|

市场调查报告书

商品编码

1716712

户外服装及配件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Outdoor Apparel and Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

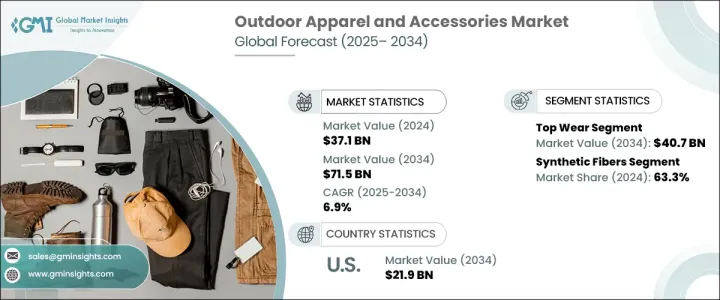

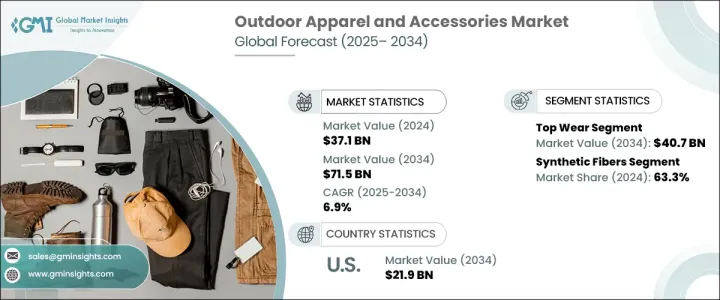

2024 年全球户外服装和配件市场价值为 371 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.9%。随着户外生活方式在全球范围内继续受到广泛欢迎,这一增长反映了消费者偏好的动态变化。从休閒徒步旅行者到经验丰富的徒步旅行者,越来越多的人将户外娱乐作为日常生活的一部分。人们的健康意识不断增强,对健身和冒险运动的兴趣也日益浓厚,推动了对高品质、高性能户外装备的需求。

此外,随着旅客寻求耐用且时尚的产品来增强户外体验,体验式旅游和生态旅游的日益增长的趋势正在推动市场扩张。随着越来越多的人参与健行、长途跋涉、滑雪和露营等活动,对创新、实用、防风雨的服装和配件的需求正在迅速增加。随着品牌推出同时满足性能和环境标准的装备,对材料科学的可持续性和技术进步的关注也影响着产品开发。户外品牌正在响应不断变化的消费者需求,提供多功能服装,可以从崎岖的小径无缝过渡到城市环境,同时确保功能性和时尚性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 371亿美元 |

| 预测值 | 715亿美元 |

| 复合年增长率 | 6.9% |

市场大致分为上衣、下装和配件,其中上衣占据主导地位,2024 年市场规模将达到 208 亿美元。对夹克、连帽衫、羊毛衫和打底衫等户外服装的需求增加,源自于全年户外运动和休閒活动的参与度不断提高,包括极端天气条件。随着消费者优先考虑能够适应不同气候的装备,他们明显转向兼具舒适性和耐用性的高性能产品。具有环保意识的消费者的激增推动了品牌采用再生聚酯、有机棉和可生物降解面料等环保材料,使永续产品更加主流。线上销售管道已成为重要的成长动力,为客户提供广泛的客製化选项和直接面向消费者的优惠,如个人化购物体验、独家系列和无缝退货。

按材料细分,市场主要以合成纤维和天然纤维为主,其中合成材料在 2024 年占据 63.3% 的主导份额。聚酯纤维、尼龙和氨纶等合成纤维凭藉其卓越的性能、轻量化的设计、快干能力和增强的耐用性,继续成为户外装备的首选。这些材料具有吸湿排汗、防紫外线和隔热等关键优点,对于高海拔和极端天气环境至关重要。随着户外运动爱好者寻求兼顾功能性和舒适性的装备,合成纤维仍然是产品创新的基石。

2024 年,美国户外服装和配件市场创造了 111 亿美元的收入,继续保持其作为区域需求最大贡献者的地位。美国户外文化根深蒂固,健行、骑自行车、露营和冬季运动的参与度不断提高,市场蓬勃发展。越来越多的消费者转向能够适应不同气候的高端、高性能装备,这加速了需求的成长。此外,美国品牌正在强调永续的生产实践和尖端材料技术,反映了美国对户外服装领域环境责任和创新的更广泛承诺。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 户外活动越来越受欢迎

- 环保意识强的顾客增多

- 材料和技术创新的兴起

- 运动休閒和休閒服饰潮流的影响力不断扩大

- 产业陷阱与挑战

- 不断变化的消费者需求

- 高成本投资

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品,2021 年至 2034 年

- 主要趋势

- 顶部

- T恤

- 背心

- 运动胸罩

- 夹克

- 运动衫

- 其他(运动服、泳衣)

- 底部

- 绑腿

- 短裤

- 运动裤

- 运动裤

- 其他(瑜珈裤、瑜珈裙)

- 配件

- 手套和连指手套

- 背包

- 睡袋

- 帐篷

- 头盔

- 水合装备

- 眼镜

- 绑腿

- 帽子

- 其他(围巾、急救用品等)

第六章:市场估计与预测:依资料,2021 年至 2034 年

- 主要趋势

- 合成纤维

- 聚酯纤维

- 尼龙

- 天然布料

- 棉织物

- 麻

- 竹子

- 羊毛

- 其他的

第七章:市场估计与预测:依消费者群体划分,2021 年至 2034 年

- 主要趋势

- 男性

- 女性

- 孩子们

第八章:市场估计与预测:依定价,2021 年至 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第九章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 网路零售

- 电子商务

- 公司网站

- 离线

- 专卖店

- 大型零售商店

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Arc'teryx Equipment Inc.

