轿车

- 越野车

- 其他的

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 杂交种

- 电的

- 其他的

第七章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 点对点

- 特许经销商

- 独立经销商

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 个人的

- 商业的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alibaba

- Asbury Automotive Group

- AUDI

- AutoNation

- Avis Budget Group

- CarMax

- CARS24

- Carvana

- eBay

- Group 1 Automotive

- Hendrick Automotive Group

- Hertz Global Holdings

- Lithia Motors

- Mahindra First Choice Wheels

- Maruti Suzuki True Value

- Penske Automotive Group

- Scout24 AG

- Sonic Automotive

- TrueCar

- Van Tuyl Group

The Global Used Car Market was valued at USD 2.5 trillion in 2024 and is projected to grow at a CAGR of 4.5% between 2025 and 2034. The rising demand for pre-owned vehicles stems from their affordability compared to new cars, making them an attractive option for budget-conscious buyers. As new vehicles depreciate rapidly, consumers can acquire relatively recent models at a fraction of the original price. This affordability factor drives demand among first-time buyers, middle-income families, and businesses looking to expand their fleets without a substantial financial burden.

Economic uncertainty and inflationary pressures have further strengthened the appeal of the used car market. With the cost of new vehicles rising due to supply chain disruptions, semiconductor shortages, and higher manufacturing expenses, pre-owned cars offer a cost-effective alternative without compromising on quality. Consumers today are more value-conscious than ever, opting for vehicles that provide long-term reliability and resale value. Certified pre-owned (CPO) programs backed by automakers and dealerships are also gaining traction, offering extended warranties and quality assurance, boosting consumer confidence in the market. Additionally, the growing adoption of digital platforms has made it easier for buyers to research, compare, and purchase used cars online, streamlining the entire buying experience. The integration of AI-powered pricing tools and vehicle history reports ensures transparency, further driving the market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Trillion |

| Forecast Value | $4 Trillion |

| CAGR | 4.5% |

Many high-income individuals continue to favor private vehicle ownership for lifestyle and convenience. Beyond financial savings, used cars cater to the increasing need for mobility, especially in urban areas where public transportation may not always be reliable. The wide variety of available pre-owned models meets diverse consumer preferences, from fuel-efficient compact cars to feature-packed SUVs and luxury vehicles. The expansion of shared mobility services, such as ride-hailing and leasing programs, has also contributed to the market's growth, as these services regularly refresh their fleets, supplying a steady stream of well-maintained used cars.

The market is segmented by vehicle type, including hatchbacks, sedans, SUVs, and others. The SUV segment is expected to generate USD 290 billion by 2034, driven by its strong build, spacious interiors, and versatility for both urban and off-road driving. Consumers favor SUVs due to their perceived safety, higher resale value, and adaptability to changing road conditions. With increasingly unpredictable weather patterns, buyers are shifting preferences toward durable and high-performing vehicles. Compact and mid-size SUVs are particularly popular, reshaping the market and influencing automakers' strategies.

Based on end-use, the used car market is divided into personal and commercial segments. The personal segment dominated in 2024, accounting for 85% of the market share. Used cars provide consumers with a practical and cost-effective ownership experience, offering lower initial costs, reduced insurance premiums, and access to attractive financing options. Competitive interest rates and flexible installment plans make pre-owned vehicles more accessible, fueling demand in this segment.

North America Used Car Market generated USD 583 billion in 2024, with the U.S. leading in vehicle ownership. Millions of registered vehicles on American roads create a high turnover, ensuring a steady supply of pre-owned cars. This dynamic market benefits from continuous vehicle replacements, making a diverse selection of used cars readily available. Digital marketplaces, dealership networks, and CPO programs further support industry expansion, reinforcing North America's position as a key player in the global used car market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trends

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Affordability and cost savings

- 3.6.1.2 Rising disposable income and urbanization

- 3.6.1.3 High depreciation of new cars

- 3.6.1.4 Growth of online platforms and digitalization

- 3.6.1.5 Availability of financing and loan options

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Lack of standardization and quality assurance

- 3.6.2.2 Rising competition from new car sales and leasing models

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hatchback

- 5.3 Sedan

- 5.4 SUV

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Hybrid

- 6.5 Electric

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Peer-to-peer

- 7.3 Franchised dealers

- 7.4 Independent dealers

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alibaba

- 10.2 Asbury Automotive Group

- 10.3 AUDI

- 10.4 AutoNation

- 10.5 Avis Budget Group

- 10.6 CarMax

- 10.7 CARS24

- 10.8 Carvana

- 10.9 eBay

- 10.10 Group 1 Automotive

- 10.11 Hendrick Automotive Group

- 10.12 Hertz Global Holdings

- 10.13 Lithia Motors

- 10.14 Mahindra First Choice Wheels

- 10.15 Maruti Suzuki True Value

- 10.16 Penske Automotive Group

- 10.17 Scout24 AG

- 10.18 Sonic Automotive

- 10.19 TrueCar

- 10.20 Van Tuyl Group