- Black Diamond Equipment Ltd.

- Columbia Sportswear Company

- Eddie Bauer LLC

- Helly Hansen AS

- Patagonia, Inc.

- Prana Living, LLC

- REI Co-op

- Salomon SA

- The North Face, Inc.

The Global Outdoor Apparel and Accessories Market was valued at USD 37.1 billion in 2024 and is projected to grow at a CAGR of 6.9% between 2025 and 2034. This growth reflects a dynamic shift in consumer preferences as outdoor lifestyles continue to gain widespread popularity worldwide. From casual hikers to seasoned trekkers, more individuals are embracing outdoor recreation as part of their daily lives. Increasing awareness about health and wellness, along with a rising interest in fitness and adventure sports, is pushing demand for high-quality, performance-driven outdoor gear.

Additionally, a growing trend toward experiential travel and eco-tourism is fueling market expansion as travelers seek durable and stylish products to enhance their outdoor experiences. As more people engage in activities like hiking, trekking, skiing, and camping, the need for innovative, functional, and weather-resistant clothing and accessories is rapidly increasing. The focus on sustainability and technological advancements in material science is also shaping product development as brands introduce gear that meets both performance and environmental standards. Outdoor brands are responding to evolving consumer demands by offering versatile apparel that can seamlessly transition from rugged trails to urban settings, ensuring both functionality and style.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.1 Billion |

| Forecast Value | $71.5 Billion |

| CAGR | 6.9% |

The market is broadly categorized into top wear, bottom wear, and accessories, with top wear leading the way and generating USD 20.8 billion in 2024. The heightened demand for outdoor clothing like jackets, hoodies, fleeces, and base layers stems from increasing participation in outdoor sports and recreational activities throughout the year, including extreme weather conditions. As consumers prioritize gear that can withstand varying climates, there is a notable shift toward high-performance products that offer both comfort and durability. The surge in environmentally conscious consumers is driving brands to adopt eco-friendly materials such as recycled polyester, organic cotton, and biodegradable fabrics, making sustainable products more mainstream. The online sales channel has emerged as a significant growth driver, offering customers a wide range of customization options and direct-to-consumer benefits like personalized shopping experiences, exclusive collections, and seamless returns.

Segmented by material, the market prominently features synthetic and natural fabrics, with synthetic materials accounting for a dominant 63.3% share in 2024. Synthetic fibers, including polyester, nylon, and spandex, continue to be the preferred choice for outdoor gear due to their superior performance, lightweight design, quick-drying capabilities, and enhanced durability. These materials provide critical benefits such as moisture-wicking, UV protection, and thermal insulation, essential for both high-altitude and extreme weather environments. As outdoor enthusiasts seek gear that balances functionality with comfort, synthetic fabrics remain a cornerstone in product innovation.

The U.S. Outdoor Apparel and Accessories Market generated USD 11.1 billion in 2024, maintaining its position as the largest contributor to regional demand. With a deeply rooted outdoor culture and increasing participation in hiking, cycling, camping, and winter sports, the U.S. market is thriving. A growing consumer shift toward premium, high-performance gear that can adapt to diverse climates is accelerating demand. Additionally, U.S. brands are emphasizing sustainable production practices and cutting-edge material technologies, reflecting the nation's broader commitment to environmental responsibility and innovation in the outdoor apparel space.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2018 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing popularity in outdoor activities

- 3.2.1.2 Rise of eco-conscious customers

- 3.2.1.3 Rise in innovation in materials and technology

- 3.2.1.4 Expanding influence of athleisure and casual wear trends

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Evolving consumer demands

- 3.2.2.2 High-cost investment

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 – 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Top

- 5.2.1 T-shirts

- 5.2.2 Tank tops

- 5.2.3 Sports bras

- 5.2.4 Jackets

- 5.2.5 Sweatshirts

- 5.2.6 Others (track suits, swimmer suits)

- 5.3 Bottom

- 5.3.1 Leggings

- 5.3.2 Shorts

- 5.3.3 Sweatpants

- 5.3.4 Track pants

- 5.3.5 Others (yoga pants, skirts)

- 5.4 Accessories

- 5.4.1 Gloves & mittens

- 5.4.2 Backpacks

- 5.4.3 Sleeping bags

- 5.4.4 Tents

- 5.4.5 Helmet

- 5.4.6 Hydration gear

- 5.4.7 Eye wear

- 5.4.8 Gaiters

- 5.4.9 Hats

- 5.4.10 Others (scarves, first aid supplies etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Synthetic fabrics

- 6.2.1 Polyester

- 6.2.2 Nylon

- 6.3 Natural fabrics

- 6.3.1 Cotton fabrics

- 6.3.2 Hemp

- 6.3.3 Bamboo

- 6.3.4 Wool

- 6.3.5 Others

Chapter 7 Market Estimates & Forecast, By Consumer Group, 2021 – 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Male

- 7.3 Female

- 7.4 Kids

Chapter 8 Market Estimates & Forecast, By Pricing, 2021 – 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online retail

- 9.2.1 Ecommerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Specialty stores

- 9.3.2 Mega retail stores

- 9.3.3 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Arc'teryx Equipment Inc.

- 11.2 Black Diamond Equipment Ltd.

- 11.3 Columbia Sportswear Company

- 11.4 Eddie Bauer LLC

- 11.5 Helly Hansen AS

- 11.6 Patagonia, Inc.

- 11.7 Prana Living, LLC

- 11.8 REI Co-op

- 11.9 Salomon S.A.

- 11.10 The North Face, Inc.